Daily Morning Note – 11 May 2022

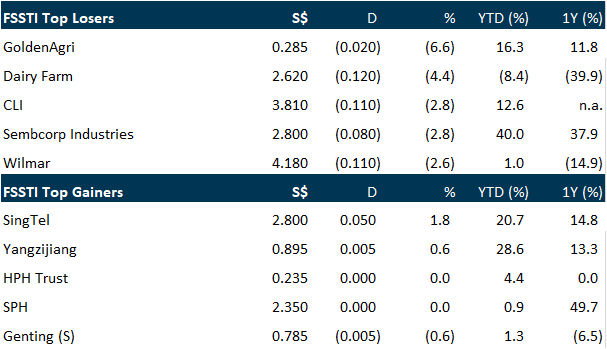

The Straits Times Index (STI) fell 1.3 per cent or 40.88 points to close at 3,234.19 on Tuesday (May 10), tracking a rout in the US equity market and tumbling oil prices. In the wider Singapore market, losers outnumbered gainers 400 to 145, with 1.66 billion securities worth S$1.66 billion changing hands. Dairy Farm International (DFI) saw the largest decline among blue-chip counters, sliding 4.4 per cent or US$0.12 to close at US$2.62. While Singtel was the most actively traded counter on the STI for the second straight day this week. It was also the top gainer among the constituent stocks. The counter rose 1.8 per cent or S$0.05 to end at S$2.80, after 63.1 million shares changed hands.

Wall Street’s main indexes opened higher on Tuesday with investors buying into beaten-down banks and megacap growth stocks following a three-day sell-off on concerns over aggressive monetary tightening and slowing economic growth. The Dow Jones Industrial Average rose 258.4 points, or 0.80 per cent, at the open to 32504.09. The S&P 500 rose 43.9 points, or 1.10 per cent, at the open to 4035.18, while the Nasdaq Composite rose 277.1 points, or 2.38 per cent, to 11900.343 at the opening bell.

SG

Private market exchange ADDX has partnered with Temasek unit Fullerton Fund Management to list the latter’s private equity fund of funds, the Fullerton Optimised Alpha Fund, on its digital platform. The Fullerton Optimised Alpha Fund is a closed-end fund that is targeting annual returns of 8 to 12 per cent over its fund life of 7 years, ADDX said on Wednesday (May 11). As a result of efficiencies from tokenisation, accredited individual investors on ADDX will be able to access the Fullerton fund with a minimum amount of US$10,000, instead of the US$250,000 required through traditional non-tokenised channels.

ESR-Reit began trading in the local market as ESR-Logos Reit (E-Log) on May 5, beginning a potentially interesting phase of growth after significantly enlarging itself by subsuming Ara Logos Logistics Trust (A-Log). With some S$5.5 billion in assets, E-Log is now the flagship Singapore-listed asset securitisation platform of ESR Cayman, which recently completed the acquisition of Ara Asset Management. E-Log’s manager has said its enlarged sponsor has a US$59 billion portfolio of “new economy” assets, and a S$2 billion initial pipeline of “visible and executable” assets that will accelerate E-Log’s growth.

Mainboard-listed precision-engineering company UMS Holdings net profit for the first quarter ended Mar 31, 2022 rose 26 per cent year on year to S$19.4 million from S$15.4 million previously. It also announced an interim dividend of 1 Singapore cent per share for the quarter ended March 31. In its bourse filing on Tuesday (May 10), the group noted that its sales surge for the quarter was driven by the sustained increase in semiconductor demand and the consolidation of sales from JEP Holdings – which became a subsidiary of the group from Q2 2021 – bringing on board a new revenue stream from the aerospace business.

US

Netflix could introduce its lower-priced ad-supported subscription plan by the end of the year, earlier than originally planned, the New York Times reported on Tuesday (May 10). The streaming pioneer is also planning to start cracking down on password sharing among its subscriber base around the same time, the report said, citing an internal note to employees. Netflix did not immediately respond to a Reuters request for comment. The company last month posted its first loss of subscribers in more than a decade and signaled deeper losses ahead, a stark shift in fortune from the boom it recorded during the pandemic. The lagging subscriber growth prompted Netflix to contemplate offering a lower-priced version of the service with advertising, citing the success of similar offerings from rivals HBO Max and Disney+.

Pfizer said on Tuesday (May 10) it will buy migraine drug maker Biohaven Pharmaceutical Holding Company for about US$11.6 billion in cash, as the drugmaker seeks to beef up its portfolio ahead of patent losses for some cancer drugs. Through the deal, Pfizer will gain access to Biohaven’s approved drug Rimegepant that belong to a class of migraine drugs known as calcitonin gene-related peptide (CGRP) inhibitors. Pfizer built a cash pile on the back of success with its Covid-19 vaccine and oral drug Paxlovid, with some investors expecting it to spend on deals as it faces the loss of patent protection for key drugs in the next few years.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

FAANGM Monthly Apr 22: De-rating valuations an attractive opportunity

Recommendation: OVERWEIGHT (Maintained)

Analyst: Jonathan Woo

– The FAANGM declined 14.9% in April, worse than Nasdaq’s drop of 13.4%. S&P 500 was down 8.8%. NFLX continued to underperform, declining 49% in the month, largely due to a negative effect from a contracting user base. Meta, Apple, and Microsoft were the outperformers, declining 10%.

– 1Q22 earnings for the FAANGM stocks were largely in line with analyst consensus estimates, with slowing growth as the overall theme for the month, led by the overhang from the Russia/Ukraine conflict, a weaker macro environment, and a general de-rating of tech stocks.

– On the hardware side, short-term headwinds continue to cloud AAPL’s outlook, with Covid shutdowns and lingering semiconductor shortages affecting supply. Higher costs continue to affect AMZN’s margins, with decreasing productivity and overcapacity affecting efficiency. For software, we expect corporate demand for MSFT’s higher-end licenses to continue. And for the internet, we like the increasing popularity of YouTube Shorts as an additional revenue driver for GOOGL, as well as continued growth in Google Cloud.

– We remain OVERWEIGHT on FAANGM. Following the sell-off in tech stocks, FAANGM stocks are currently trading at attractive valuations, near their all-time lows. We believe that long-term secular tailwinds remain intact, and should overshadow current short-term headwinds in the market.1Q22 Revenue (+1.5% YoY) and NPI (+0.5% YoY) were in line; NPI formed 23.7% of our FY22 forecast.

Click the link to join: https://t.me/stocksbnb

Date: 9 May 2022

For any research-related matters, email: research@phillip.com.sg

For general enquiries, email: talktophillip@phillip.com.sg

or call 6531 1555.

Read the research report(s), available through the link(s) above, for complete information including important disclosures Important Information

Disclaimer

The information contained in this email is provided to you for general information only and is not intended to create any binding legal relation. The information or opinions provided in this email do not constitute investment advice, a recommendation, an offer or solicitation to subscribe for, purchase or sell any investment product. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise.

You should obtain advice from a financial adviser before making a commitment to invest in any investment product or service. In the event that you choose not to obtain advice from a financial adviser, you should assess and consider whether the investment product or service is suitable for you before proceeding to invest.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.