两全其美:房产投资信托基金(REIT) +交易所交易基金(ETF) = 房产信托交易所交易基金(REIT ETF)

什么是房产投资信托基金(REITs)?

房产投资信托基金 (REITs) 是投资于可产生收益的房地产资产组合的基金,如购物中心,写字楼,工业地产,酒店等。[1] REITs 可以根据投资的房产类型和地理位置进行分类:

1) 零售房产投资信托基金 (如:CapitaMall Trust,Frasers Centrepoint Trust)

2) 工业房产投资信托基金 (如:Ascendas REIT,Mapletree Industrial Trust)

3) 办公房产投资信托基金 (如:Frasers Commercial Trust,Keppel REIT)

4) 医疗房产投资信托基金 (如:Parkway Life REIT , First REIT)

5) 酒店和度假村房产投资信托基金 (如:Frasers Hospitality Trust, Far East Hospitality Trust)

6) 住宅房产投资信托基金 (如:Ascott Residence Trust)

(REITs 和REIT 基金经理的类型并非详尽无遗)

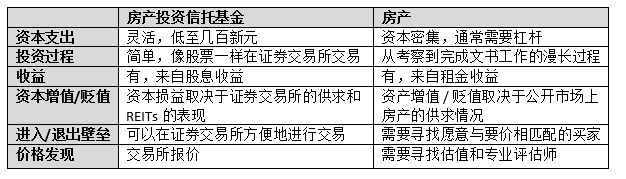

当涉及到投资房产时,许多投资者可能会考虑购买实物房产 (私人公寓,商铺等)。他们可能不知道的是,REITs 允许投资者在房产领域拥有既得利益,而不必做出购买房产的重大承诺。大多数投资者可能没有投资房产所需的资本,而REITs 为他们提供了一种成本效益高的方式,以获得对实物房产的投资,并使其投资组合多样化。

[1] http://t.cn/RkTyCPn

REITs与房产投资的对比表

REITs的特点

REITs 的基础资产由专业人士管理,资产产生的收入 (主要是租金收入) 定期分配给投资者。因此,REITs 对于那些寻找全年持续派发股息的投资者来说,是理想的选择 (派息频率和收益率取决于REITs 各自的政策)。

REITs 可在世界各地的交易所进行交易。然而,REITs 与股票类似,特别容易受到市场风险和非市场风险的影响。例如,零售REITs 的表现容易受到经济环境的影响,与消费者的购买力(市场风险) 呈正相关。实体零售商场 (零售REITs的基础资产) 也面临着来自在线零售商店的激烈竞争,这将反过来影响零售REITs 的表现 (非市场风险)。

除了各种不同的REIT 行业分类外,REITs 也可能位于不同的地理区域,容易受到该地区特定的政治发展和财政政策的影响。例如,利率下降可能会鼓励企业借入更多的资金,投资于零售或办公场所,进而反过来推高各自REITs 的业绩。反之,利率的提高会增加借款成本,最终影响到REITs 的杠杆比率和绩效。

REITs 的5大优势

在不同的地理位置有各种各样的REITs 可供选择

获取房产投资的成本- 效益方法

一种独特的资产类别,供投资者的投资组合多样化

稳定的派息及可观的股息率

适合寻求补充其被动收入的投资者

一个独特的混合体:REIT ETFs

REIT ETFs 是在证券交易所上市和交易的开放式基金。然而,与传统REITs 不同的是,REIT ETFs 包含一篮子REITs 作为其基础资产,并让REIT ETF 持有者拥有一篮子REITs 的风险敞口,而不是单一的REIT。

REIT ETFs 的投资目标是复制其追踪的基准指数,并采用被动指数编制策略。这种策略为投资者提供了便利,因为他们不必追踪每个REIT 的表现。

从REIT ETFs 的基础资产中获得的股息将分配给ETF 持有者,其频率和收益率由REIT ETFs 的基金经理决定。

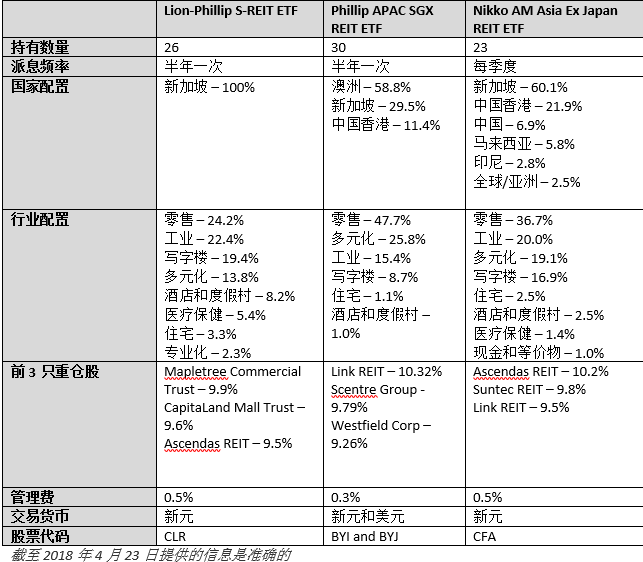

世界上第一个REIT ETF 是iShares US Real Estate ETF, IYR, (链接转到 http://t.cn/RkTUNL0 ) 于2000年6月在纽约证券交易所上市。在新加坡,有3只REITs ETFs 在新交所上市,即Phillip SGX APAC Dividend Leaders REIT ETF (辉立新交所亚太股息领先房产投资信托挂牌基金),Nikko Asset Management Asia REIT ETF(日兴海峡资产管理亚洲房产投资信托交易所挂牌基金)和Lion-Phillip S-REIT ETF(利安-辉立新加坡房产投资信托交易所挂牌基金)

Lion-Phillip S-REIT ETF

Lion-Phillip S-REIT ETF是新加坡第一只由26 个高质量的新加坡REITs组成的REIT ETF。这只REIT ETF 的主要目标是追踪晨星新加坡投资信托收益指数。纳入这一指数的标准是:

1) 财务健康

2) 优质

3) 股息收益率

因此,投资者可以通过这只ETF获得低成本的投资机会,并在新加坡房产市场拥有广泛的敞口。除了允许投资者多样化投资组合外,这只ETF 还通过每半年一次的股息分配向投资者提供定期和可持续的收入流。当ETF 的基础资产价值增长时,投资者也有潜在的资本增长。

新交所挂牌的REIT ETFs 对比表

REIT ETFs的好处 – 多样化和便利性

希望投资于REITs 并尽量减少对REITs 波动性敞口的投资者,可以利用REIT ETFs 为他们带来好处。REIT ETFs 由不同的REITs 组成,其组成部分可以跨越多个行业和地理区域。因此,发生在特定行业或地区的不良事件对REIT ETF 的影响,不会像对单个REIT 那样大。

便利性。希望多元化投资于REITs 的投资者,不需要单独交易不同行业或地区的每一只REIT ,并在此过程中产生高昂的交易成本。REIT ETFs 为他们提供了一种便捷的方式,通过单一基金持有,就可以在多个行业和地区获得敞口。

多样化的主要目的是在享受稳定收入流的同时,降低风险。REIT ETFs 的主要投资目标是复制ETF 追踪的基准指数的表现。REIT ETFs 是根据指数基准成分选择的。投资者可简单地选择最符合投资策略和目标的REIT ETFs。

根据ETF 的投资目标和指数基准标准,REIT ETF 基金经理代表ETF 持有者对ETF 的持有进行再平衡。表现较弱的REITs 将被表现较好的REITs所取代,这将反过来有利于REIT ETF 的整体表现。

总结

尽管REITs 与股票有一些相似之处,但它本身是一种独特的资产类别。它们为投资者提供了一种投资于房产市场的具有成本效益高的方式,并提供了一种额外的选择,使他们的投资组合资产配置多样化。然而,投资者必须注意到REITs 投资的缺点和局限性;对市场波动的敏感性,高杠杆率以及对REITs 基金经理的素质和能力的依赖。

通过使用REIT ETFs,投资者可以利用ETF 的特点,增强他们在REITs 行业的风险敞口,并克服REITs 带来的一些缺点。REIT ETFs 的多样化使投资者在特定REIT 的行业和地理区域的风险敞口降至最低。除了REIT ETFs 为投资者提供的便利外,它们还为投资者提供了可能希望在金融资产中获得的持续股息支付和股息收益率。

欲了解更多有关ETFs的信息,请访问 https://www.poems.com.sg/products/etf/

或致电(0065) 6531 1246,与我们的产品专家联系。

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡房地产, 新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,