Company Overview

Suntec REIT is an office and retail REIT, with ARA Trust Management (Suntec) Limited as the Manager and HSBC Institutional Trust Services (Singapore) Limited as the Trustee. The REIT has a presence in 3 countries, Singapore, Australia and United Kingdom. Within its Singapore property portfolio, Suntec REIT owns Suntec City Mall, which comprises approximately 815,000 sq ft of net lettable area, office units in Suntec Towers 1-3 and the whole of tower 4 and 5. It also holds 66.3% effective interest in Suntec Singapore Convention & Exhibition Centre and 33.3% in both One Raffles Quay, Marina Bay Financial Centre Towers 1 and 2, and Marina Bay Link Mall (which is also collectively known as MBFC properties). Suntec REIT was listed on SGX-ST on 9th December 2004 (ticker: T82U.SI) and has a market capital of $3.87bn as of 11 Jan 2023.

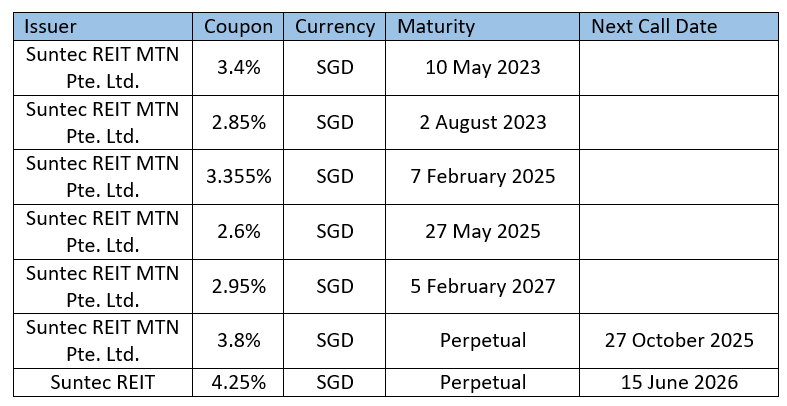

Figure 1: Income Contribution breakdown geographically and by Sector

Source: Suntec REIT

Financials

In its 3Q2022 business update, it said higher contributions from Suntec City and The Minster building located in London had led gross revenue to increase 15.7% Y.o.Y from $92.7 million to $107.3 million in 2022 which also led Net Property Income (NPI) to increase 12.1% Y.o.Y from$68.8 million to $77.1 million in 2022. Joint Venture income also increased by 2.4% Y.o.Y from $29.2 million to $29.9 million and this is was due to higher contributions from One Raffles Quay and MBFC Properties. Despite higher NPI, distributable income fell by 5.8% YoY from $63.7 million to $60 million due to higher financing costs and higher asset management fees in cash (50%) vs 3Q2021 (20%). Distribution per Unit (DPU) also declined by 6.6% from 2.232 cents to 1.884 cents in 3Q2022. The Singapore office portfolio occupancy remains robust with its Singapore overall office space occupancy nearing to full occupancy at 99.4%, and a weighted average lease (WALE) of 2.7 years. The office portfolio also experienced 17 straight quarters of positive rental reversion with 3Q2022 experiencing a positive rental reversion of 5.9%. In UK, its overall occupancy stood at 98.3%, with a WALE of 9.9 years.

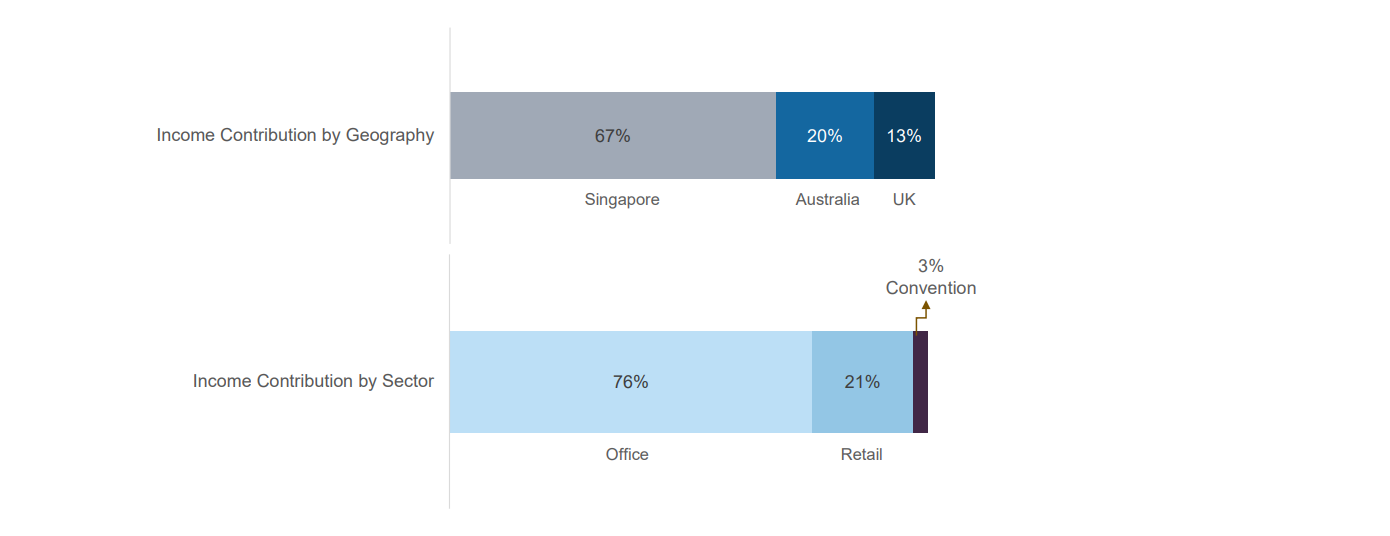

In the Retail sector, the easing of restrictions in Singapore coupled with the return of events and roadshows, increased overall tenant sales and footfall for Suntec City Mall, which is illustrated in Figure 2. Suntec City Mall portfolio occupancy level improved by 0.6% from 96.1% to 96.7% in 3Q2022.

Figure 2: 3Q2022 Tenant Sales and Shopper traffic vs 2019 average.

Source: Suntec REIT

Finally, with all establishments being able to operate at 100% capacity with no group size limit, its convention halls are also seeing a recovery in revenue performance from conferences and corporate event being held in its halls. So, Suntec REIT is optimistic about the uplift in income for the full year 2022 once it has consolidated the last quarter’s data.

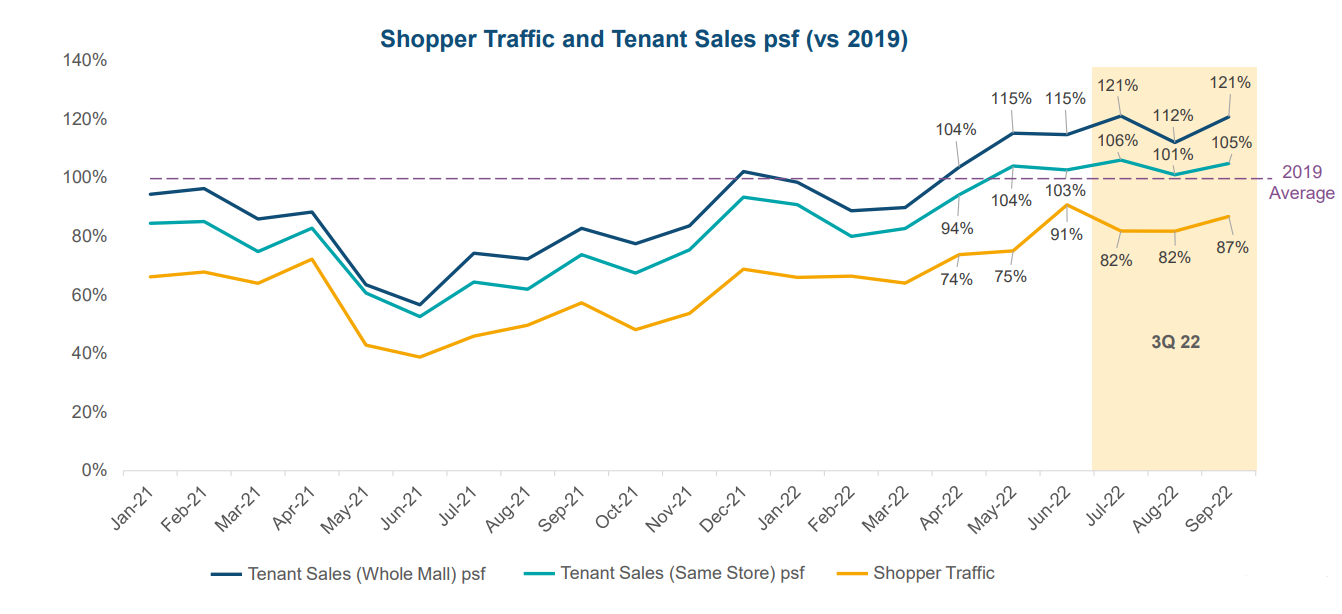

Figure 3: Suntec REIT’s Debt Maturity Profile

Source: Suntec REIT

Suntec REIT has a weighted average debt maturity of 2.73 years, which has gone down from 2.99 years in 1H2022. Of this, approx. 59% of its borrowings is fixed (up from 56%) and 61% of its foreign currency borrowings are hedged (up from 58%). Suntec REIT also has an adjusted interest coverage ratio (calculated by dividing the trailing 12 months earnings before interest, tax, sinking fund contribution, depreciation and amortisation by the trailing 12 months interest expense, borrowing-related fees and distributions on hybrid securities) of 2.5 times while maintaining a aggregated leverage ratio of 43.1%

As such, Suntec REIT is in a good a position to capture the recovery in the retail space as the REIT is expecting the recovery to continue in 2023 with the rebound of its MICE (Meeting, Incentives, Conference and Exhibitions) sector and footfall in its mall with higher tourist arrivals.

Secondly, with high demand and portfolio occupancy for its office sector, Suntec REIT is also expecting its office income to strengthen further from its 17 quarters of positive rental reversions. Last but not least, the high occupancy and long WALE of its UK office space is also expected to provide resiliency in its revenue streams in the coming years.

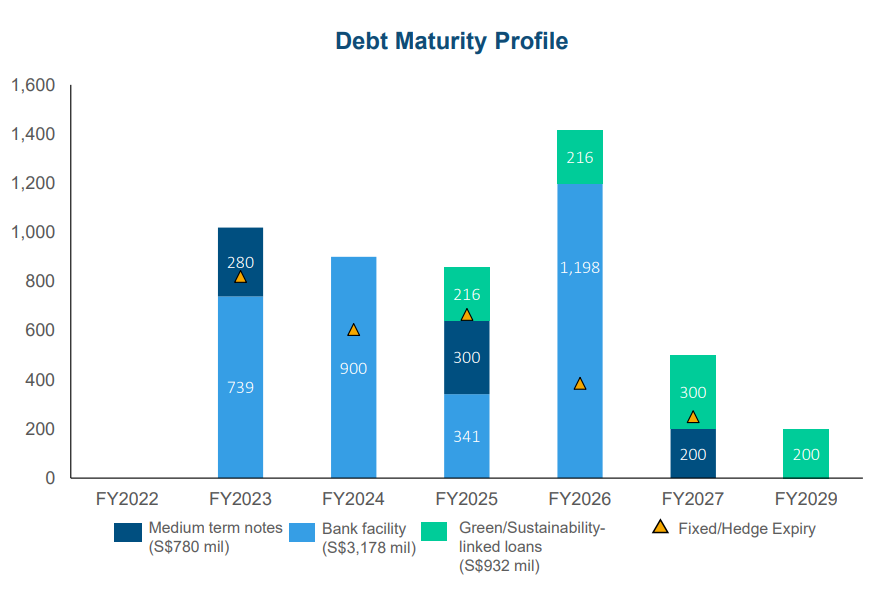

Suntec REIT Outstanding Bonds