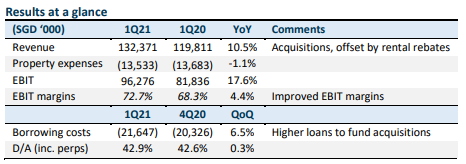

- Revenues rose 10.5% YoY to S$132.4mn, EBIT grew 17.6% YoY to S$96.3mn on higher margins of 72.7%, up 4.4%.

- Gearing (D/A) including perpetuals remained stable, up 0.3% to 42.9% despite net debt issuance. Borrowing cost rose 6.5% QoQ on higher borrowings for acquisitions.

- Occupancies remained healthy at 97.2% from 98.0% previous quarter, and rental reversions was positive 1.9%, vs 2.0% previous quarter.

- We are Overweight on the MLTSP 4.18% Perp Corp (SGD) with a yield to call of 3.15% and yield to worst of 3.08%, and Neutral on the MLTSP 3.65% Perp Corp (SGD) with YTC of 3.31% and YTW of 2.76%.

The Positives

+ Revenue rose 10.5% YoY to S$132.4mn on existing portfolio and new acquisitions, offset by rental rebates to eligible COVID-19 impacted tenants and divested investment properties. EBIT grew 17.6% to S$96.3mn on higher revenues and EBIT margins of 72.7%, up 4.4%. Average rental reversion was positive 1.9% for the quarter, mainly due to properties in China, Hong Kong SAR, Malaysia and Vietnam. Leasing demand for warehouse space remain resilient amidst COVID-19 and 98.7% of MLT’s tenants in terms of total revenue have resumed operations, except of 1.3% mainly from Singapore. The group has hedged 78% of revenues to SGD.

+ Portfolio occupancy remained healthy ay 97.2%. WALE stood at 4.3 years and is well-staggered with 15.6% and 24.2% of leases by NLA expiring in the next 2 years respectively.

+ Adequate aggregate leverage of 39.6%. Our stress tests show investment property values can fall by 22% or borrowings increased by S$1bn or 30% before the MAS gearing limit is breached. Also, MLT has sufficient committed credit facilities of S$530mn to pay off all short-term debt.

Debt maturity profile is well staggered with 10% maturing in the next 2 years and an average debt duration of 4 years. In the quarter, MLT refinanced S$127mn equivalent of HKD and AUD loans with existing committed credit facilities. As a result, short-term debt declined to S$129mn QoQ from S$202mn. 80% of total debt has been hedged to fixed rates, with the weighted average annualised interest rate at 2.3%.

The Negatives

– Borrowing costs increased 6.5% from net debt issuance of S$86mn in the quarter for acquisitions. Interest cover ratio including perpetual bond payments remained healthy at 3.6x.

Outlook

MLT’s performance remained resilient despite COVID-19. With a debt headroom of S$1bn based on the MAS gearing limit of 50%, MLT has room for more growth through acquisitions. A proposed acquisition of a Grade A logistics facility in Brisbane Australia for S$20.2mn is expected to complete and begin contributions in 3Q21. MLT is rated investment grade Baa2 with a stable outlook by Moody’s.

Bond Recommendation

On the Mapletree curve, we are Overweight on the MLTSP 4.18% Perp Corp (SGD) with a yield to call of 3.15% and yield to worst of 3.08%. and Neutral on the MLTSP 3.65% Perp Corp (SGD) with YTC of 3.31% and YTW of 2.76%.