DAILY MORNING NOTE | 12 July 2022

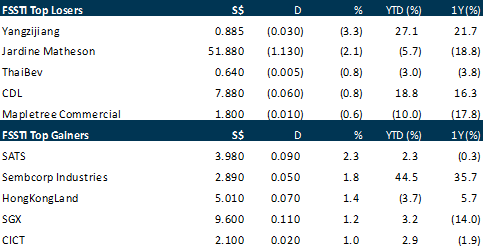

Singapore stocks tracked the positive performance across most regional markets on Friday (Jul 8) and overnight gains on Wall Street to end the week higher. The benchmark Straits Times Index (STI) rose 0.1 per cent or 1.86 points to close at 3,131.26. For the week, the market barometer was up 1.2 per cent. Financial markets in Singapore and Malaysia were closed on Monday (Jul 11) for a public holiday. Trading will resume on Jul 12.

Wall Street’s main indexes opened lower on Monday (Jul 11) as investors braced for the start of the earnings season, which could see profits come under pressure at a time of growing fears of an economic downturn due to aggressive interest rate hikes. The Dow Jones Industrial Average fell 60.17 points, or 0.19 per cent, at the open to 31,277.98. The S&P 500 opened lower by 18.44 points, or 0.47 per cent, at 3,880.94, while the Nasdaq Composite dropped 110.82 points, or 0.95%, to 11,524.49 at the opening bell.

SG

Emperador, the largest liquor company in the Philippines, is expected to begin its secondary listing on the Singapore Exchange (SGX) on Thursday (Jul 14), the company said on Monday. The company, whose primary listing is on the Philippine Stock Exchange (PSE), is set to become the first such company to conduct a secondary listing on the SGX mainboard. In a statement, it said that it expects the conditions set out in the eligibility-to-list letter from SGX Securities Trading (SGX-ST) to be satisfied and its shares to be listed under the stock code “EMI”. The outstanding conditions in the letter include, among others, the release of an announcement disclosing the latest share price of the company on the Philippine Stock Exchange (PSE) and the Singapore dollar equivalent prior to the listing of the company on the SGX mainboard, Emperador said. The company is expected to maintain its primary listing on the PSE, with the stock trading on both exchanges concurrently.

The voluntary conditional cash offer to privatise TTJ Holdings from THC Venture – an investment holding company held solely by TTJ’s executive chairman Teo Hock Chwee – has turned unconditional, the company announced in a bourse filing on Saturday (Jul 9). The total shares owned, controlled or agreed to be acquired by the offeror and its concert parties amounted to some 90.26 per cent of total number of TTJ shares as at 6pm on Friday, or an aggregate of some 315.4 million shares. This includes valid acceptances of the offer received from the concert parties, amounting in aggregate to some 295.3 million shares, which represent about 84.49 per cent or the total number of issued shares. TTJ’s shares held by the public as at the date of the unconditional announcement stands at about 9.74 per cent, which is less than the requisite 10 per cent free float requirement of the listing manual. Back in May, THC Venture sounded its intention to privatise the company at an offer price of S$0.23 in cash per share. In a surprising move, 4 directors of TTJ — executive director and chief financial officer Chiong Su Been, lead independent director Lim Yian Poh, as well as independent directors Ling Chien Yien and Leong Yee Yew — recommended that shareholders reject the offer.

Hafary Holdings plans to purchase a row of shophouses from Broadway Textile for S$71.3 million, to be used as its new flagship store. The property, 161 Lavender Street, has a book value of S$73.4 million, and a total frontage of 110-metre along three roads: Lavender Street, Foch Road and Tyrwhitt Road. Hafary will use a combination of internal funds and bank borrowings to pay for the transaction. Hafary last traded at 19 cents, which gives it a market capitalization of S$80.5 million.

US

Oil prices fell on Monday (Jul 11) in volatile trade, reversing some gains from the previous session as markets braced for new mass Covid testing in China potentially hitting demand, a worry that outweighed ongoing concerns about tight supply. Brent crude futures fell US$1.02, or 1 per cent, to US$106.00 at 0605 GMT, after climbing 2.3 per cent last Friday. US West Texas Intermediate (WTI) crude futures declined by US$1.38, or 1.3 per cent, to US$103.41, paring a 2 per cent gain from Friday. Trading was thinned by a public holiday in parts of South-east Asia, including oil trading hub Singapore. The market was rattled by news that China had discovered its first case of a highly transmissible Omicron subvariant in Shanghai and that new cases had jumped to 63 in the country’s largest city from 52 a day earlier.

Frontline and rival Euronav have signed an all-stock merger deal to create a market-leading oil tanker group with 146 vessels including 68 Very Large Crude Carriers (VLCCs), the companies said on Monday (Jul 11). The firms, which expect the merged company to have a market capitalisation of more than US$4 billion and the merger to generate synergies of at least US$60 million a year, first announced their intention to merge on Apr 7. Shares in Oslo-listed Frontline, the smaller of the 2 but after which the combined group is to be named after, will be exchanged into Brussels-listed Euronav shares at a ratio of 1.45 to 1. The combined company will be held roughly 55 per cent by existing Euronav shareholders and 45 per cent by existing Frontline shareholders, assuming all Euronav shares are tendered in the tender offer. Frontline and its Famatown Finance Limited currently already own 18.8 per cent of the total outstanding shares in Euronav, it said.

Billionaire Elon Musk wants to abandon his US$44 billion deal to purchase Twitter, as per letter submitted on his behalf to the company’s chief legal officer late Friday (Jul 8). However, Twitter’s board chairman, Bret Taylor, stated that the firm is committed to closing the transaction at the agreed-upon price and intends to take legal action to enforce the agreement. Twitter shares were down about 11% on Monday (Jul 11).

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

Upcoming Webinars

Strategy & Stock Picks (US, HK & CN)

Date: 16 July 2022

Time: 1pm – 3.30pm

Register: https://bit.ly/3acvOQm

Guest Presentation by Pan-United Corporation Limited

Date: 5 August 2022

Time: 11am – 12pm

Register: https://bit.ly/3OFbJ41

Research Videos

Weekly Market Outlook: The Place Holdings, Uni-Asia Group Ltd, SG Banking Monthly, SG Weekly

Date: 4 July 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials