在美股亚洲时段交易的五大优势

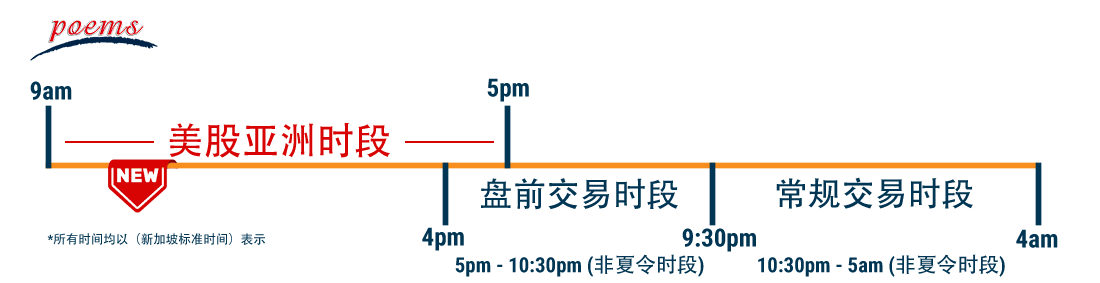

什么是美股亚洲时段?这是一项新服务,我们的客户可以在亚洲时间(从新加坡时间的上午9点至下午5点)交易美股。辉立证券私人有限公司是东南亚首家通过其在线交易平台POEMS,在亚洲交易时段内提供美国做市服务的 经纪公司 ,使我们的客户能够从新加坡时间上午9点开始,更早地交易美股。加上盘前和常规交易时段,现在POEMS为客户提供了19个美国交易活跃时段。目前,有 35只股票和2只ETFs 可供交易。

图1:美国交易时段

图1:美国交易时段

美股亚洲时段有哪些主要特点?

- 能够从上午9点至下午5点交易美股(新加坡时间)

- 在美股亚洲时段、美国盘前交易和常规交易时段之间实现无缝交易

- 结算期为T+2个交易日

- 可通过POEMS 2.0网页版和POEMS移动端3下单

- 最小订单规模为每笔10 美元

- 支持市价单和限价单

使用美股亚洲时段交易有什么好处呢?

1. 突发事件中的股价

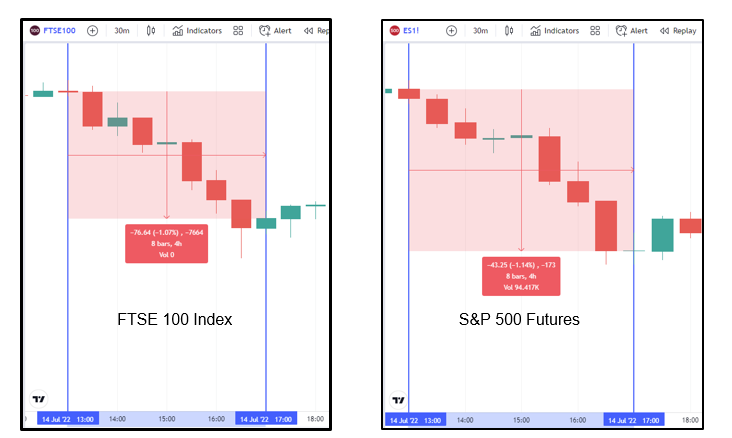

您将能够对亚洲市场时段内发生的任何动向采取行动。例如,2022年7月13日,美国消费者物价指数 (CPI) 为9.1%,高于8.8% 1的预期,表明通胀高于预期。这高于预期的CPI,可能会导致美联储采取更激进的紧缩货币政策。

对紧缩货币政策的担忧逐渐蔓延到欧洲市场。富时100指数是在伦敦证券交易所内,市值最高的100家上市公司的股票指数,在亚洲市场时段下跌了约1%,如图2所示。受到密切关注,以衡量市场情绪的标普500指数期货也下跌了1.14%。

美股亚洲时段,那些担心熊市情绪将延续到盘前和常规交易时段的投资者,将能够抢先于其他市场参与者提前进行平仓。

图2:CPI对富时100和标普500指数期货的影响

图2:CPI对富时100和标普500指数期货的影响

2. 利用财报发布时间点的优势

上市公司每季度发布一次。这些盈利发布对投资者来说很重要,因为这些业绩显示了上市公司本季度的表现,并影响股价。由于盈利发布对股价产生重大的影响,公司通常会在常规交易时段外发布。

对于在常规交易时段之后发布的,投资者可以利用盘后交易产生势头。例如,特斯拉在2022年7月21日新加坡时间上午4点,发布其盈利报告,这也是在常规交易时段后发布的。在盘后交易中,该股以742.50美元报收,在随后的盘前交易中,以751.50美元报开盘,之后在常规市场中,开盘价为765.32美元,收于815.12美元。这表明该股的看涨势头从盘后交易一直延续到常规市场,如图3所示。因此,投资者可以利用财报发布时间点所带来的优势, 有效的运用美股亚洲时段这项功能。

图3:TSLA.US 发布盈利后的表现

图3:TSLA.US 发布盈利后的表现

3. 对内部人士活动的反应

据SEC称,内部人士主要是该公司的董事,以及持有公司10%以上股份的人士。内部人士进行的交易很重要,因为这些交易是向市场传递有关股票价值的信号。当内部人士购买股票时,表明该股票被低估了,而出售股票的情况就正好相反。一些内部人士活动的备案发生在盘后时段,尚未反映在股价中。因此,投资者在美股亚洲时段下单时坐拥先发优势。

4. 衡量情绪的标准

客户可使用POEMS平台作为一个数据点来评估市场情绪。尽管美股亚洲时段显示的报价,可能不是衡量常规交易时段的完美指标,但亚洲时段观察到的情绪可以用来为盘前的交易时段做准备。

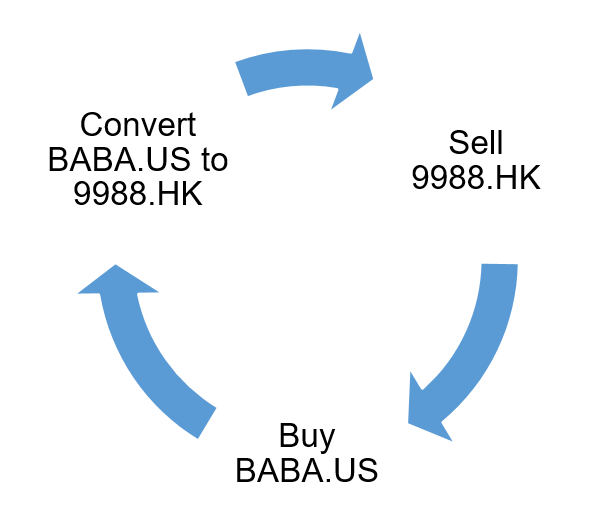

5. 潜在的套利机会

当同一资产在不同市场3价格,存在套利机会。

美股亚洲时段与美国盘前交易的时间在新加坡时间下午4点至5点时重合。美股亚洲时段的价格可能与盘前交易的报价不同,这我们的客户在两个市场同时买入和卖出,进行套利交易。

图4:美股亚洲时段与香港交易所重合

图4:美股亚洲时段与香港交易所重合

在双重上市的股票中也存在机会。例如,阿里巴巴在港交所上市,股票代码为9988.HK,而在纽交所上市,其代码为BABA.US。那些同时持有9988.HK和BABA.US的投资者,将能够利用这个套利机会。当投资者注意到9988.HK的卖出价高于BABA.US时,他们可以同时卖出9988.HK和买入BABA.US,以确保他们对阿里巴巴的敞口仍然相同。如果客户希望获得港股和美股的阿里巴巴股票的比例与以前相同,则可以将BABA.US的股票转换为9988.HK。如图5的图解所示。

图5:套利过程

图5:套利过程

请注意,转换过程中将涉及到费用。此外,美国存托凭证 (ADRs) 代表了外国公司股票的特定数量,因为此等投资者必须了解这些ADR的转换比率。就阿里巴巴而言,1个BABA.US由8个9988.HK组成。客户在使用这一策略时,除转换费外,还应考虑外汇差价。

除了分享这些好处后,在交易美股亚洲时段时,还需注意2点:

1. 最小交易规模

美股亚洲时段的最小交易规模为每笔订单10美元。例如,当福特汽车 (F.US) 的报价为9美元时,投资者将必须购买至少2股。任何低于此金额均将被拒绝。因此,与常规时段和盘前交易时段不同,投资者需要注意美股亚洲时段的数额。

2. 买卖价差扩大

客户可能会受到买卖价差扩大的影响。流动性和利差之间的关系是相互关联的。一般来说,流动性越高,买卖价差就会越窄。对于美股亚洲时段,交易量明显低于常规交易时段,这将导致价差扩大。因此,投资者在美股亚洲时段交易时,必须注意这种利差。

欲了解更多有关美股亚洲时段的详情,来参与我们的网络研讨会吧!

归根结底,参与美股亚洲时段的交易对投资者来说,是一个极大的优势。能够在亚洲时间进行交易,赋予投资者在投资过程中享有更大的灵活性。由于美股亚洲时段有其独特之处,请务必熟悉这些与美国盘前交易和常规交易时段不同的因素。认识并理解美股亚洲时段的特性,可以让投资者在 美股亚洲时段交易 时受益。

Reference: