阿里巴巴赴港上市,上市前一天交易阿里巴巴股票

有消息称,在线零售商巨头阿里巴巴(Alibaba)要重返香港上市,预计在11月底或12月初上市,拟筹集100亿至150亿美元资金。在过去十年中,阿里巴巴以令人印象深刻的销售和盈利增长而闻名,年增长率超过20%。在本月的11.11 光棍节,仅第一个小时就创造了超过100亿美元的销售额。

值得说的就是,在阿里巴巴赴港上市交易的前一天,您还是可以通过辉立暗盘提前买入阿里巴巴的股票。

暗盘交易介绍:

通常暗盘交易都是在新股上市的前一天,不过不是通过交易所的系统,而是通过券商内部的系统进行撮合报价。另外,并不是所有新股都有暗盘,只有在主板上市的新股才有暗盘,在创业板上市的股票,由于发行规则不同,参与的风险比较高,暂时没有接入暗盘交易。关于暗盘价和上市价的关系,尽管暗盘的涨跌从一定程度上体现了新股的受追捧程度,不过暗盘价并不能全面反映市场需求,买卖盘透明度不高,所以暗盘价并不能被视作该股的走势指标。

辉立暗盘交易细则

在香港,辉立证券是第一个为客户提供暗盘交易渠道的券商,交易时间一般为新股上市前一个交易日的下午4点15至下午6点半,半日市的交易时间为下午2点15至下午4点半。

了解更多,请访问辉立暗盘交易页面

个股举例 – 阅文集团

腾讯的子公司阅文与2017年11月8日赴港上市,引发投资者的认购热潮。该股发行价55港币,每手股数为200股,上市前超额认购达625倍。据辉立交易场资料显示,阅文暗盘开市报77.9元,之后高见92元,收报89.65元,较招股价上涨63%。

上市首日,阅文开盘报价90港元,后迅速上涨,一度触及110港元,较发行价上涨100%,尽管随后涨幅小幅回落,但一直保持在100港币之上,最后收盘报价102.4港元,上涨近86%,总市值达928亿港元。

个股举例 – 希玛眼科

顶着马化腾概念股光环的希玛眼科于2018年1月15日在港交所挂牌。希玛眼科欲募资7300万美元,其中10%的认购者为散户。最终以高达1500倍的超额认购,超越阅文的620倍超额认购。希玛眼科招股书显示,此次IPO将发售1.97亿股股份,其中香港发售1970万股,国际发售1.773亿股,发售股份将占公司全球发售完成后的已发行股本的25.05%,价格在2.35-2.9港元之间,每手2000股。

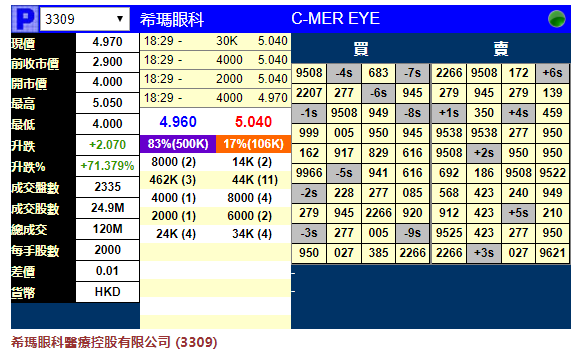

在创下史上最高超额认购记录后,前一交易日的暗盘交易也极为火爆。根据辉立证券香港官网数据显示,希玛眼科交易价达4.97港元,较招股价大涨71%。总成交额超过1.2亿港元。

上市当日,该股开盘即暴涨84.5%,报5.35港元。之后股价如坐火箭一般飙升,连续4日大幅上涨,最高价达19.9港元,较发行价涨686.2%,较第一天开盘价涨371.96%。之后有所回落。

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡房地产, 新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,IPO, 香港IPO, 阿里巴巴IPO