- The Oxley 6.375% USD bond has been on our radar for a while for its compelling value. At the current price of 95.3, it offers an SGD swap implied yield to maturity of 12.51% with a tenor of less than 10 months (maturity date on 21 April 2021). Upon Oxley’s recent company update on 9 July 2020, we provide some colour on the company’s performance and its debt repayment ability, and why we believe Oxley’s cash flows looks adequate to redeem the bond.

CREDIT VIEW

+ Strong cash flow visibility despite construction delays. The group’s construction projects in Singapore have been halted since April due to COVID-19 measures, and may resume end July subjected to regulatory approval. Consequently, TOP dates have been delayed.

Cash and cash equivalents available as at 31 December 2019: S$324mn

Cash flows expected in 2020

The group’s Singapore projects expected to be completed and revenues recognised in 2020 include The Verandah (S$15mn) and Sea Pavilion Residences (S$16mn), and similarly for overseas projects include Royal Wharf (S$345mn), Dublin Landings (S$116mn), The Bridge (S$5mn) and The Palms (S$24mn), bringing the total revenues due for recognition in 2020 to S$521mn. In addition to the cash flows from project completions, Oxley also received cash flows of S$206mn from its successful divestment of Chevron House announced on 22 June 2020, and GBP30mn (S$53mn) from a sale of its 20% stake in Galliard Group. Total expected cash inflows in 2020 amount to approximately S$780mn.

Cash flows expected in 2021

Singapore projects due to TOP in 2021 include 1953 (S$43mn), The Verandah (S$150mn), and Sixteen35 Residences (S$34mn), while overseas projects include The Peak (S$213mn), bringing expected 2021 total project development revenue recognition to S$440mn.

Comments

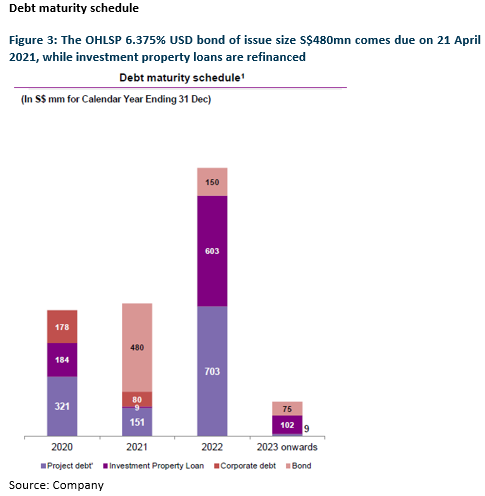

With a debt maturity schedule of S$499mn (321+178) in 2020 and S$711mn (480+80+151) in 2021 totalling S$1,210, and cash flow visibility of S$1,104mn (324+780) in 2020 and S$440mn in 2021 totalling S$1,544mn, we believe Oxley has adequate liquidity to redeem the OHLSP 6.375% USD bond maturing in 2021.