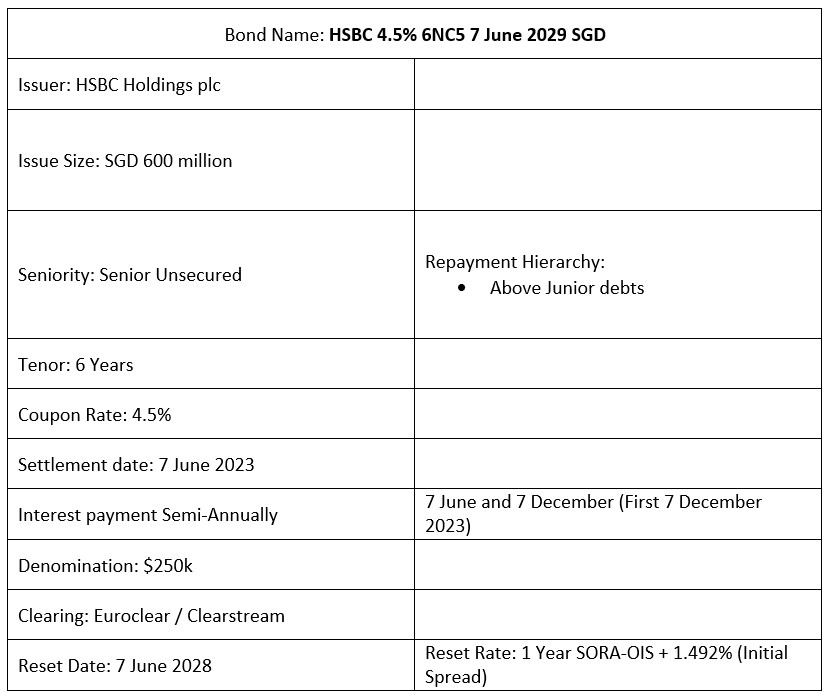

HSBC Holdings PLC (HSBC) recently announced the issuance of its 6NC5 senior unsecured bonds at a final price guidance of 4.5%. These bonds carry a tenor of 6 years with an attached one-time callable option by the issuer in the 5th year (7 June 2028). If the bonds are not called on the 5th year, these bonds will be reset at the prevailing 1-year SORA OIS + initial margin of 1.492%. The coupon payments for these bonds are paid out semi-annually and are scheduled on 7 June and 7 December each year, with the first coupon payment to be paid out on 7 December 2023.

The notes also have a loss absorption disqualification event redemption feature, which allows the issuer to redeem the notes in whole, but not in part, at a redemption price equal to 100% of their principal amount, plus any accrued and unpaid interest to (but excluding) the applicable redemption date. The issuer may exercise this redemption right within 90 days of the occurrence of a relevant Loss Absorption Disqualification Event. This new issuance is expected to have a rating of A3 / A- / A+ (Moody’s/S&P/Fitch).

Company Overview

HSBC is one of the world’s largest banking and financial services organizations. It serves approximately 39 million customers through its global businesses: Wealth and Personal Banking; Commercial Banking; and Global Banking & Markets. Its network covers 62 countries and territories in Europe, Asia, the Middle East and Africa, North America and Latin America.

Headquartered in London, The Hongkong and Shanghai Banking Corporation Limited’s Wealth and Personal Banking, Commercial Banking, and Global Banking and Markets constitute 45%, 33%, and 22% of the bank’s 1Q2023’s revenue respectively.

1Q2023 Financials

In HSBC 1Q2023 results, the bank recorded an increase in its revenue of 74% YoY from USD 11.6bn in 1Q22 to USD 20.2bn in 1Q23. This was mainly attributed to its non-net interest income improvement of approx. 104% YoY, which brings the amount up to USD 11.2bn from the prior USD 5.4bn in the previous 1Q. Of this increase, approx. USD 3.6bn was driven by the reclassification of its French retail business and a provisional gain on the acquisition of SVB UK.

Net Interest Income (NII) and Net Interest Margin (NIM) remained fairly stable QoQ with NIM moving up by 1bps from 168bps in the previous quarter to 169bps in 1Q2023; and NII falling a little from USD 8.98bn in the previous quarter to USD 8.95bn in 1Q2023.

In terms of its credit position, HSBC’s CET1 ratio improved by 0.5% from the previous quarter from 14.2% to 14.7% in 1Q2023. The bank also said that it intends to maintain its common equity tier 1 (CET1) ratio within the medium-term target range of 14% to 14.5%. HSBC’s liquidity coverage ratio (LCR) remains at 132%, matching the previous quarter and this is well above the regulatory requirement of 100%.

Bond Overview