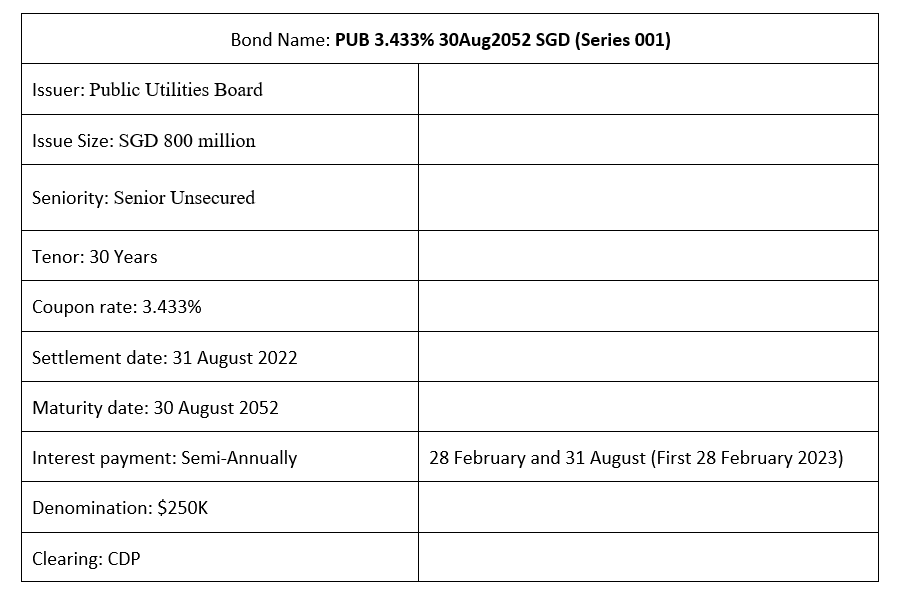

To contribute towards achieving sustainable and wastewater management, and renewable energy, the Public Utilities Board (PUB) has issued a green bonds at a final price guidance of 3.433%. These green bonds carries a 30-year tenor which will mature on 30 August 2052, and these are plain vanilla bonds that do not carry any special feature. The coupon repayment will be done semi-annually on 28 February and 31 August with the first coupon payment on 28 February 2023.

PUB is Singapore’s national water agency and is also a statutory board under the Ministry of Sustainability and the Environment (MSE). In terms of credit rating, Singapore is rated the highest possible by all three ratings agencies at Aaa/AAA/AAA (Moody’s/S&P/Fitch).

These green bonds are part of the new $10 billion multicurrency, medium-term note programme which PUB announced on the 18 August 2022. This issuance is the first series of the programme. The notes and coupons of all series going forward including this will constitute as unsecured and unsubordinated obligations of the issuer. Therefore, they are rank pari passu and without preference among themselves.

PUB has also stated that the proceeds from this green bond issuance will be used for financing or refinancing new or existing eligible green projects such as the floating solar panel system at Tengeh Reservior under PUB’s Green Financing Framework. These bonds will come under the following categories of the Green Bond Standards: 1. Renewable Energy 2. Sustainable water and wastewater management.

PUB’s Green Financing Framework

Using the Singapore Green bond framework as the standard, PUB’s Green financing framework is a set of guidelines that PUB will adhere to as the statutory board aims to provide transparency, disclosure, integrity and quality in their Green Finance reporting. The framework follows the International Capital Market Association (ICMA) Green Bond Principles 2021 and ASEAN Capital Market Forum (ACMF) ASEAN Green Bond Standards 2018. PUB also has an independent external reviewer, Sustainalytics, to review its framework and it was deemed credible and impactful.

This framework consist of four components:

- Use of proceeds

- Process for project evaluation and selection

- Management of proceeds

- Reporting

Overview

As Singapore is moving towards a more self-reliant and sustainable future, we can expect to see more green bond issuances moving forward. Earlier this month, MAS announced its first green bond issuance at 3.04% with a tenor of 50 years which we have article on here.

Bond Overview