DAILY MORNING NOTE | 11 January 2023

Mapletree Logistics Trust (SGX: M44U)

Analyst: Zane Aw(Current Price: S$1.63) – TECHNICAL BUYBuy price: S$1.63 Stop loss: S$1.60 Take profit: S$1.75

Analyst: Zane Aw(Current Price: S$0.380) – TECHNICAL BUYBuy price: S$0.380 Stop loss: S$0.360 Take profit: S$0.445

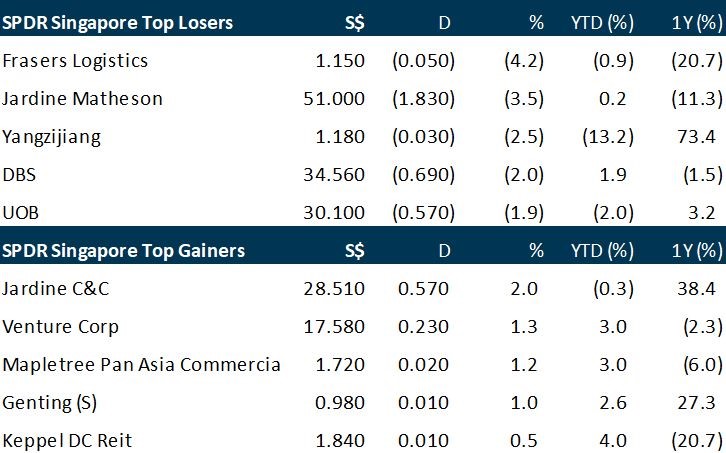

The Straits Times Index (STI) fell 1.3 per cent or 42.76 points to 3,262.91 points on Tuesday (Jan 10). In the wider Singapore market, losers outnumbered gainers 266 to 233, with 989.9 million shares worth S$1.16 billion traded. The decline came amid mixed trading across key Asian markets, as renewed fears over higher-for-longer US interest rates overshadowed optimism over China’s reopening. Japan’s Nikkei 225 rose 0.8 per cent and South Korea’s Kospi edged up 0.1 per cent, while the Shanghai Composite Index dipped 0.2 per cent and the FTSE Bursa Malaysia KLCI lost 0.6 per cent.

The S&P 500 and the Nasdaq opened lower on Tuesday (Jan 10) as concerns about interest rate hikes persisted after Federal Reserve chair Jerome Powell’s comments did not provide further clarity on the monetary policy outlook. The S&P 500 opened lower by 3.52 points, or 0.09 per cent, at 3,888.57, while the Nasdaq Composite dropped 27.93 points, or 0.26 per cent, to 10,607.72 at the opening bell. The Dow Jones Industrial Average was flat at the open.

Stocks to watch: Olam Group

SG

Olam Group has outlined plans to list Olam Agri, its agribusiness unit, as early as H1 2023, it said on Tuesday (Jan 10). The move will result in a primary listing in Singapore, a concurrent one in Saudi Arabia, and a demerger of Olam Agri and Olam Group through a distribution in specie of shares in Olam Agri to shareholders. If the transaction goes through, Olam Agri’s initial public offering (IPO) will be the first dual-listing for a company on both the Singapore and Saudi Arabia stock exchanges and the first-ever listing in Saudi Arabia for a non-Gulf Cooperation Council incorporated business, Olam Group said in a press statement. The latest development comes days after Bloomberg reported that the group had picked banks to lead the proposed Olam Agri listing, which could raise as much as US$1 billion, according to sources.

As many as 205 companies were forced to wind up last year, according to figures released by the Ministry of Law. This was higher than the number of compulsory wind-ups in 2021 and 2020, when 191 and 201 companies, respectively, were forced to shut for good. The High Court also received 238 applications to wind up companies from January to November 2022, which is slightly below the full-year figure of 260 applications filed in 2021, but more than the 224 applications filed in 2020. The number of bankruptcy applications filed in the first 11 months of 2022 also reached a high of 3,380, close to 2019 levels after two years of decline.

Businesses hope Singapore’s Budget 2023 will support them in addressing costs (74 per cent), manpower challenges (57 per cent) and assistance in cash flow management (48 per cent), according to the Singapore Business Federation’s (SBF) latest National Business Survey 2022/2023. Other areas of support required include help with the transformation and deepening of enterprise capabilities (38 per cent), support in obtaining credit (33 per cent) and helping businesses to internationalise (29 per cent), according to the more than 931 firms surveyed. In terms of top challenges faced by Singapore businesses, these largely related to the increase in overall business costs and manpower.

US

Meta Platforms, the parent company of Facebook and Instagram, said advertisers will no longer be able to use a teenager’s gender to target them with promoted messages on its sites. The updated settings are scheduled to go into effect in February, according to a company blog post, and will mean advertisers can market to teens based only on age and location. Meta previously stopped advertisers from targeting teenagers based on their Facebook or Instagram activity, such as the Pages they like.

Amazon.com is expanding a program that lets Prime subscribers use the company’s speedy delivery service when shopping on other websites. Introduced in April by invitation only, “Buy With Prime” will be generally available in the US by the end of the month, according to Amazon. Pointing to the enduring power of the Prime membership program, the company said the number of customers who bought a product after clicking on it increased 25 per cent on sites using the service.

Tens of thousands of tech sector job cuts may not be enough to reverse the collapse in share prices, given the looming economic downturn could slash companies’ revenues far more than the cost savings they make via layoffs. Amazon.com last week announced more than 18,000 job cuts, the biggest reduction in its history, while Salesforce said it would cut about 10 per cent of its workforce, adding to the toll in a sector that has been scrabbling for months to retrench. Industry tracker Layoffs.fyi estimates 18,300 employees have been let go this year, following the loss of 154,000 jobs in 2022. Investors have applauded the cuts on the expectation that they will help protect margins; Salesforce, for instance, has rallied since its announcement, while shares in Facebook owner Meta Platforms have rebounded 34 per cent since it announced it would cull more than 11,000 jobs.

Amazon has said it plans to shut three UK warehouses in a move that will impact 1,200 jobs, PA Media reported on Tuesday (Jan 10). An Amazon representative did not immediately respond to a request for comment. The Seattle-based online retailer last week said it would cut more than 18,000 roles, impacting its e-commerce and human resources organisations – the latest in a series of layoffs to affect the tech industry.

Taiwan Semiconductor Manufacturing Co (TSMC) recorded its first quarterly revenue miss in two years, signalling the global decline in electronics demand is starting to catch up with the chip giant. The shortfall suggests that even TSMC, with its technology and scale advantages, can’t escape a global slowdown in spending by consumers affected by rising interest rates and accelerating inflation. The world’s biggest contract manufacturer of chips last year reduced its capital spending plans by about 10 per cent to US$36 billion and some analysts have warned it may further delay expenditure on expansion in 2023. TSMC, which is the exclusive supplier of Apple’s Silicon chips for iPhones and Macs, may also have been affected by problems at the US tech giant’s assembly operations in China. Apple was forced to trim output estimates after Covid-related chaos at a plant in Zhengzhou exposed vulnerabilities in the company’s supply chain.

Airbus consolidated its leadership in civil aviation for 2022 on Tuesday, reporting more orders and deliveries than American archrival Boeing as both companies contend with lingering supply chain challenges. In terms of deliveries, Airbus finished the year having 661 planes arrive with clients, much higher than Boeing’s 480. But the Airbus lead in new contracts was slimmer, with its 820 net orders outpacing Boeing by just 12.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Block Inc – Bitcoin weakness to weigh on growth

Recommendation: NEUTRAL (Initiation); TP: US$70.00

Analyst: Ambrish Shah

– Block is putting up double-digit growth at Square and Cash App divisions. In FY22e, we model Square segment revenue growth of 30% YoY driven by resurgence of in-person activities, while Cash App (Ex-bitcoin) segment revenue to rise by 46% YoY due to surge in active users and strong adoption of core services like Instant Deposit and Cash Card.

– Weak consumer demand for Bitcoin and falling cryptocurrency prices to pull back Block’s group revenue. Bitcoin revenue expected to fall by 29% YoY to US$7.2bn in FY22e.

– Block is not consistently profitable. We anticipate a net loss of US$499mn in FY22e due to ongoing product innovations and growth investments.

– We initiate coverage with a NEUTRAL recommendation and DCF-based target price (WACC 7.1%, g 4.0%) of US$70.

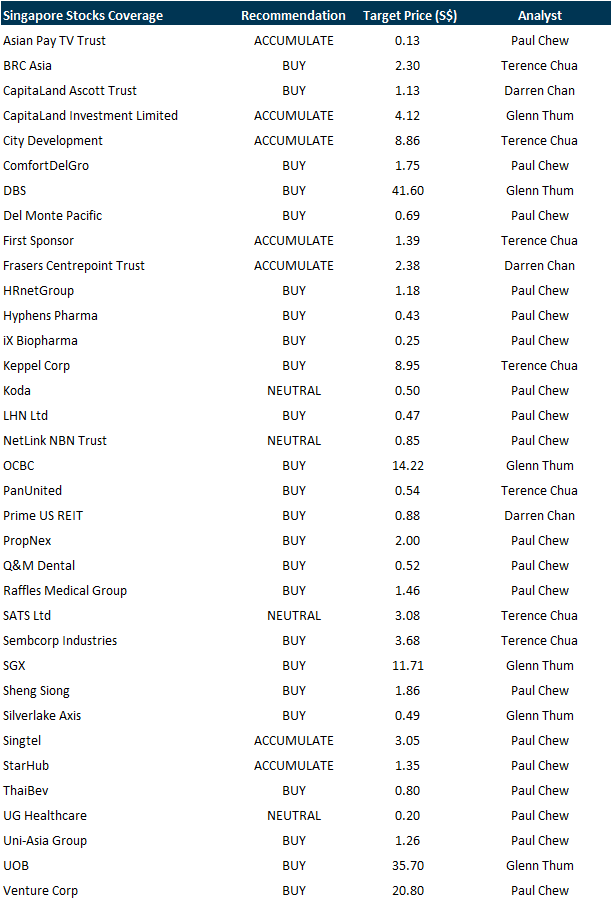

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Civmec

Date: 20 January 2023

Time: 12pm – 1pm

Register: https://bit.ly/3iwhMx1

Research Videos

Weekly Market Outlook: SG 2023 Equity Strategy, Technical Analysis

Date: 9 January 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials