Summary

- Credit metrics little change after removal of lossmaking business.

- SPH share valuations look undemanding.

- SPH perpetual bonds look attractive. We prefer the SPHSP 4.5% Perpetual (SGD) with a yield to call of 3.79% callable on 7 June 2024.

Singapore Press Holdings Limited (SPH) announced a proposed restructuring of its media assets and operations on 6 May 2021. Subject to SPH shareholder and regulatory approval, SPH’s media business (SPH Media) will be transferred to a company limited by guarantee (CLG) for a consideration of S$1. The CLG will be a not-for-profit entity, and any profits by SPH Media will be kept within the CLG. After the proposed restructuring, SPH will no longer own or operate the media business. Below are highlights of the restructuring.

The proposal. The lossmaking media business will be transferred to a not-for-profit company limited by guarantee. A total of S$351.3mn of assets will be transferred from SPH’s books into the CLG. These include S$88.8mn in target shares of relevant media companies including SPH’s stake in 4 digital assets, S$147mn market value of key leases from SPH News Centre and SPH Print Centre, S$21.4mn in 23.4mn units of SPH REIT (as at 28 Feb 2021), S$14.1mn in 6.9mn shares of SPH (as at 28 Feb 2021), and S$80mn in cash from SPH balance sheet. The amount of cash and shares transferred will be used to tide the media business for 3-4 years before seeking its own funding sources. Any debt in the media business will be left in SPH balance sheet.

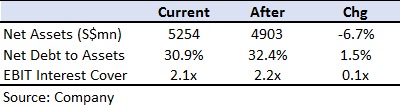

SPH financial metrics little change. The restructuring represents a 6.7% fall in SPH net asset value. SPH’s net debt to asset will rise to 32.4% from 30.9% due to a lower asset base. EBIT interest coverage will improve slightly to 2.2x from 2.1x given the deconsolidation of the lossmaking business.

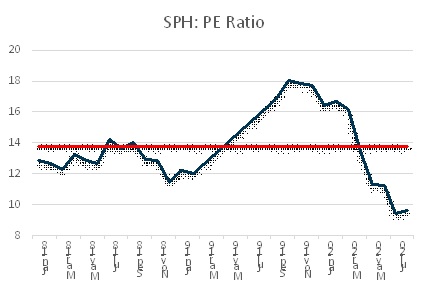

Valuations undemanding after deconsolidation. Based on FY21e profit after taxes and minority interest after stripping out the media losses, SPH’s price to earnings ratio (PE ratio) stands at 9.4x. This PE ratio level remains at historically low levels despite the removal of the lossmaking media business. We may see this multiple expand closer to SPH’s 3 year average PE of 14x on improved fundamentals. From a book value perspective, SPH’s price to book ratio stands at 0.68x after the restructuring, which is both historically low and also low compared to SPH REIT’s price to book of 0.85x. SPH’s 66% stake in SPH REIT is worth S$2.82bn, higher than SPH’s market cap of S$2.43bn.

Source: Bloomberg

Bond valuations

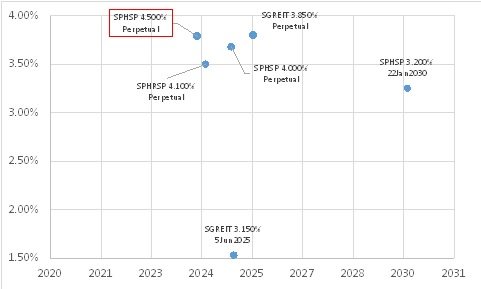

We see value in the SPHSP 4.5% Perpetual (SGD) bond. SPH perpetual bonds saw a slight selloff after the restructuring announcement. They now trade closely to the comparable Starhill Global REIT bonds despite SPH’s larger market cap of S$2.59bn (vs Starhill’s S$1.2bn) and lower gearing level of 32.4% (vs Starhill’s 35.9%).

The SPHSP 4.5% Perpetual (SGD) bond is priced at 102.05 with a yield to call of 3.79% callable on 7 June 2024 with a 1% coupon step-up if not called. It offers relative value over the SPHSP 4.0% Perpetual (SGD), with a 0.11% yield pickup despite having an earlier call date. The bond also comes with dividend stopper and pusher clauses, which help protect boldholder coupons.

Source: Bloomberg, POEMS

Timeline. EGM shareholder approval Jul-Aug 2021. Restructuring completion expected around 4Q21 to early 2022.