We attended Azalea’s Astrea Investor Day 2021 on 28 January 2021. Azalea, the sponsor of the Astrea bond series, gave an update on the bonds’ portfolio performances. Here are the highlights.

Background

In 2016, Azalea, an indirect wholly-owned asset-management subsidiary of Temasek Holdings, launched its Astrea III investment products to broaden investors’ access to private equity (“PE”). The investment products were the first listed notes in Singapore backed by cash flows from PE funds. Since then, Astrea IV and V bonds have been launched, in 2018 and 2019 respectively. The Astrea IV Class A-1 Bonds were the first listed PE Bond available to retail investors in Singapore, providing an opportunity to gain exposure to private equity.

Investor demand was strong for each launch. The Class A-1 bonds for Astrea IV were 7.4x subscribed and for Astrea V, 4.5x subscribed. The popularity of PE investments among the public appears to be growing, and Azalea’s objective of issuing the Astrea bonds is to provide greater investor exposure to PE.

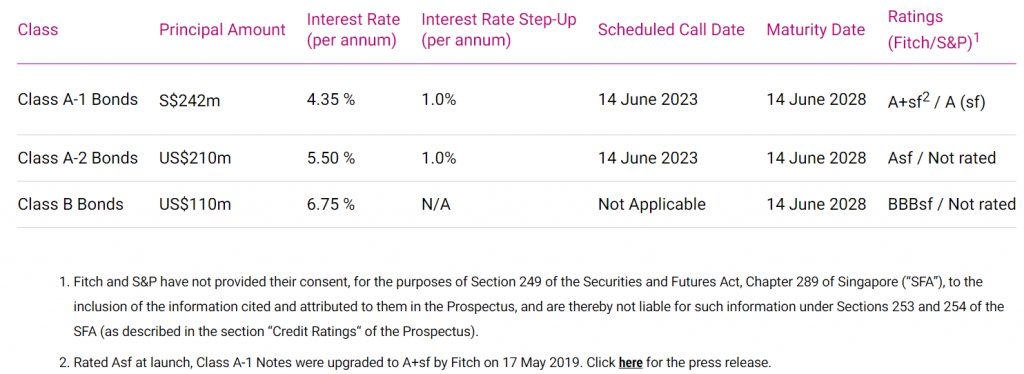

Figure 1: Astrea IV Outstanding Bonds

Source: Astrea

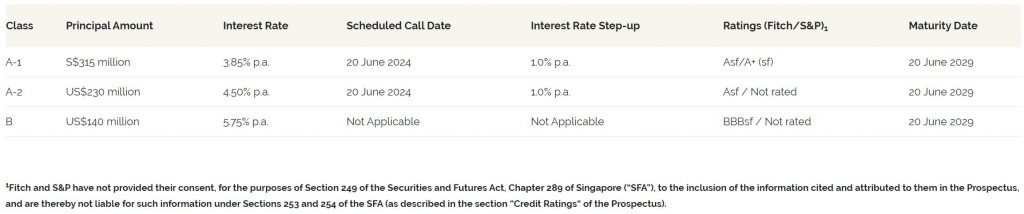

Figure 2: Astrea V Outstanding Bonds

Source: Astrea

Safeguards for Astrea Bonds

The Astrea bonds have been designed to be highly safeguarded debt securities. There is also a scheduled reserves mechanism to enable timely principal repayment of the bonds at maturity. The structure must also maintain a Maximum Loan-to-Value (LTV) Ratio of 50% or less at all time. If the LTV Ratio exceeds 50%, cash will be diverted to the Reserves Accounts and, if necessary, repay outstanding Class B Bonds until the Maximum LTV Ratio is no longer exceeded.. Moreover, at issuance, the Astrea IV and V PE funds are mostly mature buyout funds with 6-8 weighted average years in their cash-generative stages.

Portfolio Performance Update

In line with the market, the total value of the Astrea portfolios have recovered above pre-pandemic levels. Including cumulative net distributions received, Astrea IV’s portfolio appreciated 5.6% from 2 December 2019 to 30 November 2020 to US$1,306mn. Similarly, Astrea V’s total portfolio value (including cumulative net distributions) grew 17.3% from 6 December 2019 to 7 December 2020 to US$1,741mn. Cash flows from the PE funds remained substantially healthy and the funds did not have to rely on credit facilities to pay out dividends or maintain operations. At the latest distribution date, Astrea IV generated US$83mn of available cash flows to pay US$13.5mn of bond interest payments. Astrea V generated US$165mn, way above the US$14mn bond interest payments. Total undrawn credit facilities remained unchanged for both IV and V at US$204mn and US$195mn respectively.

During the peak of the pandemic, the Sponsors of Astrea IV and V waived their rights to receive cash under the priority of payments and direct this cash to accelerate reserving of amounts in the Reserves Accounts. This helped to re-risk the Astrea IV and V structures. As the LTV ratio for Astrea IV had exceeded the 50% threshold by 0.1%, an additional US$1mn was deposited into its reserve account from available cash flows to bring the ratio down. The ratio was further lowered to 42.4% after the Sponsor Waiver of US$53mn. The Sponsor also waived its Astrea V cash receipts of US$12mn into the Reserve Accounts in prudence despite its LTV ratio not exceeding 50%. As of Dec 2020, Astrea IV’s LTV ratio was 32.8% and Astrea V’s 32.7%, both significantly below their 50% threshold.

Bond Performance Update

Both the Astrea IV and V Class A-1 bonds traded on the SGX showed lower volatility than the FTSE STI and have recovered to pre-pandemic levels. The greatest decline for Astrea IV was 7% while that for Astrea V was 10% from 3 Mar 2020 to 23 Mar 2020 when the market was impacted by the onset of the COVID-19 crisis. Compare this with the FTSE STI, which fell 27% to its trough in the same period.

Figure 3: Astrea retail bonds performance (green, blue) vs the Straits Times Index (yellow)

Source: POEMS 2.0 Trading Platform

Bottom line

The Astrea bonds have continued to be a stable source of yields for Singaporean investors. The bonds structural safeguards include the mandatory building of reserves, maximum LTV ratio of 50% and mature PE funds that are cash generative. These not only helped secure coupon payments through a crisis, but also kept bond prices firmly stable relative to the overall market. The hunt for yield continues in this low interest rate environment, and Azalea’s Astrea bonds are something investors can consider as a fixed income investment.