- Home

- Environmental, Social and Governance (ESG)

Environmental, Social and Governance (ESG)

What is Environmental, Social and Governance (ESG) Investing?

ESG investing is the inclusion of environmental, social and governance issues as part of financial analysis and an important part of the investment process. It allows investors to manage material risks and drive positive impact while facilitating investment opportunities, ensuring longer-term viability for investments.

In January 2004, 55 of the world's leading financial institutions endorsed the UN Global Compact report "Who Cares Wins". The report required the participating companies to conduct financial evaluations with the consideration of ESG factors as these issues impact a company's investment value.

The financial institutions believed that addressing these issues would bring benefits in the long-run. Today, emphasis on ESG is growing increasingly as more investors expect companies to commit strongly to ESG criteria.

Background of ESG

How good ESG management impacts a company?

The way a company manages ESG issues gives insight into its quality and ability to compete successfully. Companies that perform better in addressing these issues can:

- increase shareholder value

- anticipate regulatory action

- anticipate stakeholder management

- contribute to sustainable development

Background of ESG

In January 2004, 55 of the world's leading financial institutions endorsed the UN Global Compact report "Who Cares Wins". The report required the participating companies to conduct financial evaluations with the consideration of ESG factors as these issues impact a company's investment value.

The financial institutions believed that addressing these issues would bring benefits in the long-run. Today, emphasis on ESG is growing increasingly as more investors expect companies to commit strongly to ESG criteria.

How good ESG management impacts a company?

The way a company manages ESG issues gives insight into its quality and ability to compete successfully. Companies that perform better in addressing these issues can:

- increase shareholder value

- anticipate regulatory action

- anticipate stakeholder management

- contribute to sustainable development

Why ESG Matters to Investors?

It is possible to achieve a triple bottom line of (i) Good Investment Returns (Prosperity); (ii) Good Social Impact (People); and (iii) Positive Environmental Impact (Planet) — all with ESG Investing.

The "3Ps" of Triple Bottom Line

Prosperity

People

Planet

How can ESG Investment be beneficial?

Good Risk Management

ESG investing has gone mainstream and stakeholders have become increasingly aware that ESG decisions can enhance the value of a company in the long term. Companies that perform well on non-financial ESG factors are better positioned.

Positive Impact to The World

Environmental threats have had harsh ecological, social and economic impacts. Investing in ESG funds means supporting countries and companies that make positive changes that benefit people, the economy and the financial markets. It also means investing in a world that is free of the consequences of climate change and biodiversity loss.

Future-proofing

Sustainable investing is not just a trending fad, but a need for our funds to flow where the world's pressing issues can be addressed. Investors should be aware of threats that may affect their financial future, then align investments to where it contributes most to a sustainable future.

Rewarding Investors' Values

ESG investing allows investors to contribute meaningfully to global climate, biodiversity and sustainable development goals. Investment commitments in these spaces cater to what investors value most, be it environmental, social or corporate governance, that helps to accelerate action towards meeting our global goals.

Our ESG Position Statement

By incorporating ESG considerations to our investment process, we are able to apply our fiduciary duty, to assure regulatory compliance, and to approve longer term investments.

Through our funds, we aim to reinforce countries and companies that are aligned to global climate, biodiversity and sustainable development goals, and reward those in transition to a low-carbon and circular economy with pathways that are socially-just and nature-positive.

Our ESG Approach

"Partner Not Punish"

At PhillipCapital, we are committed to being change-making custodians of all our resources.

Stewardship and care for people are embedded in the PhillipCapital Code and those values have been at the forefront, aligning profits with purpose, broadening the group's strong foundations in economic resiliency. We are defining a new legacy that matches a changing world, growing client trust built over generations, and assuring lasting business success.

We've taken stock of Earth's pressing concerns, their drivers and societal root causes, and understand the dependence of the economy on nature's ecosystem services and natural cycles.

We see the cause-and-effect relationships between our ways of life (population, production, consumption, land-use) and what has begun to end business as usual – climate change and biodiversity loss. We believe we can influence the trajectory of these pathways through collective efforts and the way we channel capital for change.

Click on the icons below to find out more!

Why you should consider PhillipCapital in your ESG

We adopt and implement the UN-supported Principles of Responsible Investment as part of our contribution towards a sustainable global financial system. As signatories, we foster good governance, maintain integrity, and are held accountable to our peers through performance reports. We address ESG issues by incorporating them into our policies and processes so as to cultivate long-term investment rewards that benefit the environment and society as a whole.

King & Shaxson Ethical is under the PhillipCapital Group, and has been managing ethical portfolios since 2002, effectively reflecting clients’ ethics in their portfolio.

King & Shaxson Ethical believes in investment that reflects core beliefs and principles of investors, we enable advisers and clients to articulate and document what ethical means to the individual.

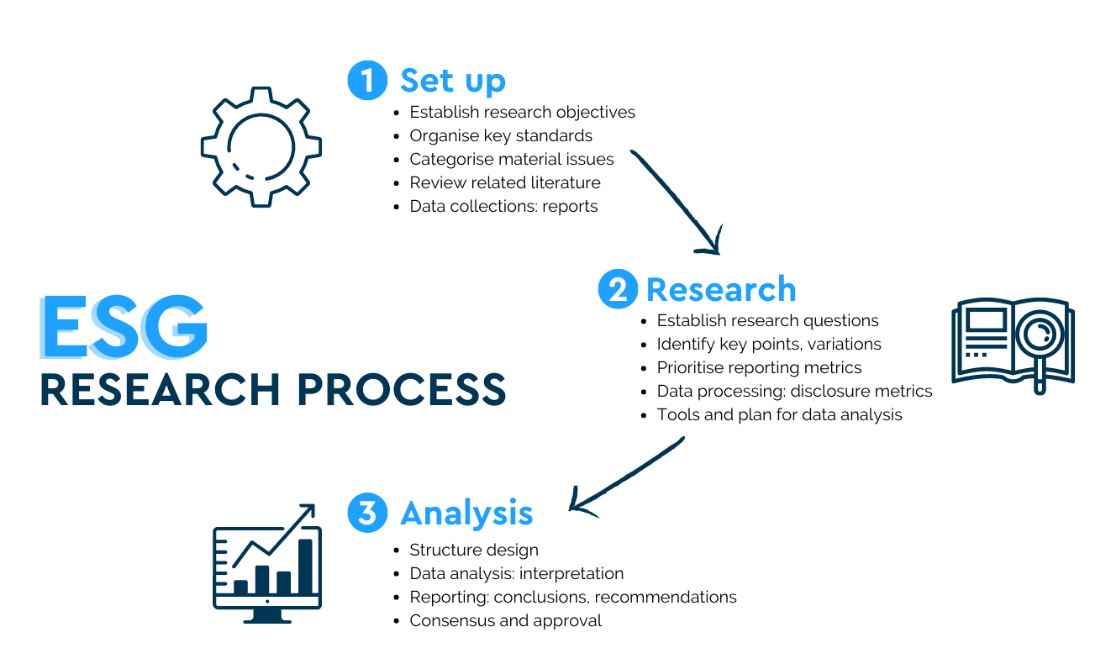

Our ESG Investment & Research Process

In our upcoming ESG efforts, we want to focus on what matters most. Our ESG Investments will emphasise on pressing environmental and social issues that affect the global economy. With this focus, we are able to channel funds towards countries and companies that commit to positive change and sustainable outcomes. Hence, a wide variety of ESG solutions will be offered to meet the diverse interests and needs of our clients. Our investment process:

– recognises the interconnectedness of E, S and G issues

– separates the assessments of risks and impacts

– differentiates a company's external risk exposure from its ability to mitigate its negative externalities

– assesses performance over measurable targets and initiatives to claim new business opportunities

We combine a quantitative and qualitative investment approach, bringing together third party ESG research with our own internal research. This rigorous approach leaves no stone unturned.

Our research process enables us to advance materiality by focusing on the ESG factors most important to each business, and deepen coverage beyond third-party analytics. Such research provides clarity to the questions we need answering in order for us to assess if a company is an investable one for the long term, where management is robust, strategies are resilient, and profits are gained responsibly.

Enquiry

Have an enquiry? Get in touch with us at (+65) 6531 1555 or message us below!