新基建第二讲 – 大数据中心产业链及相关个股

我们在上期新基建介绍中为大家解答了三个常见问题,本期将为大家重点介绍新基建中的大数据产业。

本篇文章将为大家介绍大数据中心的概念,产业链,以及相关个股。

Q1; 什么是大数据中心产业

大数据中心产业,可以理解为在如今这个海量信息时代对数据的获取,优化,储存,进而分析并应用于各种行业及生活场景的技术。

当前新兴产业的未来发展将大量依赖于数据资源,因此从国家政务到各大行业,建立数据中心将有助于促进行业转型和实现企业升级。

Q2; 大数据中心产业链

我们将大数据产业链按照提供的产品以及应用场景划分为上游,中游,下游:

上游: 主要包括硬件设备(服务器,交换机,路由器,光模块,软件等)商以及基础设备(UPS,变压器等)建造商。

大数据硬件是指数据的产生、采集、存储、计算处理、应用等一系列与大数据产业环节相关的硬件设备,包括传感器、移动终端、传输设备、存储设备、服务器、网络设备和安全设备等。

中游:大数据中心产业链的中游公司主要提供包括数据采集,数据存储和云平台,数据分析与挖掘,数据安全以及数据交换等服务。

现实世界中的数据大多不完整或不一致,无法直接进行数据挖掘或挖掘结果不理想,需要对采集的数据进行填补、平滑、合并、规格化、检查一致性等数据预处理操作,并且往往需要大量的人工参与,因此数据采集和清洗成为大数据产业链的一个重要环节。

当前,政府部门和以百度(BIDU),阿里巴巴(9988),腾讯(0700)为代表的互联网企业、运营商是当前大数据的主要拥有者。除此之外,利用网络爬虫或网站公开 API 等途径对网络数据进行采集也是大数据的主要来源。

下游:大数据行业的下游公司主要是大数据的各种场景应用,目前初具规模的大数据应用涵盖了出行,家居,娱乐,零售,医疗等。

大数据对传统信息技术带来革命性挑战,正在重构信息技术体系和产业格局。国内以阿里巴巴(9988)、百度(BIDU)、腾讯(0700)、浪潮(000977)等通用为代表的互联网企业、云计算和数据库厂商纷纷加大应用推广力度,在国际先进的开源大数据技术基础上,形成独自的大数据平台构建和应用服务解决方案, 以支撑不同行业不同领域的专业化应用。

Q3: 大数据中心产业在中国的发展前景

1. 2020年被纳入中国新基建的7大重点发展领域,可以预见相关政策支持的红利。

2020年4月20日,国家发改委就新基建的概念和内涵进行了阐释,明确了新型基础设施是以新发展理念为引领,以技术创新为驱动,以信息网络为基础,面向高质量发展需要,提供数字转型、智能升级、融合创新等服务的基础设施体系。

这其中,大数据中心首次被纳入“新基建”的7大重点发展领域中,这无疑将为数据中心产业带来可以预见的一大波红利。更值得关注的是, 5G、物联网、工业互联网、人工智能的发展势必会引发新一轮的数据井喷,数据处理和存储需要将迎来可预见的快速上涨。

2. 中国大数据中心行业市场规模增长速度远超全球平均水平。

根据IDC的报告显示,2019年中国数据中心市场规模达到1560.8亿元,同比增长27.1%,远高于世界11%的平均水平。

另外,IDC估计中国数据中心未来3年复合增长率更有望接近30%,预计2020年市场规模将突破2000亿元。

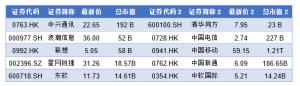

Q4:相关概念股

上游:IT设备,软件,运营商

中游:数据采集,存储与处理

下游:场景数据应用

附:由于大数据中心产业链相关股票在中国香港,中国上海,中国深圳,美国均有上市,请注意表格中的价格和市值是对应市场的货币

如果有想了解更多全球股市资讯,请关注微信公众号 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易全球股票和ETF

美股,港股,新加坡股,中国A股,越南股票,韩国股票,德国股票,马来西亚股票,泰国股票,印尼股票,菲律宾股票,日本股票,澳大利亚股票,台湾股票,加拿大股票,英国股票,法国股票,荷兰股票,葡萄牙股票,比利时股票,土耳其股票

如果本文是英文翻译版本,一切请以英文为准