DAILY MORNING NOTE | 13 March 2023

Technical Pulse: SPDR S&P Regional Banking ETF (Current Price: US$50.69)

Analyst: Zane Aw

Resistance Zone: US$54.00-57.30 Support Zone: US$36.30-40.30

Technical Pulse: SPDR Select Sector Fund – Financial (NYSEARCA: XLF (Current Price: US$32.93)

Analyst: Zane Aw

Resistance Zone: US$33.20-34.60 Support Zone: US$28.40-30.00

Technical Pulse: JP Morgan Chase & Co. (NYSE: JPM) (Current Price: US$133.65)

Analyst: Zane Aw

Resistance Zone: US$135.00-138.30 Support Zone: US$122.20-128.20

Technical Pulse: Bank of America Corporation (NYSE: BAC) (Current Price: US$30.27)

Analyst: Zane Aw

Resistance Zone: US$31.10-32.70 Support Zone: US$23.50-26.20

Technical Pulse: Citigroup, Inc. (NYSE: C) (Current Price: US$48.34)

Analyst: Zane Aw

Resistance Zone: US$52.60-55.90 Support Zone 1: US$42.50-47.00

Support Zone 2: US$35.00-39.20

Technical Pulse: Wells Fargo & Company (NYSE: WFC) (Current Price: US$41.36)

Analyst: Zane Aw

Resistance Zone: US$41.60-44.00 Support Zone: US$30.90-36.40

Week 11 equity strategy: The Silicon Valley Bank collapse just clipped the Fed’s ability to raise rates. This is not a credit event but a collapse in bond prices. The bank borrowed from depositors and bought the safest assets (on paper) such as government and mortgage bonds. The spike in rates and bond losses cratered its balance sheet triggering panic among depositors. The contagion is enormous in the US, which the Fed cannot ignore. The direct impact is business failures from loss of deposits and the inability to refinance loans. The indirect impacts are bank runs across other regional banks, tighter credit standards and the selling of other assets in the hunt for liquidity. This too shall pass and can pass faster if Fed discounts SVB bonds at book value or small discount. US bank ETFs look like an opportunity.

There are two key distinctions with Singapore banks. Firstly, SVB held more assets as securities at 57%, more than triple Singapore banks 15%. Singapore banks also face bond losses, but a higher portion of their assets were variable rate loans where they could pass on the higher interest rates. Secondly, while quality or permanency of deposits is difficult to ascertain, SVB deposits almost tripled over three years. In comparison, Singapore banks only rose 22%. The sudden spike for SVB does suggest the immaturity of the deposits.

Singapore’s stocks dropped 1.2 per cent on Friday. The banking trio slid between 0.9 and 2.2 per cent. The shares declined by 1.7 per cent over the week.

Wall Street’s indexes fell on Friday (Mar 10) as investors stressed out about the health of US banks broadly after regulators had to close a high-profile lender to the technology sector, overshadowing the February jobs report. The Dow Jones Industrial Average fell 356 points, or 1.1 per cent, to 31,898.86, the S&P 500 lost 59.09 points, or 1.5 per cent, to 3,859.23 and the Nasdaq Composite dropped 215.77 points, or 1.9 per cent, to 11,122.58.

SG

OCBC and UOB’s Central Provident Fund Investment Account (CPFIA) customers using their ordinary account (OA) savings will soon be able to buy Treasury bills (T-bills) online. The start date is Mar 31 for OCBC customers and Apr 22 for UOB customers.

Thai Beverage is seeking to delist its subsidiary, Oishi Group, from the Stock Exchange of Thailand. On March 10, the food and beverage (F&B) group announced that its board has approved the group’s plan to make a tender offer of all the 76.3 million shares in Oishi Group at 59 baht ($2.29) per share.

Southern Alliance Mining is expected to report a net loss for the six months ended Jan 31, the Malaysian-based iron ore producer said in a profit guidance issued on Friday (Mar 10). The Catalist-listed company attributed the losses for H1 FY2023 to a decrease in iron ore production as a result of intense overburden removal activities, lower sales volume of iron ore, coupled with a lower average realised selling price for iron ore concentrate and iron ore tailing.

Construction services provider Sysma Holdings posted a net loss of S$2.7 million for the six months ended Jan 31, 2023, due in part to higher costs. The H1 losses represent a reversal from a net profit of S$3.1 million posted in the corresponding period a year ago. No dividend was declared or recommended for the financial period ended Jan 31, 2023, “to conserve cash for the challenging environment ahead”, said the group.

Mainboard-Listed Sunright reported a narrowed net loss of S$1.3 million for the six months ended Jan 31, 2023, less than the net loss of S$1.5 million in the corresponding year-ago period. The semiconductor company attributed the decline in revenue to a lower volume for burn-in and test services, as well as a scale-down in electronic manufacturing services. The board has not recommended an interim dividend because of the losses.

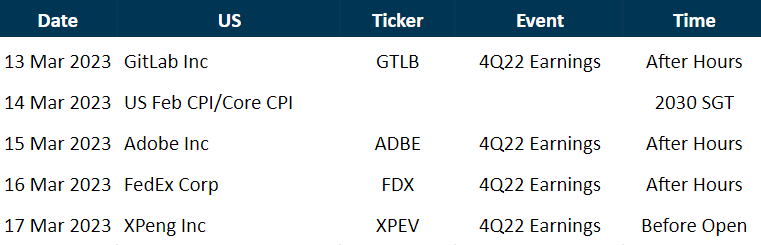

US

Nonfarm payrolls increased by 311,000 jobs last month, beating estimates of 205,000. Average hourly earnings rose 0.2 per cent last month after gaining 0.3 per cent in January. That raised the year-on-year increase in wages to 4.6 per cent from 4.4 per cent in January. The unemployment rate rose to 3.6 per cent in February from 3.4 per cent in January, which was the lowest since May 1969.

The fallout from the collapse of Silicon Valley Bank (SBV) is beginning to spread around the world. Startup founders in California’s Bay Area are panicking about access to money and paying employees. Fears of contagion have reached Canada, India and China. In the UK, SVB’s unit is set to be declared insolvent, has already ceased trading and is no longer taking new customers. On Saturday (Mar 11), the leaders of roughly 180 tech companies sent a letter calling on UK Chancellor Jeremy Hunt to intervene.

Comment: Singapore banks differ from SVB as majority of assets are in loans, Singapore banks ratio of securities to assets is 15% compared to SLB’s 57%. While Singapore banks also face bond losses, the larger composition of variable rate loans results in the ability to pass on the higher interest rates to customers. Furthermore, while the quality or permanency of deposits is difficult to ascertain, SVB deposits almost tripled over three years. In comparison, Singapore banks only rose 22%. The sudden spike for SVB does suggest the immaturity of the deposits. While SVB moved majority of their fresh deposits into securities, Singapore banks’ focus was kept on loans growth and with the rise in interest rates, the higher funding costs could be passed on directly to their customers as majority of the loans were on a floating rate.

Glenn Thum

Research Analyst

glennthumjc@phillip.com.sg

Tesla is recruiting Chinese and Korean materials suppliers to help lower the cost and boost the energy of its newest battery cells, even as the company struggles with battery-related performance and production issues that have helped delay the launch of its futuristic Cybertruck, according to people familiar with the plans. Tesla has tapped China’s Ningbo Ronbay New Energy and Suzhou Dongshan Precision Manufacturing to help trim materials costs as it ramps up production of 4680 battery cells in the US.

Meta Platforms is exploring plans to launch a new social media app in its bid to displace Twitter as the world’s “digital town square”. “We’re exploring a standalone decentralized social network for sharing text updates. We believe there’s an opportunity for a separate space where creators and public figures can share timely updates about their interests,” a Meta spokesperson told Reuters in an emailed statement. Meta’s app will be based on a similar framework that powers Mastodon, a Twitter-like service that was launched in 2016.

Ford Motor said on Friday (Mar 10) it was on track to resume production of F-150 Lightning vehicles on Monday after the No 2 US automaker recalled 18 electric trucks due to a battery cell manufacturing defect. Ford said it will replace the battery packs in the 18 vehicles, but said it is not aware of any fires or any injuries related to the recall.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Singapore Banking – The collapse of Silicon Valley Bank

Recommendation: Overweight (Maintained)

Analyst: Glenn Thum

– On 8 March, Silicon Valley Bank (SVB) announced a US$2.25bn capital raising exercise following losses on the sale of securities. Customers reacted by attempting to withdraw US42bn of deposits. On 10 March, SVB was closed and taken over by the authorities due to inadequate liquidity and insolvency.

– Singapore banks ratio of securities to assets is 15% compared to SLB’s 57%. The larger composition of variable rate loans results in the ability to pass on the higher interest rates to customers.

– Maintain OVERWEIGHT. We remain positive on Singapore banks. Bank dividend yields are attractive at 5.7% with possible upside surprise due to excess capital ratios and push towards higher ROEs. Singapore banks differ from SVB as majority of assets are in loans and higher interest rates can be passed on to customers.

TDCX Inc. – Near-term pain expected

Recommendation : ACCUMULATE (Maintained); TP: US$12.10, Last Close: US$10.40

Analyst: Jonathan Woo

– 4Q22 results were in line with expectations. FY22 revenue/PATMI was at 100%/97% of our FY22e forecasts. Earnings were hurt by S$6mn FX loss on cash and receivables.

– 14% YoY revenue growth driven by double-digit growth in the digital advertising vertical, overall net revenue retention rate of 117%.

– Adj. EBITDA margin declined 8% due to over-hiring and continued investments to support business growth. Soft FY23e revenue guidance of 3-8% YoY growth.

– We cut FY23e revenue/EBITDA estimates by 8%/16% to reflect ongoing macro challenges with clients reducing headcount, and a contraction in margins due to continued expenses to support business expansion. TDCX’s ability to generate healthy cash flows is intact – net cash from operations grew 59% in FY22. Long-term tailwinds in the expanding BPO market should also benefit TDCX. We maintain an ACCUMULATE recommendation with a reduced DCF (WACC 10.4%, g 3%) target price of US$12.10 (prev. US$14.80).

Q & M Dental Group Ltd – Pursuing operating leverage post-record expansion

Recommendation: BUY (Maintained); TP S$0.47 Last close: S$0.355; Analyst Paul Chew

Analyst: Jonathan Woo

– Revenue met expectations but earnings were below. FY22 revenue and adjusted PATMI were 99%/90% of our forecast. The significant drop in COVID-19 related earnings and higher expenses in the development of AI guided clinical support systems were the drag.

– Our adjusted PATMI excludes S$5.1mn of impairment of inventories (S$4.9mn) and plant and equipment (S$0.2mn) incurred in 4Q22.

– We are lowering our FY23e PATMI by 17% to S$17.9mn. After increasing the number of clinics by a record 34 (or 30%) over the past two years, the focus is to raise utilisation. Q&M continues to recruit new dentists to fill its existing chain of clinics and upgrade the skills of dentists. Our target price is lowered to S$0.47 (prev. S$0.52). We value the company at 25x PE FY22 earnings, in line with industry peers. Listed associate, Aoxin Q & M Dental (S$0.115, Not Rated), is valued at market price with a 20% discount.

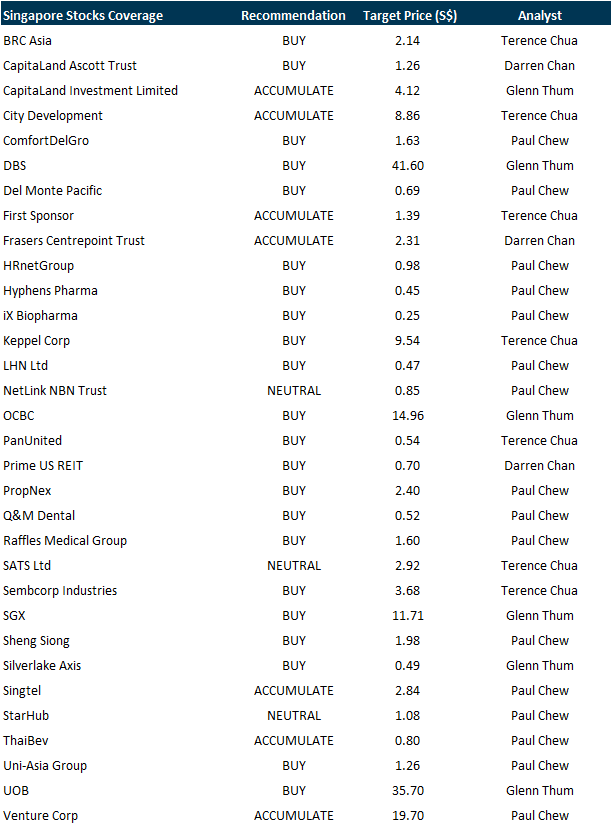

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Enviro-Hub Holdings Ltd [NEW]

Date: 14 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3KBprpA

Guest Presentation by Luminor Financial Holdings Ltd [NEW]

Date: 15 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3kj6LjP

Guest Presentation by Meta Health Limited [NEW]

Date: 16 March 2023

Time: 3pm – 4pm

Register: https://bit.ly/41oikGX

Guest Presentation by Keppel Pacific Oak US REIT (KORE) [NEW]

Date: 23 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3XY2n7v

Research Videos

Weekly Market Outlook: Block Inc, PropertyGuru, Sheng Siong, PropNex, Raffles Medical, Tech Analysis

Date: 6 March 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials