DAILY MORNING NOTE | 10 March 2023

Trade of the Day

Food Empire Holdings Ltd (SGX: F03)

Analyst: Zane Aw

(Current Price: S$0.870) – TECHNICAL SELL

Sell price: S$0.870 Stop loss: S$0.900 Take profit: S$0.825

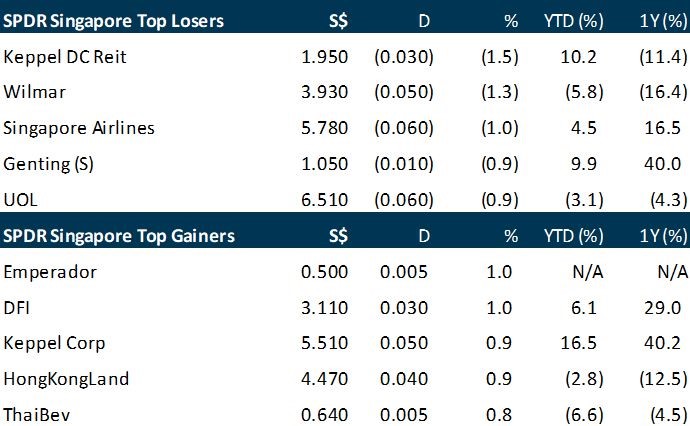

Singapore stocks drop 0.4% in tandem with most Apac when market closed on Thursday (Mar 9). These Asian-Pacific markets were bracing for a higher likelihood that the United States Federal Reserve would lift its policy rate by 50 basis points instead of 25 basis points, and possibly peak only at 6 per cent. Investors are awaiting non-farm payroll data due on Friday, which will influence the data-dependent Fed’s rates decisions.

US stocks fall as banking shares tumble on Thursday following signs of major trouble at two regional banks, adding to the pressure on stocks ahead of key US jobs data. The Dow Jones Industrial Average dropped 1.7 per cent to 32,254.86. The broad-based S&P 500 slumped 1.9 per cent to 3,918.32, while the tech-rich Nasdaq Composite Index slid 2.1 per cent to 11,338.35.

SG

Yangzijiang Financial Holding announced on Thursday (Mar 9) that it has signed a memorandum of understanding (MOU) with private market exchange ADDX to distribute funds on its platform. ADDX’s platform will serve as an additional distribution channel for funds managed by the group, broadening the group’s reach and potentially boosting its total assets under management.

Canned-food brand Del Monte Pacific on Thursday (Mar 9) posted a net profit of US$9.8 million for the quarter ended Jan 31, down 62 per cent from the US$25.9 million it posted over the same period a year earlier. The group attributed the decline in net profit to lower operating results and increased interest expense from higher bank loans, with the redemption of preference shares. DMF’s gross profit improved by 1.1 per cent to US$98.8 million, but gross margin fell 93 basis points to 19.9 per cent.

Restaurant operator No Signboard Holdings on Thursday (Mar 9) announced that it received a letter after market close on Wednesday from controlling shareholder GuGong regarding the former’s termination of the intellectual property disposal and independent contractor agreement. No Signboard said that it disagrees with the allegations and demands in the letter and intends to defend them “vigorously”. The demands include the retraction of the notice of termination, which was announced on Mar 3, as well as payment to GuGong for costs it has incurred in connection with the matter.

City Developments Limited (CDL) on Thursday (Mar 9) said it completed its acquisition of the St Katharine Docks development in London for £395 million (S$636 million). This translates to £751 per square foot (sq ft) on the existing net lettable area. The deal increased the group’s total commercial assets in the UK to around £1 billion, while also enhancing the group’s recurring income stream. The group funded the acquisition through its internal cash resources and credit facilities. It also disclosed that it bought the development from funds advised by asset manager Blackstone.

US

Applications for US unemployment benefits last week rose to the highest since December, driven by spikes in California and New York and suggesting some softening in what is still a tight labour market. Initial unemployment claims increased by 21,000 to 211,000 in the week ended Mar 4, Labor Department data showed on Thursday (Mar 9). The figure surpassed all economists’ forecasts. The median estimate was for 195,000 applications.

The US dollar held near a three-month high on Thursday (Mar 9), underpinned by Federal Reserve chair Jerome Powell’s message that interest rates will have to go higher and possibly faster than investors previously anticipated. The US dollar index eased 0.1 per cent to 105.44, but was within sight of Wednesday’s three-month high at 105.88. It was last down by 0.8 per cent against the yen at 136.29, while the euro and sterling both edged up.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Sea Ltd. – First profitable quarter

Recommendation : BUY (Maintained); TP: US$120.00, Last Close: US$79.81

Analyst: Jonathan Woo

– 4Q22 revenue missed expectations slightly due to continued weakness in gaming revenue and FX headwinds; net income beat by ~US$1bn on significant reduction in overhead costs and sales & marketing expenses. FY22 revenue was at 96% our FY22e forecasts, with Net Loss ~US$1.2bn better than our FY22e forecasts.

– Positive net income for the first time, led by 7% topline growth, improved logistical efficiencies, and sharp reduction in sales & marketing expenses.

– Shopee was driving overall revenue growth, and was finally profitable due to higher take rates, reduction in expenses.

– We cut our FY23e revenue by 20% to reflect a continued decline in gaming revenue and slower e-commerce growth, while increasing FY23e PATMI/EBITDA by US$1.2bn/US$0.7bn respectively to reflect improving profitability trends. We forecast positive net income by FY24e. We maintain a BUY with a raised target price of US$120.00, using a WACC of 7.6%, and a terminal growth rate of 3.0%.

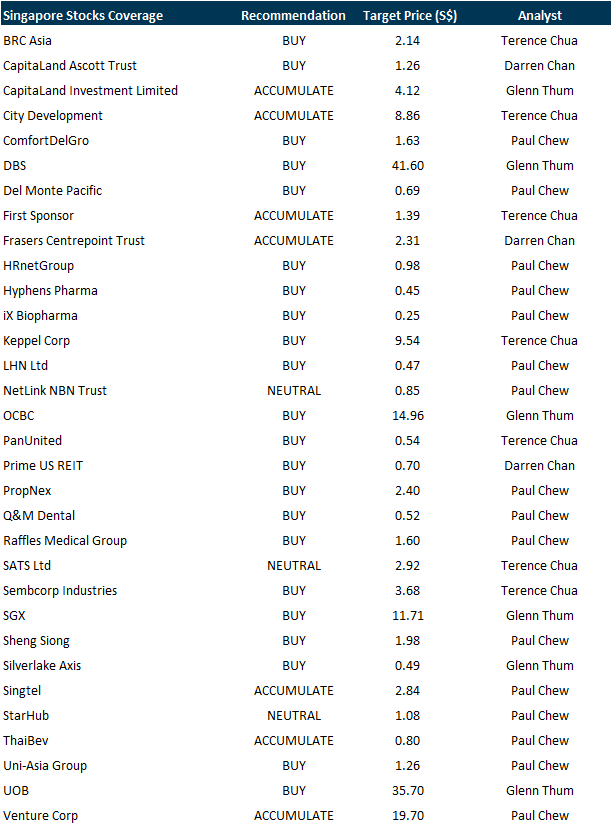

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Enviro-Hub Holdings Ltd [NEW]

Date: 14 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3KBprpA

Guest Presentation by Luminor Financial Holdings Ltd [NEW]

Date: 15 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3kj6LjP

Guest Presentation by Meta Health Limited [NEW]

Date: 16 March 2023

Time: 3pm – 4pm

Register: https://bit.ly/41oikGX

Guest Presentation by Keppel Pacific Oak US REIT (KORE) [NEW]

Date: 23 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3XY2n7v

Research Videos

Weekly Market Outlook: Block Inc, PropertyGuru, Sheng Siong, PropNex, Raffles Medical, Tech Analysis

Date: 6 March 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials