“9618”,京东送给自己的“生日礼物”—辉立暗盘,上市前一天交易京东股票

“9618”,京东送给自己的“生日礼物”—辉立暗盘,上市前一天交易京东股票

京东成立于1998年6月18日,现已成为中国最大的零售商之一。它不仅位列纳斯达克100指数,也成功跻身《财富》全球500强。除电商业务之外,京东也进军金融和技术领域。

京东作为中国领先的一站式电子商务平台之一,也被喻为eBay与亚马逊之间的交叉口,其为超过3.87亿活跃客户提供了优质的在线体验。京东同时也在不断调整公司战略,积极转型为“以供应链为基础的技术与服务企业”,调整其公司使命 “技术为本,致力于更高效和可持续的世界”。

京东在2016年与沃尔玛(Walmart)等企业建立战略合作伙伴关系,开放其技术及基础设施,为沃尔玛等集团在京东平台上开设官方旗舰店,以及提供物流解决方案,帮助本地及国际品牌快速打入中国电子商务市场。京东最值得称赞的是建立起来一个无与伦比的全国配送网络,甚至可以说覆盖了中国近99%的人口。

与此同时,京东在其招股书中表示,“京东要求所有的第三方商家达到京东对产品品质和服务质量的严格标准,同时密切监测他们在线上电商平台的运营动态。京东对产品质量、真实性的承诺涵盖了从新鲜食品到服装到电子产品、化妆品等所有产品。

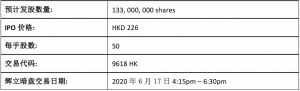

继阿里巴巴集团控股有限公司(Alibaba Group Holding)的脚步之后,京东(JD.com)将于6月18日上午9点在香港交易所上市,股票代码9618,筹集资金约310亿港元(约合40亿美元)。最高公开发售价为236港元,即每股A类普通股30.45美元,比2020年6月5日在纳斯达克收盘价59.04美元溢价约3.1%。主要基于京东在纳斯达克的每股股价代表香港交易所发行的2股A类普通股。

可以说京东的赴港上市充满了仪式感,“9618”, 京东为自己送上了一份最特别的“生日礼物”。

值得说的就是,在京东赴港上市交易的前一天(2020年6月17日),您可以通过辉立暗盘提前买入京东股票(9618.HK)。

暗盘交易介绍:

通常暗盘交易都是在新股上市的前一天,不过不是通过交易所的系统,而是通过券商内部的系统进行撮合报价。另外,并不是所有新股都有暗盘,只有在主板上市的新股才有暗盘,在创业板上市的股票,由于发行规则不同,参与的风险比较高,暂时没有接入暗盘交易。关于暗盘价和上市价的关系,尽管暗盘的涨跌从一定程度上体现了新股的受追捧程度,不过暗盘价并不能全面反映市场需求,买卖盘透明度不高,所以暗盘价并不能被视作该股的走势指标。

辉立暗盘交易细则

在香港,辉立证券是第一个为客户提供暗盘交易渠道的券商,交易时间一般为新股上市前一个交易日的下午4点15至下午6点半,半日市的交易时间为下午2点15至下午4点半。

了解更多,请访问辉立暗盘交易页面

京东暗盘交易快报:

昨天(2020年6月17日),京东在辉立暗盘交易时段交易(4:15pm-6:30pm),价格在236.20港元至240.00港元之间波动,收盘价为239.40港元(较226港元的发行价上涨了5.9%)。京东在辉立暗盘交易的总市值超过2.69亿港元。

2020年6月18日9:30am, 京东正式登陆港交所。

以下是京东在IPO前交易时段(2020年6月17日)的交易摘要

了解更多,请访问辉立暗盘交易页面