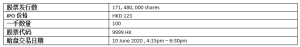

网易公司 (9999.HK)于2020年6月11日赴港上市!使用辉立暗盘,6月10日即可交易网易股票

网易公司 (9999.HK)于2020年6月11日赴港上市!使用辉立暗盘,6月10日即可交易网易股票

北京时间5月3日凌晨,美股周二普遍下跌,道指跌174.07点,或0.72%,报23924.98点;标普500指数跌19.13点,或0.72%,报2635.67点;纳指跌29.81点,或0.42%,报7100.90点。美股周二震荡收跌,道指连续第四个交易日下滑。苹果股价大涨4.4%,但未能提振股指收高。

网易公司(网易)于1997年成立,是中国领先的互联网技术公司。该公司致力提供以创新和多样化的内容,社区,通信和商务为核心的优质在线服务。

截至2019年12月31日,网易拥有超过10亿的电子邮件注册用户,和8亿的网易云音乐注册用户。它的在线广告产品包括横幅广告,直接电子邮件,赞助特殊活动,游戏,竞赛和其他活动。它还向个人用户和企业用户提供免费和收费的优质电子邮件服务。

今年手游的销量激增,因为受到新冠病毒的驱动,实施封锁和其他社交距离等措施,致使人们花更多的时间和金钱在游戏上。.

作为腾讯控股有限公司的竞争对手,网易也是开发和运营一些在中国最受欢迎的移动和个人电脑客户端游戏的市场领导者之一。该公司将通过不断扩大其在海外市场的网络游戏产品,增强其全球研发及游戏设计能力,以继续提高公司在全球市场的影响力。网易还与暴雪娱乐和Mojang AB (微软子公司)等其他领先的游戏开发商合作,运营全球知名的游戏。

网易是继阿里巴巴于2019年之后,第二家赴香港启动二次上市的公司。公司预计通过港交所共计筹资216.06亿港元 (27.8亿美元)。

值得说的就是,在网易赴港上市交易的前一天,您还是可以通过辉立暗盘提前买入网易(9999.HK)的股票。

暗盘交易介绍:

通常暗盘交易都是在新股上市的前一天,不过不是通过交易所的系统,而是通过券商内部的系统进行撮合报价。另外,并不是所有新股都有暗盘,只有在主板上市的新股才有暗盘,在创业板上市的股票,由于发行规则不同,参与的风险比较高,暂时没有接入暗盘交易。关于暗盘价和上市价的关系,尽管暗盘的涨跌从一定程度上体现了新股的受追捧程度,不过暗盘价并不能全面反映市场需求,买卖盘透明度不高,所以暗盘价并不能被视作该股的走势指标。

辉立暗盘交易细则

在香港,辉立证券是第一个为客户提供暗盘交易渠道的券商,交易时间一般为新股上市前一个交易日的下午4点15至下午6点半,半日市的交易时间为下午2点15至下午4点半。

了解更多,请访问辉立暗盘交易页面

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡房地产, 新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,IPO, 香港IPO, 网易IPO