DAILY MORNING NOTE | 07 October 2022

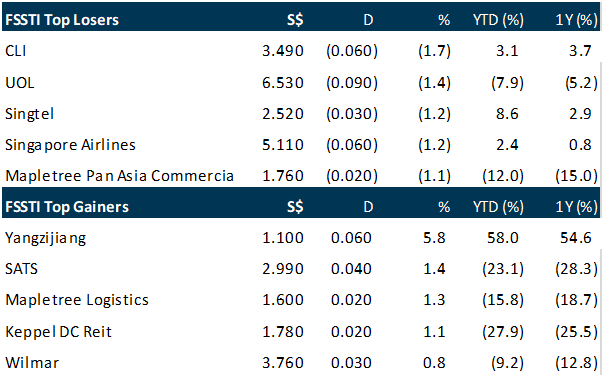

Singapore shares failed to sustain the momentum and finished marginally lower on Thursday (Oct 6), with the blue-chip Straits Times Index (STI) down 0.05 per cent or 1.67 points at 3,151.56. The bourse had opened higher. Paring losses in the US indices overnight, along with some equity futures moving higher on Thursday morning may suggest that market bulls are attempting to hang on despite the lack of reinforcement from economic data for the narrative of the Federal Reserve’s pivot to stop rate hikes. A day after Sats CEO Kerry Mok told The Business Times in an exclusive interview that the inflight caterer and ground handler aims to “reduce” the size of any rights issue, the stock rebounded and closed 1.4 per cent higher at S$2.99. The counter slid to a 52-week low of S$2.94, almost the price level in the depths of the pandemic, after the company announced the proposed acquisition of air cargo handler Worldwide Flight Services. Singapore Airlines (SIA) finished 1.2 per cent lower at S$5.11, as oil prices rose to three-week highs after the oil cartel of OPEC+ decided to cut output by two million barrels per day. The flag carrier had earlier noted its profitability could be hit by higher fuel costs because it may not be able to fully mitigate the increase in cost via fuel hedging or a rise in fares.

Wall Street stocks retreated Thursday ahead of keenly anticipated employment data that will be scrutinised for its implications on US monetary policy. Investors are looking ahead to Friday’s US jobs report, expected to show the world’s biggest economy added 250,000 positions in September and that unemployment held steady at 3.7 per cent. Stocks rallied the first two days of this week due to rising hopes the Fed might moderate its inflation-fighting stance in light of weakening economic data. But equity market drops the last two days have suggested investors are rethinking, as Fed officials continue to stress the need for more action. A better-than-expected jobs report could send stocks lower due to expectations for more aggressive interest rate hikes. The Dow Jones industrial Average dropped 1.2 per cent to finish the day at 29,926.94. The broad-based S&P 500 shed 1.0 per cent to 3,744.52, while the tech-rich Nasdaq Composite Index lost 0.7 per cent to close at 11,073.31.

SG

Mainboard-listed Chinese firm Yangzijiang Shipbuilding has secured new orders for another 22 vessels, raising its total order book value to date to a record high of US$10.27 billion and extending its top line visibility to mid-2025. In a statement updating on its contracts on Thursday (Oct 6), the Straits Times Index component shipbuilder said the 22 new orders would bring total orders it secured year to date to 40 vessels with a total value of US$3.6 billion, exceeding its FY2022 target of US$2 billion. The orders clinched recently comprise four 32,000 deadweight tonnage (DWT) bulk carriers, six 66,000 DWT bulk carriers and twelve 16,000 twenty-foot equivalent unit (TEU) liquefied natural gas dual-fuel containerships. Yangzijiang Shipbuilding noted that it has delivered 51 vessels in total as of end-September, It is therefore on track to achieve its FY2022 delivery target of 70 vessels. The counter closed 5.8 per cent higher at S$1.10.

City Developments Ltd (CDL) and MCL Land will open applications for their Copen Grand executive condominium (EC) project in the upcoming Tengah area on Friday (Oct 7), with prices starting from S$1.08 million for a two-bedroom unit. The Copen Grand EC will be the first residential project to be launched in the wake of fresh market cooling measures just announced by the government last week, when tighter limits on housing loans came into effect. Units on offer at the Tengah Town development range from 807 square feet (sq ft) for a two-bedroom plus study to 1,722 sq ft for a top-floor five-bedroom premium unit. The apartments are priced from S$1.08 million for a two-bedroom plus study, S$1.18 million for a three-bedroom deluxe, S$1.28 million for a three-bedroom premium, S$1.48 million for a four-bedroom deluxe, S$1.58 million for a four-bedroom premium and S$1.88 million for a five-bedroom premium. The project is being developed jointly by CDL and MCL Land, and will be the two companies’ second joint venture (JV) after the May launch of Piccadilly Grand, a 99-year-leasehold private residential project. The opening of e-applications for Copen Grand comes just after the latest set of property cooling measures announced by the government on Sep 29 to ensure prudent borrowing and moderate demand amid a rising interest rate environment. As part of the measures, the Monetary Authority of Singapore will raise the medium-term interest rate floor used to compute the total debt servicing ratio (TDSR) and mortgage servicing ratio (MSR) for residential and non-residential property by 0.5 percentage point. Despite the tighter limits on loans for ECs which have always been in place under the stricter MSR for this hybrid housing segment, ECs continue to appear attractive to HDB upgraders as the prices of resale flats have continued to climb over the past two years. According to caveat data from URA Realis, prices of new ECs have been found to grow at a slower pace than resale flats at 26.2 per cent as opposed to 29.3 per cent. Sales bookings for Copen Grand will start on Oct 22.

Units of Kim Heng, namely Kim Heng Marine & Oilfield (KHMO), Khan Hin Engineering (KHE), and its 49% owned subsidiary Bridgewater Marine (Taiwan) L(BMT) have been awarded multiple contracts totalling US$35 million comprising of new builds and sale of various existing marine and land-based marine assets. The contracts were awarded by establised construction companies in Taiwan. KHMO was warded US$17.3 million of contracts, KHE US$14.6 million and BMT US$3.1 million. Under the Contracts, KHMO and KHE will provide design, engineering and shipbuilding for the new vessel builds. Completion date is scheduled for 4Q2023. The contracts are expected to contribute positively to the group’s earnings per share and net tangible assets for the financial year ending December 31, 2022 and December 31, 2023.

US

Peloton is cutting another 500 jobs in a move that CEO Barry McCarthy said should position the struggling fitness equipment maker to return to growth. The cuts, which amount to about 12% of Peloton’s workforce, mark a pivot point for the company, McCarthy told CNBC on Thursday. Peloton already has had multiple rounds of layoffs this year. McCarthy said the company now has to prove its recent spate of strategy changes, including equipment rentals and partnerships with Amazon and Hilton, can help it grow. Shares of Peloton were up 4% in morning trading. The stock is down about 76% so far this year. McCarthy took over as CEO of Peloton earlier this year from co-founder John Foley, and has overseen drastic changes to its business model as the company struggled after a sales boom earlier in the Covid pandemic. A former Spotify and Netflix executive, he has pushed the company’s business further into subscriptions while broadening the availability of its products beyond Peloton’s direct-to-consumer roots. Earlier this week, the company said it would put its bikes in every Hilton-branded hotel in the United States. It recently announced partnerships to sell equipment in Dick’s Sporting Goods stores and on Amazon.

Electric vehicle startup Rivian Automotive told investors in March that it will produce 25,000 vehicles in 2022. It has three months and a seemingly tall order to get there. Through the end of September, Rivian had built just 14,317 electric vehicles — meaning that it will have to build about 10,700 more between now and the end of December to deliver on its promise to investors. Rivian is confident it can meet its goal. The company has reiterated that guidance several times since March, most recently on Monday when it announced its third-quarter production total. Wall Street isn’t too concerned, either. As several analysts noted this week, Rivian just had its best quarter for production yet, with 7,363 EVs built between July and September. That’s more than it built in the entire first half of 2022, thanks to a second shift of workers added during the quarter — and thanks to management’s efforts to mitigate the supply-chain woes that Rivian faced earlier in the year. The company’s stock is off 65% this year, underperforming broader market losses. Rivian has been ramping up production at its Illinois factory at a relatively steady pace since early this year. So, while supply-chain factors could still complicate its efforts, its third-quarter result seems to put its full-year target in range, analysts say. In a Monday evening note, Canaccord Genuity’s George Gianarikas pointed out that Rivian’s production rate has gone from an average of about 78 vehicles per week in the fourth quarter of 2021 to about 566 per week in the third quarter of 2022. It’ll have to ramp up further, to an average of about 822 per week between now and the end of the year, to make its full-year goal. Rivian is expected to report its third-quarter financial results and to provide additional color on the status of its production ramp in early November.

GENERAL Electric (GE) is laying off workers at its onshore wind unit as part of a plan to restructure and resize the business, which is grappling with weak demand, rising costs and supply-chain delays, four sources familiar with the move said. The sources said the company on Wednesday (Oct 6) notified employees in North America, Latin America, the Middle-East and Africa about the cuts. It also has plans to cut its onshore wind workforce at a later date in Europe and Asia-Pacific. The cuts are expected to affect 20 per cent of the onshore wind unit’s workforce in the United States, they added. This would equate to hundreds of workers, one of the sources said. GE confirmed to Reuters it was “streamlining” its onshore wind business in response to market realities but did not comment directly on any workforce cuts. Onshore wind is the largest of GE’s renewable businesses, which together employed 38,000 people worldwide at the end of 2021. The unit, however, has been battling higher raw material costs due to inflation and supply-chain pressures. In the United States, which has been GE’s most profitable onshore wind market, policy uncertainty following the expiry of renewable electricity production tax credits last year has hit customer demand, leading to a fall in the unit’s revenue this year. The troubles at GE’s onshore wind unit, which accounted for 15 per cent of the company’s industrial sales last year, are also affecting the performance of its overall renewable energy business. In July, the company blamed its North American onshore wind business for two-thirds of the decline in its second quarter renewable revenue. As part of its efforts to improve profitability, the onshore business is trying to reduce fixed costs, which the company estimates could result in a couple of hundred million dollars of savings next year.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Analyst: Zane Aw

Recommendation: Technical BUY

Buy limit: 60.50 Stop loss: 53.30 Take profit: 73.00

Sea Ltd (NYSE: SE) A potential bullish reversal to the upside to retest the downtrend line resistance.

Upcoming Webinars

Guest Presentation by RE&S Enterprises Pte Ltd [NEW]

Date: 21 October 2022

Time: 2pm – 3pm

Register: https://bit.ly/3REOBnY

Guest Presentation by Keppel REIT [NEW]

Date: 3 November 2022

Time: 12pm – 1pm

Register: https://bit.ly/3SOLOsr

Research Videos

Weekly Market Outlook: Spotify, SATS, Nanofilm, Technical Pulse, SG Weekly

Date: 03 October 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials