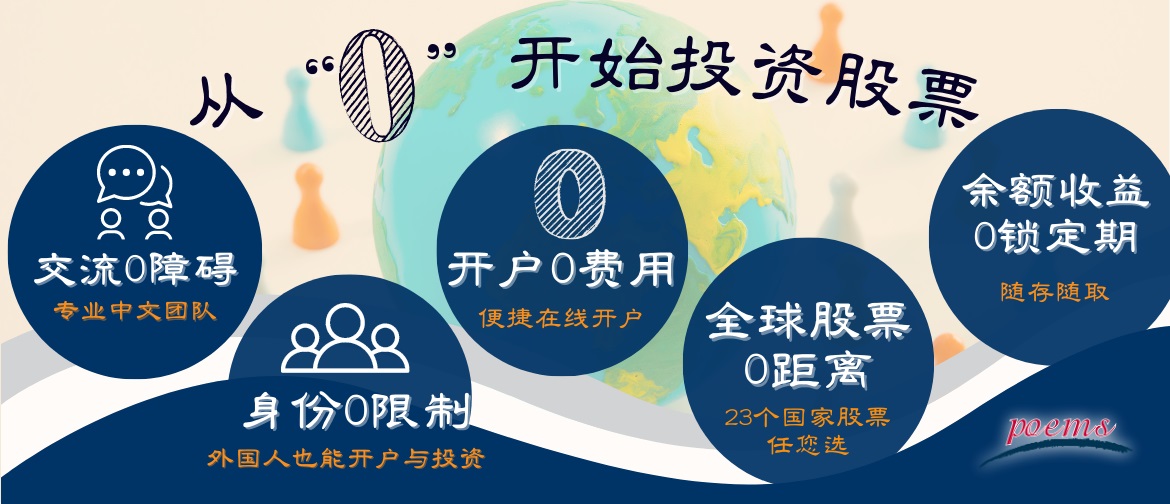

为什么选择辉立环球账户?

新加坡辉立证券是新加坡最大的券商之一,创立于1975年,历史悠久业务量庞大,连续多年荣获年度最佳股票经纪人奖。公司不断扩张的集团网络遍布全球15个国家和地区。最重要的是,辉立证券能够提供全球20多个国家和地区的股票交易,包括美国,中国,香港,英国,日本,德国,新加坡,马来西亚,澳大利亚等等。我们还特别成立了华文交易组,以便为中国内陆以及全世界华人投资者提供更好更便捷的服务!

辉立资本优势

可交易全球股票

26个国家及地区股票任您交易

包括美国,香港,新加坡,英国, 日本,马来西亚,泰国等等

多元投资商品

超过40,000种产品人您选择。

包括ETF、差价合约、单位信托、定期定额储蓄计划等等

支持多种货币进行交易结算

包括新币,马币,日元,港币,美元,澳元,加元,英镑,欧元

免费实时行情*:

美国,泰国,马来西亚&印度尼西亚

“余额通”

如果您的股票账户有闲置资金,也可以享有我们的 余额理财服务“余额通”!

免除账户管理费和海外股票托管费

没有闲置费和平台费*

专业中文交易团队

提供专属中文服务

为您提供及时的市场研究资讯以制定您的交易决策

9种可融资货币

新币,美元,港币,澳元,日元,英镑,欧元,人民币和加元

成立至今已超过45年, 是您值得信赖的金融伙伴, 并且已扩展至15个国家

开户方式

注册过程仅需5分钟

开户无国界,无开户费用,无最低押金

1. 身分证明文件:

身分证(新加坡国民、新加坡 PR 和马来西亚国民)、或护照(有效期6个月以上)

2. 当前居住地址证明文件(须最近三个月内发出)

可选择:电话账单、水电单、银行对账单或任何来自所居住国家的金融机构所发出的对账单

3. 税务号码 (Income Tax Number)

4. 银行账号信息

5. 连接电脑的摄像镜头

或扫描QRcode 立即开户:

专业的中文交易团队为您服务

我们特别成立了专业的中文交易组,

以便为全球华人投资者提供更好的解释交易模式结算方式和在交易或选股过程中遇到的各种金融知识和术语

我们还提供多种专属中文服务的联系方式, 欢迎洽询!

货币市场基金 (Money Market Fund)

如果您的股票账户有闲置资金,

不妨享有我们的余额理财服务。

辉立货币市场基金(Phillip Money Market Fund)

只需开设一个免费的辉立证券账户,把钱转入该账户即可自动购买辉立货币市场基金,即获得收益,完全不收取任何佣金。

账户内的余额资金还能随时用于股票购买。您也可以随时提取资金,没有最低锁定期。

*七天年化回报率:新币2.9105% (每年),美金3.2907% (每年)

*该年化回报率会根据市场情形发生变化

余额增值服务的优点

- 不收取任何佣金,无强制条件,无最低锁定期

- 流动性高,使用灵活,随存随取

- 投资收益最大化,无论何时账户的余额资金都不会被闲置

- 股票交易和其它投资的无缝对接(自动支付)

- 非强制性,可自主加入或停止该服务

该服务如何运作?

您一旦顺利完成办理该服务之后,您的交易账户中余额如果超过S$100,我们则将自动把余额资金投资于辉立货币市场基金。

如出现以下任一情况,该服务将自动赎回上述基金:

-

- 购股缴款、进行其它投资或缴纳交易费用

- 购股缴款、进行其它投资或缴纳交易费用

详情请参阅:https://bit.ly/3Slwx3q

![]()

亲民的交易佣金

佣金是根据前一晚帐户中的总资产值来确定

(环球账户)附带条件和条款

- 该账户每自然季度至少有1笔交易方可免除账户管理费。否则在3月、6月、9月、12月底,我们将收取每季度 15新元 的账户管理费。

- 在 2024 年 12 月 31 日之前免收美股与港股托管费。此后的费用请参阅 Cash Plus 账户信息表。

- 现金股利:净股息的1%,最低为1新元,最高为50新元(含消费税),加收境外券商费用和税费(如适用)

- 欲知更多详情,请参阅辉立环球资料表。或者,您也可开通“辉立余额通”(辉立货币市场基金),将有可能让您账户里的闲置资金带来更大的回报。

- 使用融资交易的借方余额将被征收利息。欲知更多信息,请参阅Cash Plus帐户信息表。

- 仅非专业投资者可以订阅股票实时行情,具体参照网址:http://bit.ly/3IrV6XW