DAILY MORNING NOTE | 10 January 2023

Singapore shares were pulled into positive territory on Monday (Jan 9), following a strong showing in the US and Europe markets. Singapore’s Straits Times Index (STI) rose 1.5 per cent or 48.28 points to 3,325 as at 9.25 am. Gainers outnumbered losers 188 to 93, or about two securities up for everyone one down, after 194.9 million securities worth S$303.1 million changed hands. One of the most active counters by volume was Genting Singapore : G13 0%, which rose 1 per cent or S$0.01 to S$0.98 with 20.2 million shares changing hands.

Wall Street stocks ended mixed on Monday (Jan 9) despite a strong start, with markets looking ahead to critical inflation data and bank earnings later in the week. Major indices looked poised for another solid run after Friday’s rally, which came on the back of jobs data that raised hopes for a “soft landing” in the world’s biggest economy. But markets lost their momentum in the early afternoon, leaving two of the three major indices in the red. The Dow Jones Industrial Average finished down 0.3 per cent at 33,517.65. The broad-based S&P 500 slipped 0.1 per cent to 3,892.09, while the tech-rich Nasdaq Composite Index advanced 0.6 per cent to 10,635.65.

Stocks to watch: Apac Realty

SG

Real estate services provider Apac Realty is acquiring an additional 22 per cent stake in ERA Vietnam and Eurocapital as it seeks to grow its business in Vietnam. The move will take its shareholding in each of the companies to 60 per cent. The group, which operates the ERA real estate brokerage business in Singapore, said on Monday (Jan 9) that it will acquire the shares in the companies for S$4.9 million, subject to additional earn-out payments of up to S$10.5 million. APAC Realty acquired its initial 38 per cent stake in ERA Vietnam and Eurocapital in Feb 2020 for a total consideration of S$1.5 million. Eurocapital is the sub-franchisor of the ERA brand to ERA Vietnam.

China-focused real estate investment trust Dasin Retail Trust’s trustee-manager announced on Monday (Jan 9) that it has appointed FTI Consulting (Singapore) to conduct an independent business review of the trust and its subsidiaries. It said that the purpose of the review is to assess and validate the financial position of the group. “These findings will be used as a basis to progress loan extension discussions with the various lenders of the offshore facility 1, onshore facility 1, offshore facility 2, offshore facility 3 as announced on Jan 2, 2023,” the trustee-manager said.

Construction and engineering services provider Civmec announced on Monday (Jan 9) that it has secured a A$330 million (S$304 million) contract for mining company Rio Tinto’s Western Range Project. The iron ore project, located at the Paraburdoo site in the Pilbara region of Western Australia, will include the construction of a new Run of Mine (ROM) pad, primary cruising facility, overland conveyancing circuit, as well as modifications to the coarse ore stockpile and downstream conveying system. Civmec added that the package of works will utilise most of the company’s in-house capabilities.

Enterprise Singapore’s programme to support local companies with high-growth potential to scale their operations has seen some “promising signs”, said Minister for Trade and Industry Gan Kim Yong. In a written answer to parliamentary questions on Monday (Jan 9), Gan said that out of the Scale-up SG programme’s first three cohorts, 85 per cent of companies have created new businesses or products, and more than half have expanded into new overseas markets. In addition, these companies have also created some 500 professional, managerial, executive, and technical (PMET) jobs in total. Since 2019, 80 companies have entered the programme, the minister noted.

US

The US dollar on Monday (Jan 9) neared its lowest point in seven months against other major currencies after data suggested the Federal Reserve (Fed) could slow the pace of its rate hikes, while China reopening its borders boosted riskier currencies. China’s offshore yuan neared its highest in five months against the US dollar, while the Australian and New Zealand dollars – generally regarded as more liquid proxies for the Chinese currency – rallied sharply. The US dollar posted its biggest quarterly loss in 12 years in the last three months of 2022, driven mainly by investors’ belief that the Fed won’t raise rates beyond 5 per cent, from its current range of 4.25 per cent-4.50 per cent, as inflation and growth cool.

Morgan Stanley chief operating officer Jon Pruzan, a longtime lieutenant to James Gorman and once considered a potential candidate to succeed him as chief executive officer, is exiting the firm. Pruzan, who’s leaving at the end of the month, departs after a 28-year run that included a six-year stint as chief financial officer – the public face of the firm to investors and analysts. The 54-year-old plans to pursue other opportunities, according to Gorman. “He has been a trusted adviser to me for many years,” Gorman said in a message to staff on Monday (Jan 9). Pruzan “has had a seat at the table and a voice in the decision-making process for many of the key decisions that the firm has made over the past decade.”

Apple’s push to replace the chips inside its devices with homegrown components will include dropping a key Broadcom part in 2025, according to people familiar with the situation, dealing a blow to one of its biggest suppliers. As part of the shift, Apple also aims to ready its first cellular modem chip by the end of 2024 or early 2025, letting it swap out electronics from Qualcomm, said the people, who asked not to be identified because the plans are private. Apple had been previously expected to replace the Qualcomm part as soon as this year, but development snags have pushed back the timeline.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

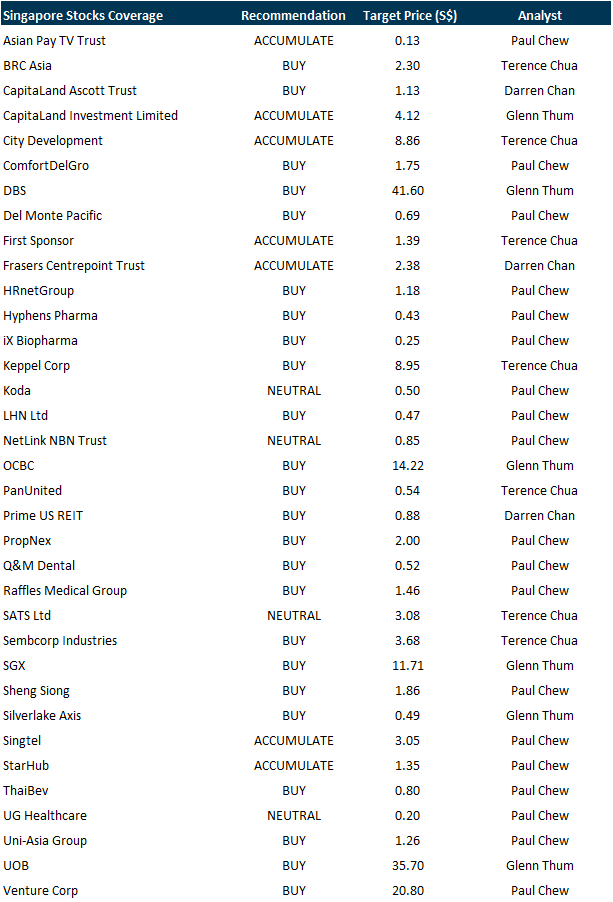

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Research Videos

Weekly Market Outlook: SG 2023 Equity Strategy, Technical Analysis

Date: 9 January 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials