-Investment grade issuer coupled with adequate liquidity

-Recent lifting of global travel restrictions bode well for a rebound in the hospitality sector.

-Increase in percentage in long-term stay properties in portfolio mix provide more stability.

Company background

Ascott Residence Trust (ART) is the largest hospitality trust in the Asia Pacific with an asset value of S$7.7 billion as at 31 December 2021. The company invests primarily in income-producing real estate and real estate-related assets which are used or predominantly used as serviced residences, rental housing properties, student accommodation and other hospitality assets diversified across different countries. ART’s international portfolio comprises 93 properties with about 17,000 units in 43 cities across 15 countries in the Asia Pacific, Europe and the United States of America.

Some prominent brands that are under ART are Ascott The Residence, Somerset, Quest and Citadines.

Financial Highlights in FY 2021

For the full FY 2021, ART’s revenue increased 7% YoY to $394.4 million (vs FY 2020’s $369.9 million) and gross profit rose 15.8% YoY to $173.3 million (vs FY 2020’s $149.6 million). The increase was led by the pickup in demand from the corporate and leisure segments as restrictions were eased in ART’s key markets (US, United Kingdom and Australia).

Liquidity Position and Credit Metrics

ART also has a relatively good credit rating (BBB- by Fitch), which indicates that the expectations of a default is low. The gearing profile of the company is at 37.1% which is lower than the MAS regulatory requirement (up to 50%). This provides a $1.9 billion debt headroom for the company should it require additional debt funding. The interest coverage of ART stands at 3.7x.

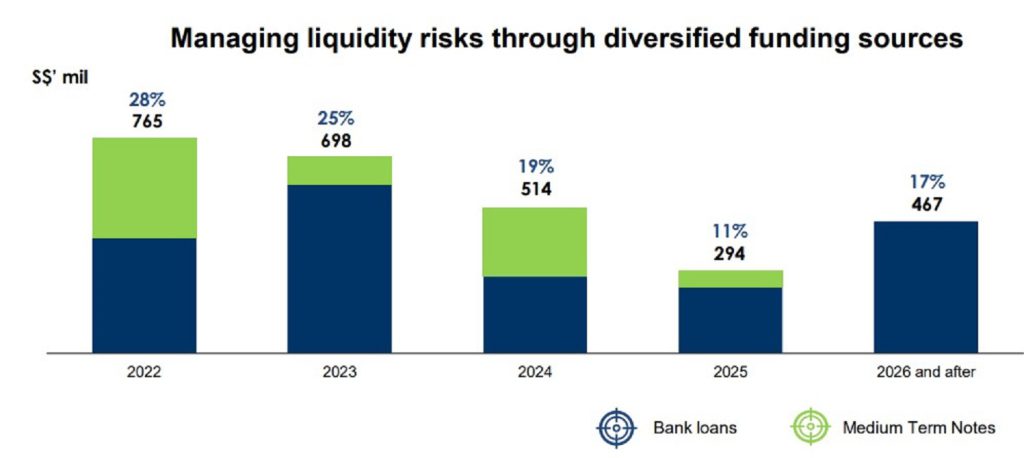

The debt maturity profile as of 31 December 2021 is as follows:

Figure 1: Debt Maturity profile

Source: Ascott Residence Trust

ART’s total borrowings are mainly made up of bank loans (72%) and medium-term notes (28%). In FY2022, ART had a total debt of $765 mn that will be maturing, but this will not be a hindrance as ART has a total of $1.04 bn available funds ($340 mn cash on hand + $700 mn credit facilities) which can be used to meet the current year’s debt obligation.

Readjustment of portfolio mix

The COVID-19 pandemic caused instability in revenue for the hospitality industry. Thus, in 2021, ART started to ramp up on its Student Accommodation/Rental Housing mix (5% to 16%) in its portfolio. ART targets to increase its asset allocation in longer-stay accommodation in the US and UK to 25-30% in the coming years. This will allows ART to further diversify from its usual cyclical revenue-generating assets and give more income stability to its unitholders. In FY 2021, 3 Japan Rental Housing properties and 8 US Student Accommodation properties were acquired with an average occupancy length of 2 years.

Summary

With a healthy liquidity position, Ascott Residence Trust is adjusting its portfolio mix towards more stability rather than just relying on its usual hospitality mix. We believe that the company is well-positioned to capture growth from the recovering market. The additional stability will sit well with investors/unitholders as it provides more confidence during rocky periods and reduces concentration risk.

Recently Issued by ART as at 18 Apr 2022:

-Ascott Residence Trust 3.63% 5 year senior bond (20 Apr 2027)