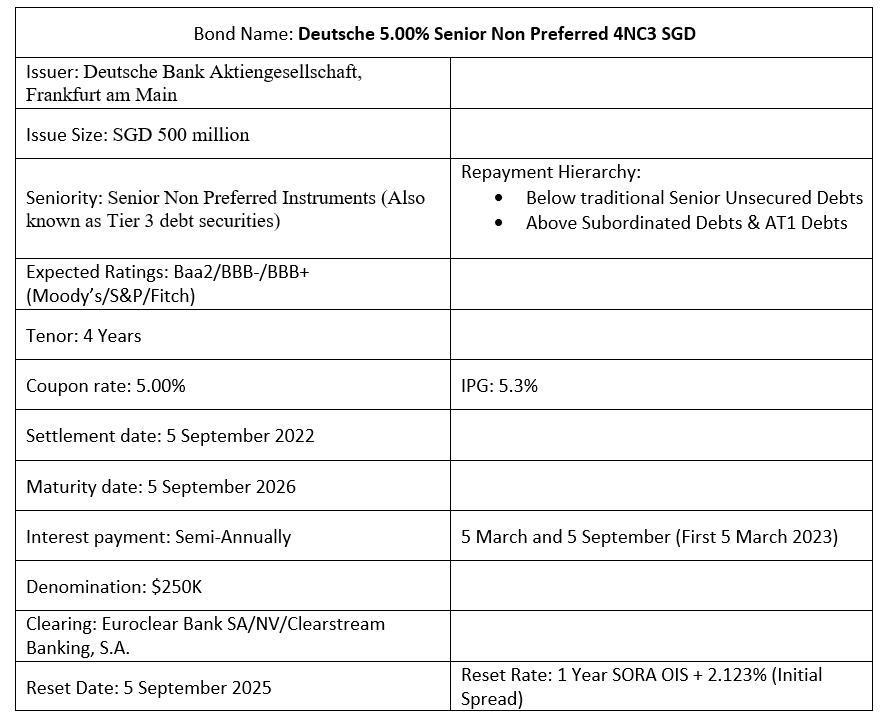

Deutsche Bank has just announced the issuance of its senior non preferred notes at a final price guidance of 5%. These bonds will not be callable for 3 years. If they are not called on 5 September 2025, they will be reset at the prevailing 1 year SORA-OIS plus the initial spread of 2.123%. In terms of the callable option, the issuer has the right to redeem the notes in whole but not in part, at 100% of the principal amount together with any accrued but unpaid interest on the call date. Do note that these bonds also carry an additional clean-up call feature of (75%). This means that the issuer will able to recall 75% of the total issuance in the event where it decides to cease the financing of this debt issuance, but this will be subject to prior regulatory approval. These notes comes with a semi-annual coupon payment on 5 March and 5 September each year and the first coupon payment will commence on 5 March 2023.

Company Background

Deutsche Bank is a German multinational investment bank and financial services company headquartered in Frankfurt, Germany. It is dual-listed on both the Frankfurt Stock Exchange (FRA ticker: DBK) and the New York Stock Exchange (NYSE ticker: DB). It is also a constituent of the DAX stock market index which is a stock market index that consists of the 40 major German blue chip companies trading on the Frankfurt Stock Exchange. The bank has a global network spanning across Europe, Asia and America. There are four main divisions within Deutsche Bank, which are Corporate Bank, Investment Bank, Private Bank and DWS (which is its asset management arm). The main revenue driver for Deutsche Bank would be its investment bank division which constituted (42.7%) of its total net revenue in 1H2022, followed by its private bank division (31.3%), corporate bank division (21.5%) and DWS (9.5%). As of 25 August 2022, Deutsche Bank has a market cap of USD16.94bn.

Deutsche Bank’s Financials in 1H2022 (ending 30th June 2022)

In the 1H2022, Deutsche Bank’s total net revenue increased by 4% YoY from €13.5bn in 1H2021 to €14bn in 1H2022. This increase was reflected by an average growth across all four core businesses (corporate bank: up 26% YoY; Investment bank up 11% YoY; private bank up 7% YoY and asset management 5% YoY)

Non-interest expenses decreased by 2.6% YoY from €5bn in Q2 2021 to €4.8bn in Q2 2022. This was driven by lower restructuring and severance and lower transformation charges.

Deutsche Bank’s post-tax return on average tangible shareholders’ equity (RoTE) stood at 7.9% in 2Q 2022, while the cost/income ratio also improved to 73% in 2Q 2022, from 80% in 2Q 2021.

Net Interest Income increased by 14% YoY from €5.45bn in 1H2021 to €6.24bn in 1H2022.

Loans and deposit development remained resilient with loans increasing by 11% YoY from €445bn in 2Q 2021 to €493bn in 2Q 2022. This was driven by the stable lending growth in the fixed income and currencies across all major businesses, following the continued growth in the corporate bank.

Deposit development also reflected a growth of 5% YoY from €581bn in 2Q2021 to €613bn in 2Q2022. The continued growth in Private Bank Germany was the primary driver for this increase.

Change in Net interest margin was at 1.39%. This increase was driven predominantly by USD interest rate rises in H1 2022 as well as lower average cash balances in the second quarter of 2022.

Credit Metric

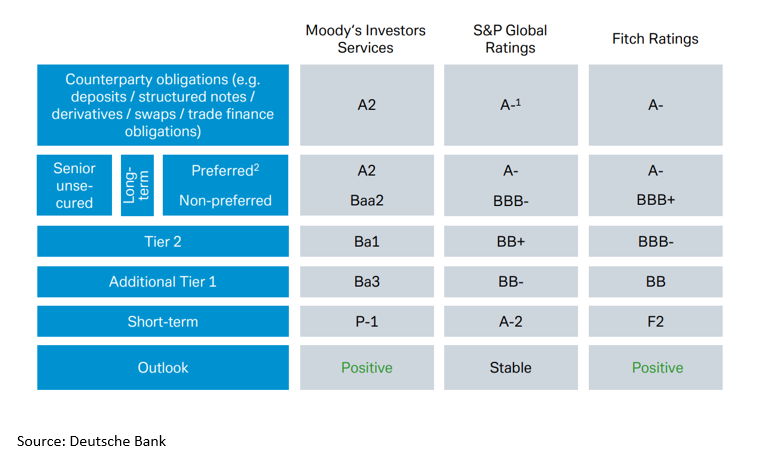

In terms of credit ratings, Deutsche Bank is rated A2/A-/BBB+ (Moody’s/S&P/Fitch).

+Deutsche Bank’s liquidity remained robust for 1H2022. It has a liquidity coverage ratio of 133%, and this is above the Basel III minimum liquidity coverage requirement of 100% or approximately €51bn. It is also aligned with its targeted levels of 130% with a surplus of €50bn, despite the recent market volatility.

+Secondly, the net stable funding ratio for Deutsche Bank is 116% with a surplus of €83bn. This is within the targeted range of 115-120% with a surplus of €100bn. This resulted from stable deposit funding, longer-term capital market issuances and the extended utilization of low-cost targeted longer-term refinancing operations funding.

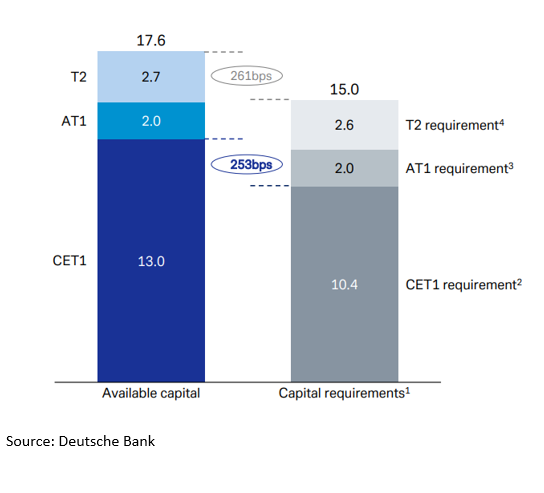

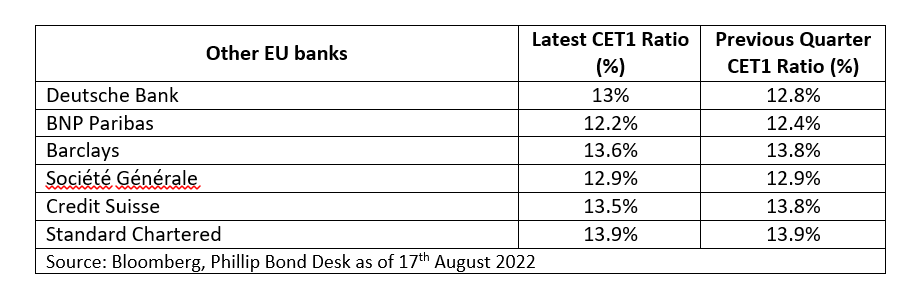

+Deutsche Bank’s CET1 ratio stood at 13%, 14bps higher from 12.8% in 1Q2022. This is due to stronger earnings reflected in Q2 2022. It is above the regulatory requirement of 10.4% as well.

The table below shows a brief overview on the CET1 of Deutsche Bank compared to some of its peers. We can see that Deutsche Bank’s CET1 is still within the range of its peers and it has remained resilient in achieving its target of a CET1 ratio of >12.5% which is (253bps above the requirement

Credit rating overview on Deutsche Bank’s Instruments

Outlook:

Deutsche Bank is well positioned in terms of its capital adequacy as it has an adequate capital buffer. Additionally, the credit rating table above illustrates that Deutsche Bank is a relatively credit worthy investment option that investors may consider in this current uncertain economic environment.

Bond Overview

ID: @349vshmi

ID: @349vshmi