- The coupon rate for the ARTSP 4.68% perpetual bond (SGD) has been reset to 3.07% and the next reset date will be on 30 June 2025 at the prevailing Swap Offer Rate plus 2.5%. The bond will be callable every 6 months onwards with the next call date on 30 December 2020.

- Issuer Profile: We are Neutral on Ascott Residence Trust (ART). While COVID-19 heavily hit operations causing some lessees to file for bankruptcy, we note that ART’s liquidity covers operating expenses for >2 years and sponsorship to Ascott Limited (part of CapitaLand Group) provides better access to funding.

- Bond recommendation: We are Overweight the ARTSP 3.07% perpetual (Yield to worst 3.16%, Yield to call 5.89% assuming called in 1 year, 264bps spread) as it looks interesting on the Ascott curve after resetting. It offers a 12bps spread pick up to the ARTSP 3.88% perp callable 1344 days later and a modest YTW senior-sub pick up of 70bps to the senior ARTSP 4.205% ‘22s. The next reset date for the perpetual is 5 years later at 30 June 2025.

COMPANY BACKGROUND

Singapore-listed Ascott Residence Trust (ART) is a hospitality trust with a market cap of S$2.5bn. Its portfolio of serviced apartments, business hotels and rental housing spans 15 countries and 39 countries totalling 88 properties after its merger with Ascendas Hospitality Trust. Majority shareholder, CapitaLand Ltd (40%), is the parent company of ART’s sponsor, The Ascott Limited, and its managers Ascott Business Trust Management Pte Ltd and Ascott Residence Trust Management Ltd.

Revenue is derived from 3 types of property leases

- Master leases (27% of FY19 gross profits): Properties have a fixed or minimum rental received from a single lessee for the lease tenure, providing stable income. These leases have longer tenures, with weighted average remaining tenure of 8 years.

- Management Contracts with Minimum Guaranteed Income (MCMGI) (13% of FY19 gross profits): Properties are operated by property operators who have to provide a minimum income guarantee to ART over the term of the contract. Weighted average remaining terms is 2 years.

- Management Contracts (60% of FY19 gross profits): Similar to MCMGI, properties are operated by property operators but do not provide minimum guaranteed income to ART.

CREDIT VIEW

+ Enough liquidity to sustain >2 years of operations with zero revenue. ART has a cash balance of S$300mn, credit facilities of S$425mn (of which S$200mn is committed capital available for use), and incoming cash proceeds of S$163mn from the divestment of Somerset Liang Court Singapore in July 2020. This totals S$888mn in liquidity. Basing off FY19 annual operating expenses of S$293mn and interest expenses (including perp distributions) of S$71mn, ART will be able to sustain operations and interest expenses for >2 years without any revenue. We note that operating expenses will also be reduced amidst reduced operations (18 properties temporarily closed as at 30 April 2020).

+ Hotel occupancies showing improvement as countries reopen. Early in June, Marriott, the world’s third largest hotel chain, reopened all of its hotels in China as business and leisure travel recovered. The group was upbeat, stating that occupancy rate was now at 40%, from a low of 7% in late January. While hotel room and occupancy rates may not recover to pre-COVID levels any time soon, we expect a decent recovery as borders are opened and lockdown measures are eased. 8% of ART’s gross profits come from China.

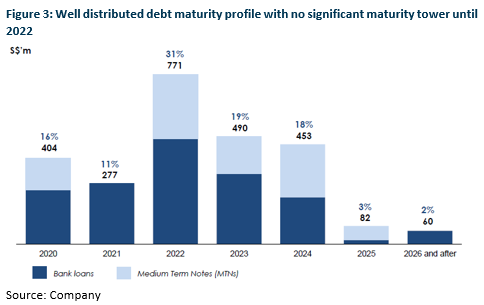

+ Large debt headroom of S$1.2bn with 69% of assets unencumbered to help ART through debt maturities. With gearing levels at 31.2% as at 31 March 2020, ART has a debt headroom of S$1.2bn before reaching the MAS REIT leverage ceiling of 50%. With connections to Capitaland and 69% of assets unencumbered (S$2.34bn of available loan amount assuming LTV of 60%), access to funding will be smooth.

With the risk of loss of property values amidst COVID-19, we note that ART’s portfolio can lose 38% before gearing levels reach the MAS 50% gearing limit (assuming constant debt levels). As a reference, hospitality valuations fell 6% during the GFC. With regards to perpetual bondholders, ART’s asset values can fall 63% before perpetual bondholders take a haircut.

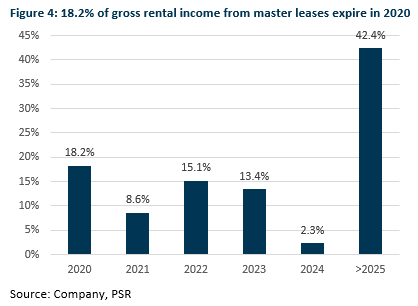

– Risk of non-renewal of expiring master leases mitigated by links to sponsor. 18.2% of master leases in terms of gross rental income (GRI) is due to expire in 2020. Master leases contributed 27% of ART’s total gross profits in FY19. While the master lease expiries may be a material concern, we note that ART’s sponsor The Ascott Limited contributes 66% of master leases gross profits (or 18% of total gross profits) in FY19. With ART’s sponsor as a major lessee of ART’s master leases, we think that non-renewal risk is reduced with sponsor support.

On 27 April 2020, WBF Hotels & Resorts (WBF), the master lessee of 3 Japan properties, filed for civil rehabilitation (bankruptcy). The 3 properties made up 1.8% of ART’s valuation that would have contributed S$6.7mn (1.3% of FY19 total revenue) in rent on a full-year basis. The impact of the default is small given ART’s large and diversified portfolio, and ART has 3 months’ worth of security deposits for the leases.