The 2019 Novel Coronavirus (“2019-nCov”) has everyone alarmed. Many are choosing to stay home to curtail the risk of infection. Consequently, global activity is slowing as economies warn of decelerating growth forecasts. In this article, we explore the impact the Coronavirus has on several issuers of local bonds.

Novel Coronavirus

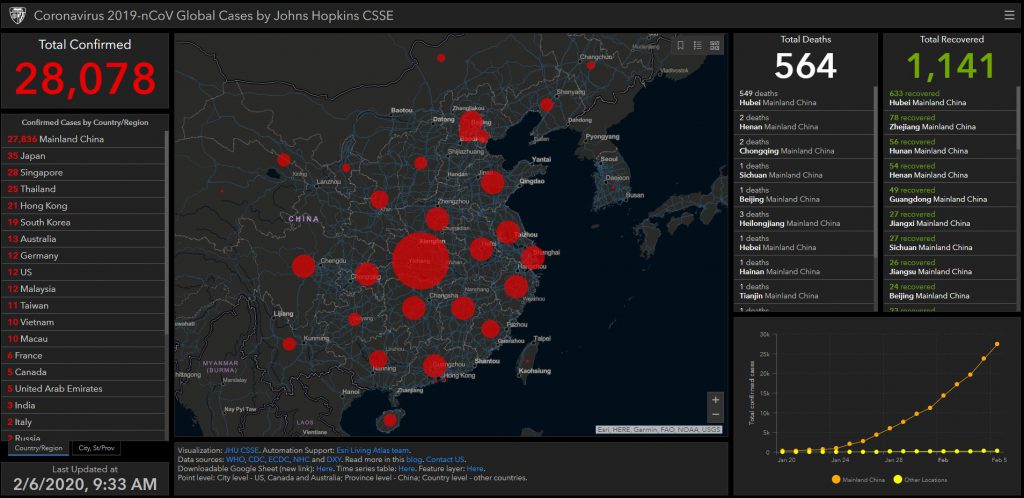

The Novel Coronavirus is a new type of flu that originated from China; the city of Wuhan to be exact, which is why many associate it as the “Wuhan” virus. So far, more than 500 people died from it, with over 28,0000 confirmed infected, mostly in China. The fear of global infection is high, as we see many countries blocking their borders to the Chinese visitors. On the other hand, according to recent news there have been breakthroughs in the search of a treatment against the virus, albeit not yet confirmed. As more people get infected daily and experts find uncertainty in reliability of data regarding the spread, we may have yet to determine if the situation is under control.

Impact

To counter further spread of the virus, some governments have resorted to interventions by restricting travel to and from China. Consequently, we expect travel volumes to slump as many people cancel flights overseas to limit their exposure to the virus. From an economic standpoint, the fall of travel volumes will have an impact on the tourism industry. Key sectors within the tourism industry comprise of transport, such as airlines, as well as hospitality like hotels. Moreover, we may also expect the retail sector to weaken as more people prefer staying indoors in lieu of spending time and money outside.

Central banks have stepped in to help remedy the economic fall out of the virus. Locally, the Monetary Authority of Singapore revealed that they are open further easing of the Singapore dollar to help soften the blow from the outbreak. The Chinese central bank has also injected considerable amounts of money into its economy and cut its interest rates in a bid to stabilize markets.

SGD Bond Issuers Affected

Transport

Our SGD bond market issuers in the transport sector consists of international airline carriers Singapore Airlines Ltd (“SIA”) and Cathay Pacific Ltd (“Cathay”). We are already seeing their performance hindered by waning travel demand.

The SIA SGD bonds include:

- SIASP 3.030% 28Mar2024 Corp (SGD) – Retail

- SIASP 3.130% 23Aug2027 Corp (SGD)

- SIASP 3.160% 25Oct2023 Corp (SGD)

- SIASP 3.145% 08Apr2021 Corp (SGD)

- SIASP 3.035% 11Apr2025 Corp (SGD)

- SIASP 3.750% 08Apr2024 Corp (SGD)

- SIASP 3.130% 17Nov2026 Corp (SGD)

- SIASP 3.220% 09Jul2020 Corp (SGD)

and the Cathay SGD bonds are:

In response to the diminished demand for air travel, SIA reduced its capacity of flights by reducing the number of flights to china or reducing the size of planes used for flights. If demand remains lackluster for a prolonged period, the company might consider cutting staff as well to further manage expenses, as it did back in 2003 during the SARS epidemic. For SIA, a significant portion of revenue from passenger flights come from East Asia, the region more highly affected by the Coronavirus. About 53% of passenger revenue in FY2019 came from East Asia.

Cathay Pacific is worse off, deriving about 66% of 1H2019 revenue from regions most affected by the virus. Accordingly, Cathay announced that they will cut capacity by 50% or more in response to the spread and have further requested all its 27,000 staff to consider taking three weeks of unpaid leave over the next few months in a bid to preserve cash.

Hospitality

The other directly impacted sector would be businesses providing lodging. In particular, sliding Chinese tourism will hit hospitality businesses in the Asia-Pacific region the hardest.

Largely exposed to the Asia-Pacific region is Frasers hospitality trust (“Frasers”). For the quarter ended December 2019, Frasers derived 41%, 20% and 14% of net property income from Australia, Singapore and Japan respectively. Tourism to these countries will take a blow from a fall in international Chinese visitors as a significant portion of their international visitors are from China.

Ascott Residence Trust (“ART”), which recently merged with Ascendas Hospitality Trust, has little exposure of properties in china (about 5% of gross profit). However, falling demand from Chinese travelers could drag on earnings because ART derives 62% of gross profits from the Asia-Pacific.

- ARTSP 3.880% Perpetual Corp (SGD)

- ARTSP 4.680% Perpetual Corp (SGD)

- ARTSP 4.000% 22Mar2024 Corp (SGD)

- ARTSP 4.205% 23Nov2022 Corp (SGD)

- ARTSP 3.523% 09Nov2023 Corp (SGD)

Retail and Commercial

Companies in the retail and commercial space could face strain as well. BreadTalk (BREAD 4.000% 17Jan2023 Corp (SGD)), with about 26% of revenue from its china food business could see a drag on earnings if Chinese consumption declines.

Golden Agri-Resources (GGRSP 4.750% 25Jan2021 Corp (SGD)) could see demand from China for its palm oil fall. equally for its cooking oil, margarine, shortening and butter oil substitutes sales to China. The company had 12% of revenue contributed by china in FY2018.

Metro Holdings (METRO 4.000% 25Oct2021 Corp (SGD) and METRO 4.300% 02Apr2024 Corp (SGD)), may see its rental affected as key rental income properties in China contributed 74.3% of profit from operations before tax in FY2019. Likewise for Mapletree North Asia Commercial Trust (MAGIC 3.200% 08Sep2021 Corp (SGD) and MAGIC 3.500% 22Mar2023 Corp (SGD)), with 31% of income from property leases in China.

Ongoing Monitoring

For now, the Coronavirus is top priority on the world’s radar as governments scramble to contain its spread. As we are still fresh in the outbreak and lacking reliable data, we have yet to determine a predictable outcome. Nevertheless, we take a cautious stand, and expect bond yield spreads to widen if the situation prolongs.

Get details on the bonds mentioned in this article. Contact us at (+65) 6212 1818 or bonds@phillip.com.sg.