DAILY MORNING NOTE | 13 December 2022

**Do note that the last day of Morning Note Issuance is on 15 December 2022. Morning Note will resume in January 2023**

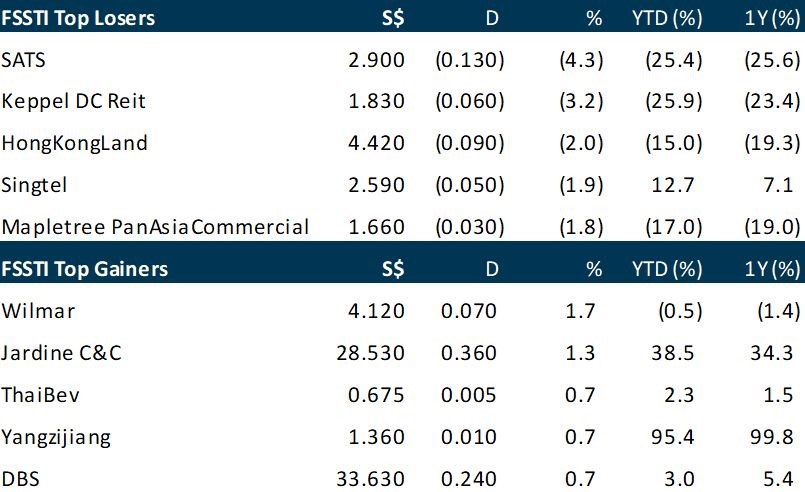

Singapore shares slipped on Monday (Dec 12), the Straits Times Index (STI) retreated 6.31 points or 0.2 per cent to 3,239.66, taking the cue from last Friday’s losses on Wall Street and ahead of a Federal Reserve meeting and inflation data this week. Some 1.23 billion securities worth S$977.59 million were traded on Monday. Losers outpaced gainers with 313 counters ending the day down, and 211 counters up.

Wall Street stocks surged on Monday, regaining some of last week’s losses, as markets showed cautious optimism ahead of a key inflation data release and closely-watched Federal Reserve meeting. Observers expect consumer price increases to slow in November, adding to signs that red-hot inflation is finally easing, while the US central bank is anticipated to announce a smaller interest rate hike after a two-day policy meeting starting Tuesday. The Dow Jones Industrial Average jumped 1.6 per cent to finish at 34,005.04, while the S&P 500 rose 1.4 per cent to land at 3,990.56. The tech-rich Nasdaq Composite Index rose 1.3 per cent as well to 11,143.74.

SG

Total securities turnover on the Singapore Exchange fell 3.2 per cent on the year to S$27.2 billion in November 2022, while total market turnover volume slid 13.2 per cent to 33.9 billion securities. Month on month, the total market turnover value was 18 per cent higher, while volumes rose 17 per cent, according to SGX’s monthly market statistics report released on Monday (Dec 12). The bourse operator noted that record foreign exchange (FX) trading activity drove derivatives volume during the month amid optimism over Asian economies and signs that the US Federal Reserve would ease interest rate hikes. Total derivatives traded volume was up 30 per cent year on year to 23.7 million contracts, the highest amount since March 2022. The daily average volume for derivatives trading was up 26.6 per cent to 1.1 million. Hedging activity on over-the-counter and futures marketplace SGX FX also accelerated in November on US dollar weakness, SGX noted. Meanwhile, total FX futures traded volume jumped 103.8 per cent on the year to an all-time high of four million contracts. The securities daily average value for November stood at S$1.2 billion, down 7.6 per cent on the year and up 7.4 per cent on the month. Volumes, meanwhile, were down 17.1 per cent on the year but up 6.5 per cent month on month.

Singapore Airlines (SIA) will adjust the conversion price of its 1.625 per cent convertible bonds due 2025, from S$5.743 to S$5.6309, the company announced in a Monday (Dec 12) bourse filing. The national carrier will also adjust the conversion price of its zero-coupon mandatory convertible bonds (MCBs) due 2030, from S$4.84 to S$4.7453. Both adjustments account for the interim dividend of S$0.10 per share that the company announced last month for the half year ended Sep 30. The adjusted conversion prices will take effect from Dec 13. SIA had announced the issuance of S$850 million worth of the 1.625 per cent convertible bonds back in 2020, to strengthen its liquidity position against the pandemic challenges. The company had then garnered strong investor interest for the bonds, with the issuance upsized from the initial S$750 million. In 2021, it raised S$6.2 billion from the issuance of the MCBs, which were in their second tranche.

Soilbuild Construction Group has clinched S$140.4 million in new contracts, bringing its total order book to S$492.7 million as at end-October, the company announced in a Monday (Dec 12) bourse filing. The company’s S$492.7 million order book comprises S$384.6 million in construction projects and S$108.1 million in precast supply and delivery projects. SB Procurement, a wholly-owned unit of Soilbuild, has been awarded a contract by the Housing and Development Board for building works at Toa Payoh Neighbourhood 1. The project involves two residential blocks, a multi-storey carpark and a community club. It is scheduled to start in Q4 this year and is set to be completed by Q2 of 2027. Another unit of the company, Soil-Build (Pte.) Ltd, has been awarded a construction contract for piling works at Pasir Ris. This is scheduled to start in Q4 and set to be completed by Q2 2023.

US

US software giant Microsoft will buy a four-per cent stake in the London Stock Exchange Group under a new IT services tie-up, the pair announced on Monday (Dec 12). The long-term partnership focuses “next-generation data and analytics and cloud infrastructure solutions” including artificial intelligence (AI), a statement said. Microsoft will acquire a holding worth £1.5 billion (S$2.49 billion) at current prices, while London Stock Exchange Group (LSEG) committed to spending a minimum of US$2.8 billion on cloud-related services. The tie-up will help LSEG further integrate Refinitiv, the US financial data provider it purchased last year, and boost revenue growth.

Rivian said Monday it was pausing plans to manufacture electric commercial vans in Europe and would “no longer pursue” the agreement it made with Mercedes-Benz just three months ago. “We’ve decided to pause discussions with Mercedes-Benz Vans regarding the Memorandum of Understanding we signed earlier this year for joint production of electric vans in Europe,” Rivian CEO RJ Scaringe said, noting the company was pursuing “the best risk-adjusted returns” on its capital investments. “At this point in time, we believe focusing on our consumer business, as well as our existing commercial business, represent the most attractive near-term opportunities to maximize value for Rivian,” he added. The U.S.-based electric vehicle manufacturer said it remains open to exploring future work with Mercedes-Benz “at a more appropriate time for Rivian.” The companies signed their original memorandum of understanding in September. Mercedes-Benz said Rivian’s decision would not impact the timeline of its electrification strategy or the planned ramp-up of its new electric vehicle manufacturing site in Jawor, Poland. “Exploring strategic opportunities with the team at Rivian in the future remains an option,” Mathias Geisen, the head of Mercedes-Benz Vans, said.

Amgen will buy rare disease drugmaker Horizon Therapeutics for US$26.40 billion, it said on Monday (Dec 12), in its biggest deal ever that gives the biotech company access to blockbuster thyroid eye disease treatment Tepezza. The company will pay US$116.50 in cash for each Horizon share held, a premium of nearly 20 per cent to the stock’s last close. A deal will add several approved drugs to Amgen’s portfolio and could help counter the impact from rising competition for its top-selling arthritis drug, Enbrel, from newer treatments and expected expiry of patents for the therapy in 2029. Sales of Enbrel have declined over the last four quarters, tumbling 14 per cent in the latest reported quarter to US$1.1 billion. The offer values Horizon at US$27.8 billion on a fully diluted basis, according to the company, which includes ordinary shares to be vested. Based on Reuters calculations, it values Horizon at US$26.40 billion.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

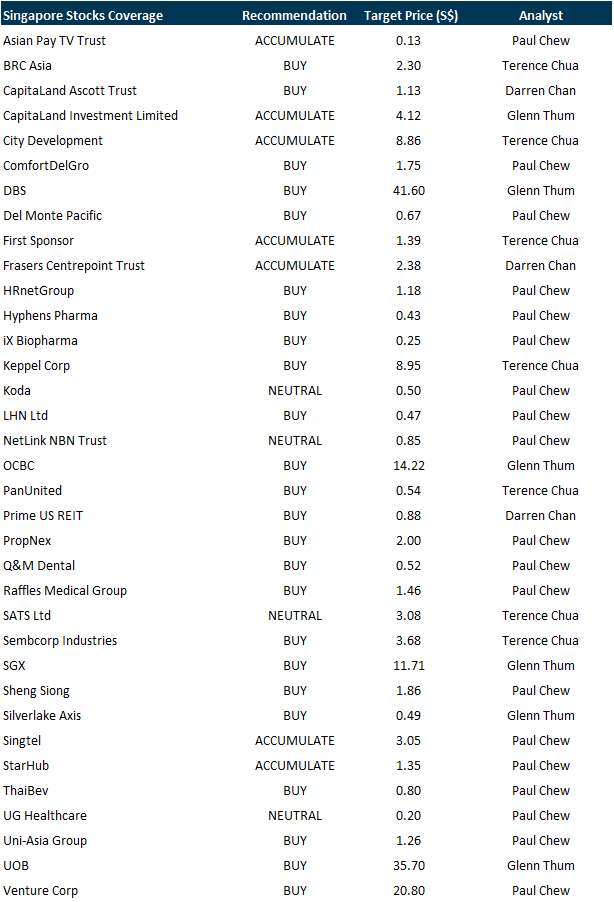

RESEARCH REPORTS

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by NoonTalk Media Limited [NEW]

Date: 13 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3gYzGI2

Guest Presentation by Keppel Infrastructure Trust ( KIT) [NEW]

Date: 15 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3UBLxd4

Guest Presentation by iWoW Technology

Date: 16 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3EqFiDT

Research Videos

Weekly Market Outlook: SGX, DelMonte, LHN, Zoom, City Developments, Zoom, Starhub, SG Weekly & More!

Date: 12 December 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials