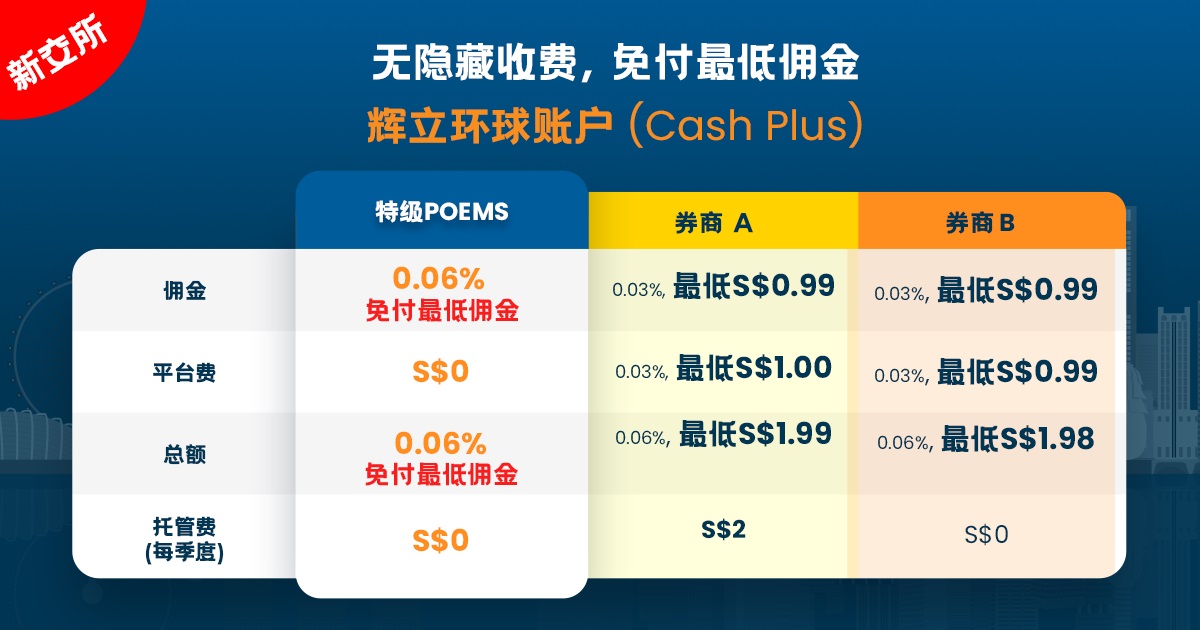

环球账户超低价格!

佣金是根据前一晚帐户中的总资产值来确定的

|

资产价值 市场 |

入门 SGD 0 – SGD29,999 |

高级 SGD30,000 – SGD249,999 |

特级 SGD250,000 及以上 |

新加坡 |

|||

美国 |

|||

香港 |

0.08%, min HKD 30 |

0.06%, min HKD 20 |

0.05%, min HKD 15 |

|

资产价值 市场 |

入门 SGD 0 – SGD29,999 |

高级 SGD30,000 – SGD249,999 |

特级 SGD250,000 及以上 |

中国 |

0.15%, min CNH 80 |

0.12%, min CNH 60 |

0.08%, min CNH 50 |

澳大利亚 |

0.18%, min AUD 25 |

0.15%, min AUD 20 |

0.12%, min AUD 15 |

英国 |

0.18%, min GBP 20 |

0.15%, min GBP 15 |

0.12%, min GBP 10 |

德国 |

0.18%, min EUR 20 |

0.15%, min EUR 12 |

0.12%, min EUR 8 |

日本 |

0.18%, min JPY 1500 |

0.15%, min JPY 1200 |

0.12%, min JPY 1000 |

马来西亚NEW! |

0.12%, min MYR 30 |

0.10%, min MYR 25 |

0.08%, min MYR 8.80 |

泰国 |

0.18%, min THB 500 |

0.15%, min THB 400 |

0.12%, min THB 300 |

印度尼西亚 |

0.18%, min IDR 250,000 |

0.15%, min IDR 200,000 |

0.12%, min IDR 150,000 |

土耳其 |

0.18%, min TRY 80 |

0.15%, min TRY 60 |

0.12%, min TRY 50 |

其他市场 |

As published |

As published |

As published |

|

资产价值 市场 |

入门 SGD 0 – SGD29,999 |

高级 SGD30,000 – SGD249,999 |

特级 SGD250,000 及以上 |

| 其他费用 & 收费 | |||

|

账户管理费用 |

免除1 |

免除1 |

免除 |

海外股票托管费 |

免除2 |

免除2 |

免除 |

股息手续费 (SGX) |

适用3 |

适用3 |

免除 |

| 利息 | |||

贷方余额 |

适用4 |

适用4 |

适用4 |

借方余额 |

适用5 |

适用5 |

适用5 |

为什么选择辉立环球账户

多货币功能 – 新币,美元,港币,澳元,马币,日元,英镑,欧元,人民币和加元。

免除账户管理费1 和海外股票托管费2. 没有闲置费和平台费.

免费实时行情4: 美国, 泰国, 马来西亚 & 印度尼西亚

使用您的闲置资金可以获取 新币1.3451%年收益,美金1.9809%年收益。 #新币1.3451%年收益,美金1.9809%年收益。

* 根据1年滚动回报率,资产净值/资产净值价格,利率更新截至 06 January 2020。

#基于过去连续一个月的平均年化收益率。

过去的表现并不一定代表未来的表现。查看免责声明

9种可融资货币 -新币,美元,港币,澳元,日元,英镑,欧元,人民币和加元

成立于1975年,是您值得信赖的金融伙伴,在全球15个国家的业务不断增长。

我们经验丰富的技术与服务团队致力于为您提供无缝的交易体验

为您提供及时的市场研究资讯以制定您的交易决策

0%销售费用、0%转换费用、0%平台费用,超过2000多个单位信托基金。

从辉立环球账户开始

常见问题

总资产价值是指资产(股票,ETF,债券,余额资金管理中的货币市场基金)的市场价值以及您帐户中的任何贷方余额。

如果您的帐户有借方余额,则不会计算到您的资产总值内。

举例说明:

1)如果A客户辉立环球账户中有 15万新元的股票和10万新元的贷方余额,则A客户的总资产价值为 25万新元。

2)当B客户辉立环球账户中有 25万新元的贷方余额时,则B客户资产总值为 25万新元。

3)当C客户辉立环球账户中有25万新元的股票和 10万新元的借方余额时,则其总资产价值为25万新元。

托管费包括账户管理费和外国股票托管费。股票托管费会在1月,4月,7月和10月从账户中扣除。

新开设账户未满3个月,日均资产总额将按照账户开通之日起来进行计算。

新转换到辉立环球账户,且未满3个月的,日均资产总额将按照账户转换之日起来进行计算。

如果您的账户内总资产价值在25万新元及以上,将免除您的股息手续费。总资产价值是以前一日您在辉立证券(PSPL)托管账户中持有的总资产价值为准。

如果有公司行为,只有您账户中的股票和现金将计算到您的资产总值中,以此来决定您的佣金及股息手续费(SGX)。

可以。在交易前,您需要转入足够的资金到辉立环球账户,方可交易。详情请查看辉立环球账户信息表(Cash Plus Account Information Sheet)Section 3(A)

但是,您使用的CPF或SRS购买的股票将不包括在您的资产总值计算中。

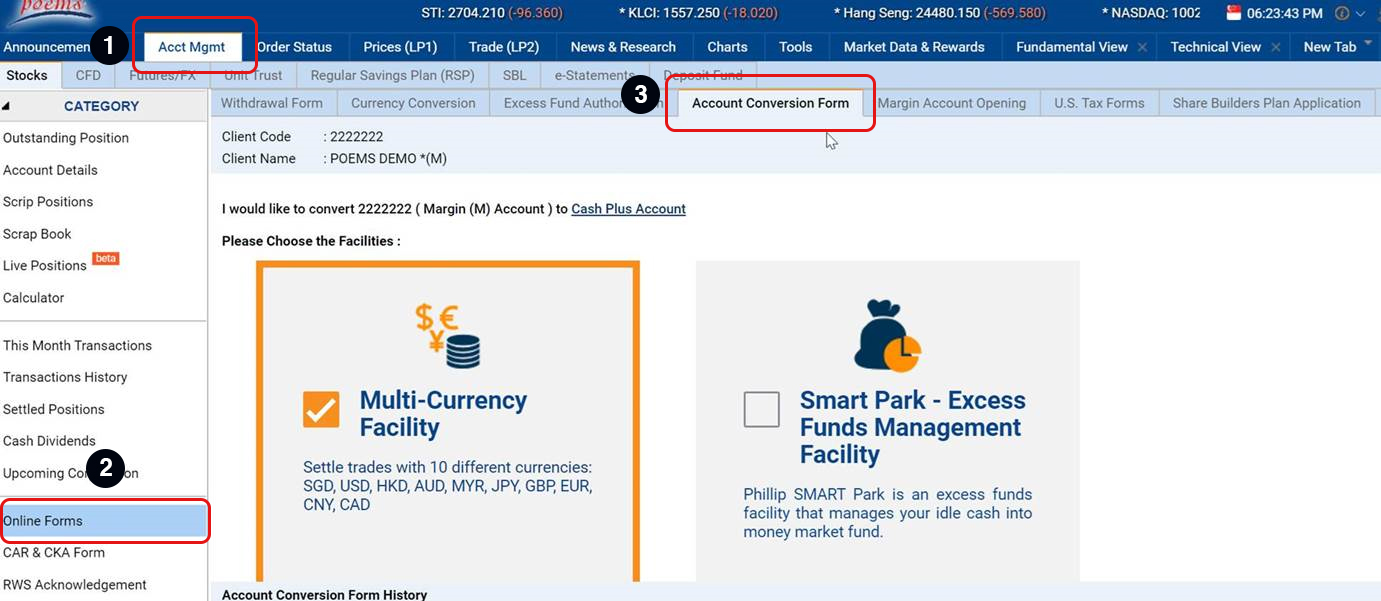

所有托管帐户(即预付(CC)帐户,托管(C)帐户,保证金(M)帐户)都可以进行转换。 帐户转换次数有限制。

请事先向您的交易代表了解账户具体功能,再将转换表格 电邮至 talktophillip@phillip.com.sg

18岁以上就可以开设账户。但是,只有21岁以上的客户才可以使用融资融券功能。

环球账户是托管类型的账户。除了CPF/SRS交易外,所有交易都必须在环球账户中进行结算。根据协议,您可以要求将您的股份转让给外部投资人,在适用的情况下将会征收转让费用。

附带条件和条款:

- 该账户每个自然季度至少有1笔交易方可免除账户管理费。否则,3月、6月、9月、12月底将收取 $15新元/季度 的账户管理费。

- 在 2024 年 12 月 31 日之前免收美股与港股托管费。此后的费用请参阅 Cash Plus 账户信息表。

- 现金股利:净股息的1%,最低为$1新元,最高为$50新元(含消费税),加收境外券商费用和税费(如适用)

- 欲知更多详情,请参阅辉立环球资料表。或者,您也可开通“辉立余额通”(辉立货币市场基金),将有可能让您账户里的闲置资金带来更大的回报。

- 使用融资交易的借方余额将被征收利息。欲知更多信息,请参阅Cash Plus帐户信息表。

- 仅非专业投资者可以订阅股票实时行情,具体参照网址:https://www.poems.com.sg/complimentary-live-price-quotes/?lang=zh-hans&TR=G88