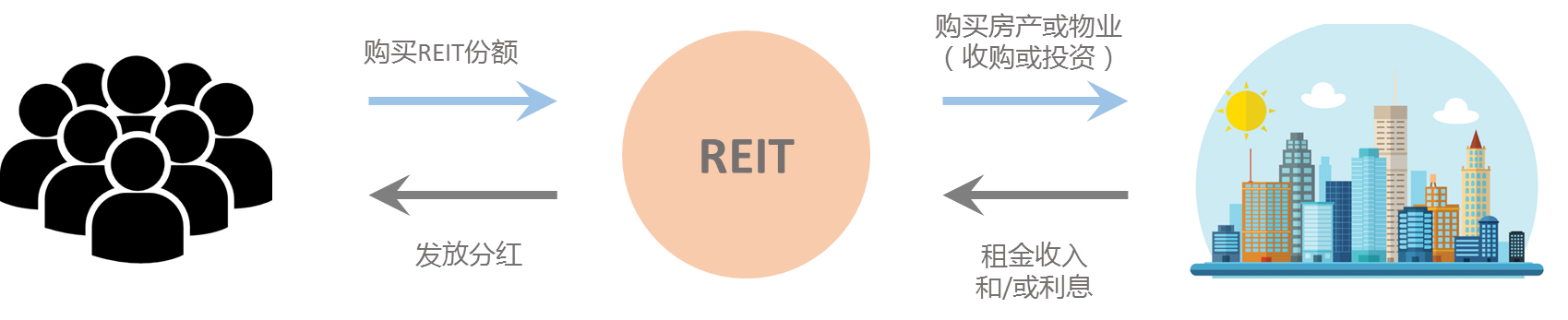

越来越多人热衷投资的新加坡REITs,究竟是什么?

最近,总是听到有客户咨询,有没有什么风险相对偏小,收益较稳定的产品可以投资。为了让大家对金融市场有更多的了解,找出最适合自己的投资产品,我们特地准备了这篇文章,为大家介绍很受新加坡人偏爱的REITs。花5分钟读完这篇文章,我们力求用最简洁明了的语言让你对新加坡REITs有更多的认识!

S-REITs的主要特点 (后文简称:S-REITs)

1. 像股票一样买卖:REITS也是在股票交易所上市,所以和股票一样可以随时买卖,价格公开透明。

一些人以为REITs是普通基金,需要找基金经理购买,但实际上REITs在交易所上市,交易方式和股票无异,且流通性比一般基金好。

2. 定期发放股息:新加坡的REITs基本是每半年或每季度发一次股息给持有人。

股票发放股息是不确定的,这取决于公司的决定。但是REITs是被要求必须定期发放股息的。

3. 较低的投资门槛:与买房投资相比,REITs的投资金额非常灵活,买入成本可以低至几百新币。

S-REITs的市场价一般在每股1-2新币左右(100股起买),也就是说最低交易金额大概在100-200新币左右。

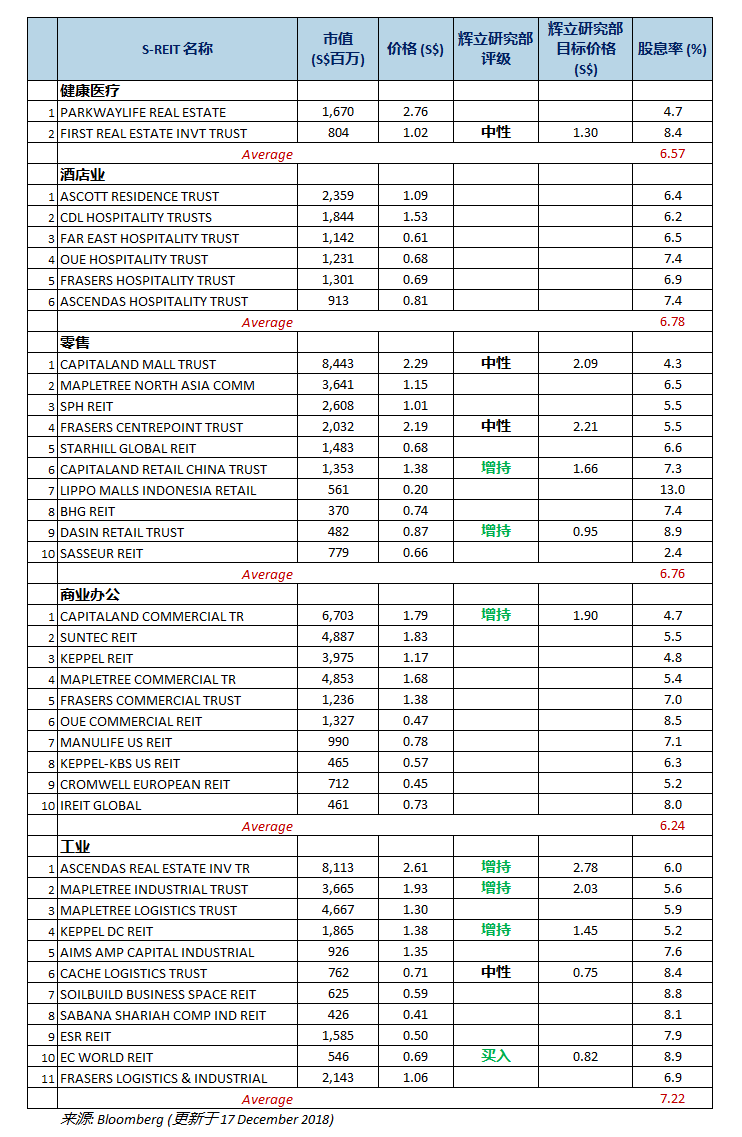

4. S-REITs种类多样化,不同的板块具有各自的特征

根据房地产用途的不同,REITs被分为以下几大类型来进行追踪和分析:

• 零售REITs (如:CapitaMall Trust,Frasers Centrepoint Trust)

• 工业/物流REITs (如:Ascendas REIT,Mapletree Industrial Trust)

• 商业办公REITs (如:Frasers Commercial Trust,Keppel REIT)

• 医疗REITs (如:Parkway Life REIT , First REIT)

• 酒店/度假村REITs (如:Frasers Hospitality Trust, Far East Hospitality Trust)

S-REITs的总体表现居于世界前列

新加坡早在2002年就推出了第一只REIT(在这之前也只有美国、澳洲、日本少数几个国家推出了REITs,中国目前还未推出REITs),发展到现今,新加坡是除日本以外亚洲第二大,也是最具国际性和成熟度的REITs市场。目前日本共有58个REITs项目,总市值1412亿新币;新加坡共有42个REITs项目,总市值848亿新币;香港则有13个REITs项目,总市值482亿新币。

除了投资本地的房地产,新加坡上市的大部分REITs都还有投资境外房地产,遍布澳洲、美国、中国、马来西亚及欧洲等地。

据新加坡交易所2018年7月发布的数据,34只S-REITs和6只合订证券的年平均股息收益率为6.7%左右,而从近几年的历史数据来看,年平均股息收益率也基本在6%上下。从2010年-2017年,新加坡REITs指数的股息收益率在较长时间内一直居世界前列。

根据S-REITs的属性,我们总结了一些适合投资REITs的人群特征

1. 有一定储蓄,想做一些投资,但又担心股票风险太高,自身风险承受能力较低的人。

2. 希望长期持有,定期收到现金分红的人。我们买股票,常常是为了从价格变动中获利,但REITs就不太适用了。它的价格波动通常不如股票大,更适合买来长期持有,然后定期拿分红。一般来说, REITs的股息分红要比普通股票高。

3. 想投资房地产市场,但又觉得精力有限,买卖房子花费太高的人。REITs是间接参与房地产的一种方式。

4. 对持有新币有一定兴趣,希望配置一定数量的外币以对冲人民币贬值风险的人。

REITs的风险

任何一种投资产品,都存在风险,大家在入市之前需要多做一些功课了解其中的风险,并判断该产品的风险是否在自己的承受范围内。

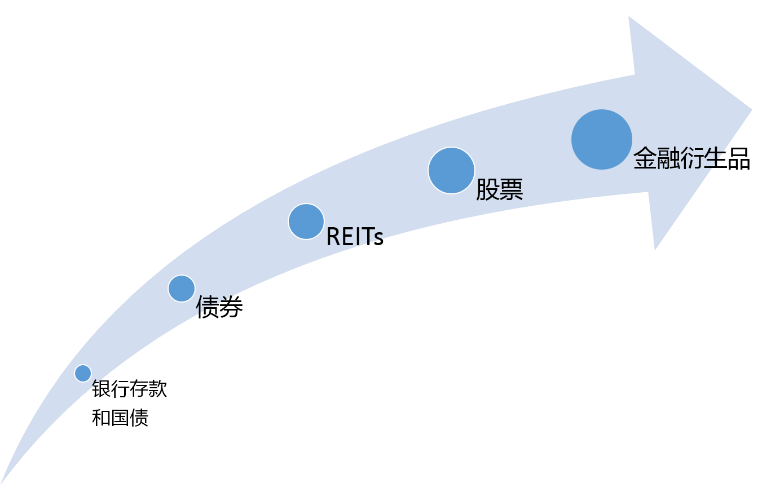

为了便于大家理解REITs的风险大小,这里做了一个简略的比较图,风险随箭头方向依次递增(注意:不能完全按照这个比较来判断风险大小,还需要考虑综合因素,比如凯德/丰树集团发行的REITs风险小于垃圾股票)

具体来说,REITs主要有以下一些风险:

1. 市场波动风险:REITs和股票一样都是在交易所上市,价格会受市场条件的影响上下波动。另外,REITs的表现还可能受到房地产政策、经济周期等的影响。

2. 债务风险:我们在做投资选择的时候需要把债务对资产负债表的影响考虑进去,当一个REIT借钱融资时,要警惕他们是否有足够的财力来偿还到期债务。通常一年内有大量的到期债务是一个危险信号,需要投资者多加关注。

3. 集中风险:这种风险有很多表现形式,比如REIT的收益是否仅从少数资产或物业中获得?这意味着如果少数房产出问题,REIT的收益会受到重创。同样的,REIT是否仅从一个主要租户哪里获得租金收入?在选择特定的REIT投资时,投资者必须谨慎考虑这些问题。

4. 利率风险:有一些REITs对银行的贷款利息非常敏感,如果它的借贷成本提高,利润自然就会减少。

即可以获得一份新加坡REITs的全部列表,附有股息率、辉立研究部评级等

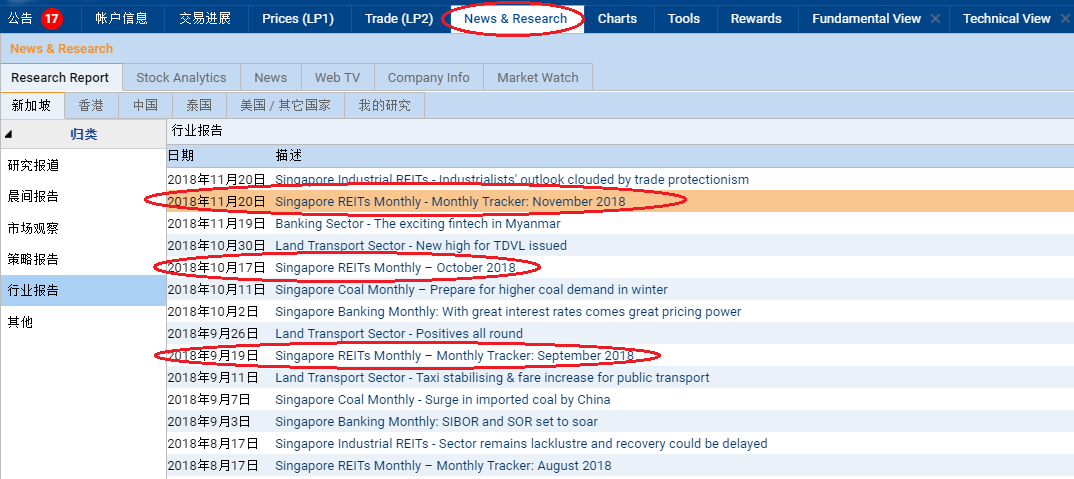

另外,已有辉立账户的客户,可以登录您的POEMS账户选择News & Research >> Research Report >>行业报告,查看辉立研究团队每月发布的S-REITs追踪研究报告和单个REIT的研究报告,以供投资参考。

接下来的REITs系列文章,我们还会为大家介绍,每月定投计划投资REITs(适合小额投资者),以及如何通过S-REITs + 融资放大收益率(适合风险偏好较高的投资者),敬请关注!

来源:新交所,21世纪经济报道,辉立,彭博(Bloomberg)

关键字:交易越南股票,越南股票, 新加坡股票账户,越南股票交易,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,胡志明证券交易所,河内证券交易所