POEMS

Online Trading Platform

& Mobile App

Your Partner in Finance

Access Global Markets at your fingertips

We have grown to be one of the region's top brokerage for trading Stocks, ETFs, CFDs, Bonds, Unit Trusts, Forex and Futures.

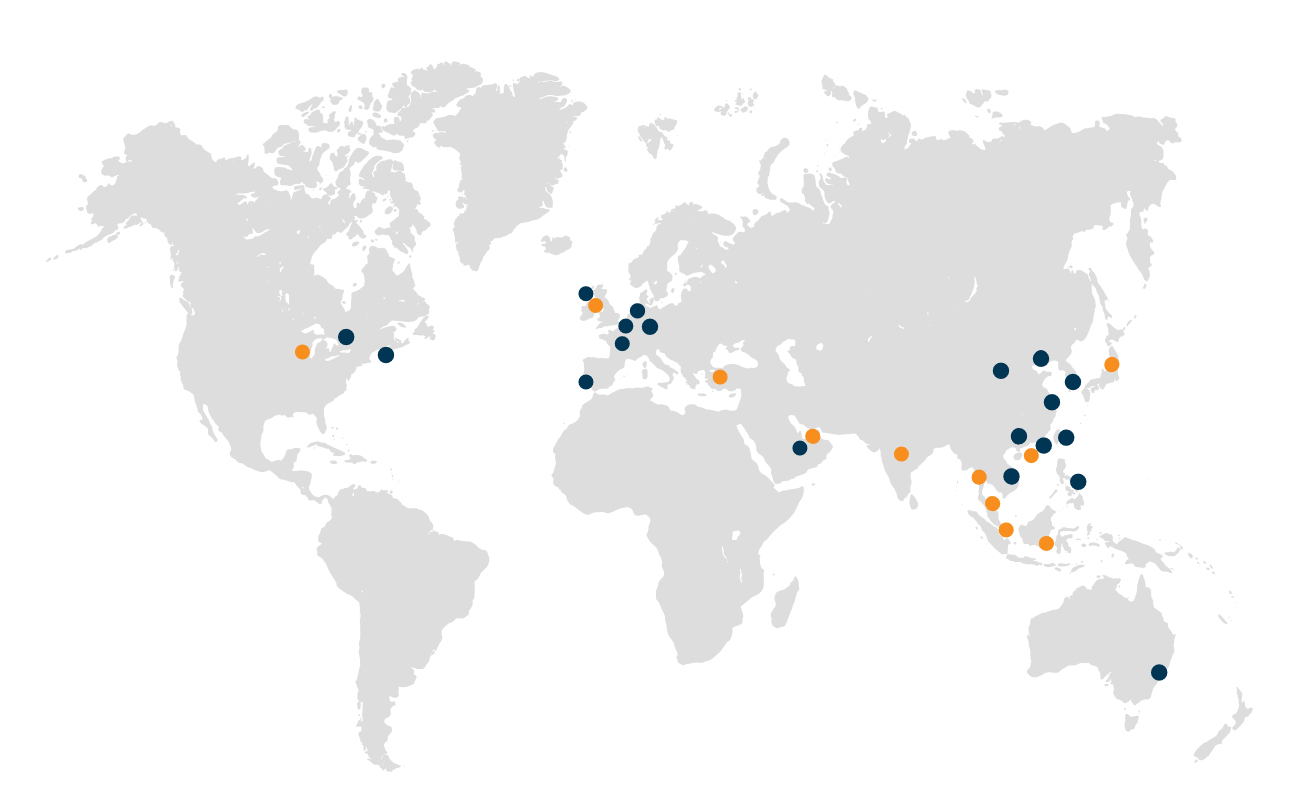

The group has clearing membership to 55 exchanges in 31 countries and trading access to many other exchanges

Clearing Membership

Trading Access

Excess Funds Management Facility (SMART Park)

Phillip SMART Park is an Excess Fund Management Facility that invests and manages your Idle Cash automatically, at discretion. Make your money work HARDER and SMARTER at:

Return (7 Day) Annualised#

2.6565% p.a.

3.3017% p.a.

Rates updated as of 16 January 2023

#Based on the average rate of annualised returns over the last rolling week.

Past performance is not necessarily indicative of future performance. View disclaimer

Fund Now

Important Announcements

View AllUpcoming Events/Seminars

2 STEPS

to start trading

instantly with MyInfo

Fund your account

within 15 minutes

Start trading

right away