Cash Plus Account

Brokerage rate is determined based on the previous day end’s Total Asset Value in the Account.

|

Asset Value Markets |

Starter SGD 0 – SGD29,999 |

Premier SGD30,000 – SGD249,999 |

Privilege SGD250,000 and above |

|

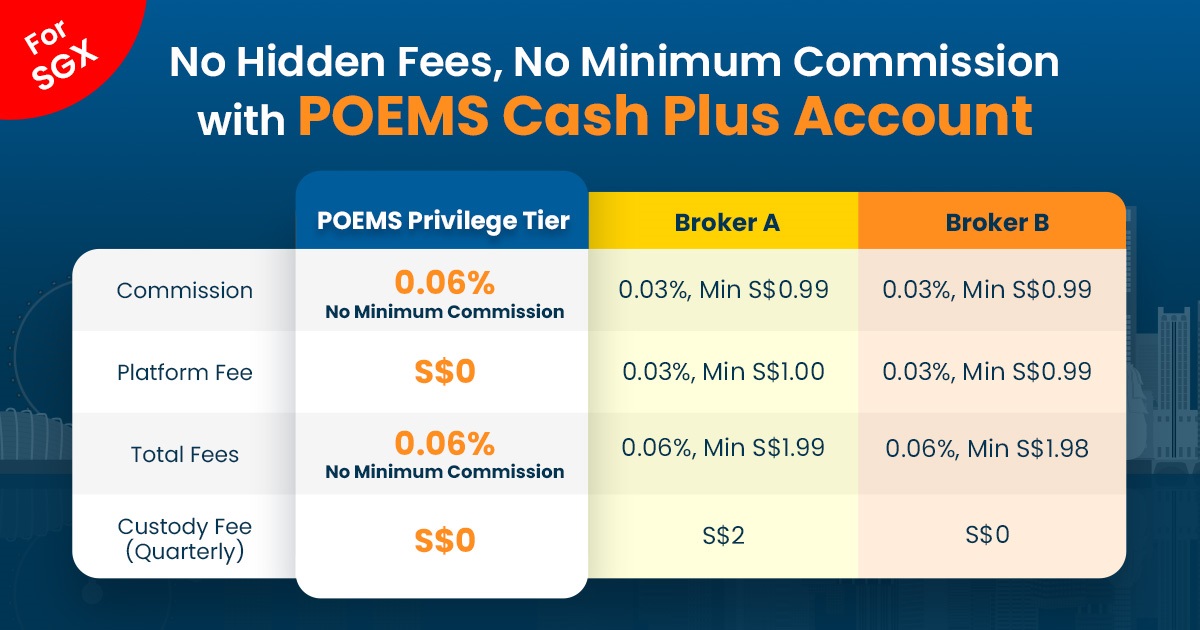

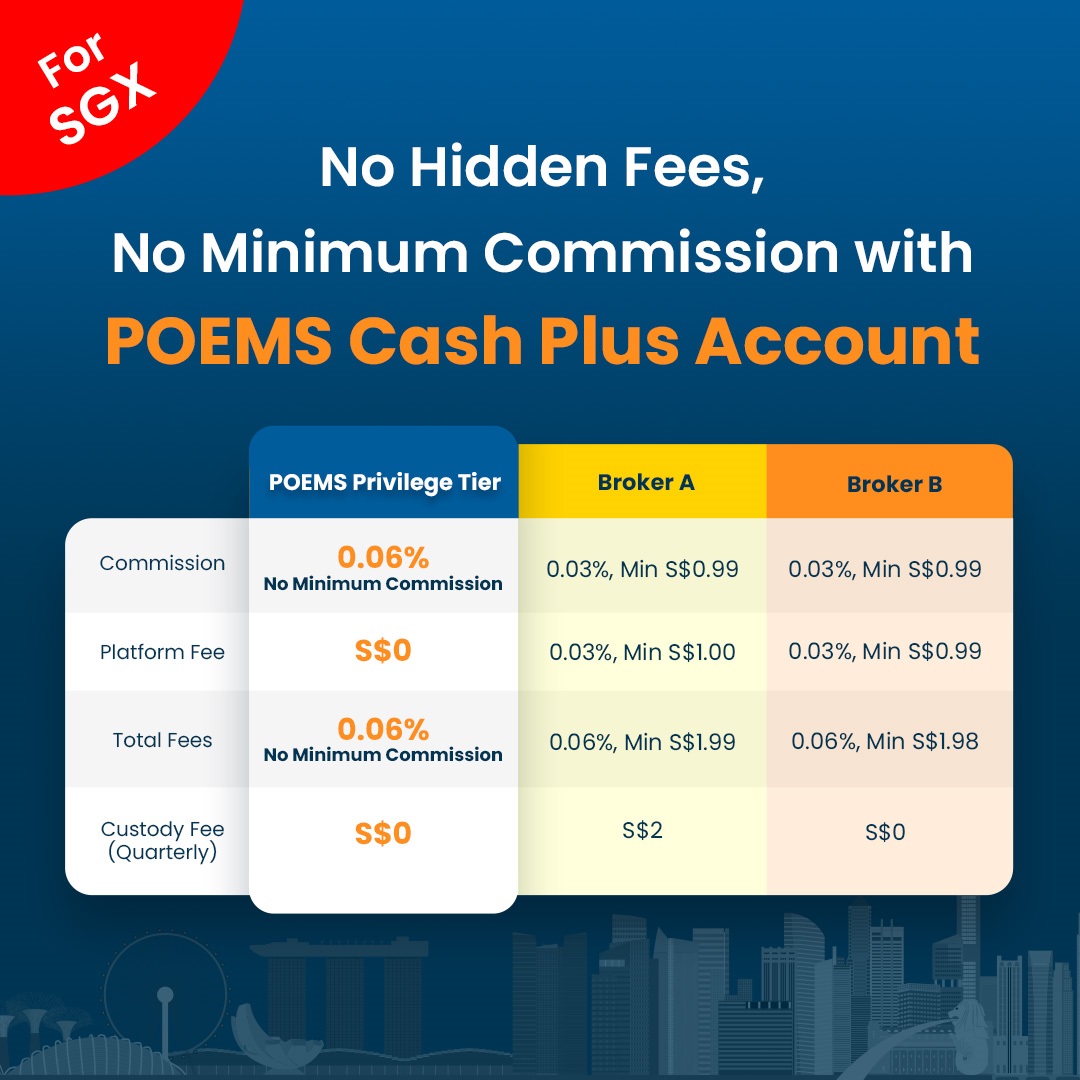

Singapore |

0.08%, No Min Comm |

0.07%, No Min Comm |

0.06%, No Min Comm |

|

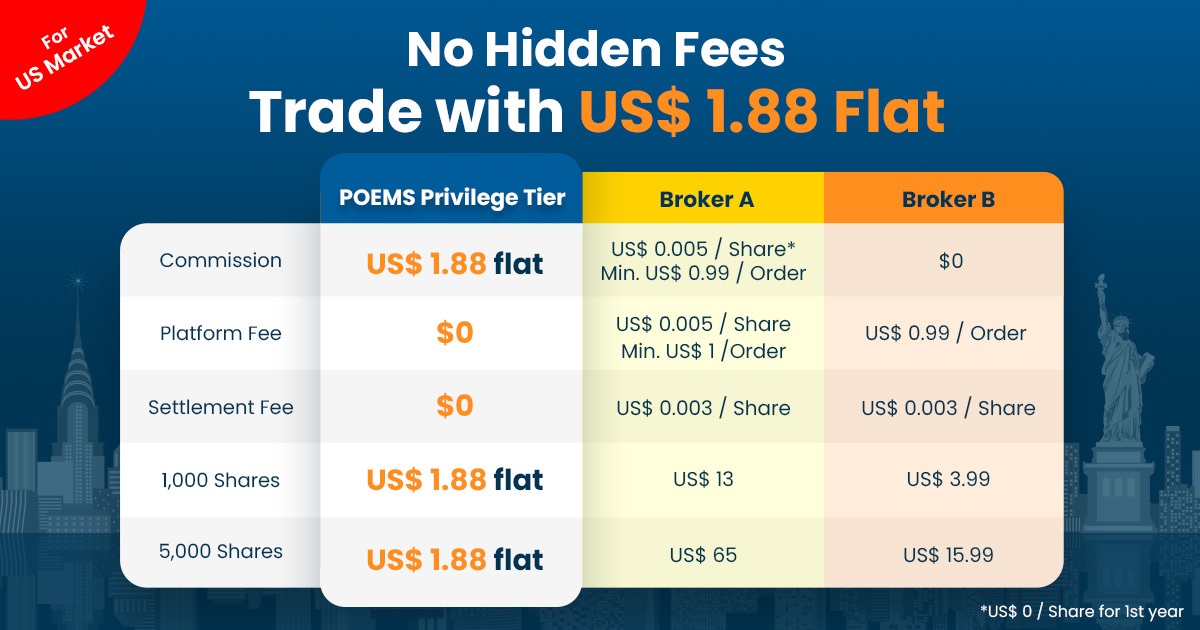

United States |

US$ 3.88 flat |

US$ 2.88 flat |

US$ 1.88 flat |

|

Hong Kong |

0.08%, min HKD 30 |

0.06%, min HKD 20 |

0.05%, min HKD 15 |

|

China |

0.15%, min CNH 80 |

0.12%, min CNH 60 |

0.08%, min CNH 50 |

|

Malaysia |

0.12%, min MYR 30 |

0.10%, min MYR 25 |

0.08%, min MYR 8.80 |

|

Thailand |

0.18%, min THB 500 |

0.15%, min THB 400 |

0.12%, min THB 300 |

|

Indonesia |

0.18%, min IDR 250,000 |

0.15%, min IDR 200,000 |

0.12%, min IDR 150,000 |

|

Japan |

0.18%, min JPY 1500 |

0.15%, min JPY 1200 |

0.12%, min JPY 1000 |

|

Australia |

0.18%, min AUD 25 |

0.15%, min AUD 20 |

0.12%, min AUD 15 |

|

United Kingdom |

0.18%, min GBP 20 |

0.15%, min GBP 15 |

0.12%, min GBP 10 |

|

Germany |

0.18%, min EUR 20 |

0.15%, min EUR 12 |

0.12%, min EUR 8 |

|

Turkey |

0.18%, min TRY 80 |

0.15%, min TRY 60 |

0.12%, min TRY 50 |

|

Other Markets |

As published |

As published |

As published |

| Other Fees & Charges | |||

|

Account Maintenance Fee (SGX) |

Waived1 |

Waived1 |

Waived |

|

Foreign Shares Custody Charges |

Waived2 |

Waived2 |

Waived |

|

Dividend Handling Fee (SGX) |

Applicable3 |

Applicable3 |

Waived |

| Interests | |||

|

Credit balance |

Applicable4 |

Applicable4 |

Applicable4 |

|

Debit balance |

Applicable5 |

Applicable5 |

Applicable5 |

For more details, please refer to the Cash Plus Account Infosheet

Note: Reduced rates are only applicable to ONLINE trades. For offline rates, please click here.

Why Cash Plus Account?

Multi-currency facility: Settle trades with 10 different currencies – SGD, USD, HKD, AUD, MYR, JPY, GBP, EUR, CNY, CAD

No US and HK Custody Fee, No Platform Fee

Complimentary live prices6 for US, Thailand, & Malaysia

Manage your idle cash into money market fund. *SGD 3.4848% p.a., US$ 4.5896% p.a.

Rates updated as of 17 Jul 2023

*Based on the average rate of annualised returns over the last rolling week.

Past performance is not necessarily indicative of future performance. View disclaimer

Financing available in 9 Currencies – SGD, USD, HKD, JPY, AUD, GBP, EUR, CNY & CAD

Your Trusted Broker since 1975, with a growing global presence in 15 countries

Our experienced technical and support teams are committed to ensure a seamless trading experience for you.

Receive insights from our timely market research to make your trading decisions.

0% Sales Charge, 0% Switching Fee, 0% Platform Fee over 2000+ Unit Trusts.

Start Small With Your Cash Plus Account

First in town – Recurring Plan for Dollars Cost Averaging

Recurring Plan gives you more control over your investments. It works similarly to the other plans, whereby it aims to manage market risk through the use of Dollar Cost Averaging. You gradually build your portfolio over a period of time with a fixed amount of regular investment that is determined by you, purchasing more units when the price is low and fewer units when price is high.

Frequently Asked Questions

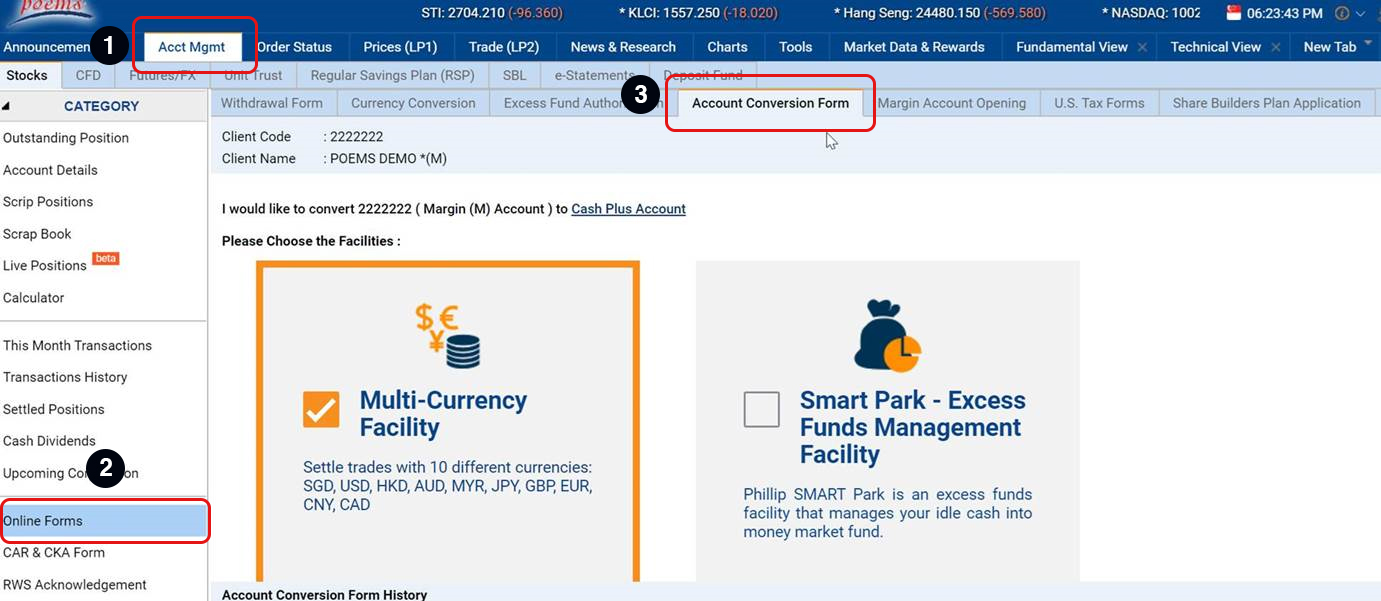

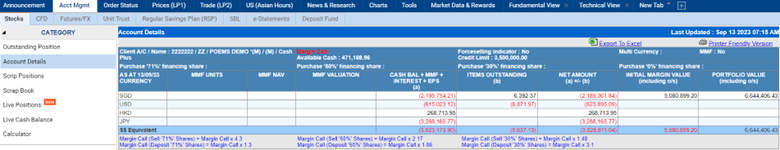

For POEMS 2.0:

Login to POEMS 2.0 > Acct Mgmt > Stocks > Account Details or visit here

Login to POEMS 2.0 > Acct Mgmt > Stocks > Account Details or visit hereFor POEMS Mobile 3 App:

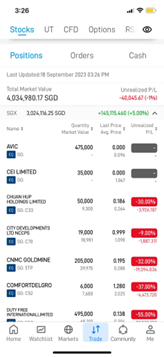

Login to POEMS Mobile 3 App > Trade tab or visit here

Terms and Conditions:

- Waiver condition is at least 1 trade per quarter for the Account. Otherwise, S$15.00 (subject to GST) per quarter is chargeable based on March, June, September and December month-end Account balance.

- Waived for US and HK Foreign Custody fee until 31 December 2024. Please refer to Cash Plus Account Infosheet for charges thereafter.

- Cash Dividend: 1% on net dividend, minimum of S$1.00 and capped at S$50.00 (subject to GST) + Foreign fees and taxes (if applicable).

- For more information, please refer to Cash Plus Account Infosheet. Alternatively, you may wish to opt-in for the Excess Funds Management facility to enjoy potentially greater returns on any surplus funds (credit balance) parked in your account.

- Interest on debit balance is applicable when you utilise the Margin facility. For more information, please refer to Cash Plus Account Infosheet.

- Only non-professionals are eligible for the complimentary live price subscription. For details, please visit https://www.poems.com.sg/complimentary-live-price-quotes/