2022 Global Markets Roundup: 7 Main Events January 18, 2023

Start trading on POEMS! Open a free account here!

The three US major indices – the Dow Jones, S&P 500 and Nasdaq Composite had similar movements and ended lower with 2022 as the worst year since 2008.

| NASDAQ | DOW JONES | S&P 500 | |

| Year Open | 15,732.50 | 36,321.59 | 4,778.14 |

| Year Close | 10,466.48 | 33,147.26 | 3839.49 |

| Annual Return | -33.47% | -8.47% | -19.64% |

2022 was different from the bullish 2021. This market journal is a recap of the seven events that took place in 2022:

7 Main Events:

- Inflation caused by an imbalance in demand and supply

- High energy prices inflicted by the Russian-Ukraine War

- Fed raised interest rates to fight inflation

- President Xi Jinping begins serving for a third term

- Crypto Winter

- Global Easing of COVID-19 measures

- Acquisition of Twitter by Elon Musk

- [1] “How COVID-19 impacted supply chains and what comes next – EY.” 18 Feb. 2021

- [2] “Fed sings the ‘transitory’ inflation refrain, unveils bond-buying ‘taper’.” 3 Nov. 2021

- [3] “Fed chair admits US inflation could prove ‘persistent’.” 1 Dec. 2021

- [4] “Timeline: The events leading up to Russia’s invasion of Ukraine.” 1 Mar. 2022

- [5] “Why Are Gasoline Prices So High? Ukraine-Russia War Sparks ….” 1 Apr. 2022

- [6] “Thirst for Oil Vanishes, Leaving Industry in Chaos – WSJ.” 14 Apr. 2020

- [7] “‘Pawn’ in energy stand-off, Germany’s Uniper suffers $12.5 bln loss.” 17 Aug. 2

- [8] “Shareholders of gas group Uniper approve German bailout – Reuters.” 19 Dec. 2022

- [9] “Fed raises interest rates half a point to highest level in 15 years.” 15 Dec. 2022

- [10] “The Fed projects raising rates as high as 5.1% before ending ….” 14 Dec. 2022

- [11] “What are midterm elections, and why are they important?.” 8 Nov. 2022

- [12] “4 Ways 2022 Midterms May Impact the Stock Market.” 10 Nov. 2022

- [13] “UK Prime Minister Boris Johnson resigns – CNBC.” 7 Jul. 2022

- [14] “Liz Truss to be UK’s new PM after winning Conservative leadership ….” 5 Sept. 2022

- [15] “UK Prime Minister Liz Truss resigns after failed budget and market ….” 20 Oct. 2022

- [16] “Rishi Sunak to be Britain’s new prime minister as rivals quit race.” 24 Oct. 2022

- [17] “From Xi’s historic third term to leadership reshuffle – CNA.” 23 Oct. 2022

- [18] “Shopping in stores is back and thriving. Here’s why | CNN Business.” 16 Jun. 2022

- [19] “China abandons key parts of zero-Covid strategy after protests – BBC.” 7 Dec. 2022

- [20] “Bitcoin price calls in 2022: How the market got it wrong – CNBC.” 23 Dec. 2022

- [21] “What Terra’s Crash Means For Crypto and Beyond – TIME.” 17 May. 2022

- [22] “What to know about Sam Bankman-Fried, FTX’s embattled founder.” 13 Dec. 2022

- [23] “How Sam Bankman-Fried’s FTX Crypto Empire Collapsed.” 14 Nov. 2022

- [24] “Bitcoin price calls in 2022: How the market got it wrong – CNBC.” 23 Dec. 2022

- [25] “Elon Musk bought Twitter. Now what? – The Washington Post.” 28 Oct. 2022

- [26] “Elon Musk tries to explain why Tesla shares are tanking – CNBC.” 20 Dec. 2022

- [27] “Tesla suspends production at Shanghai plant – Reuters.” 24 Dec. 2022

- [28] “Tesla TSLA Q4 2022 vehicle delivery and production numbers – CNBC.” 3 Jan. 2023

- [29] “Eurozone heading into recession at the end of this year, Brussels says.” 12 Nov. 2022

1. Imbalance in Demand and Supply

In 2021, the 3 indices reached an all-time high in December before crashing. The record high levels were achieved thanks to the loosening of monetary policies and stimulus from numerous fiscal policies. These policies, coupled with reduced spending due to the enforcement of social distancing measures during the height of the COVID-19 pandemic, caused savings of the Americans’ to balloon. When the COVID-19 measures started to ease, a huge pent-up demand and supply crunch1 resulted. With a huge demand and supply imbalance, prices of goods and services started to climb, leading to inflation. Back then, the Federal Reserve believed that inflation was transitory2. However, they changed their stance towards the end of the year and began tightening monetary policies3.

2. Russia-Ukraine War

Two months after the start of 2022, Russia started a war against Ukraine4, disrupting oil prices. As a result, Russia, one of the world’s largest oil producers was sanctioned. Most Russian oils were removed from global supplies5. With Russian oil supply completely cut and global petroleum refiners incapable of meeting the sudden rise in demands, there was a global shortage of oil6. With limited global supplies coupled with the ‘faster-than-expected’ reopening of economies and revenge travel, there was a sudden sharp surge in the demand for oil. Hence, oil prices skyrocketed with Brent crude oil topping US$ 130/barrel in March 2022.

The sanctions on Russia also caused its gas supplies to be cut. Germany’s Uniper lost US$12.5 billion as a result of the gas supply disruption since it had to purchase gas from other sources at a greater cost7. More than half of Uniper’s loss in the first half came from the reduction in supplies from Russia. The severe loss prompted Uniper’s shareholders to agree to a bailout, which opened the doors for the faltering gas company to be effectively nationalised8.

Performance of some energy stocks:

| Security | Year Open | Year Close | Returns |

| Constellation Energy Corp (NASDAQ: CEG) | 38.00 | 86.21 | 126.87% |

| Occidental Petroleum Corp (NYSE: OXY) | 29.21 | 62.99 | 115.65% |

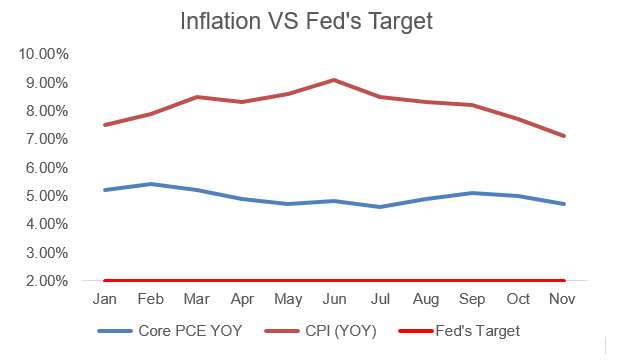

3. Rising Inflation

Referring to the chart above, core inflation remained well above the Fed’s target rate of 2%. With inflation well above the Fed’s target rate, the Fed was forced to raise interest rates to combat rising prices. In 2022, the Fed effected a total of 7 rate hikes, taking the most aggressive stance since the Fed Funds rate was used as a policy tool, dating back to 1990.

| FOMC Meeting Date | Rate Change (Basis Point) | Federal Funds Rate |

| 14 Dec 2022 | +50 | 4.25% to 4.5% |

| 2 Nov 2022 | +75 | 3.75% to 4.00% |

| 21 Sep 2022 | +75 | 3.00% to 3.25% |

| 27 Jul 2022 | +75 | 2.25% to 2.5% |

| 16 Jun 2022 | +75 | 1.5% to 1.75% |

| 5 May 2022 | +50 | 0.75% to 1.00% |

| 17 Mar 2022 | +25 | 0.25% to 0.50% |

At December 2022’s Fed meeting, the Fed went with smaller rate hike, with thoughts of creating a ‘calm-er’ inflationary environment9. However, Chairman Jerome Powell and other committee members were not fully convinced that inflation was on a downward trend and required more evidence to be sure. Chairman Powell also said that more increases in inflation rates would be appropriate to bring price growth under control. The expected terminal rate based on the FOMC dot plot is 5.1% in 202310.

4. Global politics

Looking at the political scene, the US had a midterm election in 2022 when US citizens vote for members of the two chambers of Congress: the US Senate and the House of Representatives11; whichever party controls the Senate or the House will have control over the policies that are rolled out.

The new congress might reduce spending on clean energy initiatives12 and clean tech stocks may be negatively impacted. Republicans have consistently resisted Democrats when it comes to spending on renewable energy, which has an impact on the amount of funds being allocated to combating climate change.

Another high profile event took place when then House Speaker Nancy Pelosi visited Taiwan. This was put in the spotlight as rarely any major foreign power showed support to Taiwan prior to this trip. The US went forward with this trip despite the opposition strongly expressed by China. Pelosi’s visit to Taiwan increased the political tension between the US and China.

The United Kingdom changed their prime minister twice, after Boris Johnson resigned13. Boris Johnson resigned amid controversies and scandals, with Liz Truss taking over the position14. After a short 44 days in office, Liz Truss resigned, making her the shortest-serving prime minister in British history15. Her resignation was caused by a revolt within her party when her tax-cutting budget failed, disrupting the financial market. Thereafter, Rishi Sunak came to fill the void. He helped to steer the UK economy through the COVID-19 pandemic and is seen as a safe pair of fiscal hands16.

In the East, a power reshuffle took place in Beijing17, with President Xi Jinping becoming the first Chinese president, since Mao Zedong, to get three consecutive terms. President Xi staffed the cabinet with his loyalists to strengthen his political power. This however, did not sit well with investors for non-state-driven companies. Big movers of the day included Pinduoduo (NASDAQ: PDD.US) that dropped as much as 34%, and Alibaba (NYSE: BABA.US) that fell 12%.

5. Easing of COVID-19 restrictions

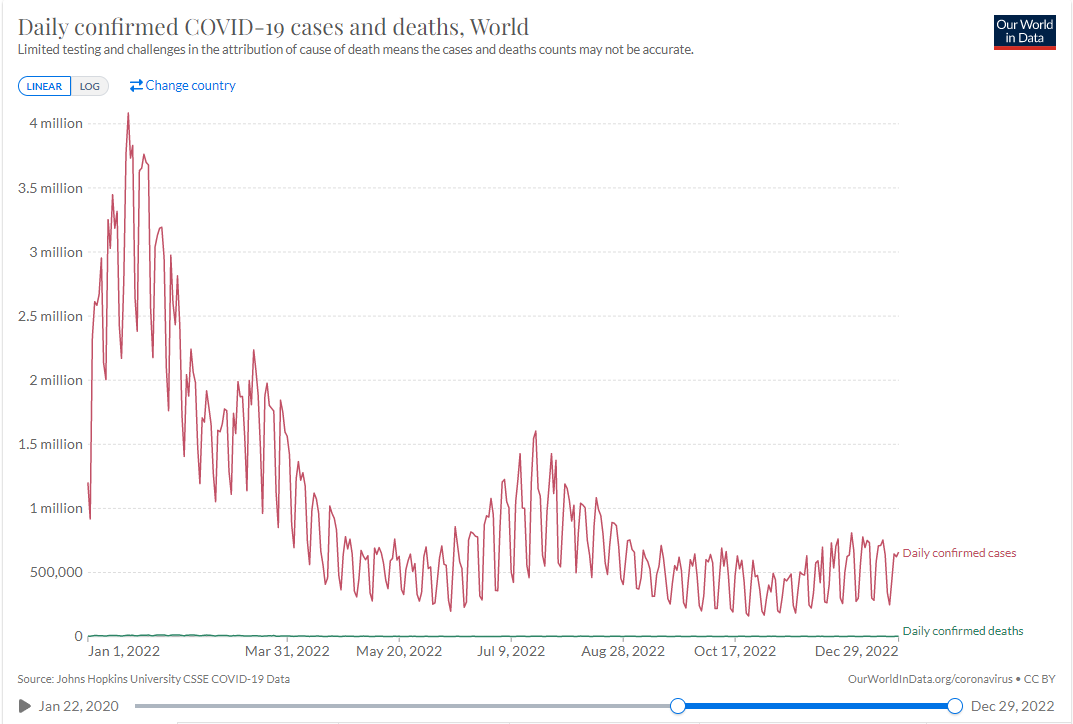

Source: https://ourworldindata.org/grapher/daily-covid-cases-deaths?time=2022-01-01..latest

Source: https://ourworldindata.org/grapher/daily-covid-cases-deaths?time=2022-01-01..latest

As dictated by the chart above, the number of confirmed COVID-19 cases has been gradually falling, allowing the easing of COVID-19 restrictions globally. As restrictions ease, consumers are shifting back to physical retail avenues instead of online shopping platforms, setting the e-commerce industry back.18

Performance of some E-commerce stocks:

| Security | Year Open | Year Close | Returns |

| Shopify Inc (NYSE: SHOP) | 139.19 | 34.71 | -75.65% |

| Amazon.com Inc (NASDAQ: AMZN) | 167.55 | 84.00 | -49.87% |

Months after ‘living with COVID-19’ became the norm for most, China started to soften its COVID-19 policies by abandoning its ZERO-COVID strategy19 after a rare protest by its citizens. Chinese citizens now no longer need to isolate in state facilities. Instead, they can choose to isolate at home. With the lifting of such measures, factories are able to resume operation, aiding to relieve the global economy from the impacts of higher interest rates and further help relieve supply chain disruptions. In 2022, the Shenzhen (SZSE) Composite Index fell from 2,541.46 to 1,975.62, which was a 22.3% drop.

6. Crypto winter

The crypto market has been battered this year, with more than US$2 trillion wiped out since its peak in November 2021.20 The strong bearish movement of the crypto market started around May 2021, when the terraUSD, also known as UST, an algorithmic stablecoin pegged one-to-one with US$ broke its peg. With the breaking of the peg, investors panicked and pulling out their money, resulting in a vicious, self-enforced bank run21, pulling down its sister token LUNA and the entire crypto market.

Then came November when FTX, one of the world’s largest cryptocurrency exchanges which was run by Sam Bankman-Fried collapsed. Many were concerned about the financial instability at FTX due to mismanagement of billions of dollars in customer funds, triggering a wave of customer withdrawals that amounted to billions of dollars22, leaving FTX with a shortfall of US$8 billion, forcing the firm to file for bankruptcy.23 The fallout from FTX continues to ripple across the cryptocurrency industry as it was the third largest crypto exchange, following closely behind Binance and Coinbase (Nasdaq: COIN.US). With the fall of FTX, many are notably questioning the strength of Binance and Coinbase to stay in the crypto game.

Performance of some Crypto related stocks:

| Security | Year Open | Year Close | Returns |

| Coinbase Global Inc (NASDAQ: COIN) | 256.27 | 35.39 | -86.19% |

| Marathon Digital Holdings (NASDAQ: MARA) | 33.68 | 3.42 | -89.85% |

| Silvergate Capital Corp (NYSE: SI) | 150.88 | 17.40 | -88.47% |

On top of crypto-specific failures, investors have also had to contend with the rising interest rates, which have put pressure on risk assets, including stocks and crypto.24

7. Acquisition of Twitter by Elon Musk

Elon Musk finally acquired Twitter in October 2022 at US$54.20 per share, or about US$44 billion.25 Unfortunately, the acquisition caused a negative impact to the other company he has high stakes in, Tesla (NASDAQ:TSLA). This is because Elon Musk is heading numerous other companies; with Twitter added into the mix, less time will be spent on managing Tesla. Furthermore, he also sold billions of dollars’ worth of Tesla shares to finance the Twitter acquisition. The final stroke? Musk might have lost shareholder’s trust after he reportedly went ahead with the sale of more Tesla shares, even after having mentioned that he would not26.

With the negative impact on Tesla potentially caused by the acquisition of Twitter by Musk, along with current macro headwinds like the suspension of work at its Shanghai factory27 and weaker consumer demand shown by the lower than expected delivery numbers28 (405,278 vs 427,000), a potential bearish movement can still be expected.

Comparing Tesla’s (TSLA.US) share performance with Nio (NIO.US), Tesla’s stock performance is not far off from Nio. Tesla slid by 67.8% while Nio dropped by 70.9%. Hence, the electric vehicle sector, as a whole, is affected by macroeconomic factors.

CONCLUSION

Energy prices seem to have stabilised from the expectation of the slowdown of the global economy. With the peak of winter behind us, seasonal pressure on energy prices have seemed to eased as well. However, uncertainty is still high, with potential unforeseen supply shocks triggering another round of new price spikes.

Economy wise, 2023 may not seem that positive. According to the European Commission’s autumn economic forecast, many European (EU) countries29 may potentially enter into its recession phase. This is not a surprise as the EU relies heavily on gas imports from Russia. Zooming into the US economy, most investors are afraid of a recession due to a hawkish central bank. However, looking at the robust labor market, it is hard to believe that a recession is around the corner. The same can be said of corporate earnings where companies are still releasing good earnings reports. Lastly, thanks to China’s re-opening, the global economy may actually experience a soft landing.

Performance of some ETFs affected in 2022

| Sector | Security | Year Open (US$) | Year Close (US$) | Returns |

| Energy | Invesco Dynamic Energy Exploration & Production ETF (NYSE-ARCA: PXE) | 19.36 | 29.58 | 52.79% |

| Energy | iShares U.S. Oil & Gas Exploration & Production ETF(NYSE-ARCA: IEO) | 61.49 | 92.86 | 51.02% |

| E-commerce | ProShares Online Retail ETF (NYSE-ARCA: ONLN) | 57.03 | 28.32 | -50.34% |

| E-commerce | Emerging Markets Internet + Ecommerce ETF (NYSE-ARCA: EMQQ) | 43.00 | 29.73 | -30.86% |

| Crypto | ProShares Bitcoin Strategy ETF (NYSE-ARCA: BITO) | 29.75 | 10.43 | -64.94% |

| Crypto | Simplify US Equity PLUS GBTC ETF (NASDAQ: SPBC) | 28.20 | 20.14 | -28.58% |

| Crypto | Bitwise Crypto Industry Innovators ETF (NYSE-ARCA: BITQ) | 21.46 | 3.39 | -84.20% |

| EV | Global X Autonomous & Electric Vehicles ETF (NASDAQ: DRIV) | 30.89 | 19.87 | -35.67% |

| EV | KraneShares Electric Vehicles & Future Mobility ETF (NYSE-ARCA: KARS) | 47.47 | 28.14 | -40.72% |

| Inflation | Invesco DB Commodity Index Tracking Fund (NASDAQ: DBC) | 20.72 | 24.65 | 18.97% |

| Inflation | ProShares Inflation Expectations ETF (NYSE-ARCA: RINF) | 30.86 | 32.96 | 6.80% |

Bloomberg analysts’ recommendations

The table below shows the consensus ratings and average ratings of all analysts updated on Bloomberg in the last 12 months. Consensus ratings have been computed by standardising analysts’ ratings from a scale of 1 (Strong Sell) to 5 (Strong Buy). The table also shows a number of analysts’ recommendations to buy, hold or sell the stocks, as well as their average target prices.

| Security | Consensus Rating | BUY | HOLD | SELL | 12 Mth Target Price (US$) |

| Amazon.com Inc (NASDAQ: AMZN) | 4.79 | 54 (93.1%) | 3 (5.2%) | 1 (1.7%) | 137.04 |

| Constellation Energy Corp (NASDAQ: CEG) | 4.57 | 12 (85.7%) | 1 (7.1%) | 1 (7.1%) | 100.23 |

| Marathon Digital Holdings (NASDAQ: MARA) | 4.25 | 5 (62.5%) | 3 (37.5%) | 0 | 14.33 |

| Silvergate Capital Corp (NYSE: SI) | 4.09 | 7 (63.6%) | 3 (27.3%) | 1 (9.1%) | 47.09 |

| Tesla Inc (NASDAQ: TSLA) | 3.89 | 25 (56.8%) | 14 (31.8%) | 5 (11.4%) | 246.77 |

| Shopify Inc (NYSE: SHOP) | 3.56 | 18 (37.5%) | 26 (54.2%) | 4 (8.3%) | 39.94 |

| Occidental Petroleum Corp (NYSE: OXY) | 3.41 | 7 (25.9%) | 19 (70.4%) | 1 (3.7%) | 75.39 |

| Coinbase Global Inc (NASDAQ: COIN) | 3.36 | 14 (42.4%) | 12 (36.4%) | 7 (21.2%) | 73.54 |

Get yourself educated! Join our free webinar here!

Explore a myriad of useful features including TradingView chartings to conduct technical analysis with over 100 technical indicators available!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

Reference:

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Global Markets Desk US Dealing Team

The Global Markets Desk US Dealing team specialise in handling the US Markets in the Global Markets Desk.

Their responsibilities and capabilities extend from managing and taking orders from clients trading in the US market, to content generation, Technical Analysis and providing educational content to POEMS clients.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It