DAILY MORNING NOTE | 11 August 2022

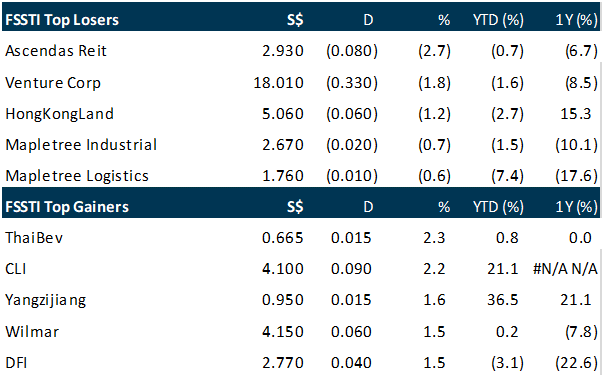

Singapore stocks rose on Wednesday (Aug 10), defying a rout in the region as Asia markets turned nervy ahead of the release of a US inflation report after Wall Street posted losses. Major indexes in Hong Kong, Japan, Australia and South Korea fell between 0.5 per cent and 2 per cent, but the benchmark Straits Times Index (STI) closed 0.5 per cent or 15.35 points higher at 3,286.33. Among STI constituents, Thai Beverage and Capitaland Investment were top performers, closing up 2.3 per cent and 2.2 per cent at S$0.665 and S$4.10 respectively. Yangzijiang Shipbuilding also outperformed, ending at S$0.95, up 1.6 per cent or S$0.015. At the bottom of the performance table were Ascendas Reit, which shed 2.7 per cent or S$0.08 to close at S$2.93, and Venture Corporation, which lost 1.8 per cent or S$0.33 to end at S$18.01. In the broader market, Sembcorp Marine was the most actively traded counter by volume. The counter closed up 0.85 per cent at S$0.119 after 214 million of its shares worth S$25.5 million exchanged hands.

US stocks surged on Wednesday, with the Dow gaining more than 500 points, on better-than-expected inflation data that raised hopes the Federal Reserve might ease up on its aggressive interest rate hikes. With energy costs dropping in recent weeks, the annual consumer price index dipped to 8.5 per cent in July from a 40-year high of 9.1 per cent the previous month, the Labor Department reported. And in a big surprise, monthly CPI was unchanged. Signs that inflation could be coming off the boil in the world’s biggest economy could persuade the Fed to move much more gradually. But economists and Fed officials warned against that hopeful view saying inflation is still high, and a third consecutive, 0.75-percentage-point hike remains possible. All three major indices closed with big gains. The Dow Jones Industrial jumped 1.6 per cent to end the day at 33,309.51. The broad-based S&P 500 surged 2.1 per cent to 4,210.24, and the tech-rich Nasdaq Composite Index, meanwhile, surged 2.9 per cent to finish at 12,854.81. Among individual stocks, Disney shares ended 4 per cent higher ahead of its quarterly results posted after markets close, which showed paying-subscribers to its streaming service leapt beyond expectations, as rival Netflix’s ranks ebbed. Netflix shares closed 6 per cent higher. Cryptocurrency exchange Coinbase Global ended the day up 7.4 per cent despite second quarter losses while hotel and casino operator Wynn Resorts, which also saw losses in the same quarter, closed down 1.0 per cent. AFP

SG

Real estate agency PropNex on Wednesday (Aug 10) posted a 20.7 per cent drop in net profit for the second quarter, as revenue fell due to fewer marketing launches. Net profit for the 3 months ended Jun 30 stood at S$13.1 million, compared with a net profit of S$16.5 million posted the same period a year ago. The results translate to earnings per share (EPS) of S$0.0354, against EPS of S$0.0446 last year. Revenue was down 11.4 per cent year on year to S$230.7 million from S$260.5 million, as commission income from project marketing services fell due to fewer marketing launches. This was partially offset by a rise in commission income from agency services as more such transactions were completed during the quarter. For the 6 months ended Jun 30, net profit was down 13.8 per cent to S$27 million, from S$31.3 million in the year-ago period, translating to an EPS of S$0.073. Revenue dropped 1.8 per cent to S$472.3 million from S$481.1 million. PropNex chief executive Ismail Gafoor observed that property cooling measures in December 2021 have slowed price growth in the private residential market to a more sustainable pace. As a result, transaction volumes softened in the first half of the year compared with 2021 as buyers held back on property purchases to monitor the impact of cooling measures. PropNex was trading 0.6 per cent or S$0.01 lower at S$1.67 as at 4.09 pm on Wednesday.

Real estate group Far East Orchard has posted earnings of S$8 million for the first half ended June, improving from a net loss of S$1.9 million recorded in the year-ago period. Revenue rose 15.9 per cent to S$63.7 million in H1, from S$54.9 million a year ago. This was mainly due to stronger operating performance from the hospitality segment as borders opened and global travel picked up in the second quarter, the group said in a bourse filing on Wednesday (Aug 10). In Singapore, the group said its hospitality business also continued to be supported by government isolation contracts in H1. It added that this is expected to extend to the end of 2022. Meanwhile, its purpose-built student accommodation (PBSA) segment also contributed higher revenue on the back of a higher occupancy rate of 85 per cent for the academic year started September 2021.

Chocolate confectionery company Delfi posted a net profit of US$19.4 million in H1 2022, up 57.6 per cent from the corresponding period last year. Delfi said in a bourse filing on Wednesday (Aug 10) that the strong H1 2022 bottom-line performance was on the back of a 17 per cent year-on-year increase in revenue to US$246.3 million, surpassing the US$226.9 million it achieved in H1 2019 – signalling a “recovery and return to pre-Covid-19 levels”. Revenue growth was driven by the Indonesian segment which rose by 16.1 per cent to US$167.2 million; and also from regional markets improving by 18.9 per cent to US$79.1 million. The group has declared an interim cash dividend of US$0.0158 to be paid out to shareholders on Sep 7. John Chuang, Delfi’s chief executive officer, said since last year the group’s markets have gradually come out of tight Covid-19 restrictions, and this has resulted in higher social and economic activities and improved consumer sentiment across the region. Barring any unforeseen circumstances, the group expects its performance for the year ending Dec 31, 2022, to be better than the performance in 2021. The counter closed down S$0.01 or 1.3 per cent at S$0.740 on Wednesday before the announcement.

US

Micron Technology cut its current-quarter revenue forecast on Tuesday (Aug 9) and warned of a negative free cash flow in the coming 3 months as customer inventories pile up amid waning demand for chips used in PCs and smartphones. The dismal forecast comes a day after Nvidia warned of weakness in its gaming business, accentuating fears of the first chip industry downturn since 2019. That sent Micron’s shares and the Philadelphia SE Semiconductor index down 5.7 per cent and 4.3 per cent, as investors looked past US President Joe Biden signing a landmark bill for US$52.7 billion in subsidies for semiconductor production and research. Micron also announced a US$40 billion investment in memory chip manufacturing in the United States but said the capital expenditure was expected to decrease in fiscal 2023 from 2022. Fourth-quarter revenue is likely to come in at or below the low end of the company’s prior forecast. Its earlier range of US$6.8 billion to US$7.6 billion had fallen short of Wall Street targets in June. Micron, which last reported negative free cash flow in 2020 during the early days of the pandemic, warned it could see significant sequential declines in revenue and margins in its first quarter due to a fall in shipments. Surging prices have forced consumers to curb their spending on electronic gadgets, prompting production revaluations at companies sitting on excess inventory of chips and other components in anticipation of strong post-pandemic demand. Shipments of PCs are expected to drop 9.5 per cent this year, according to IT research firm Gartner. That, and cooling demand for smartphones, has drawn demand-related warnings from Micron and others including Intel, Advanced Micro Devices, Qualcomm and Nvidia. Micron is seeing cloud, industrial and automotive customers also make “inventory adjustments” due to macro uncertainty, finance chief Mark Murphy said at the Keybanc Technology Leadership forum on Tuesday.

Roblox missed estimates for quarterly bookings on Tuesday (Aug 9), in yet another sign the gaming industry is facing a slowdown after a pandemic-fueled boom, sending shares of the gaming platform down around 19 per cent in extended trading. Roblox’s downbeat results come as firms ranging from console makers and chip makers to video game publishers warn of a slowdown in the gaming world as red hot inflation hammers discretionary spending, challenging the idea of a “recession proof” industry. The California-based Roblox, famous for its games Jailbreak and MeepCity, posted net bookings of US$639.9 million in the second quarter, compared with US$665.5 million a year earlier. Analysts were expecting US$644.4 million, according to Refinitiv data. Gaming demand, which saw a boom during the pandemic, slowly subsided as restrictions ease and people venture outside for other entertainment options. Last month, Xbox-maker Microsoft reported a slump in gaming revenue, while PlayStation-maker Sony trimmed its forecast on waning consumer interest in video games. On an adjusted basis, Roblox reported loss of 30 US cents per share, compared to estimates of 21 US cents per share loss, according to Refinitiv IBES data. Bookings for July were up between 8 per cent and 10 per cent year over year, while Daily Active Users (DAUs) rose 26 per cent. Roblox shares fell 15 per cent to US$40.40 in after hours trading on Tuesday. The stock has shed more than 50 per cent in value so far this year.

Coinbase Global posted a US$1.1 billion second-quarter loss and lower-than-expected revenue as the largest US cryptocurrency exchange was battered by tumbling digital-asset prices. Shares of the company, which were first listed last April, dropped about 5 per cent after the close of regular trading. Coinbase has slumped 65 per cent so far this year amid what has been labelled as the latest “crypto winter”. Revenue declined to US$808.3 million, missing the US$854.8 million estimate from analysts polled by Bloomberg. Monthly transacting users dropped to 9 million in the second quarter, a 2 per cent decline from prior quarter. Trading volume also missed estimates, with Bitcoin’s share of trading volume rising to 31 per cent from 24 per cent. On full-year outlook, the company now expects 7 million to 9 million average monthly transacting users, narrowing the range from earlier forecast. That compares with the average analyst estimate of 8.7 million users. Coinbase said in May, the Securities and Exchange Commission sent a voluntary request for information on its listings and listing process, and it does not yet know if this inquiry will become a formal investigation. Coinbase bondholders aren’t reacting well to the results. The company’s 3.375 per cent bonds due 2028 dropped 1.375 US cents on the dollar to 70 US cents. And its 0.5 per cent convertible notes due 2026 are down around 2.25 US cents to less than 70 US cents. Both bonds now yield more than 10 per cent.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

RESEARCH REPORTS

Singapore Banking Monthly – NIM improvement across the board

Recommendation: Overweight (Maintained)

Analyst: Glenn Thum

• July 3M-SIBOR was up by 51bps MoM to 2.02%, the highest in 7 years.

• 2Q22 results, banks’ NII rose 17% YoY as NIM improved by 8% with loans growth of 8%. Fee income was a drag, declining 10%. Banks raised their FY22e NIM guidance.

• Hong Kong’s domestic loans declined 2.34% YoY and 0.17% MoM in June. Malaysia’s domestic loans growth increased 5.61% YoY and 0.68% MoM in June.

• Maintain OVERWEIGHT. We remain positive on banks. Bank dividend yields are attractive at 5% with upside surprise due to excess capital ratios. Stable economic conditions and rising interest rates remain tailwinds for the banking sector. SGX is another beneficiary of higher interest rates. Pressure points for the banks will be higher staff costs and a nudge in general provisioning due to weaker economic assumptions.

Upcoming Webinars

Guest Presentation by A-Sonic Group

Date: 11 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3PmoIrl

Guest Presentation by Marathon Digital Holdings

Date: 18 August 2022

Time: 10am – 11am

Register: https://bit.ly/3yNSfUu

Guest Presentation by First REIT

Date: 18 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3BqQe3q

Guest Presentation by Audience Analytics

Date: 23 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3P3eBYR

Guest Presentation by Meta Health Limited (META)

Date: 24 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3nYZXWx

Guest Presentation by United Hampshire US REIT [NEW]

Date: 7 September 2022

Time: 7pm – 8pm

Register: https://bit.ly/3SgiZFV

Research Videos

Weekly Market Outlook: AirBnb, Apple, Amazon, DBS, OCBC, First Sponsors, Starhub, SG Weekly & More

Date: 8 August 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials