DAILY MORNING NOTE | 1 December 2022

Trade of The Day

Technical Pulse: Raffles Medical Group Ltd

Analyst: Zane Aw

Recommendation: Technical BUYBuy price: S$1.36 Stop loss: S$1.30 Take profit 1: S$1.45 Take profit 2: S$1.54

Raffles Medical Group Ltd (SGX: BSL) A potential breakout of a bullish cup & handle formation to retest the resistance zone at $1.45-1.54.

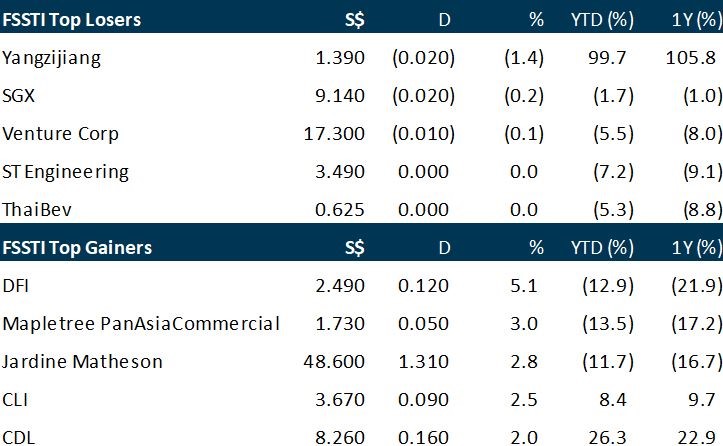

Singapore shares managed to spike as trading leapt nearer to the closing bell on Wednesday (Nov 30), with the Straits Times Index rising 0.4 per cent or 14.13 points to 3,290.49 points. The index had been trading under Tuesday’s close most of the day, but spurted in the minutes before market close. Elsewhere in Asia, most key markets wrapped up trading higher. Shares of Singapore Airlines (SIA) were up 0.6 per cent to S$5.50, a day after it announced that it would hold a 25.1 per cent stake in Air India after the latter merges with Vistara. Sembcorp Marine was the top counter in terms of trading volume, with almost 142.6 million shares transacted. The offshore and marine player inched up 1.5 per cent to S$0.138. Across the broader bourse, gainers beat losers 326 to 219, on a trading volume of 1.6 billion worth S$2.4 billion.

Wall Street stocks soared on Wednesday after Federal Reserve Chair Jerome Powell signaled a moderation from the central bank’s aggressive posture to counter inflation. The Dow Jones Industrial Average finished up 2.2 per cent at 34,589.77, an increase of nearly 740 points. The broad-based S&P 500 gained 3.1 per cent to 4,080.11, while the tech-rich Nasdaq Composite Index jumped 4.4 per cent to 11,468.00. Powell, appearing at the Brookings Institution in Washington, said the Fed could ease its stance on interest rate hikes “as soon as” December when policymakers are next scheduled to meet. He added that the full effects of the bank’s rapid tightening are yet to be felt. “Thus, it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down,” he said. But Powell warned that policy will likely still have to remain tight “for some time” to restore price stability. The Fed has raised the benchmark lending rate by 0.75 percentage points four consecutive times in recent months, out of six times this year, in an aggressive effort to rein in prices. Powell’s latest remarks add to expectations that the Fed will undertake a smaller 0.50 percentage point increase in December. Major indices had been near flat prior to his speech, but rallied once the remarks were reported.

SG

City Developments Limited (CDL) saw sales slow in its third quarter ended Sep 30, as the property player had a low inventory of unsold units with no new launches in the quarter. The group and its joint-venture (JV) associates sold 95 units with a total value of S$281 million in Q3, CDL said in its third-quarter operational results on Wednesday (Nov 30). For the first nine months ended Sep 30, the group and its JV associates sold 802 units worth S$1.9 billion, compared to 1,382 units worth S$2.5 billion in the same period a year ago. CDL noted, however, that sales have surged to 1,417 units worth S$2.8 billion as at Nov 30, mainly led by the October launch of its JV project, Copen Grand executive condominium (EC). The response for the EC was “overwhelming”, with an average launch price of S$1,300 per square foot, CDL said. For its investment properties in Singapore, CDL noted that its office portfolio was resilient with 94.3 per cent committed occupancy, while its retail portfolio also remained healthy with 95.3 per cent committed occupancy. With the easing of travel restrictions and pent-up travel demand, CDL’s hotels also registered a global revenue per available room growth of 88.9 per cent to S$161.90 for Q3, from S$85.70 in the same period a year ago. As for its fund management segment, CDL said it is placing a temporary pause on its initial public offering aspirations for its UK commercial properties until the market stabilises. Looking ahead, while CDL noted that rising interest rates, inflationary concerns and Singapore’s property cooling measures may cause potential buyers to be more cautious in their decision-making, it expects the property market to remain resilient given the low stock levels. “Moreover, with a recovering economy, Singapore’s political stability, and its strength as a financial hub, there is sustained interest from local buyers, foreign investors and high-net-worth individuals,” CDL added.

The Singapore Exchange (SGX) will launch futures on a climate index made up of component stocks of Japan’s benchmark Nikkei 225 to “address rising investor appetite for climate-related products”, it said on Wednesday (Nov 30). The Nikkei 225 Climate Change 1.5°C Target Index, created by Nikkei and US investment technology and advisory company Wilshire, complies with the index regulations of the European Union aimed at attaining the goals of the Paris climate accord. It is designed to halve the total greenhouse gas emissions of its parent Nikkei 225, by adjusting the number and weight of constituents, and also for emission levels to be further decreased by 7 per cent annually in the coming years. In response to queries from The Business Times, an SGX spokesperson said that it is targeting to launch the climate futures in the first half of 2023. “Derivatives contracts are typically employed for trading, hedging and risk management purposes. The index is a subset of the widely traded Nikkei 225 index, with the added benefit of its underlying assets complying with the EU Paris-Aligned Benchmark. These are features that market participants may want to leverage on,” added the spokesperson. Michael Syn, head of equities at SGX Group, said that the exchange’s partnership with Nikkei puts it at the forefront of Japanese risk management solutions. “Demand for climate investing continues to grow. The Nikkei 225 Climate Change 1.5°C Target Index futures will complement SGX’s existing suite of climate-related solutions, and enhance our comprehensive Nikkei offering to investors seeking exposure to Japan’s economy.” The launch of this new climate futures product comes after SGX announced in October that it will license the recently launched MSCI Climate Action Indexes for listed futures contracts. With the licence, SGX said that it will work with market participants to develop climate-related products, including futures contracts, to help investors reduce their portfolio’s carbon footprint.

Hyflux and two of its units are claiming over S$684.6 million from the group’s former external auditor, KPMG, for alleged negligence in auditing the accounts. The professional services firm has denied the allegation. According to the statement of claim filed in October, Hyflux, Hydrochem and Tuaspring alleged that Hyflux’s financial statements for the years 2011 to 2017 in relation to the Tuaspring desalination and power plants were materially misstated. This was because Hyflux had failed to recognise provisions and impairment losses in accordance with financial reporting standards. Hyflux would not have prepared its financial statements on a going concern basis from 2014 onwards had the misstatements been recognised, charged the plaintiffs. The plaintiffs said that the desalination plant and the power plant should have been assessed separately for provisions and impairment purposes. In doing so, the embattled Hyflux should have recognised a provision in its 2011 to 2017 financial statements, as well as an impairment in its 2013 to 2017 financial statements. If a joint assessment was done, Hyflux should have recognised significant impairments for at least its 2014 to 2017 financial statements. That would have led Hyflux to post a loss in its income statement, said the plaintiffs. Also, the plaintiffs alleged that KPMG did not obtain sufficient appropriate audit evidence on whether the cash flow analysis Hyflux performed for the Tuaspring project was reasonable, as well as whether the going concern assumption was appropriate. KPMG should have realised that Hyflux needed to inform the market and lenders of the significant provisions, impairment losses and operating cash losses. The announcement of which would have caused the share price of Hyflux to be significantly impacted, thereby making it difficult to raise further funds by debt or equity. It would then not have been able to continue trading and incurred further losses. The plaintiffs are therefore asking KPMG for reimbursements of S$684.6 million, which include the dividends paid out to shareholders from 2012 to 2018, and discretionary bonuses paid to directors and senior management. They are also seeking funding loss incurred during the period when the group continued operating even though it was already not a going concern, with the quantum of compensation to be assessed.

US

The US central bank could scale back the pace of its interest rate hikes “as soon as December,” Federal Reserve Chair Jerome Powell said on Wednesday, while warning that the fight against inflation was far from over and key questions remain unanswered, including how high rates will ultimately need to rise and for how long. “It makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting,” Powell said in a speech to the Brookings Institution think tank in Washington. But, in remarks emphasising the work left to be done in controlling inflation, Powell said that issue was “far less significant than the questions of how much further we will need to raise rates to control inflation, and the length of time it will be necessary to hold policy at a restrictive level.” While the Fed chief did not indicate his estimated “terminal rate,” Powell said it is likely to be “somewhat higher” than the 4.6 per cent indicated by policymakers in their September projections. He said curing inflation “will require holding policy at a restrictive level for some time,” a comment that appeared to lean against market expectations the US central bank could begin cutting rates next year as the economy slows. “We will stay the course until the job is done,” Powell said, noting that even though some data points to inflation slowing next year, “we have a long way to go in restoring price stability … Despite the tighter policy and slower growth over the past year, we have not seen clear progress on slowing inflation.”

Oil prices settled up by over US$2 per barrel on Wednesday on signs of tighter supply, a weaker dollar and optimism over a Chinese demand recovery. Capping gains, the Opec+ decision to hold its Dec 4 meeting virtually signals little likelihood of a policy change, a source with direct knowledge of the matter told Reuters on Wednesday. Brent crude futures settled up US$2.40, or 2.8 per cent to US$85.43 per barrel while US West Texas Intermediate (WTI) crude futures settled up US$2.35, or 3.01 per cent, to US$80.55. Support followed expectations of tighter crude supply. US crude oil stocks plunged by nearly 13 million barrels, the most since 2019, in the week ended Nov 25, according to the Energy Information Administration. But heating oil demand fell for the second consecutive week heading into winter, curbing price support. Likewise, US oil output climbed 2.4 per cent to 12.27 million barrels per day (bpd) in September, government figures showed on Wednesday, the highest since the onset of the Covid-19 pandemic. The International Energy Agency expects Russian crude production to be curtailed by some 2 million barrels of oil per day by the end of the first quarter next year, its chief Fatih Birol told Reuters on Tuesday. Russia would not supply oil to countries imposing a price cap, Russia’s foreign ministry spokesperson Maria Zakharova said. On the demand side, further support came from optimism over a demand recovery in China, the world’s largest crude buyer. China reported fewer Covid-19 infections than on Tuesday, while the market speculated that weekend protests could prompt an easing in travel restrictions. Guangzhou, a southern city, relaxed Covid-19 prevention rules in several districts on Wednesday. A fall in the US dollar was also bullish for prices. A weaker greenback makes dollar-denominated oil contracts cheaper for holders of other currencies, and boosts demand.

Salesforce said Wednesday that Bret Taylor will step down as co-CEO on Jan. 31, leaving Marc Benioff alone again at the top of the cloud software company he co-founded in 1999. Benioff closely embraced Taylor, who joined the company in 2016, when he sold his productivity software startup Quip to Salesforce. Taylor played a key role in Salesforce’s $27.1 billion acquisition of Slack, the company’s largest transaction ever. Salesforce promoted Taylor, 42, exactly a year ago from the position of president and chief operating officer. Benioff described Taylor then as “a phenomenal industry leader who has been instrumental in creating incredible success for our customers and driving innovation throughout our company.” His departure is surprise considering how rapidly he climbed the ranks and gained the trust of Benioff and the board. Two months ago, Benioff and Taylor were speaking together on stage at the company’s Dreamforce conference in San Francisco. The duo each donned rabbit ears, a reference to the rabbit mascot for the Genie service Salesforce was introducing at the time. The announcement also calls into question Benioff’s ability to work alongside someone with an equal title. Almost three years ago, Keith Block, an ex-Oracle executive, left as co-CEO of the company. He’d held the role for just 18 months after being promoted from operating chief. Benioff told CNBC soon after Block became co-CEO that he liked the idea of having someone share the top job so they could have a “divide and conquer strategy” and so he could spend time investing, doing philanthropy and mentoring other business leaders.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

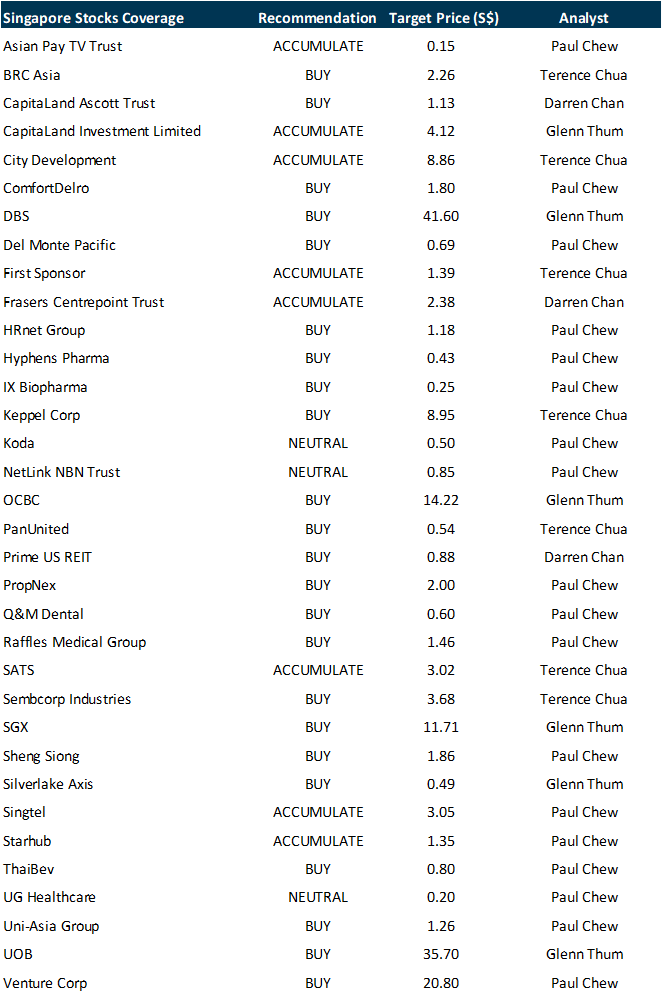

RESEARCH REPORTS

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by IREIT Global [NEW]

Date: 2 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3DRroub

Guest Presentation by Marco Polo Marine [NEW]

Date: 6 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3h1bowW

Guest Presentation by Zoom Video Communications, Inc

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Guest Presentation by Sabana Industrial REIT [NEW]

Date: 8 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3UIuyXl

Guest Presentation by iWoW Technology [NEW]

Date: 16 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3EqFiDT

Research Videos

Weekly Market Outlook: Sea Ltd, Silverlake Axis, Q&M Dental, ComfortDelgro, APTT, Tech Analysis…

Date: 21 November 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials