DAILY MORNING NOTE | 12 January 2023

Technical Pulse: Pinduoduo Inc.

Analyst: Zane AwRecommendation: Technical SELLSell price: US$94.09 Stop loss: US$104.30 Take profit: US$71.30

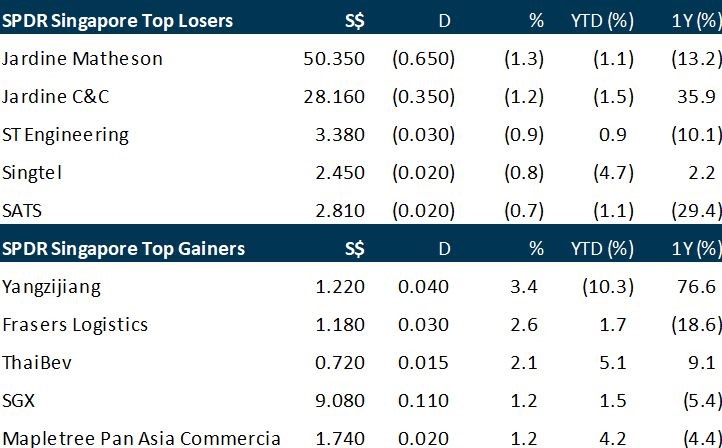

The Straits Times Index (STI) rose 0.3 per cent or 8.60 points to 3,271.51 on Wednesday (Jan 11). In the wider Singapore market, gainers outnumbered losers 275 to 243, with 1.2 billion securities worth S$1.1 billion changing hands. Most key Asian markets also closed higher. Hong Kong’s Hang Seng, Japan’s Nikkei 225, South Korea’s Kospi and the FTSE Bursa Malaysia KLCI rose between 0.2 per cent and 1 per cent.

Wall Street’s main indexes opened higher on Wednesday (Jan 11) as focus shifted to a key inflation reading due later in the week, which would provide clues on how aggressive the Federal Reserve’s monetary tightening could be this year. The Dow Jones Industrial Average rose 49.93 points, or 0.15 per cent, at the open to 33,754.03. The S&P 500 opened higher by 13.10 points, or 0.33 per cent, at 3,932.35, while the Nasdaq Composite gained 52.36 points, or 0.49 per cent, to 10,794.99 at the opening bell.

Stocks to watch: Marco Polo Marine

SG

Marco Polo Marine has signed a landmark memorandum of understanding (MOU) with Namsung Shipping Co., Ltd. and HA Energy Co., Ltd. to jointly pursue synergistic offshore wind vessel operations in South Korea. According to Marco Polo Marine, the signing of the MOU, which follows its expansion into Taiwan and Japan, marks a “milestone entry” into another major offshore wind market in Asia. Namsung, South Korea’s legacy private shipping line, is known in the intra-Asia trade lanes. The company services over 60 main ports in Asia and has since expanded rapidly into relevant businesses, including international materials distribution and vessel management. Namsung is also a strategic investor in the 1.5 GW fixed-bottom Chujin offshore wind project, which will feature around 100 wind turbines in the far south of South Korea. HA-Energy, on the other hand, is a multi-discipline company that offers engineering, construction and commissioning services for various offshore platforms and marine vessels in South Korea.

Fund managers in Singapore are upbeat about Asian equity and credit markets in 2023, going by a survey that polled more than 50 C-suite and key personnel from fund houses with combined assets under management of some US$30 trillion globally late last year. The survey conducted by the Investment Management Association of Singapore (IMAS) asked the asset managers for their end of 2023 market calls, and the area that drew the strongest consensus was the outlook of the MSCI AC Asia Ex Japan Index. Seven in 10 are expecting a solid 10 to 20 per cent recovery in equities from this indicator – which captures large- and mid-cap representation across 10 markets in Asia, excluding Japan.

One of Australia’s most ambitious renewable energy projects has entered into voluntary administration after shareholders couldn’t come to a consensus on the future direction and funding of the plan to power Singapore using a 4,200-kilometer (2,600-mile) submarine cable. The A$30 billion ($21 billion) Sun Cable, backed by billionaire climate crusader Mike Cannon-Brookes and iron ore magnate Andrew Forrest, will likely seek expressions of interest for a recapitalization or sale of the entire business, the company said Wednesday. FTI Consulting’s Christopher Hill, David McGrath and John Park have been appointed as administrators, it said.

Singapore Post (SingPost) says it will be acquiring an additional 37% interest in Australian services provider, Freight Management Holdings (FMH), for A$175.4 million ($161.0 million). This brings SingPost’s total stake in FMH to 88% from 51% previously. SingPost first acquired a 28% stake in FMH in December 2020. It then upped its stake to 51% in November 2021. The latest acquisition was made via SingPost’s wholly-owned subsidiary, SingPost Australia Investments Pty Ltd. The transaction will be funded by the group’s cash reserves and available bank loan facilities. The group’s cash reserves stood at $435.8 million as at Sept 30, 2022.

US

Tesla is close to sealing a preliminary deal to set up a factory in Indonesia, according to people familiar with the matter, as Elon Musk’s electric vehicle pioneer looks to capitalise on the South-east Asian nation’s reserves of key battery metals. The plant would produce as many as 1 million cars a year, the people said, in line with Tesla’s ambition to have all its factories globally reach that capacity. The discussions include plans around multiple facilities in the country, serving different functions across production and the supply chain, one of the people said. A deal hasn’t been signed and the agreement could still fall through, said the people, asking not to be identified as the talks are confidential.

Staff at Goldman Sachs are bracing for news on whether they will keep their jobs on Wednesday (Jan 11), as the US investment bank begins a sweeping cost-cutting drive that could see its 49,000-strong global workforce shrink by thousands. The long-anticipated jobs cull at the Wall Street titan, expected to represent the biggest contraction in headcount since the financial crisis, is likely to affect most of the bank’s major divisions, with its under-fire investment banking arm facing the deepest cuts, a source told Reuters this month. Just over 3,000 employees will be let go, the source, who could not be named, said on Jan 9.

Twitter was accused of carrying out a “sham redundancy process” and threatened with lawsuits by UK staff targeted by mass firings following Elon Musk’s takeover of the social-media giant. Law firm Winckworth Sherwood said Twitter had behaved “unfairly and without regard for English law” when it took moves to fire staff late last year by locking them out of company systems, according to a letter sent to the company on Monday and seen by Bloomberg News.

Verily, Alphabet’s life sciences unit, is cutting 15 per cent of jobs as it eliminates some programmes and streamlines operations. More than 200 jobs will be eliminated, Verily said after announcing the layoffs in a blog post on Wednesday (Jan 11). “We are making changes that refine our strategy, prioritise our product portfolio and simplify our operating model,” said Stephen Gillett, Verily’s chief executive officer, in the post. “We will advance fewer initiatives with greater resources.” The company, owned by the same parent as Google, will also discontinue Verily Value Suite, a medical software programme, and some early-stage products, such as microneedles for drug delivery, Gillett said. Some employees leading the programmes will be reassigned to other teams, while others will be leaving Verily, he said.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

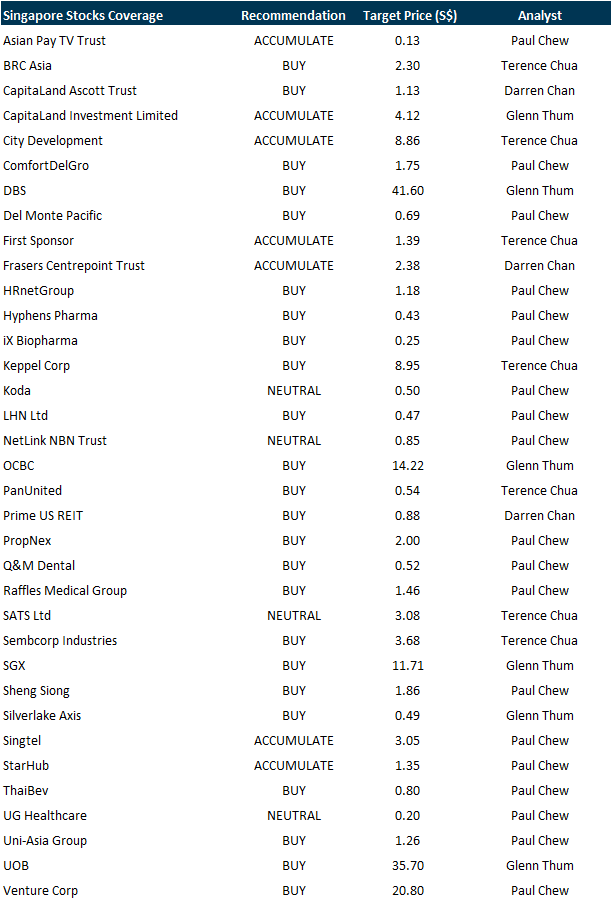

RESEARCH REPORTS

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Civmec

Date: 20 January 2023

Time: 12pm – 1pm

Register: https://bit.ly/3iwhMx1

Research Videos

Weekly Market Outlook: SG 2023 Equity Strategy, Technical Analysis

Date: 9 January 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials