DAILY MORNING NOTE | 13 February 2023

Trade of the Day

Analyst: Zane Aw

(Current Price: US$0.625) – TECHNICAL BUY

Buy price: US$0.625 Stop loss: US$0.590 Take profit 1: US$0.665Take profit 2: US$0.720

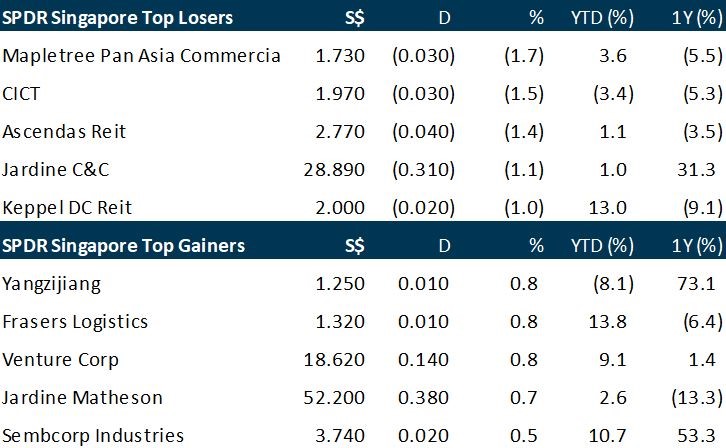

Singapore shares ended the week largely unchanged, as investors took stock of inflation levels and the possibility of future rate hikes by the US Federal Reserve. The Straits Times Index finished Friday’s (Feb 10) trading session with a marginal gain of 0.04 per cent or 1.21 points to 3,360.69. Losers outnumbered gainers 329 to 222, after about 1.2 billion securities worth a collective S$883.7 million changed hands. Jardine Matheson Holdings was the top gainer for the day, rising 0.7 per cent or US$0.38 to US$52.20. The trio of lenders were also among the biggest advancers. UOB added 0.5 per cent or S$0.15 to S$30.55; DBS rose 0.3 per cent or S$0.11 to S$36.03, and OCBC gained 0.4 per cent or S$0.05 to S$13.15. Nio was the biggest loser. The counter slipped 3.8 per cent or US$0.41 to US$10.47. Jardine Cycle and Carriage was another top decliner, falling 1.1 per cent or S$0.31 to S$28.89. Sembcorp Marine was the most actively traded counter on Friday, with some 61.5 million shares changing hands. The stock closed at S$0.135, down 0.7 per cent or S$0.001. Other actively traded counters were Halcyon Agri, The Place Holdings and Golden Agri-Resources.

Petroleum-linked shares rallied Friday (Feb 11) with oil prices, as US stocks closed out a lackluster week with a mixed session. The gains by producers like Chevron and Halliburton, as well as other oil services companies, came after Russia announced it would trim production by 500,000 barrels per day in March after Western countries imposed a price cap over the Ukraine conflict. The rally in energy stocks helped lift both the Dow and S&P 500 to positive sessions even as higher Treasury bond yields weighed on the Nasdaq. The Dow Jones Industrial Average finished at 33,869.27, up 0.5 percent. The broad-based S&P 500 climbed 0.2 percent to 4,090.46, while the tech-rich Nasdaq Composite Index declined 0.6 percent to 11,718.12. All three major indices finished with losses for the week in a pullback after a torrid January as Treasury yields advanced. Among individual companies, ride-hailing firm Lyft plunged more than 36 percent after reporting a US$568.1 million loss in the fourth quarter and projecting lower first quarter revenues than expected. Expedia dropped 8.6 percent as it reported quarterly earnings that missed estimates after hurricanes and winter storms drove up cancelations, crimping revenues.

SG

DBS’ 4Q2022 results beat expectations with net profit of S$2.34bn vs our estimate of S$2.02bn. Bulk of the beat was from stronger than expected net interest income of S$3.28bn (+53% YoY) and net interest margin growth to 2.05% (+62bps YoY). More details to follow after 11.30am analyst call. 4Q22 dividend up 17% YoY to 42 cents with an additional special dividend of 50 cents, total FY22 dividend at 200 cents (+67% YoY).

The board of directors of Sembcorp Marine on Saturday (Feb 11) defended the company’s management personnel, among other things, in response to an extensive list of queries from the Securities Investors Association (Singapore), or Sias, regarding the company’s highly-anticipated proposed merger with Keppel Offshore & Marine (KOM). Sias had questioned if Sembmarine’s board had “critically reviewed” the performance of its management in the past two to five years. Particularly, Sias wanted to know if the company’s management is able to navigate the competitive landscape of the industry as a standalone entity. Sembmarine said it reviews its management performance regularly. The company also said the management has successfully secured a pipeline of new projects worth about S$7 billion in 2022. Sembmarine’s board believes that the proposed combination is the “best and most compelling way forward” for the company to unlock long-term value for its stakeholders. Sembmarine’s EGM will be held at 11 am on Feb 16 by virtual means only.

Thai Beverage (ThaiBev) has reported an ebitda of 13.53 billion baht ($534.0 million) for the 1QFY2023 ended Dec 31, 2022, which is down 7.7% y-o-y. The lower ebitda was due to the lower ebitda across the group’s segments – spirits, beer, non-alcoholic beverage (NAB) and food. During the quarter, ThaiBev’s sales revenue increased by 4.9% y-o-y to 80.90 billion baht as all its segments, except spirits, grew on a y-o-y basis.

Thomson Medical Group has reported earnings of $22.8 million for the 1HFY2023 ended Dec 31, 2022, 82.6% higher than the earnings of $12.5 million in the same period the year before. Earnings per share (EPS) rose to 8.6 cents from the previous period’s 4.7 cents on a fully diluted basis. Revenue for the six-month period increased by 26.6% y-o-y to $184.0 million as revenue from both the hospital and specialised services segments increased. The higher revenues from both segments came from the overall increase in patient loads and higher average bill sizes. The group’s 1HFY2023 ebitda also saw an increase of 40.6% y-o-y to $55.5 million, on the back of higher revenue growth. Results from operating activities increased by 46.4% y-o-y to $45.2 million. During the 1HFY2023, the group reported a share of loss of a joint venture of $286,000. Profit for the period surged by 74% y-o-y to $24.3 million.

The manager of EC World Reit on Sunday (Feb 12) said it has released a portion of its margin deposit – or an aggregate of roughly 198.9 million yuan (S$38.9 million) – from escrow, and utilised the amount to partially repay the outstanding mandatory repayment of its offshore and onshore bank loans. About 140.2 million yuan was put towards the partial repayment of the Reit’s existing offshore bank loans, while 58.6 million yuan was used for the partial repayment of existing onshore bank loans. This arrangement would allow EC World Reit to save on interest payments which would otherwise be incurred on the outstanding loan amounts, the trust said.

LHN has agreed to buy GSM Building in a collective sale for $80 million, with an eye to convert some of the space in this commercial building along Middle Road into serviced apartments as part of its broader expansion into this market. The property, at 141 Middle Road, has a total land area of 1,115.1 sqm with a tenure of 99 years commencing from May 2 1978. The property consists of 33 units, of which 13 are self-occupied and 20 are rented out, respectively, as well as common property. In a filing to the stock exchange on Feb 10, LHN says it intends to convert levels 3 to 6 of the building into serviced apartments. For levels 1 and 2, LHN shall retain the space for commercial use.

RE&S Holdings has reported earnings of $5.55 million in its 1HFY2023 ended December, 61.7% higher compared to the previous corresponding period. Revenue grew by 23.5% y-o-y for 1HFY2023 to $88 million from $71.2 million in 1HFY2022, primarily due to higher contribution from both full-service restaurants (FSR) and quick service restaurants, convenience and others (QSR) segments. This is on the back of the removal of social distancing restrictions, which increased the number of seats for dine-in customers. The revenue growth was also boosted by the opening of three new QSR outlets.

Group revenue of mainboard-listed Yoma Strategic for the quarter ended Dec 31, 2022 rose year on year by 76 per cent to US$35.9 million from US$20.4 million. Topline growth was driven by contributions from the real estate development segment, where revenue grew 96.5 per cent to US$16.7 million from US$8.5 million, in the three months ended December 2021. For the financial services segment, revenue grew 335.7 per cent on year to US$6.1 million from US$1.4 million, following the acquisition of Telenor Group’s 51 per cent interest in Myanmar-based fintech Wave Money in December 2022. However, in the same segment, Yoma Fleet’s revenue continued to be impacted by early lease terminations, contract renewals and extensions at lower rates, and import restrictions. Meanwhile, revenue from Yoma’s food and beverage (F&B) segment continued to grow significantly. Yoma Motors was impacted by import restrictions and challenges with customs clearance for vehicles and spare parts. The company expects robust consumer demand for Yoma Land and Yoma’s F&B businesses, which will contribute positively to its results in upcoming quarters.

US

Oil prices rose more than 2 per cent on Friday (Feb 10) and posted weekly gains of over 8 per cent, as Russia announced plans to reduce oil production in March by 500,000 barrels per day, or about 5 per cent of output, said deputy prime minister Alexander Novak, after the West imposed price caps on the country’s crude and fuel. Brent crude futures rose to settle at $1.89, or 2.2 per cent, to $86.39 a barrel US West Texas Intermediate crude futures (WTI) were up US$1.66, or 2.1 per cent, at US$79.72. Brent posted a weekly gain of 8.1 per cent, while WTI gained 8.6 per cent.

General Motors (GM) signed a deal with GlobalFoundries to lock up production capacity for semiconductors, helping the automaker manage a chip shortage that has hindered auto production for several years. GlobalFoundries (GF), a provider of made-to-order semiconductors, will set aside capacity at its New York plant exclusively for chips destined for GM vehicles. The automaker will tell its chip designer suppliers to use the company’s production to make some of the components it deems essential to its vehicles.

China’s biggest chipmaker Semiconductor Manufacturing International Corp, posted record revenue in 2022, despite ongoing U.S. sanctions, but warned of a more difficult year ahead given a slump in the semiconductor industry. SMIC said Thursday that 2022 revenue totaled $7.2 billion, up 34% year on year while its gross margin stood at a record 38%. That’s the second year of sales growth above 30% for the company. However, SMIC said revenue in the first quarter is forecast to decrease by between 10% and 12% versus the December quarter.

Ford Motor has cut its stake in struggling EV maker Rivian Automotive to 1.15 per cent, a week after the Detroit automaker reported a fall in profit and predicted a tough year ahead. Shares of Rivian, which declined to comment on the matter, were down 3.6 per cent in early trade. Ford, which wrote down the value of its Rivian investment by US$7.4 billion in 2022, has been paring down its stake amid production struggles at the Irvine, California-based company. Ford held a 11.4 per cent stake in Rivian at the end of 2021.

Expedia Group executives gave an optimistic outlook for travel demand in the current quarter, reassuring investors after the company’s fourth-quarter results were weaker than expected. Lodging gross bookings grew 20 per cent in January compared with 2019, chief financial officer Julie Whalen said. Excluding the impact from Hurricane Ian in October and December’s winter storms, monthly growth reached high single digits in the fourth quarter, she said. Though sales increased 15 per cent to US$2.62 billion last quarter, that missed the average analyst’s estimate of US$2.7 billion. Gross bookings, the total value of transactions adjusted for cancellations and refunds, came in at US$20.5 billion, short of Wall Street’s average forecast for US$21.1 billion. Adjusted earnings before interest, taxes, depreciation and amortisation for the quarter came in at US$449 million, compared with the average analyst estimate of US$559 million. Adjusted EBITDA for the quarter came in at US$449 million, compared with the average analyst estimate of US$559 million. Adjusted earnings per share were US$1.26, compared with estimates for US$1.77.

ByteDance Ltd., the China-based owner of TikTok, is starting to snare market share in the virtual-reality headset space that Meta Platforms Inc. has identified as critical to its future. Two years ago, ByteDance bought Pico, a Chinese startup that makes VR headsets. Pico’s headset shipments have since jumped, turning it into a small but fast-rising No. 2 to Meta in the global market, according to industry data, even though Pico doesn’t sell its consumer headsets in the U.S. Meta held 90% of the market share about a year ago, according to research firm International Data Corp. By the third quarter of 2022, its market share had dropped to about 75%. Market share for Pico more than tripled over the same period to about 15%. No other VR headset maker held more than 3% of the market.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

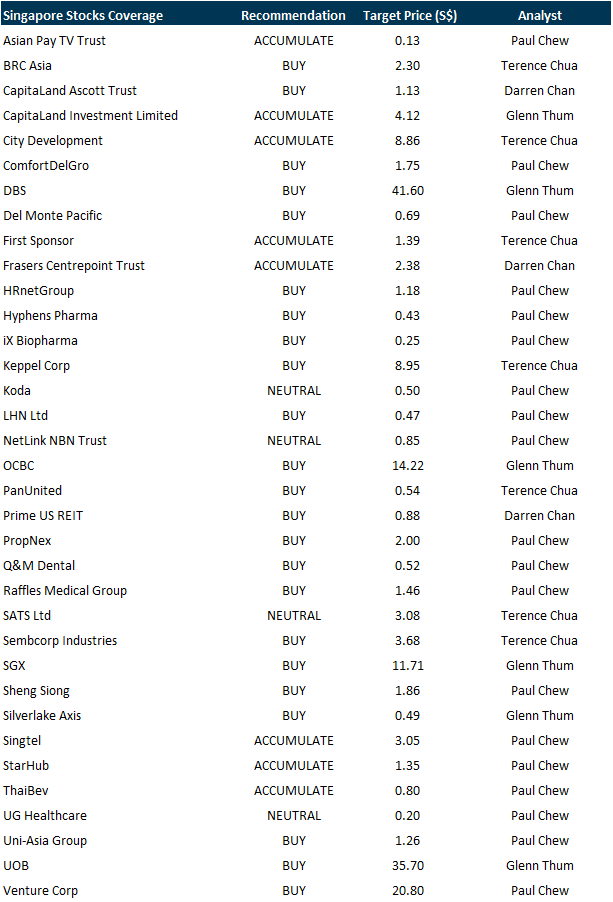

Thai Beverage PLC – A slow start to FY23

Recommendation: ACCUMULATE (Downgraded); TP S$0.80, Last close: S$0.70; Analyst Paul Chew

– 1Q23 revenue/EBITDA was below expectations at 27%/and 25% of our FY23e forecasts, respectively. 1Q is a seasonally stronger quarter.

– 1Q23 spirits volume contracted 15% YoY to 175mn litres after record volumes a year eariler, which enjoyed trade-inventory loading ahead of price increases.

– Our FY23e earnings are maintained. We expect earnings to recover with the re-opening of borders in Thailand, event-driven spending from the election and improvement in economic conditions. Our BUY recommendation is downgraded to ACCUMULATE following the recent share price performance. The target price of S$0.80 is unchanged at 18x FY23e core earnings, its 5-year average.

Singapore Exchange Limited – Derivatives and treasury income boost growth

Recommendation: BUY (Maintained), Last done: S$9.20

TP: S$11.71, Analyst: Glenn Thum

– 1HFY23 revenue of S$571mn met our estimates, at 48% of FY23e, and adjusted PATMI of S$237mn also met our estimates, at 49% of FY23e. 1HFY23 DPS was unchanged at 16 cents.

– Treasury income surged 124% YoY to S$47mn, mainly due to higher yield on margin balances from the higher interest rate environment.

– FICC grew 35% YoY, led by increased volumes in commodity and currency derivatives and higher contribution from OTC FX.

– We maintain BUY with an unchanged target price of S$11.71. Our estimates remain unchanged, and our target price remains pegged to +2SD of its 5-year mean or 26x P/E. Catalysts include continued growth from derivatives volumes and fees, and higher treasury income as the higher interest rates start to kick in. Expense growth for FY23e was also guided down by management and expected to be at the lower end of the range (7%).

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Paragon REIT [NEW]

Date: 17 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3ZNn4W0

Guest Presentation by Keppel DC REIT [NEW]

Date: 17 February 2023

Time: 3pm – 4pm

Register: https://bit.ly/3CYgrGr

Guest Presentation by First REIT Management Limited [NEW]

Date: 23 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3GY2tp8

Research Videos

Weekly Market Outlook: Spotify, Apple Inc, SG Banking Monthly, Technical Analysis, SG Weekly & More

Date: 6 February 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials