3个问题,让您更了解新基建

新基建是什么:

Q1: 什么是新基建?

新基建用一句话来概括,可以理解为新型技术对应的基础设施建设。例如5G通信技术对应的基站建设,新能源汽车对应的充电桩普及,城际高速要求的铁路铺设等。

每一种新型技术的推广普及,都需要大量基础设施的建设,以我们经常听到的5G技术为例,根据中国工信部的数据,2020年将完成超过60万个基站建设(1),据中国信通院预测,预计到2025年我国5G网络建设投资累计将达到1.2万亿。(2)

新基建政策背景:

Q2:新基建政策是针对新冠疫情对中国经济的影响提出的吗?

不是的,新基建其实最早在 2018 年的 12 月份的中央经济工作会议首次提出。市场认为新基建政策是对三去一降一补所代表的供给侧改革的一种补充与拓展。

2018年会议中,强调要加大制造业技术改造和设备更新,要加快 5G 商用步伐,加强人工智能,工业互联网,物联网等新型基础设施建设。随后“加强新一代信息基础设施建设”被列入2019年政府工作报告,“新基建”由此诞生。

当然,新冠疫情对经济的影响也一定程度上加快了中国对于新基建政策的实施以及投资力度,我们认为本轮中国的新基建项目更针对较成熟,适合推广于民用的新型技术。

相关板块以及规模:

Q3: 新基建的主要内容和涉及到的板块有哪些?

根据2020年4月中国国家官方给出的解释,当前新型基础设施建设将围绕三个方面:

一是信息基础设施,主要指基于新一代信息通信技术演化生成的基础设施,比如,以5G、物联网、工业互联网、卫星互联网为代表的通信网络基础设施,设施包括基站,传感器推广与铺设等;以人工智能、云计算、区块链等为代表的新技术基础设施,设施包括数据中心、智能计算中心等。

二是融合基础设施,主要指深度应用互联网、大数据、人工智能等技术,支撑传统基础设施转型升级,进而形成的融合基础设施,设施包括智能交通基础设施、智慧能源基础设施等。

三是创新基础设施,主要指支撑科学研究、技术开发、产品研制的具有公益属性的基础设施,比如,重大科技基础设施、科教基础设施、产业技术创新基础设施等。

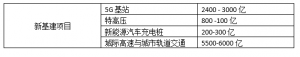

中国的新基建将围绕标准较为明确,技术成熟,适用于大范围推广的科技技术。综合来看,5G 基站,特高压,系能源充电桩,城际高速与城市轨道交通将成为2020年新基建项目重点。

我们为您总结了相关新基建项目的投资规模:

相关个股:

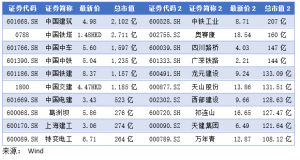

市值前20的新基建概念股:

(1) http://www.xinhuanet.com/fortune/2020-05/18/c_1125998277.htm

(2) http://www.21jingji.com/2020/3-10/0NMDEzODFfMTU0MTQ0Nw.html