Enhance your investments with Thematic Portfolios

May 26, 2020 | Posted by Gina Ng

What is a Thematic Portfolio?

A thematic portfolio is an investment approach that uncovers long-term trends which drive the future of the global economy. A typical thematic portfolio consists of a list of companies with a similar theme or idea that follows certain social, economic, environmental trends prevalent in today’s society.

POEMS Thematic Portfolios not only help investors identify megatrends and benefits from the materialization of those trends, but also diversify their portfolios. This forward-looking approach allows investors to invest in the future today amid anticipated changes to our global economy and society. To long-term investors in particular, this strategy is important in ensuring their portfolios are well-positioned for growth opportunities.

How does it work?

To place a trade:

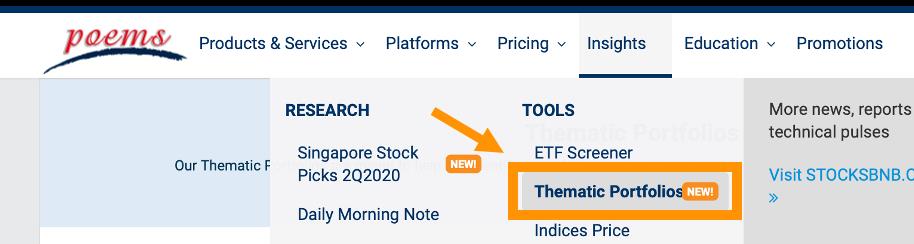

Step 1 – Go to Insights and under Tools, click on Thematic Portfolios.

Step 2 – Choose from the various themes available.

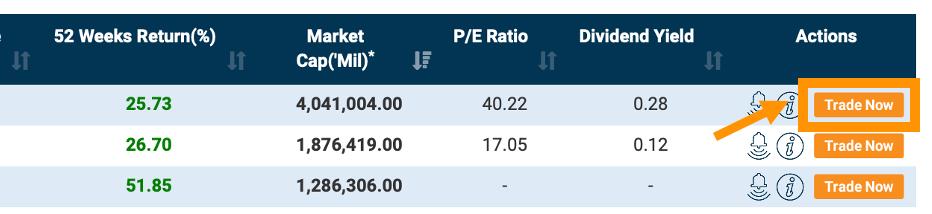

Step 3 – To place a trade, click on the Trade Now button*.

Step 4 – Upon clicking on the button, you will be redirected to the POEMS login page or POEMS Mobile 2.0 app (depending on the device used).

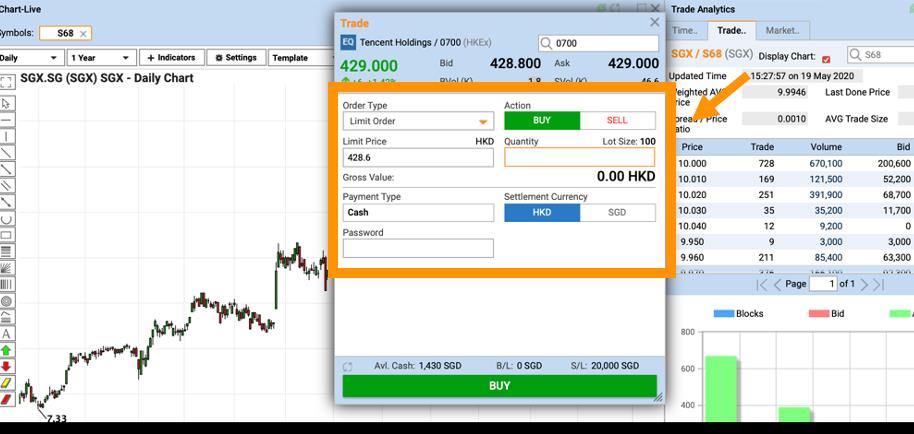

Step 5 – Upon login, a trade ticket will be populated with the counter you chose. Select the order type and action, as well as key in your desired price, quantity and password to proceed with the trade.

To create a price alert:

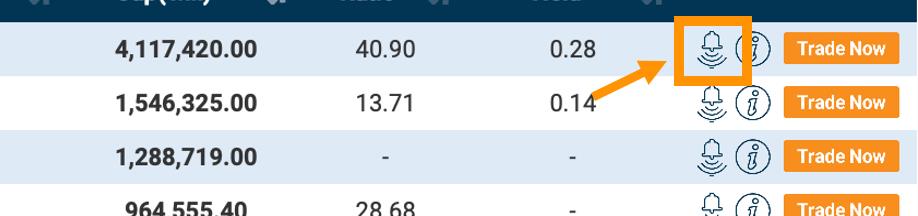

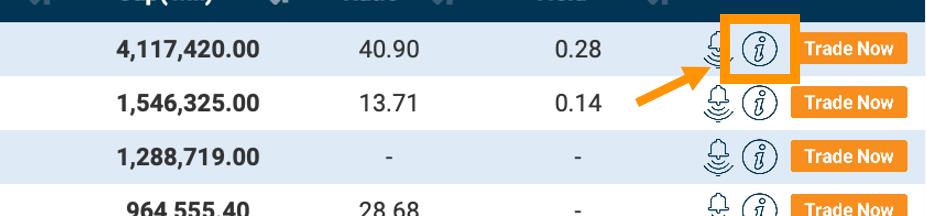

Step 1 – To create a price alert, click on the Set Price Alert icon*.

Step 2 – Upon clicking on the icon, you will be redirected to the POEMS login page or POEMS Mobile 2.0 app (depending on the device used).

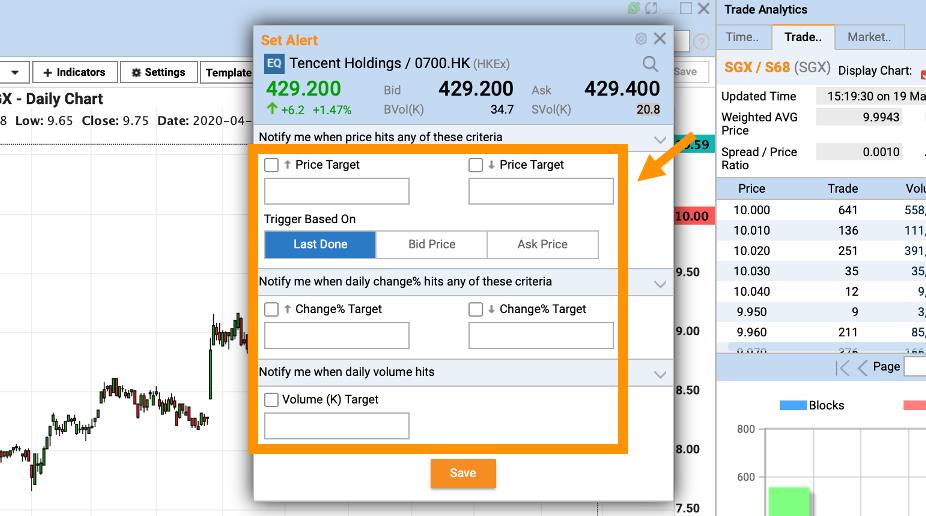

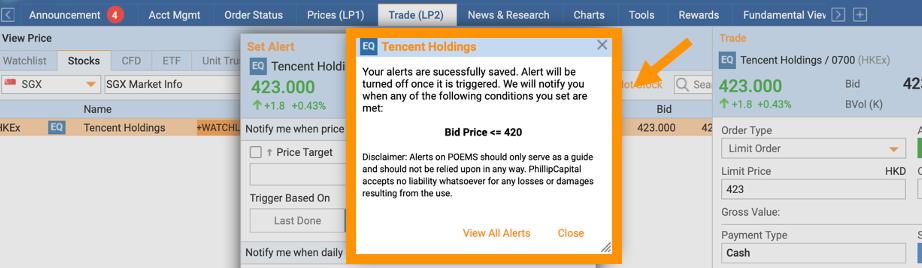

Step 3 – Upon login, a Set Alert pop-up will be populated with the counter you chose. Key in your desired price in the relevant box and select the trigger type. You may also choose to receive notifications when there are changes in % or volume.

Step 4 – Once saved, a pop-up will appear to notify you that your alerts are successfully saved.

To leverage our intuitive Stock Analytics tool:

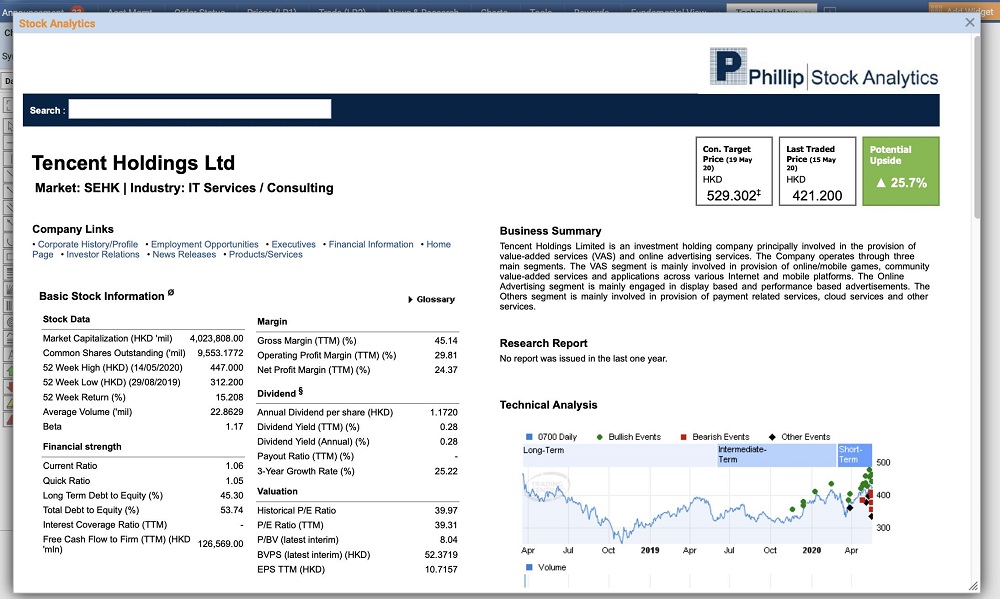

Step 1 – To find out more about the company, click on the Stock Analytics icon*.

Step 2 – Upon clicking on the icon, you will be redirected to the POEMS login page or POEMS Mobile 2.0 app (depending on the device used).

Step 3 – Upon login, a Stock Analytics page will be populated with the counter you chose. In this page, you can find news updates, evaluate key figures and ratios and refer to analyst ratings in a single page right from your trading account.

*Only existing POEMS users are able to access these shortcut features. For non-existing POEMS client, you may choose to download the app or open an account to utilise the features.

To view our Thematic Portfolios, click here.