Daily Morning Note – 13 April 2022

Stocks to watch: ESR-Reit

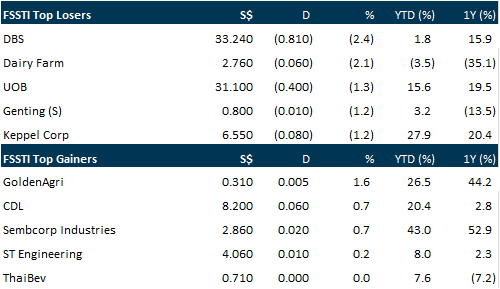

Local shares declined further on Tuesday (Apr 12) amid concerns about the usual suspects – global interest rates, inflation levels, the war between Russia and Ukraine, as well as the pandemic outbreak in Shanghai. In Singapore, the benchmark Straits Times Index fell 1 per cent or 33.31 points to 3,330.25, marking the second consecutive day of red ink this week. Across the broader market, decliners outnumbered advancers 264 to 200, after some 1.6 billion securities worth a total of S$1.2 billion changed hands.

Wall Street turned rally to sell-off on Tuesday (Apr 12), reversing earlier gains as impending monetary tightening from the Federal Reserve once again pulled growth stocks back into red territory. All 3 major US stock indexes turned from positive to negative early in the afternoon, weighed down by healthcare and financials. The Labor Department’s CPI report showed the prices urban American consumers pay for a basket of goods posted the biggest monthly jump since September 2005, and an annual surge of 8.5 per cent, the hottest year-on-year inflation number in more than 4 decades. The Dow Jones Industrial Average fell 87.72 points or 0.26 per cent to 34,220.36, the S&P 500 lost 15.08 points or 0.34 per cent to 4,397.45 and the Nasdaq Composite dropped 40.38 points or 0.3 per cent to 13,371.57.

SG

Mainboard-listed Singtel and a unit of the subsidiary of Keppel Corporation will each divest their respective 50 per cent stakes in Radiance Communications to a subsidiary of Telechoice International, another mainboard-listed player. Each seller will pocket S$625,000 from the sale. Before the divestment, Radiance Communications will distribute dividends and return capital of about S$2 million each to Singtel and Keppel Communications, the KepCorp unit involved in the sale. The total proceeds will hence be about S$2.6 million for each seller. However, the divestment that will end Radiance Communications’ status as an associate is not expected to have a material impact on the net tangible assets or earnings per share of KepCorp, it stated in its regulatory filing on Tuesday (Apr 12).

ESR-Reit is redeveloping its 21B Senoko Loop general industrial property into a build-to-suit, high-specification facility for existing master tenant NTS Components Singapore. The redevelopment will cost about S$38.5 million and is expected to be completed by Q1 2024, the real estate investment trust’s manager said in a press statement on Tuesday (Apr 12). It will also raise the number of high-spec assets in ESR-Reit’s portfolio to 9, representing 18.4 per cent of its portfolio valuation as at Dec 31, 2021. Adrian Chui, chief executive and executive director of the manager, noted: “The redevelopment will increase the proportion of resilient New Economy assets in our portfolio, enabling us to continue delivering long-term sustainable value to our unitholders.”

Condominium resale volumes rebounded in March 2022 after slipping in February, while prices continued upward for the 20th straight month. Some 1,302 resale units changed hands March 2022, 35.6 per cent higher than the 960 units resold in February 2022. Year on year, volumes were 31.4 per cent lower but 7.8 per cent higher than the 5-year average volumes for March. A majority of resale transactions, or 61.1 per cent, came from the outside of the central region (OCR). About 25.4 per cent of volumes were from the rest of central region (RCR), while 13.6 per cent was from the core central region (CCR). Property analysts noted that market activities gained some ground in March after the Chinese New Year lull period. The Singapore government had also relaxed Covid-19 safe management measures, which helped facilitate more property viewings. Overall resale prices continued to climb in March, rising 0.8 per cent from February. Prices were up 9.7 per cent on the year, despite the cooling measures introduced in mid-December last year.

US

KKR is in advanced talks to buy cybersecurity firm Barracuda Networks from its private equity owner Thoma Bravo for around US$4 billion, including debt, people familiar with the matter said. California-based Barracuda, which manages the data security of its customers over the cloud on a subscription basis, was taken private by Thoma Bravo in 2017. KKR declined to comment. Barracuda and Thoma Bravo did not immediately respond to requests for comment. The deal is expected to be announced later on Tuesday (Apr 12), although the sources, who requested anonymity, cautioned that talks, which are confidential, could yet collapse. Dealmaking in cybersecurity has jumped in recent months as the Covid-19 pandemic accelerated the shift to remote working, forcing companies to ramp up spending in the sector. Russia’s invasion of Ukraine has also led to a spike in cyberattacks. Thoma Bravo on Monday agreed to buy cybersecurity firm SailPoint Technologies, while Datto, a security solutions provider, was also taken private in a US$6.2 billion deal by investors led by Insight Partners.

Boeing on Tuesday moved orders for 141 of its airplanes into accounting limbo due to the war in Ukraine and international sanctions against Russia, meaning it no longer expects the jets to be delivered. Boeing unveiled the adjustment to its order backlog in monthly orders and deliveries data that also showed it had delivered 41 jets to customers in March. The monthly deliveries tally included 34 of its cash-cow 737 MAX single-aisle jets, two 767 freighters for FedEx Corp and a 777 freighter for China Airlines. The 41 March deliveries – nearly double the 22 it delivered in February and up from 29 a year ago – reflect rebounding travel and pandemic-driven cargo demand. Boeing said year-to-date deliveries stood at 95 aircraft. However, deliveries of its 787 Dreamliner remain frozen as Boeing performs inspections and repairs on the twin-aisle jetliners sidelined by production problems for more than a year.

US monthly consumer prices increased by the most in 16-1/2 years in March as Russia’s war against Ukraine boosted the cost of petrol to record highs, cementing the case for a 50 basis points interest rate hike from the Federal Reserve next month. The consumer price index surged 1.2 per cent last month, the biggest monthly gain since September 2005, the Labor Department said on Tuesday (Apr 12). The CPI advanced 0.8 per cent in February. Gasoline prices on average soared to an all-time high of US$4.33 per gallon in March, according to AAA. While petrol was the main driver of inflation last month, food and services such as rental housing also made strong contributions. Russia is the world’s second-largest crude oil exporter. The United States has banned imports of Russian oil, liquefied natural gas and coal as part of a range of sanctions against Moscow for its invasion of Ukraine.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

Click the link to join: https://t.me/stocksbnb

Date: 11 April 2022

For any research-related matters, email: research@phillip.com.sg

For general enquiries, email: talktophillip@phillip.com.sg

or call 6531 1555.

Read the research report(s), available through the link(s) above, for complete information including important disclosures Important Information

Disclaimer

The information contained in this email is provided to you for general information only and is not intended to create any binding legal relation. The information or opinions provided in this email do not constitute investment advice, a recommendation, an offer or solicitation to subscribe for, purchase or sell any investment product. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise.

You should obtain advice from a financial adviser before making a commitment to invest in any investment product or service. In the event that you choose not to obtain advice from a financial adviser, you should assess and consider whether the investment product or service is suitable for you before proceeding to invest.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.