DAILY MORNING NOTE | 1 February 2023

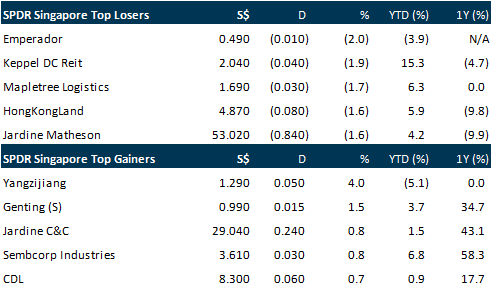

Singapore shares fell on Tuesday (Jan 31), tracking losses on Wall Street. The Straits Times Index (STI) slid 0.4 per cent or 12.62 points to end at 3,365.67. Losers outnumbered gainers 297 to 241, after 1.3 billion securities worth S$1.2 billion changed hands. The top gainer on the STI was Yangzijiang Shipbuilding, gaining 4 per cent to close at S$1.29. Meanwhile, the top loser on the index was Emperador. It fell 2 per cent to close at S$0.49. Elsewhere in the region, markets were largely in the red. The Hang Seng Index fell 1 per cent, the Nikkei 225 Index slid 0.4 per cent, the Kospi Composite Index was down 1 per cent, and the FTSE Bursa Malaysia Index closed 0.9 per cent lower.

Wall Street stocks advanced on Tuesday, embracing a trove of mostly good earnings news and shrugging off a downcast consumer confidence report ahead of a Federal Reserve decision on interest rates. ExxonMobil, General Motors and UPS were among the companies that surged following solid earnings in one of the busiest rounds of the quarterly reporting period. That helped offset a survey from the Conference Board that showed greater unease about the about the short-term outlook for jobs and near-term business conditions. The Dow Jones Industrial Average finished up 1.1 per cent at 34,086.04. The broad-based S&P 500 climbed 1.5 per cent to 4,076.60, while the tech-rich Nasdaq Composite Index jumped 1.7 pre cent to 11,584.55.

SG

Sembcorp Marine (Sembmarine) will hold an extraordinary general meeting (EGM) on Feb 16, 2023, to vote on its proposed merger with Keppel’s offshore and marine (O&M) unit. In a bourse filing on Tuesday (Jan 31), Sembmarine said its independent directors recommend that shareholders vote in favour of the deal. The independent financial advisers (IFA) for the deal saw its terms as fair and reasonable, and had advised the independent directors to recommend shareholders to vote in favour of the deal, the company noted. The long-anticipated merger of the two O&M giants was first announced in April 2022, with plans to carry out separate schemes of arrangement that will result in Keppel O&M and Sembmarine becoming wholly-owned subsidiaries of a combined entity. The terms were later revised in October, such that Sembmarine would directly acquire Keppel O&M from Keppel Corp at the revised equity-value exchange ratio of 46:54, where Sembmarine shareholders will own 46 per cent of the enlarged entity. Keppel will own 54 per cent, of which it will retain 5 per cent and distribute 49 per cent of the enlarged Sembmarine shares in specie to its shareholders. Sembmarine will also retain its listing status on the Singapore Exchange mainboard, and directly issue new shares to Keppel.

UG Healthcare Corporation says it expects to report a loss for its 1HFY2023 ended Dec 31 2022, due to higher operating costs even as average selling prices drop. Customers, according to the company, are holding smaller levels of inventories, thereby contributing to the dip in demand. Across the board, glove makers have been seeing similar trends as the pandemic ease and once white-hot demand for their products dissipate. UG Healthcare will report its earnings on Feb 14.

Meta Health, which is in the midst of transforming from a metal parts maker to a healthcare company, has sounded its own profit warning. It expects to report a loss for its FY2022 ended Dec 31 2022. Meta Health attributes this to the drop in revenue from the metal parts business, due to the lockdown in China which affected sales and operations. The company will report on or before March 1.

Guoco Midtown’s office tower has achieved its temporary occupation permit (TOP), announced GuocoLand Limited on Jan 31. Guoco Midtown, which measures 3.2 hectares, is an integrated mixed development located along Beach Road. The development comprises a unique mix of premium Grade A offices and luxury residences, retail concepts, gardens and landscaped spaces in the heart of the city. The integrated mixed development’s office portion spans some 709,000 sq ft over 30 storeys. So far, the office has achieved a pre-commitment take-up of 80% to-date. According to GuocoLand, the integrated mixed development’s offices have received “robust interest” from major multinational corporations (MNCs) from a wide range of industries, who are looking for quality offices within the city. The 80% includes deals that are in the advanced stages of negotiation.

Cromwell European Real Estate Investment Trust (Cromwell E-Reit) on Tuesday (Jan 31) reported a total portfolio valuation of about 2.5 billion euros (S$3.6 billion) for FY2022 ended Dec 31, 2022, after taking into account valuation increases on properties under development in Italy and the Czech Republic. The latest valuation represents a drop of 1.6 per cent from June last year, as the Reit’s assets in most countries saw a valuation decline. In the Netherlands, Cromwell E-Reit saw a valuation decline of 25.4 million euros, while valuation of the US portfolio also fell by 16.6 million euros. Valuations in Germany, Italy, and Poland were also down by six million to seven million euros each. The Reit manager attributed this to higher capitalisation rates caused by increased interest rates. On the other hand, the Denmark and France assets reflected valuation increases of 12.2 million euros and 2.4 million euros respectively, which the manager said was owing to asset management enhancement initiatives and market rent growth.

StarHub shares surged, drawing a query on unusual trading activity from the Singapore Exchange. StarHub shares closed at $1.14, up 7.55%. The bulk of the gains was in the last half hour just before the market ended for the day. In its response just over an hour later, the company says it is not aware of what might have caused the share price to move the way it did, and that it believes it is in compliance of relevant regulations. The telco is due to report its full year earnings on Feb 7.

US

Advanced Micro Devices (AMD), the second-largest maker of computer processors, gave a better-than-feared sales forecast for the first quarter as gains in the lucrative server market help make up for a collapse in demand for PC chips. Revenue will be as much as US$5.6 billion in the period, AMD said in a statement on Tuesday (Jan 31), compared with an average analyst prediction of US$5.56 billion — with estimates coming in as low as US$5 billion. Though a less severe drop than expected, the outlook represents the company’s first year-over-year quarterly sales decline since 2019, ending a growth streak that elevated AMD into the upper ranks of the chip industry. The shares, which were up 3.7 per cent at the close in New York trading, rose as much as 4.6 per cent in extended trading following the announcement. AMD has beaten its rival Intel to the market with more capable chips for the machines that run corporate networks and serve as the backbone for cloud-computing data centres. That’s allowed it to take share in a market where spending has held up better than the PC industry.

Paypal Holdings said it will cut 2,000 staffers as it contends with a macroeconomic slowdown that’s weighed on the firm’s business in recent quarters. The cuts, which will affect about 7 per cent of employees, will take place in the coming weeks, chief executive officer Dan Schulman told employees in a memo. “While we have made substantial progress in right-sizing our cost structure, and focused our resources on our core strategic priorities, we have more work to do,” Schulman said. PayPal’s stock has been battered by the slowdown in growth in payments volume on its platform after the pandemic began to recede. In response, the company has vowed to reduce expenses — including through job cuts and the shuttering of offices across the country.

Mcdonald’s shares slipped after the company’s fourth-quarter operating margin and its projection for 2023 both fell short of analyst estimates. The measure of profitability came in at 43.6 per cent for the most recent quarter, below the average estimate of 45.5 per cent compiled by Bloomberg. Looking ahead, the fast-food giant expects its operating margin to be about 45 per cent in 2023, below the consensus estimate of 46.5 per cent. The forecast shows the difficult balance of raising menu prices to keep up with higher expenses – but without driving away customers. The chain said that lower-income customers are still coming in, but ordering less when they do. Meanwhile, inflation for commodities, labour and utilities are continuing to pressure the company and its franchisees across the globe.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

TDCX Inc. – Spending weakness to continue

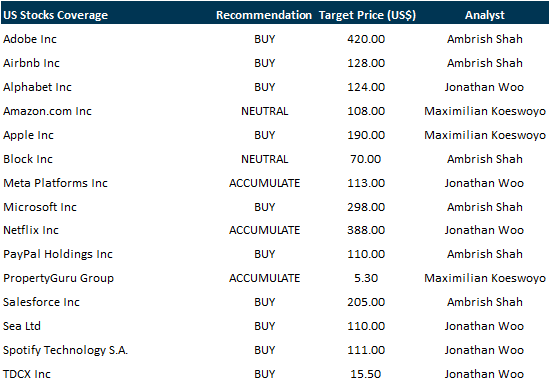

Recommendation : ACCUMULATE (Downgraded); TP: US$14.80, Last Close: US$12.70

Analyst: Jonathan Woo

– We cut our FY23e revenue forecasts by 6% to S$765mn (15% YoY) to reflect a continued pullback in spending by tech companies. Similarly, we also cut our FY23e PATMI forecasts by 5% to S$130mn (20% YoY).

– We expect FY23e adjusted EBITDA (excluding stock-based compensation) to be S$235mn, with adj. EBITDA margin of around 31%, similar to FY22e levels.

– We downgrade to ACCUMULATE with a reduced DCF target price of US$14.80 (prev. US$15.50), a WACC of 10.4%, and a terminal growth rate of 3.0%.

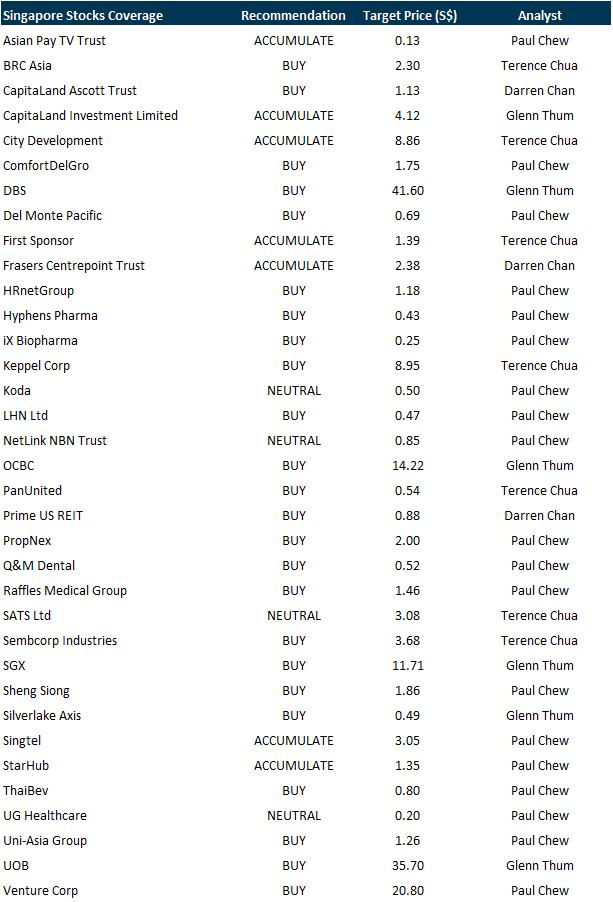

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by LMS Compliance [NEW]

Date: 8 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3IX0pAr

Guest Presentation by First REIT Management Limited [NEW]

Date: 16 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3GY2tp8

Guest Presentation by Paragon REIT [NEW]

Date: 17 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3ZNn4W0

Guest Presentation by Keppel DC REIT [NEW]

Date: 17 February 2023

Time: 3pm – 4pm

Register: https://bit.ly/3CYgrGr

Research Videos

Weekly Market Outlook: Block Inc., SG Banking Monthly, Technical Analysis, US1Q23 Strategy & More

Date: 16 January 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials