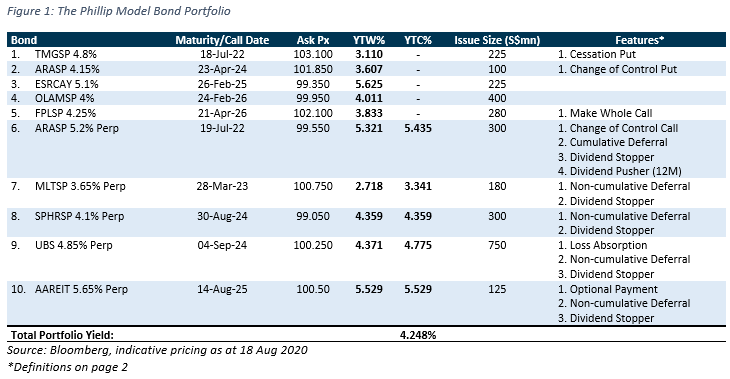

We launch our Phillip Model Bond Portfolio consisting of wholesale corporate bond picks (minimum denomination of S$250k) for fixed income investors. The list includes bullet and perpetual corporate bonds denominated in SGD. Corporate bond investing provides a means for generating a stable and predictable income stream through the receipt of promised regular coupon payments and your invested principal back at a specified date.

Strategy commentary

Our bond picks are diversified across issuers with resilient credit profiles to weather downturns, and across a range of industries, some proving to be beneficiaries of COVID-19 trends. Singapore bond prices have rallied strongly in response to depressed interest rates, thus we’re increasingly selective for reasonable cash ask prices that offer decent yields above government bonds and inflation. The portfolio will be reviewed on a monthly basis.

Portfolio commentary

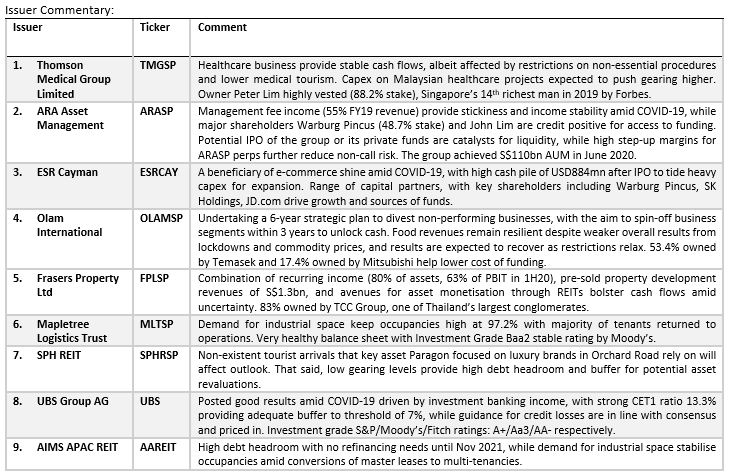

Issuers are diversified across various industries including healthcare, real estate management, logistics and e-commerce, real estate development, retail and industrial REITs, commodity, and banking. All issuers are listed entities except for ARA Asset Management; a private company previously delisted from the Singapore Exchange. There is a balanced mix of 5 bullet bonds and 5 perpetual bonds. We identify with investor wariness on perpetual bonds after the non-call event by Ascott Residence Trust, which was in response to the lower reset rates caused by the lower interest rate environment. However, given record low interest rates currently, and the perpetual bonds in our portfolio with call dates around 2 years away, we argue that there are opportunities for perpetual bonds now with a longer term view that interest rates rise as the economy recovers from the pandemic over the next 2 years.

Within the bond list, we classify the TMGSP 4.8%, ARASP 4.15%, FPLSP 4.25%, OLAMSP 4%, and MLTSP 3.65% as high grade bonds, and the ESRCAY 5.1%, ARASP 5.2%, SPHRSP 4.1%, UBS 4.85%, and AAREIT 5.65% as high yield bonds.

Bond feature definitions

- Change of Control Call/Put. With a Change of Control Call, in the event that certain “Change of Control Events” occur, the issuer is obliged to immediately re-pay the bondholders their nominal amount invested. With a Change of Control Put, the bondholder has the option to oblige the issuer to redeem the bond in a “Change of Control Event”. The change of control clause is designed to protect investors from the bond issuing company being taken over by another person or entity during the life-time of the bond, thus changing the overall risk profile that the original bond investors signed up for.

- Cumulative and Non-cumulative Deferral. If coupon payments are deferred or unpaid by the issuer, bondholders are entitled to all outstanding arrears if the bond has a Cumulative Deferral clause, whereas coupons payment are foregone if there is a Non-cumulative Deferral clause.

- Dividend Stopper. The issuer and its subsidiaries shall not declare or pay any dividends if they opt to defer or not pay coupon payments to bondholders. Dividend Pusher. A trigger where the bond coupon must be paid as a consequence of a decision made by the general shareholders’ meeting to pay share dividends. The look-back period determines how far back accrued interest payments will be made to bondholders, which in some way counteracts the Cumulative Deferral clause.

- Optional Payment. An option given to the issuer to, at its discretion, elect not to pay a distribution.

- Loss Absorption. A common feature for bank bonds where the issuer can write-down a bond’s face value (your principal) either temporarily or permanently upon a trigger event, usually if its CET ratio falls below a certain level.

- Cessation Put. Should the issuer’s shares cease to be traded on the exchange or are suspended for a certain period, the issuer is obligated to redeem the bond with interest accrued.

- Make Whole Call. A provision allowing the issuer to redeem the bond early.