Earlier this week, Monetary Authority of Singapore (MAS) said on 1 Aug 2022 that the central bank was looking to raise a minimum of $1.5 billion through the issuance of its first sovereign green bonds.

Today MAS announced its first sovereign green bond at a final price guidance of 3.04%. These sovereign green bonds, which are known as Green Singapore Government Securities (Infrastructure) bonds, or Green SGS (Infra) bonds in short, will be denominated in Singapore dollars and come with a tenor of 50 years, so they will be maturing on 1 August 2072. The coupon payments will be made semi-annually with the first coupon on 1 February 2023. The minimum investment amount for these bonds will be $200,000 for the placement tranche and $1,000, and in multiples of $1,000 for the public offer.

These green bonds will form a part of the pipeline of the $35 billion sovereign and public sector green bond target that the Singapore Government and its statutory boards are aiming to issue by 2030. The Green SGS (Infra) bonds will come under the Significant Infrastructure Government Loan Act (SINGA) and will be in alignment with the Singapore Green Bond Framework, where the issuer will have to detail the intended use of the green bonds proceeds. In terms of credit ratings, Singapore is rated the highest credit rating possible by all three ratings agencies. The ratings are Moody’s (Aaa), S&P (AAA) and Fitch (AAA).

(See related article regarding Singapore Green Bond Framework: Singapore’s Green Bond Framework: Focus on financing a sustainable future

The proceeds from these Green SGS (Infra) bonds will be used to finance expenditures in support of the Singapore Plan 2030, including the expansion of the electric rail network (Jurong Region Line and the Cross Island Line), which are expected to be complete in 2029 and 2030. The ministry of finance will also publish a progress report annually regarding the allocations of the funds as well as its impact associated with its environment benefits and social co-benefits, where possible.

This Green SGS (Infra) bonds issuance is different

Unlike the usual SGS bond launches, where there is a regular schedule and investors will have to bid through an auction to make the purchase, these sovereign green bonds, will be launched through a syndication process.

Syndication

Syndication is essentially a book-building process and it involves the appointment of a group of banks, also known as bookrunners or underwriters, to jointly market and distribute a bond. This group of banks comprises DBS, Deutsche Bank AG Singapore Branch (DB), HSBC, OCBC and Standard Chartered Bank.

The syndication process comprises 2 stages, the Placement Tranche and the Public Offer. In the first stage, which is the placement tranche/pricing day, the bonds will be offered by the bookrunner to institutional and other investors to submit their bids on the number of bonds that they are interested in buying and the prices that they would be willing to pay. During this process, the bookrunners will then determine the price and yield at which the bonds will be offered by evaluating the aggregate demand from the submitted bids. This process will be completed in that evening of that day.

The second stage will be the Public Offer. MAS will announce the offer size, yield, price and the application timeline of the bond after it has been priced by the institutional market during the placement tranche. The bonds will then be offered to the public to apply via ATMs or internet banking platforms provided by DBS, OCBC and UOB.

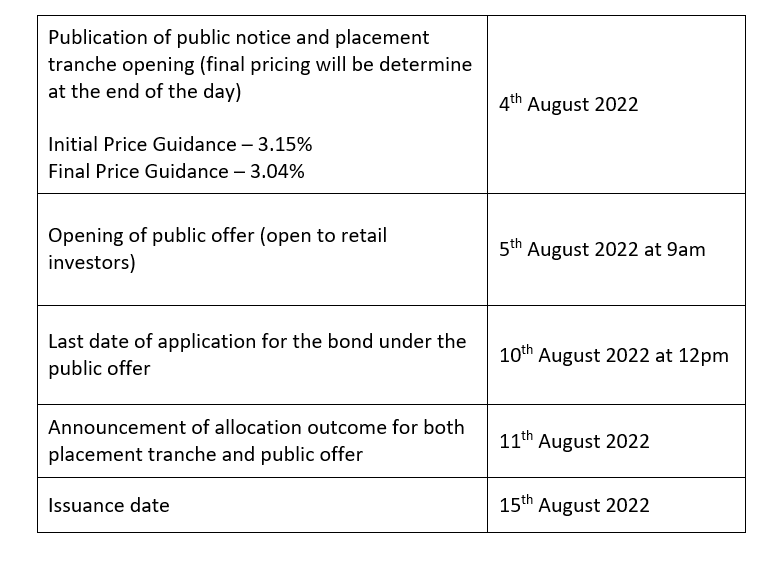

(An overview of the expected timeline)

Competitive tax rate for individual investors

Interest and other qualifying income derived from these Green SGS (Infra) bonds are tax exempt for both residential and non-residential investor.

Overview

All in all, this green high quality bond issuance, will play a key part in driving Singapore’s overall sustainability agenda and attract green investors who are looking for a steady and safe long term growth opportunity.

Some questions that you may ask:

Q. Why is it launched through syndication this time round as compared to the usual auctioning?

-This is the first time that MAS will be trying to complement the regular schedule of SGS auctions.

Q. Will there be a re-opening of this Green SGS (Infra) bond this year through a mini-auction?

-According to the mini auction calendar, there will not be any more mini-auctions this year. Hence, there will be no re-opening of this Green SGS (Infra) bond this year.

Q. Can I use my CPF or SRS funds for the application?

-No. Only cash will be accepted for this issuance.

Q. How can I subscribe to this Green SGS (Infra) bonds in the public offer?

For individual who are applying for the public tranche, you can click here for a rough guide.