- Ascott Residence Trust has opted not to call its 4.68% perpetual bond on the first call date of 30 June 2020, setting an industry first.

- We are wary of upcoming non-call risk of perpetual bonds as companies seek to (i) allow coupons to reset lower and save on finance costs, and (ii) conserve cash amidst difficult economic conditions.

- However, some perpetual bonds remain attractive as risk-reward conditions improve after prices fall.

A new precedent – The first perpetual non-call

Given the harsh impact on the hospitality sector, Ascott Residence Trust announced on Friday, 29 May 2020 that it has taken the prudent step of not calling their 4.68% perpetual bond with first call date on 30 June 2020. This sets a precedence in the Singapore perpetual bond market since its inception in 2011, apart from defaults and restructuring,.

Moving forward for ARTSP 4.68%: Lower distribution rate with ongoing option to redeem

The ARTSP 4.68% Perp will, from the first call date of 30 June 2020, pay a lower distribution rate based on the date’s Swap Offer Rate (SOR) + 2.5%. Based on the current 5-year SOR rate of 0.525%, the new coupon rate will be around the 3.025% area. This translates to a YTC of 6.16% assuming the bond is called 1 year later, and a YTW of 3.16% based on the current indicative ask price of 97.

Given Ascott’s option to call the perpetual every distribution date after 30 June 2020 (every 6 months), the company’s management has indicated their consideration to call the bond when credit markets stabilise possibly within the next 1-2 call dates.

Wary of non-call risk for upcoming perpetual call dates

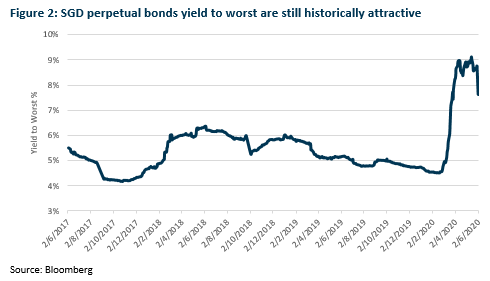

Perpetual bonds with upcoming call dates may face the same fate as the ARTSP 4.68% Perp. To determine the risk of non-call, we look at the potential new refix coupon rate compared to the current coupon rate. A lower refix coupon rate will translate to higher cost savings for the issuer if not called, suggesting a higher non-call risk. We outline the SGD perpetual bonds with upcoming call dates in Figure 1.

Limited downside: yield to worst levels are attractive historically

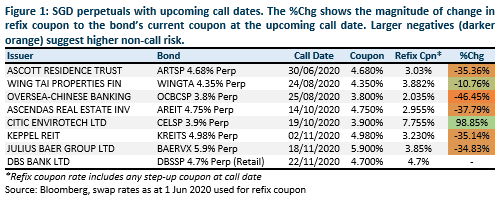

Given the large selloff of perpetuals in March this year, we believe that non-call risk has largely been priced in, limiting downside risks to bond prices. Yields have been compressed as we start to see demand for attractive risk-reward despite non-call risks.

Looking at average yield-to-worst (worst yield scenario) of the SGD perpetual bond market, yields are historically attractive and have room for further yield compression. We do not see demand for perpetual bonds weakening.