DAILY MORNING NOTE | 10 October 2022

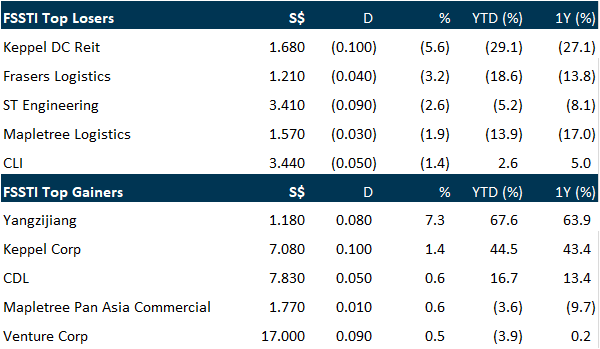

Singapore shares finished lower on Friday (Oct 7) with the Straits Times Index (STI) falling 5.75 points or 0.2 per cent to 3,145.81. The STI capped a lacklustre week with a gain of just 0.5 per cent as a result of a two-day rally. With the US non-farm payroll data out on Friday night (Singapore time), investors have been staying on the sidelines as the keenly watched economic numbers could have an impact on the Federal Reserve’s hawkish rate hike stance. ComfortDelGro shares closed 0.8 per cent lower at S$1.28, making the counter barely higher than its 52-week low of S$1.27. Mainboard-listed Sembcorp Marine, after its 389.1 million shares changed hands on Friday, became the most traded stock and has been hogging the position every day this week. The counter rose 1.7 per cent to S$0.117 on Friday. The Singapore Exchange noted that there were net institutional inflows of S$20 million into the stock in the first four trading days this week. The broader Singapore market saw 256 losers against 220 gainers, with a turnover of 1.45 billion securities worth a total of S$973.75 million.

Wall Street fell sharply on Friday (Oct 7) following a solid jobs report for September that increased the likelihood the Federal Reserve will barrel ahead with an interest rate hiking campaign many investors fear will push the US economy into a recession. The Labor Department reported the unemployment rate fell to 3.5 per cent, lower than expectations of 3.7 per cent, in an economy that continues to show resilience despite the Fed’s efforts to bring down high inflation by weakening growth. Nonfarm payrolls rose by 263,000 jobs, more than the 250,000 figure economists polled by Reuters had forecast. Money markets raised to 92 per cent the probability of a fourth straight 75 basis-point rate hike when Fed policymakers meet on Nov. 1-2, up from 83.4 per cent before the data. The job gains, lower unemployment rate and continued healthy wage growth point to a labor market Fed officials will likely still see as keeping inflation too high. Next week’s consumer price index will provide a key snapshot of where inflation stands. The Dow Jones Industrial Average closed down 630.15 points, or 2.1 per cent, at 29,296.79, the S&P 500 lost 104.86 points, or 2.8 per cent, to 3,639.66 and the Nasdaq Composite dropped 420.91 points, or 3.8 per cent, to 10,652.41.

SG

Singapore Exchange (SGX) must look beyond equity assets and focus on areas where it can be competitive, said SGX chairman Kwa Chong Seng. Responding to questions at SGX’s annual general meeting on Thursday (Oct 6), Kwa said the bourse operator is unlikely to be able to compete with players such as the US exchanges for company listings given that Singapore is a “very small market”. “We need to focus on where we can beat them, and not fight on areas where we can’t,” he said. While SGX still welcomes small and medium-sized enterprises (SMEs) for financing, Kwa said the bourse operator is also focusing on other areas – such as foreign currencies and commodities – where it sees a competitive edge. SGX chief executive Loh Boon Chye said the bourse operator had continued to diversify its product offerings and collaborated with different regions and countries during the financial year. For instance, SGX partnered the New Zealand Exchange to offer dairy derivatives. Loh said SGX’s derivatives platform saw high volumes across all asset classes in FY2022, and expects its over-the-counter foreign exchange business to achieve an average daily volume of US$100 billion in the medium term. He added the bourse operator’s focus is to realise its exchange partnerships and extend its engagement with end clients, digitalise financial markets, as well as work on sustainable investing efforts.

With the pandemic easing and the sale prices of gloves sliding, mainboard-listed Aspen (Group) is now proposing to sell its glove-making subsidiary’s factory building and the leased land on which the facility sits for RM200 million (S$61.1 million). As the deal entails a sale of over 20 per cent of the group’s total net asset value, it is therefore a major transaction. Aspen would need the approval of its shareholders to go ahead with it. Aspen noted that the proposed disposal could book a gain of about RM14.9 million; if the sale goes through, it could bring the net tangible asset value per share of the company to 39.22 sen from 37.84 sen, on a pro forma basis. In a statement filed by Malaysia-based Aspen on Friday (Oct 7), the property developer – which waded into glove-making at the height of the pandemic, when demand for the protective gear was through the roof – said it intends to sell the land in Kulim Hi-Tech Park in the state of Kedah to Singapore real estate fund manager, Cambridge. An Aspen unit had built the Kulim facility on a plot of land leased from Kulim Technology Park Corporation Land, the approval of which was one of the conditions to complete the deal. Aspen shares closed at S$0.049 on Friday, 2.1 per cent higher, before this proposed sale was announced.

Japan Foods clarified that its unit Japan Foods Enterprises (JFE) and not the whole group is temporarily prohibited by the authorities from applying or renewing employees’ work passes and that it was not told details of any potential breach. The food & beverage player stated in its response on Friday (Oct 7) to the Singapore Exchange (SGX) that it has not been given any details by the Ministry of Manpower (MOM) and it did not want to speculate about the “past hiring and payroll practices” that might have flouted the Employment of Foreign Manpower Act. Also, the Catalist-listed player noted JFE is not restricted from hiring local full-timers, part-timers and contract staff if they do not require the application or renewal of work passes. Japan Foods furnished a statement to the SGX on Tuesday on JFE facing the suspension while MOM investigates. And to deal with MOM’s restriction, JFE will work on “right-balancing” its workforce but the group’s existing operating outlets might not have to be shut temporarily. Prominent brands under Japan Foods include Afuri, Ajisen Ramen and Fruit Paradise. The counter closed flat at S$0.415 on Friday.

US

Advanced Micro Devices (AMD) shares were down 13.9% on Friday as investors digest the company’s disappointing preliminary third-quarter results, adding to concerns about the sputtering market for personal computer (PC) chips. The chipmaker cut its sales forecast on Thursday for the third quarter, blaming a larger-than-expected decline in the personal computer market and supply chain issues. AMD now expects preliminary quarterly revenue of about $5.6 billion thanks to “reduced processor shipments.” That’s more than $1 billion below the $6.7 billion it had previously forecast as the midpoint of its revenue expectations for the quarter. The company also said its non-GAAP gross margin is expected to come in around 50%, while it had previously expected gross margin to be closer to 54%. Shares of other chipmakers like Intel and Nvidia were also down, more than 5% and 8%, respectively, as weak PC demand and supply chain issues could weigh on other semiconductor players. AMD plans to report full third-quarter earnings on Nov 1, followed by a conference call to discuss the results. The company said it doesn’t plan to give any additional financial updates before then.

The FedEx Corp division that handles most of the company’s e-commerce deliveries plans to lower volume forecasts because its customers plan to ship fewer holiday packages, according to an internal memo obtained by Reuters. The message to the 6,000 independent contractors that handle delivery and trucking for FedEx Ground in the United States and Canada came about two weeks after the global shipping firm pulled its full-year forecast and announced an unexpected first-quarter profit drop of more than 20%. Shares in FedEx fell 2.7% to $151.05 on the news on Friday. “We expect there to be downward adjustments to volume forecasts,” Paul Melander, a FedEx Ground senior vice president said in the message to the unit’s delivery contractors earlier this week. The new forecasts will be available on or about Oct. 21. “These changes will reflect the latest information from customers about how they anticipate current conditions are likely to decrease their volumes this holiday season,” Melander said. FedEx did not immediately respond to requests for comment. The company’s Ground division contributes more than 40% of its operating income. More than a dozen contractors told Reuters that their volumes were down anywhere from 5% to 15% this year versus the same time in 2021.

Electric vehicle maker Rivian Automotive will recall about 13,000 vehicles it delivered to customers after discovering a minor structural defect. Irvine, California-based Rivian will recall the vehicles because a fastener “may not have been sufficiently torqued,” chief executive officer RJ Scaringe said in a letter to customers that was seen by Bloomberg News. The company is recalling about 13,000 vehicles, even though the issue was discovered only in seven, “out of an abundance of caution.” The cost of the recall is not material, according to a person familiar with the matter. The recall is a setback to Rivian, which has only recently overcome production problems and parts shortages to deliver its EVs to customers in meaningful volumes. The company also had to deal with the fallout of an embarrassing U-turn in March to raise prices on preorders. Rivian builds the battery-electric R1T pickup and R1S sport utility vehicle for consumers. It also has a deal with Amazon.com Inc., one of its biggest shareholders, to build 100,000 EV delivery vans by the end of this decade. Rivian was seen as the hottest new EV startup to challenge incumbent Tesla, after a monster initial public offering in November and big-name Wall Street backers and strategic investors like Ford Motor. However, production challenges have sent the shares down 67 per cent this year, though its reaffirmation of a goal of building 25,000 EVs this year helped trim losses.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Upcoming Webinars

Guest Presentation by RE&S Enterprises Pte Ltd [NEW]

Date: 21 October 2022

Time: 2pm – 3pm

Register: https://bit.ly/3REOBnY

Guest Presentation by Keppel REIT [NEW]

Date: 3 November 2022

Time: 12pm – 1pm

Register: https://bit.ly/3SOLOsr

Research Videos

Weekly Market Outlook: Spotify, SATS, Nanofilm, Technical Pulse, SG Weekly

Date: 03 October 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials