Markets Offered

United States (NYSE, NYSE-MKT, NASDAQ)

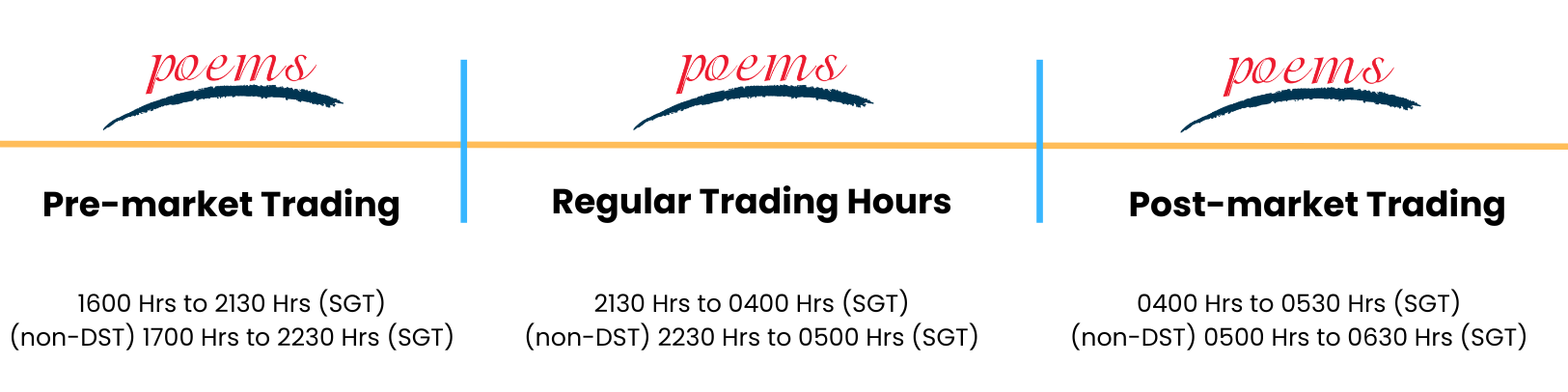

US extended hours trading is available on the POEMS suite of trading platforms (POEMS 2.0), POEMS Mobile 2.0, POEMS Pro, POEMS Mobile 3.0), where you can place trades FIVE and a half hours before the commencement of US regular trading hours and 90 minutes after the US regular trading.

-

What is extended hours?

Extended hours refers to the trading hours outside regular trading sessions including both pre-market and post-market. POEMS NOW OFFERS you Pre and Post-Market trading between 1600hrs – 2130hrs SGT and 0400hrs – 0530hrs SGT (for Non-Daylight between 1700hrs – 2230hrs SGT and 0500hrs – 0630hrs SGT).

- What time are the extended hours?

Pre-Market Start Time Pre-Market End Time Regular Market Start Time Regular Market End Time Post-Market Start Time Post-Market End Time Eastern Standard Timing (EST) 04:00 09:30 09:30 16:00 16:00 17:30 Singapore timing (Daylight) 16:00 21:30 21:30 04:00 04:00 05:30 Singapore timing (Non-Daylight) 17:00 22:30 22:30 05:00 05:00 06:30 - What time will the extended hours quote be available?

Extended hours quote will be available from 1600hrs – 2130hrs SGT & 0400hrs – 0530hrs (for Non-Daylight between 1700hrs – 2230hrs SGT & 0500hrs – 0630hrs)

- What is a Market Order?

- A market order is an order placement with a defined quantity but without a price. It will be traded at the best price currently available in the market.

- What is Market on Open?

- A MOO order is an order placement with a defined quantity but without a price. It is placed before a market is opened and will trade at the best price when the exchange starts trading. It is an order to execute at the day’s opening price.

- What is Market on Close?

- A MOC order is an order placement with a defined quantity but without a price. It is placed during the market trading session and will be executed at the closing. It is an order to execute at the day’s closing price.

- When can I start placing a Market Order, MOO and

MOC?

- A Market Order, MOO and MOC orders can be placed on the trading day from 0900 EST till US market close at 1600 EST (subject to cut off time below). Any order placements outside of the allowed hours will be rejected with effect from 12 September 2022.

- What is the cut-off time for placing an order?

Order Type Market Cut Off Time

(Before market open/close)Order Entry Order Withdrawal Market on Open(MOO)Marketable Limit Orders prior to open NYSE No cut off on both Order Entry or Withdrawal NASDAQ 2 mins 5 mins AMEX 5 secs 1 min Market on Close(MOC)Marketable Limit Orders prior to close NYSE 10 mins 2 mins NASDAQ 5 mins 10 mins AMEX 10 mins 10 mins

More information about Market, MOO & MOC order

Risk of Overtrading for Market, Market on Open and Market on Close orders:

Financial markets may fluctuate rapidly and susceptible to ‘gapping ’where there is a sudden shift in prices from one level to another. As Market, Market-On-Close and Market-On-Open orders are executed at the best price currently available in the market, there will always exist a risk of over-trading due to excessive price movements.

- What is GTD Order

GTD orders will continue to be effective until the order is fully executed, cancelled or expired. For clients who may have a target price away from the current levels, GTD orders allow for orders to be entered at a bid (offer) well below (above) the current trading price of the counter without replacing the order daily. - Eligible order types for GTD

Only Regular Trading Hours (RTH) Limit and Stop-Limit (SLO) orders are eligible for GTD. - Validity and expiry of GTD orders

Only expiry dates of T+1 or more and up till 30 days from T can be selected. GTD orders will stay effective till a maximum of 30 days and will expire after the market closes on the expiry date selected. GTD orders with expiry dates that fall on a weekend/US holiday are invalid and will be rejected. - Corporate action on GTD order

- Forward/Reverse split and Stock Dividend:

Any outstanding GTD orders will be withdrawn on the date of corporate action at 0815hrs (EST) with the exception of overnight GTD orders (orders submitted after the market closes i.e. 1615 EST on the day before the corporate action). - Cash Dividend:

Buy limit and Sell stops/limit will be adjusted down by the value of the cash dividend on the ex-date.

- Forward/Reverse split and Stock Dividend:

- Withdrawal of in-queue GTD

Please do note that GTD withdrawals for the US markets may be delayed until the counterparty’s system comes online to process the request at 810am EST.

| Order Placement | Via

1) POEMS or 2) Your designated Trading Representative or 3) Night dealer (US Trading Hours) |

| Trading lot | 1 share | |

| Live price | Via POEMS (live price quote) | |

| Exchange | NYSE, NASDAQ and NYSE-MKT | |

| Order Type1 | Limit Order, Stop Limit Order, Market Order, Market on Open Order, Market on Close Order | |

| Minimum bid size2 | Share price (USD) | Minimum Bid Size (USD) |

| <1 | 0.0001 | |

| ≥1 | 0.01 | |

| Exchange fees: | |

| Securities and Exchange Commission (SEC) Fee | 0.0008%^(sell trades) *** Revised to 0.00278% (sell trades effective trade date 20 May 2024) |

| Trading Activity Fee (TAF) | Applicable only for sell trades at USD 0.000166 per share, subject to maximum of USD 8.30 (With effect from 2 January 2024). |

| Other charges/exchange fees: | |

| Financial Transaction Tax | 0.3% (Buy trades only, applicable for French ADRs with

market cap >= EUR 1 B) 0.1% (Buy trades only, applicable for Italian ADRs with market cap >= EUR 500 M) 0.2% (Buy trades only, applicable for Spanish ADRs with market cap >= EUR 1 B) |

| American Depository Receipt (ADR) / Depository Receipt (DR) fee | Varies for each counter |

Note: All fees and charges are subject to Goods & Services Tax (GST). Fees & charges may be subject to changes without prior notice. Please click here for custodian charges.

| Singapore Time | 09:30pm – 04:00am (Daylight Saving Time) |

| 10:30pm – 05:00am (Non-Daylight Saving Time) | |

| US(Eastern) Time | 09:30am – 04:00pm |

2024

| Month | Day | Date | Holidays | Settlement | Trading Day |

| January | Monday | 1 January | New Year’s Day | No | No |

| Monday | 15 January | Martin L. King Day | No | No | |

| February | Monday | 19 February | Presidents’ Day | No | No |

| March | Friday | 29 March | Good Friday | No | No |

| May | Monday | 27 May | Memorial Day | No | No |

| June | Wednesday | 19 June | Juneteenthy | No | No |

| July | Wednesday | 3 July | Indep. Day Early Close | Yes | Partial |

| Thursday | 4 July | Independence Day | No | No | |

| September | Monday | 2 September | Labor Day | No | No |

| October | Monday | 14 October | Columbus Day | No | Full |

| November | Monday | 11 November | Veterans’ Day | No | Full |

| Thursday | 28 November | Thanksgiving | No | No | |

| Friday | 29 November | Day After Thanksgiving | Yes | Partial | |

| December | Tuesday | 24 December | Day Before Christmas | Yes | Partial |

| Wednesday | 25 December | Christmas Day | No | No |

Note: Information is correct at the time of posting

US Daylight Saving Time starts on 2nd Sunday of March to 1st Sunday of November

An ADR is a stock that trades in the United States but represents a specified number of shares in a foreign corporation. ADR agents (banks and investment banks) purchase stocks on foreign exchanges and then sell receipts for these shares on American exchanges. ADR agents charge these ADR fees to compensate for inventorying the foreign stocks and all other costs involving registration, compliance and recordkeeping services.

The ADR Fees will vary for each counter and you will be billed according to the shareholdings for each ADR shares.

No. US Citizens or US Residents are not allowed to trade in US Stocks through PSPL.

Can I continue to trade in US markets if I subsequently become a US Resident/US Citizen/US Taxpayer?

No. Once you are a US Resident/US Citizen/US Taxpayer, you will not be able to trade in US Stocks through PSPL and you are required to notify PSPL should there be any change of your citizen/residency status.

A negotiable financial instrument issued by a bank to represent a foreign company’s publicly traded securities. The depositary receipt trades on a local stock exchange. Examples of DR include American Depository Receipt (ADR) that trades in the United States and Global Depository Receipt (GDR) that trades globally. DR agents (banks and investment banks) purchase stocks from the originating foreign exchanges and sell them on the domestic exchanges (e.g. American exchange). DR agents charge DR fees to compensate for inventorying the foreign stocks and all other costs involving registration, compliance and recordkeeping services

DR fees will vary for each counter and you will be billed according to the shareholdings for each DR shares.

Why is my limit or market orders not done when market opens at 9.30am (EST) and why is my executed price different from the opening price shown on POEMS?

All the orders received prior to market open will be routed and protected versus the stock’s primary listing exchange market opening print. Sometimes, there may be a delay in the opening for certain stocks in the primary exchange which will result in these counters not being able to open at 9.30am sharp.

However, you may still see transactions execute off the primary exchange before the official open, which by themselves are still required to be reported under SEC regulation. Any activity prior to the primary market open that is reported to the tape would be from alternative display facilities or dark pools. The reason that these trades are still reported to the tape, even though the primary market is not opened, is because under SEC rules, every stock transaction must be reported to a consolidated data feed, whether it occurs on an exchange, like the Nasdaq or Intercontinental Exchange Inc’s (ICE.N) New York Stock Exchange (NYSE), or in a dark pool. Off-exchange trades are reported through Trade Reporting Facilities (TRFs) run by Nasdaq and NYSE in conjunction with FINRA.

Similarly, the high and low of the day for certain counters may be executed off the primary exchange and may not be taken as official primary executed prices

Please take note of following error messages

- Error Message “ Order Size Exceeds 30 Days Ave Daily Vol Check Order size for US trades exceeding the stock’s 30 days’ average daily volume will be rejected by the system.

- Error Message : 00614-LIMIT/STOP ORDER EXCEEDS THE PERCENTAGE OF DEVIATION DURING MARKET HOURS

Trading Rule 614 requires that Limit orders at or below $5 per share would be permitted up to 10%, between $5 to $50 per share would be permitted up to 5% and with limits above $50 per share would only be permitted 3% marketability

Orders exceeding these stipulated marketability will be rejected.

You may contact the night dealing team at 6531 1225 if you wish to sell your existing OTC shares that are currently held with us. Phillip Securities does not allow new purchases or transfer in of OTC shares. Broker assisted rates apply for OTC trading.

As electronic systems become increasingly prevalent, US stock exchanges and self regulatory organizations (SROs) are implementing policies that will address the problem of clearly erroneous trades – defined as trades resulting from a market participant placing a transaction or a series of transactions that adversely affect the market price of a security.

Please note that with effect from 2nd May 2011, our US counterparty will implement trading rules control check on all orders being routed to their order management system

The control rules will check order size relative to a percentage of the stock’s 30 days average daily volume (ADV) – Rule 612 – Check the price of the order relative to a percentage parameter against the National Best Bid/Best Offer (NBBO) quote during core trading session – Rule 614 Initiate a Reject outcome should the above rules be breached

Should your US orders submitted through our online systems fail to pass the new control rules check, the orders will be rejected automatically by the system and error messages will be updated in the order status as below:

- Rule 612 – Order Size Exceed 10% of 30 Days Avg Daily Vol Check

Order size for US trades exceeding 10% of the stock’s 30 days average daily volume will be rejected by

the system - Rule 614 – Limit orders at or below $5 per share would be permitted up to 10%, between $5 to $50 per share would be permitted up to 5% and with limits above $50 per share would only be permitted 3% marketability

You can access the following US Stock Indices on POEMS, kindly go to Stocks > LP1 > NYSE and select ‘Market Indices”.

- Nasdaq Bank index

- Nasdaq Biotechnology index

- Nasdaq computer index

- Nasdaq financial – 100 index

- Nasdaq industrial index

- Nasdaq insurance index

- Nasdaq other financial index

- Nasdaq telecommunication index

- Nasdaq – 100 index

- NYSE composite index

- Wilshire 5000 equity index

Trading in US Markets via Phillip Securities is only available to non-US citizen / non-US resident.

You have to sign and mail-in the W-8Ben Form before trading in the US market.

When will W8-BEN form expire?

W8-BEN form will remain in effect for a period of 3 years, starting on the date the form is signed and expiring on the last day of the 3rd succeeding calendar year. It is mandatory for you to renew this form before the last day of the 3rd succeeding calendar year in order to continue to trade in the US market. Failing which, Phillip Securities Pte Ltd “PSPL” will cease to provide custodian services to your US portfolio.

Yes, you are required to accept ALL the agreements.

No. It does not matter where you live. To have access to real-time market data and quotes from NASDAQ, NYSE and NYSE-MKT, you must accept the appropriate Exchange Subscriber Agreement(s).

You are a PROFESSIONAL if you meet any one of the following criteria for the entire term of your subscription and you must sign further agreements as well as are subject to the appropriate additional Exchange fee structure:

- You are subscribing on behalf of a firm, corporation, partnership, trust, or association.

- You use the information in connection with any trade or business activities and not for personal investment.

- You plan to furnish the information to any other person(s).

- You are a securities broker-dealer, registered representative, investment advisor, investment banker, futures commission merchant, commodities introducing broker or commodity trading advisor, money manager, member of the Securities Exchange or Association or Futures Contract market, or any owner, partner, or associated person of the foregoing.

- You are employed by a bank or an insurance company or an affiliate of either to perform functions related to securities or commodity futures investment or trading activity.

You are a NON-PROFESSIONAL investor if you do not meet any one of the criteria outlined above.

Please note that subscriber assumes all liability declaring status as a professional or non-professional and will be held accountable for all applicable penalties and/or the Exchange fees if declaration is incorrect. There shall be no refund of the unused portion should you wish to terminate the services prior to the expiry date.

Non-professional users

- Enjoy free US Live price for Non-Professional User!

- Login to POEMS

- Select Reward > New Reward Subscriptions

- Choose NYSE Live Price Subscription, NYSE-MKT Live Price Subscription or NASDAQ Live Price Subscription [Non- Professional Only]

- Click “Submit” and input your POEMS password to proceed with the subscription.

For more information, visit https://globalmarkets.poems.com.sg/promotions/complimentary-live-price-quotes/

Step 1

Login to POEMS 2.0 and select Stocks > Reward > New Reward Subscriptions >

Step 2

Choose NYSE Live Price Subscription, NYSE-MKT Live Price Subscription or NASDAQ Live Price Subscription [Non-Professional Only]

Step 3

Tick the box beside the “0” points followed by “Submit New” and input your password for confirmation

Terms & Conditions:

1) The promotion is applicable to new and existing clients of Phillip Securities Pte Ltd (PSPL).

2) This promotion is open to individuals who qualify as non-professional as defined in the FAQ on this page.

3) Subscribers must subscribe and agree to the agreements set out in the subscription page to enjoy this promotion

4) A subscriber, who falsely declare to be Non-Professional but is a Professional, will be held accountable for all applicable penalties and/or Exchange fees

5) PSPL staff and agents, and PSPL cross-border clients are not eligible for this promotion

6) PSPL account application Terms & Conditions apply

7) The management reserves the right to make changes to the Terms and Conditions of this promotion without prior notice.

When will my US Live Prices activated?

Kindly take note that the subscription will be activated on the next calendar day after your subscription. You can login to Reward > Renew or Check Rewards Subscriptions to check activation date.

Can I cancel the subscription?

Redemption of Reward Points must be done though online redemption system on POEMS and once effected, is final. No cancellation or amendments will be entertained.

Professional User

What is the charge for real-time market data for Professional investors?

Professional investor package [1-months subscription fee] = S$200 (excl. GST). You may subscribe in 1, 3 or 6 months. Please note that subscriber assumes all liability declaring status as a professional or non-professional and will be held accountable for all applicable penalties and/or the Exchange fees if declaration is incorrect. There shall be no refund of the unused portion should you wish to terminate the services prior to the expiry date.

What is the application procedure for Professional user?

Professional users subscribing to the NASDAQ, NYSE-MKT and NYSE real-time market data need to submit the relevant exchange agreements to Phillip Securities (“PSPL”) to seek exchange approval before real-time market data can be granted to the Professional user. The agreement should be completed by person/s that are authorized (as per Board resolution) to execute contracts on behalf of the company and be completed using the full legal name of the entity.

For NYSE-MKT or NYSE real-time data, Professional user (the company) are required to submit attached Subscriber Agreement. Please be informed that NYSE will invoice the company directly for the subscription fees and charges. Should the Professional user wish to make payment to PSPL instead of NYSE, please submit the attached Third Party Addendum.

For NASDAQ real-time data, Professional user is required to submit attached NASDAQ Subscriber agreement.

Kindly fill up the NYSE/NYSE-MKT agreement form, NASDAQ agreement forms, Third Party Addendum form and mail to:

POEMS Marketing

251 North Bridge Road

#06-00 Raffles City Tower

Singapore 179101

Professional user only needs to submit the application once only.

When will my US Live Price subscription be activated?

Kindly take note that the subscription will not be activated immediately as we need the exchanges approval before activating the Live Prices.

Can I submit redemption using POEMS Reward program?

Yes, Professional user can redeem via POEMS Reward Program, however, kindly take note that the redemption status will be reflected as “Request-In-Progress”. Professional users will be required to make payment and submit the “Declaration Form” in order to activate the US Live Prices. Please note that this will be subjected to the exchange approval.

Without accepting these Agreements, you can continue to place orders via TRADE page. To view real-time prices, you have to accept the Agreements and subscribe the service accordingly.

No, there is no change in the order execution process.

To accept the agreement, please login to POEMS > Stocks > PRICE/ LP1/LP2 > auto message will be prompted. If you have already accepted the agreement before, you should not see this message again.

Help is available through each of the Exchanges:

NASDAQ (NASDAQ Stock Market) 1-301-978-5307 / mktdatasvc@nasdaq.com

NYSE (New York Stock Exchange) 1-212-656-3000 / mds@nysedata.com

For the purposes of the Exchange Subscriber Agreements, real-time market data means last sale information for securities listed on the respective Exchanges, including quotations, volumes, highs and lows, and all other information that is derived from the last sale information, during exchange market hours of operation.

Phillip Securities Pte Ltd and the Data Providers do not warrant or make any representations or claims concerning the validity, accuracy and timeliness or otherwise of the Information provided herein, nor shall Phillip Securities Pte Ltd or the Data Providers (NYSE, NYSE-MKT and NASDAQ) shall be liable or responsible for any claim or damage, direct or consequential, arising out of the use, interpretation or other implementation of said Information.

The various Exchanges have each developed an Exchange Subscriber Agreement to ensure that clients understand and agree to the terms of retrieval and use of real-time market data.

The following Exchanges require Exchange Subscriber Agreements:

- NYSE MKT – The New York Stock Exchange

- NASDAQ – The NASDAQ Stock Market

- NYSE – The New York Stock Exchange