DAILY MORNING NOTE | 11 October 2022

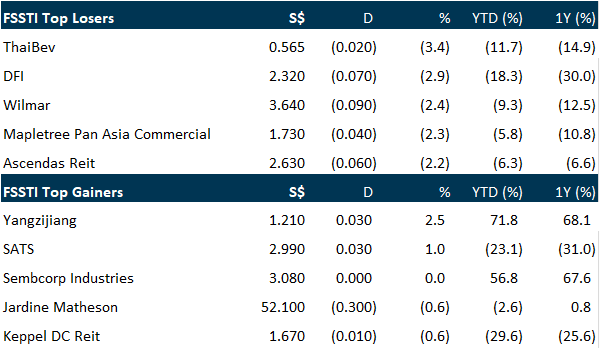

Singapore stocks closed lower on Monday (Oct 10) mirroring regional declines, after a robust US jobs report last Friday dampened investors’ hope of a policy pivot by the US Federal Reserve. The key Straits Times Index (STI) fell 1.2 per cent or 38.34 points to close at 3,107.47, with nearly all index counters ending the day in the red. Thai Beverage led the decliners after its shares fell 3.4 per cent to close at S$0.565. The trio of local banks, DBS, OCBC and UOB were also among the losers, falling between 0.8 per cent and 1.4 per cent. Sats and Yangzijiang Shipbuilding were the only index counters in positive territory for the day. Yangzijiang Shipbuilding was the top STI gainer, after climbing 2.5 per cent to close at S$1.21. Some 80.7 million shares worth S$95.8 million were traded, making it the most actively traded by value on Monday. Across the broader market, decliners outnumbered gainers 360 to 191 after 1.2 billion securities worth S$960.4 million changed hands.

Wall Street stocks were modestly lower on Monday after a quiet session to open a news-jammed week filled with major economic reports and corporate earnings. This week’s calendar includes the latest US consumer price index data, which will give an updated reading on inflation that has prompted significant Federal Reserve interest rate hikes. Investors will also take in new retail sales figures and earnings from Delta Air Lines, JPMorgan and others. Monday’s calendar saw no major economic reports. The bond market was closed for Columbus Day. The Dow Jones Industrial Average shed 0.3 per cent to 29,202.94. The broad-based S&P 500 fell 0.8 per cent to 3,612.43, while the tech-rich Nasdaq Composite Index dropped 1.0 per cent to 10,542.10.

SG

The board of directors of CSE Global Limited and together with its subsidiaries announced that the Company proposes to undertake a renounceable non-underwritten rights issue of up to 102,480,337 new ordinary shares in the capital of the Company at an issue price of S$0.33 for each Rights Share, on the basis of one Rights Share for every five ordinary shares in the capital of the Company held by the shareholders of the Company who are eligible to participate in the Rights Issue as at the Record Date, fractional entitlements to be disregarded. The Issue Price represents a discount of approximately 20.5% to the last transacted price of S$0.415 per Share on the Mainboard of the Singapore Exchange Securities Trading Limited on 10 October 2022, being the last trading day on which trades were done on the Shares prior to this announcement; and 17.7% to the theoretical ex-rights price of S$0.4011 per Share as calculated based on the Last Traded Price. Based on the Issue Price, the Rights Issue will raise gross proceeds of up to approximately S$33.8 million. The net proceeds from the Rights Issue will amount to approximately S$33.4 million after deducting estimated fees and expenses incurred in connection with the Rights Issue. The Company intends to utilise the Net Proceeds for potential acquisitions of synergistic businesses in New Zealand and the United States of America; and to partially repay some of the loans previously drawn down for certain business acquisitions as part of the Company’s ongoing and prudent balance sheet management to enhance the financial flexibility of the Group.

Shares of mainboard-listed Golden Energy and Resources rose S$0.065 or 7.7 per cent to close at S$0.905, the highest the counter has ever been since its reverse takeover of UFS in 2015, following news of “a possible acquisition”. The mining company said in a bourse filing that it is in discussion with certain shareholders, including Indra Widjaja, regarding the potential deal. “At present, there is no concrete outcome from the aforementioned discussions, and no definitive agreements have been entered into, involving the company and its subsidiaries,” the group added. Indra Widjaja, Franky Oesman Widjaja and Muktar Widjaja are the ultimate controlling shareholders of Golden Energy.

Shares of Sembcorp Marine reached a two-month high amid heavy trading after the group announced on Monday (Oct 10) that it inked a definitive agreement with Borr Drilling to defer US$800 million in receivables. The deferment will result in Borr Drilling making earlier and higher amounts of interest payments and partial principal repayments to Sembmarine-owned PPL Shipyard (PPLS) from 2022 to 2024, the offshore and marine engineering group said in a bourse filing. The counter was the most heavily traded by volume on the Singapore bourse, with over 140 million shares changing hands. It also rose 0.8 per cent or S$0.001 to close at S$0.118. The last time Sembmarine’s shares closed near this level was Aug 11. Sembmarine said in its announcement that Borr Drilling has also met the required conditions. This includes raising certain amounts of equity and completing the refinancing of its other secure creditors. The owed sum was from a sales agreement in October 2017. Borr Drilling and its subsidiaries bought nine of PPLS’s Pacific Class 400 jackup drilling rigs at an aggregate consideration of about US$1.3 billion. The group does not expect the deferment agreements with Borr Drilling to have any material impact on its net tangible assets or earnings per share in FY2022.

US

The International Monetary Fund and World Bank warned of the rising risk of a global recession as faster inflation forces central banks to raise interest rates, crimping growth. Higher borrowing costs are “really starting to bite,” IMF Managing Director Kristalina Georgieva said alongside World Bank President David Malpass at a virtual event on Monday (Oct 10) kicking off the annual meetings of their institutions. The IMF calculates that about one-third of the world economy will have at least two consecutive quarters of contraction this year and next, and that the lost output through 2026 will be US$4 trillion. At the same time, policymakers can’t let inflation be a “runaway train,” Georgieva said. Malpass warned that there’s a “real danger” of a worldwide contraction next year, and that dollar strength is weakening the currencies of developing nations, increasing their debt to “burdensome” levels.

Tesla Inc hit a record of more than 83,000 electric-vehicle deliveries from its recently upgraded Shanghai factory in September, according to data released by the China Passenger Car Association. The plant delivered 83,135 EVs last month, an 8% increase from August, according to data released by the association on Sunday. The American EV maker still trailed Chinese rival BYD Co., which topped the charts for EV deliveries last month with almost 95,000 units, up 14% from August. BYD’s total sales, including hybrids, were a combined 201,000 units in September. BYD also broke its own records in September, in EVs as well as total sales. The rivalry between the world’s leading EV companies intensified this year after BYD abandoned the production of traditional gasoline-powered vehicles to fully convert to new-energy cars. BYD dominated the domestic market when Tesla lost ground after suffering production hiccups from Covid-19 lockdowns in Shanghai earlier this year, but both are now seeing significant growth. In July, Tesla suspended operations for several days to upgrade its assembly lines to increase production capacity. Its Shanghai plant can now crank out more than 750,000 a year, the company said at the time. Tesla said last week it delivered 343,830 EVs globally during the quarter ended Sept. 30. Vehicles from Shanghai made up about 54% of its global deliveries during this period, up from 44% in the second quarter, according to calculations based on the association’s data.

Amazon.com said on Monday (Oct 10) it will invest more than 1 billion euros (S$1.4 billion) over the next five years in electric vans, trucks and low-emission package hubs across Europe, accelerating its drive to achieve net-zero carbon. The retailer said the investment was also aimed at spurring innovation across the transportation industry and encouraging more public charging infrastructure for electric vehicles (EVs). The US online retailer said the investment would help its electric van fleet in Europe more than triple from 3,000 vehicles to more than 10,000 by 2025. The company did not say what percentage of its European last-mile delivery fleet is electric today but said those 3,000 zero-emission vans delivered over 100 million packages in 2021. Amazon said it also hopes to purchase more than 1,500 electric heavy goods vehicles – used for “middle-mile” shipments to package hubs – in the coming years. Amazon’s largest electric van order is for 100,000 vehicles from Rivian Automotive through 2025. The company said that alongside EVs, it will invest in thousands of chargers at facilities across Europe. The retailer said it will also invest in doubling its European network of “micro-mobility” hubs from more than 20 cities today. Amazon has used those centrally located hubs to run new delivery methods including electric cargo bikes or on-foot deliveries to cut emissions. The company plans to achieve net-zero carbon by 2040.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Upcoming Webinars

Guest Presentation by RE&S Enterprises Pte Ltd [NEW]

Date: 21 October 2022

Time: 2pm – 3pm

Register: https://bit.ly/3REOBnY

Guest Presentation by Keppel REIT [NEW]

Date: 3 November 2022

Time: 12pm – 1pm

Register: https://bit.ly/3SOLOsr

Research Videos

Weekly Market Outlook: Technical Pulse, 4Q22 SG Strategy & Stock Picks

Date: 10 October 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials