DAILY MORNING NOTE | 10 November 2022

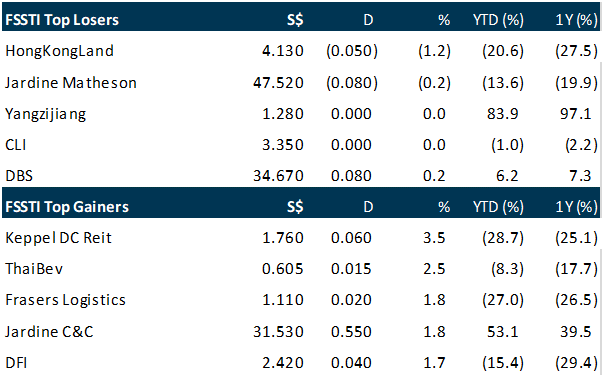

The Straits Times Index (STI) added 0.6 per cent or 19.67 points to close at 3,165.50 on Wednesday (Nov 9), tracking a rally on Wall Street as major US indices gained for the third consecutive day. In the broader Singapore market, gainers outnumbered losers 323 to 213, with 1.6 billion securities worth S$1.1 billion traded. Data centre-focused Keppel DC Reit was the top performer among Singapore’s blue-chip stocks on Wednesday, gaining 3.5 per cent or S$0.06 to end at S$1.76. At the bottom of the table was Hongkong Land – part of the Jardine Matheson Group – which fell 1.2 per cent or US$0.05 to US$4.13. Jardine Matheson Holdings was the only other decliner on the STI, falling 0.2 per cent or US$0.08 to US$47.52. Yangzijiang Shipbuilding was the most heavily traded STI stock for the second consecutive day, closing flat at S$1.28 after 38 million shares changed hands. The trio of local lenders all ended higher. DBS edged up 0.2 per cent or S$0.08 to S$34.67, UOB climbed 1 per cent or S$0.29 to S$29.14, and OCBC added 0.8 per cent or S$0.10 to end at S$12.25.

Wall Street stocks tumbled on Wednesday, with the Dow dropping nearly 650 points, as markets digested US election results and monitored upheaval in the cryptocurrency market. After three straight positive sessions, stocks were in the red the whole session after US midterm elections. The Dow Jones Industrial Average lost 2.0 per cent to finish at 32,513.94. The broad-based S&P 500 fell 2.1 per cent to 3,748.57, while the tech-rich Nasdaq Composite Index slid 2.5 per cent to 10,353.18.

SG

Inflight caterer and ground handler SATS on Wednesday (Nov 9) reported a net loss of S$9.9 million for its second quarter, reversing a year-ago profit of S$6.8 million, as operating expenses rose and lower government grants were received. Excluding the effect of reliefs, net loss for the three months ended Sep 30 would have been S$19.7 million, an improvement from the S$30.1 million net loss excluding reliefs in the year-ago period, the company said in a bourse filing. During the second quarter, SATS revenue rose 46 per cent to S$429 million, as its food and gateway segments reported higher revenue on the back of aviation recovery and the consolidation of revenue from Asia Airfreight Terminal. Operating expenses climbed 48.9 per cent to S$437 million, due to factors such as higher staff costs and lower job support grants, the group said. For the first half of its financial year, SATS revenue climbed 41.3 per cent on year to S$804.5 million, driven by growth in cargo volume and recovery in travel demand. “Travel recovery is on track and picking up pace with further improvements expected in coming quarters,” the group said. The group’s net loss for H1 FY23 stood at S$32.5 million, a reversal from the net profit of S$13.2 million in the year-ago period. Excluding the impact of government reliefs, net loss for H1 FY23 would have been S$51.7 million, an improvement from S$65.5 million loss in the prior-year period. No dividend was declared, as the board said “it would be prudent to not pay a dividend until SATS restores profitability without government reliefs”. Meanwhile, SATS also provided an update on its proposed acquisition of Worldwide Flight Services (WFS), which was announced in September this year. It said it is “at an advanced stage of finalising its funding plan” for the proposed acquisition. The company said the proposed rights issue will not exceed S$800 million. With the total acquisition cost of S$1.8 billion, the balance will be funded primarily through a combination of term loans and internal cash, SATS said. “SATS has received term loan proposals from the company’s principal bankers at favourable market terms,” the company said, adding it believes this funding mix is “optimal”, given the current market conditions. The rights issue is targeted to be launched after an extraordinary general meeting, expected to be convened in January 2023, with further details of the funding plan to be announced prior to the meeting. SATS shares rose 1.5 per cent or S$0.04 to close at S$2.72 on Wednesday, before the announcement.

Comment: SATS has provided an update on its funding for WFS. Near-term implication is higher gearing in the next few years, though management is confident in paying this down. We believe the clearer funding structure will reduce the overhang on the stock.

Terence Chua

Senior Research Analyst

terencechuatl@phillip.com.sg

Singtel’s first half net profit rose 23% to S$1.17 billion, boosted by a net exceptional gain from the Group’s partial divestment of its stake in Airtel compared to a net exceptional loss the previous year. Operating revenue was down 5% to S$7.26 billion due to adverse currency effects and the absence of revenue from NBN migration and Amobee. On an underlying and constant currency basis, EBITDA and EBIT would have increased 3% and 8% respectively. The core telco business saw margin improvements, driven by mobile services with the continued roaming recovery from the rebound in travel. Underlying net profit was up 2% to S$1.01 billion, and would have risen 5% on a constant currency basis. Mr Yuen Kuan Moon, Singtel Group CEO, said, “Our strong results underscore the progress we’ve made executing to our reset as economies reopen. There was a major rebound in our core business as the resumption in travel lifted roaming revenues across both our consumer and enterprise businesses. NCS capitalised on the digitalisation trend to add new bookings of S$1.3 billion to deliver an order book of S$3.5 billion. With the S$2.5 billion we’ve raised from partially divesting our direct stake in Airtel, we’ve recycled some S$6 billion in the past 18 months since setting out to proactively monetise our assets to achieve better capital efficiency. We’ve also reduced our net debt by nearly a third from a year ago to buttress our balance sheet in these uncertain times. As testament to our proven asset recycling model, we are sharing the benefits by returning excess cash to our shareholders after setting aside capital for our growth initiatives.” The regional associates’ pre-tax profit contributions rose 15% to S$1.16 billion. This was due to Airtel’s standout performance in India as it grew ARPU through higher usage and tariff hikes. Airtel also saw strong demand for its enterprise and home broadband solutions. Other associates posted higher revenues from robust data demand and a reopening of their economies despite intense competitive pressures. However, their profit contributions, with the exception of AIS, were impacted by higher depreciation from investments in 5G and fibre. In addition, AIS and Globe were affected by a sharp depreciation in the Thai baht and Philippine peso. The associates’ pre-tax contributions would have grown by 18% had the regional currencies remained stable from the same period last year. In Australia, rapid and successive interest rate hikes, a weaker Australian dollar and softer consumer and business sentiment due to a slowing economy have resulted in a non-cash impairment charge of S$1 billion on Optus’ goodwill. This impairment does not affect the Group’s cashflow or its ability to pay dividends, nor does it impact Optus’ operational performance. The overall effect on net profit remains positive with the Airtel stake sale. Mr Yuen said, “We’ve made good progress towards our goals and remain confident in Optus’ strong fundamentals and long-term growth prospects but we’re also facing stronger macroeconomic headwinds which we expect to persist into 2023. In addition to exercising prudence across our businesses through cost discipline and operational efficiencies, our strong balance sheet will allow us to better navigate this challenging environment. We remain committed to investing in our people and capabilities to create sustainable value over the longer term.” The Board has approved an interim ordinary dividend of 4.6 cents per share for the half year ended 30 September 2022, totalling S$760 million. This represents 76% of the Group’s underlying net profit for the first half of the year. A special dividend of 5.0 cents per share, totalling S$826 million, was also approved to share the benefits of the Group’s asset recycling initiatives with shareholders. It will be paid in two tranches of 2.5 cents each, together with the ordinary dividends.

Mainboard-Listed telco StarHub reported on Wednesday (Nov 9) a 32 per cent year-on-year decline in net profit for the third quarter, even as total revenue rose 14.2 per cent. Net profit for the three months ending Sep 30, 2022 fell to S$27.4 million from S$40.2 million in the year-ago period. The net profit for the third quarter was also 12.3 per cent lower than the net profit of S$31.2 million it reported for Q2 FY 2022. The weaker profits came despite stronger topline figures, with total revenue for Q3 FY 2022 rising 14.2 per cent on year to S$590.8 million. StarHub noted in its business update that service revenue had grown 15.5 per cent on year to S$482.9 million for Q3 FY 2022, which came from higher contributions across all segments. However, the telco also had recorded higher operating expenses, which amounted to S$547.1 million in Q3 FY2022, up from S$456.2 million in the year-ago period. The company said the lower profits were due to higher staff costs, marketing and promotions (a “one-off expense” relating to the Premier League), repairs and maintenance (including Dare+ investments relating to network and IT transformation), and occupancy costs. Excluding “one-off expenses” for Premier League and Dare+ investments, net profit for the third quarter would have been 19.8 per cent lower year-on-year, at S$32.3 million, the company said For the nine-month period ending Sep 30, 2022, StarHub’s net profit was down 18.4 per cent on year to S$88.3 million, while its total revenue was 10.6 per cent higher, at S$1.6 billion. StarHub noted that its service revenue had also grown 13 per cent on year during the first three quarters of FY2022, reaching S$1.4 billion, which is ahead of prior guidance offered for FY 2022 of at least 10 per cent growth. It added that its service earnings before interest, taxes, depreciation and amortisation (Ebitda) margin was 23.2 per cent for the first nine months of 2022, which was also higher than the earlier guidance of “at least 20 per cent”. StarHub has raised its service revenue guidance for FY2022 to 12-15 per cent growth. It reiterated its service Ebitda margin guidance of at least 20 per cent. StarHub shares fell 0.9 per cent on Wednesday to close at S$1.05, before the business update was released.

US

Tesla chief executive officer Elon Musk sold at least US$3.95 billion of the electric-vehicle maker’s shares just days after closing his buyout of Twitter. Musk unloaded 19.5 million shares, according to regulatory filings, his first disposals since August. The documents didn’t indicate that the transactions were pre-planned. The world’s richest person followed through with his takeover of the social-media platform in October, after spending months trying to get out of it. In August, Musk had said he was done offloading Tesla stock and that it was important to avoid an “emergency sale” of the shares in case he was forced to close the Twitter acquisition and struggled to bring in additional equity partners. It’s not fully clear how the US$44 billion deal ultimately was financed, beyond the roughly US$13 billion of debt commitments from Wall Street banks. Several high-profile individuals promised to invest some US$7 billion, though it isn’t known whether all of them stuck to their pledges. And Musk has never said publicly how he planned to gather his share of the cash needed to close the deal. But one thing’s clear: Twitter is losing money and now faces annual interest payments of nearly US$1.2 billion. Since Musk took over, several major companies have halted their ads on the platform, waiting to see how it evolves under the billionaire’s leadership. Musk, 51, and his financial right-hand man, Jared Birchall, did not respond to an emailed request for comment. The billionaire’s drastic moves to cut costs – including firing half the staff and later asking some to come back – and overhaul of the platform’s operations have resulted in two tumultuous weeks at the social-media company, with some employees not being entirely clear on whether they are still employed there or not. The deal has also sparked concern among some Tesla shareholders that the CEO is spreading himself too thin and would have to get rid of even more of his stock. He’s unloaded about US$36 billion worth of shares in the carmaker in the past year – around half of that since he went public with the Twitter buyout plan, data compiled by Bloomberg show. Now the stock is down 53 per cent from its peak last year, pushing Musk’s fortune to US$179.5 billion from US$340 billion at the high, according to the Bloomberg Billionaires Index.

Roblox Corp on Wednesday missed Wall Street estimates for quarterly revenue by a wide margin after the video games developer changed its accounting practices. The company’s revenue grew 2% to $517.7 million in the third quarter ended Sept. 30, lower than analysts’ expectation of $686.3 million. Roblox changed the period of estimated paying user life to 28 months from 25 months, resulting in a $111 million decrease in revenue during the reporting quarter. It also lowered costs by $25.5 million. The company’s results come as growth rates plummet in the broader gaming sector after people stepped outdoors and reserved spending for essential items in a bid to counter inflation. Compounding challenges further, a deteriorating economy continues to ravage the advertising industry, including giants such as Snap Inc and Facebook owner Meta Platforms. Net loss for Roblox grew to $297.8 million, or 50 cents per share, in the quarter, from $74.0 million, or 13 cents per share.

Electric vehicle maker Rivian Automotive on Wednesday reaffirmed its 25,000-vehicle production target for 2022, but said it plans to spend less to do it as the company reported third-quarter revenue that fell short of Wall Street’s expectations. Rivian cut its guidance for 2022 capital expenditures: It now expects its full-year capital expenditures to total about $1.75 billion, down from the $2 billion it guided to after the second quarter, as it shifts some planned spending to next year. The company still expects its full-year adjusted loss before income, taxes, depreciation and amortization to come in at $5.4 billion, in line with the guidance it gave in August. Rivian’s net loss for the third quarter was about $1.72 billion, a wider loss than the $1.23 billion it reported a year earlier. As of September 30, the company had about $13.8 billion in cash remaining, down from $15.5 billion as of June 30. Rivian said while inflation has been a factor in its supply chain, it’s taking steps to reduce costs and slow spending on future product. It reiterated that it’s “confident” its cash hoard will last through 2025. As part of its moves to slow spending, the company now expects to launch its upcoming smaller product platform, called R2, in 2026 rather than in 2025 as it had previously said. The R2 will be built in a new factory in Georgia. Rivian said it now has “over 114,000” preorders for its R1-series trucks and SUVs, up from about 98,000 preorders as of Aug. 11. Those totals don’t include the 100,000 electric delivery vans ordered by Amazon in 2020. Rivian said it’s added a second shift of workers at its Illinois factory, a key step toward boosting production volumes. It noted that the new workers are still coming online — but said that the second shift is already producing vehicles. Rivian said on Oct. 3 that it produced 7,363 vehicles in the third quarter and delivered 6,584 vehicles to customers during the period. Year to date, through the third quarter, Rivian produced 14,317 vehicles. The automaker also said Wednesday that with production volumes increasing, it has moved to shipping its vehicles by rail, rather than by truck. That change has reduced costs, but it also means that new vehicles may take more time to get to customers after being produced. Because of that lag, Rivian said, the gap between its quarterly production and delivery totals may increase going forward.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

PRIME US REIT – Strong leasing momentum

Recommendation: Buy (Maintained), Last done: US$0.48

TP: US$0.88, Analyst: Darren Chan

• 9M22 distributable income (+9.2% YoY) was in line, forming 73% of our FY22e estimate.

• Leasing activity in 3Q22 was close to the previous 2 quarters combined (246.2k vs 1H22 257.5k sq ft), with positive rental reversions of 10.1%. Occupancy remained stable at 89.6%.

• No change in our forecasts. Maintain BUY, DDM-TP (COE 10.55%) unchanged at US$0.88. PRIME is our top pick in the US office sector for greater tenant exposure to STEM/TAMI sectors. Catalysts include improved leasing and a greater return to office. The current share price implies FY22e/FY23e DPU yield of 14.6/14.8%.

Phillip Macro Update: Key Points for November FOMC Meeting

Analyst: Shawn Sng

• Interest rates – The U.S Federal Reserve (Fed) has increased its benchmark interest rate by another 75bps to a range of 3.75% – 4%. This will be the 4th consecutive ¾ percentage point hike this year and for this November’s meeting, there was no dot plot graph being provided.

• Guidance – In terms of guidance, Chairman Jerome Powell did not give any clear indication in this meeting. He pointed out that there could be a possibility of a slowdown, either at the December meeting or the following one in January next year.

• Higher-than-expected rates – With recent incoming data such as total PCE prices rising by 6.2% YoY and core PCE prices up by 5.1% YoY in September. This has signalled the Fed to suggest that the interest rate peak will be higher than what was previously expected in its earlier meeting.

Upcoming Webinars

Guest Presentation by IREIT Global [NEW]

Date: 2 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3DRroub

Guest Presentation by Marco Polo Marine [NEW]

Date: 6 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3h1bowW

Guest Presentation by Zoom Video Communications, Inc [NEW]

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Research Videos

Spotify, Airbnb, Apple, DBS, OCBC, CapitaLand Ascott Trust, First Sponsor, Venture Netlink, Technical Pulse, SG Weekly 45

Date: 7 November 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials