Daily Morning Note – 14 February 2022

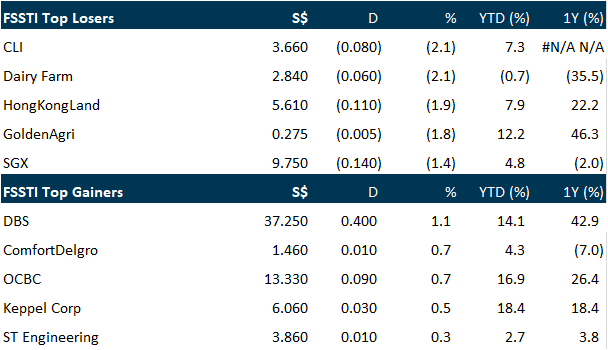

After 4 consecutive days of gains this week, Singapore shares ended the last trading day of the week largely unchanged, due in part to inflation levels in the US for January hitting the highest levels in 40 years with prices rising 7.5 per cent from January 2021. The benchmark Straits Times Index inched up by a negligible 0.03 per cent or 0.95 point to 3,428.95. Daily turnover came in at 1.2 billion securities worth S$1.4 billion, with decliners outnumbering advancers 255 to 184, for the first time this week. Across the region, markets mostly ended the day with losses. The Hang Seng Index was down 0.1 per cent; the SSE Composite Index fell 0.7 per cent, and the Kospi shed 0.9 per cent.

Wall Street stocks ended sharply lower on Friday (Feb 11) for the second straight session, as investors fretted about deepening tensions between Russia and Ukraine. Nine of the 11 major S&P 500 sector indexes declined, led by technology, down 3 per cent, and consumer discretionary, down 2.8 per cent. The energy sector index surged 2.8 per cent as oil prices hit 7-year highs. The Dow Jones Industrial Average fell 1.43 per cent to end at 34,738.06 points, while the S&P 500 lost 1.90 per cent at 4,418.64.

Stocks to watch: Hatten Land

SG

Malaysian property developer Hatten Land narrowed losses to RM30.7 million (S$9.88 million) for the half year ended Dec 31, 2021, from a net loss of RM42.4 million from a year ago. While revenue for the second quarter fell 67 per cent from RM9.7 million to RM3.2 million because of lower sales amid the pandemic, other income for the quarter went up by RM12 million, due mainly to higher overdue interest and forfeiture income charged to purchasers, management fees charged to third-party property management office and share of profit from a rental sharing scheme, the group said in a bourse filing on Sunday (Feb 13). For the quarter ended Dec 31, 2021, net loss was reduced to RM15.3 million, from RM27.1 million in the year-ago period. The group’s loss per share for H1 2022 stood at 1.86 sen. For Q2 FY22, this translates to 0.92 sen.

Singapore continues to lead the Asia ex-Japan region as the largest Reit exchange traded fund (ETF) market following the listing of CSOP iEdge S-Reit Leaders ETF and the UOB APAC Green Reit ETF on the Singapore Exchange last year. Together with the two new listings, the 5 Singapore-listed Reit ETFs now have combined assets under management (AUM) of close to S$800 million, which has more than doubled since January 2020. The 2 ETFs with 100 per cent focus on S-Reits – Lion-Phillip S-Reit ETF and CSOP iEdge S-Reit Leaders ETF – recorded a combined AUM of S$353 million while the other 3 ETFs which offer Asia and Asia-Pacific exposure – NikkoAM-StraitsTrading Asia Ex Japan Reit ETF , Phillip SGX APAC Dividend Leaders Reit ETF and UOB Asia Pacific (APAC) Green Reit ETF – recorded S$437 million of combined AUM. Retail investors, which net bought (note that net buy/sell amount is derived by subtracting total sell amount from total buy amount) over S$1 billion of S-Reits in 2021, have been a key driver of the overall S-Reits sector fund flow activities.

Mainboard-listed ST Engineering is positioned to capture the recovery in the aviation sector that is expected in 2023 to 2024 as it expands its capabilities in maintenance, replacement and overhaul (MRO), aircraft components and passenger-to-freighter conversions. The group will flex its muscles at the upcoming Singapore Airshow 2022, giving trade visitors a better understanding of its aviation solutions ranging from design to MRO to asset management. It is the show’s largest exhibitor, with almost 100 exhibits organised around the 3 clusters of aviation, defence and smart city at the biennial aviation event that will take place from Tuesday (Feb 15) to Friday. ST Engineering’s wholly-owned aviation asset management unit is in a 50-50 joint venture (JV) for freighter aircraft leasing with state investor Temasek, with targets to build a US$600 million portfolio value within 5 years, investing in passenger aircraft to be converted into highly efficient freighters.

US

Intel on Friday (Feb 11) launched a new chip for blockchain applications such as Bitcoin mining and minting non-fungible tokens (NFT) to cash in on the rising usage of cryptocurrencies. The chip will ship later this year and the first customers include Block, the Jack Dorsey-led firm that recently changed its name from Square to highlight its growing focus on the blockchain. Blockchains serve as public ledgers that keep records of transactions on a network of computers and have grown in prominence in recent years. Their rise has also triggered a buzz around words like “Web.3” and “NFTs” that tout the decentralisation of technologies.

Apple is bumping the pay of many US retail employees in the face of a tightening labour market, inflation woes and complaints from some staffers about working conditions during the Covid-19 pandemic. The iPhone maker announced the pay increases this week during store briefings and individual meetings with employees, according to people with knowledge of the matter. The increases are catered at least in part to employees who have worked at the company prior to the pandemic’s start in 2020 and are designed to better align veteran staff with more recent hires. The raises, which have ranged from 2 to 10 per cent depending on store location and role, are going to salespeople, Genius Bar technical support staff and some senior hourly workers, said the people, who asked not to be identified because the matter is private. The increases don’t apply to all employees, and not all stores have been notified of the changes yet. A representative for Cupertino, California-based Apple declined to comment on the raises, which are set to take effect this month. The increases are separate from the company’s normal annual raises, which typically take place in October to coincide with the end of its fiscal year.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

StarHub Limited – Upfront investments to drag FY22e earnings

Recommendation: NEUTRAL (Maintained); TP S$1.35, Last close: S$1.33; Analyst Paul Chew

– 4Q21 revenue met our expectations. EBITDA beat estimates at 109% of our FY21 forecast.

– Operating expenses declined 8% YoY in 4Q21 led by lower content cost, dealer commissions, marketing and staff cost. FY21 FCF was a record $485mn.

– StarHub guided a steep decline in service margins from 30% in FY21 to at least 20% in FY22e. StarHub will be investing in technology OPEX, staff cost and maintenance for its transformation road map of growth (DARE+). Another trigger for higher cost is electricity expenses. CAPEX to sales will rise from 4% to 12-15% of sales.

– We cut FY22e EBITDA by 22%. The NEUTRAL recommendation is maintained with a higher target price of S$1.35 (previous S$1.24). Our valuation is raised from 6x to 8x FY22e EV/EBITDA due to appreciation in peer valuation. We raised mobile ARPU expectations by 14% for FY22e as roaming revenue begins to normalise.

Singapore Exchange Limited – Growth led by newly acquired businesses

Recommendation: Neutral (Maintained), Last Done: S$9.75

TP: S$10.78, Analyst: Glenn Thum

– 1HFY22 revenue was slightly below our estimates, at 44% of FY22e, while earnings met our estimates, at 50% of our FY22e. Variance came from lower-than-expected equity and FICC revenue.

– FICC and DCI grew 15%/3% YoY, led by newly acquired businesses, BidFX and Scientific Beta, respectively.

– Excluding treasury income, revenue was up 6% YoY, lifted by higher trading and clearing revenues from equity derivatives, currencies, and commodities.

– Lower yields dragged down equity derivatives treasury income. Equities – Cash & Derivatives was 5% lower YoY as equity derivatives volume declined 4%.

– Maintain NEUTRAL with unchanged target price of S$10.78. Our TP is pegged to 25x FY22e P/E, +2SD of its 5-year mean. Catalysts include continued growth from new acquisitions and higher treasury income as economic conditions improve.

BRC Asia – Strong start to FY22

Recommendation: Buy (Maintained), Last Done: S$1.68

Target price: S$1.84, Analyst: Terence Chua

– 1Q22 net profit exceeded our expectations. We believe the beat came from higher volumes delivered. Orderbook stands at $1.3bn.

– Significant deleveraging of Group’s balance sheet as it saw a $132mn cash inflow for the quarter.

– The Building and Construction Authority (BCA) has upgraded forecasts of construction demand for 2022 by 3.5%. Steel rebar demand is forecasted to grow ~22% to 1mn-1.2mn tonnes in tandem with the overall construction sector recovery.

– Maintain BUY with an unchanged target price of S$1.84. Our TP is based on 11x FY22e P/E, still at a 15% discount to the 10-year historical average, on account of the uncertain environment. Catalysts expected from higher foreign-worker inflows to Singapore.

Click the link to join: https://t.me/stocksbnb

For any research-related matters, email: research@phillip.com.sg

For general enquiries, email: talktophillip@phillip.com.sg

or call 6531 1555.

Read the research report(s), available through the link(s) above, for complete information including important disclosures Important Information

Disclaimer

The information contained in this email is provided to you for general information only and is not intended to create any binding legal relation. The information or opinions provided in this email do not constitute investment advice, a recommendation, an offer or solicitation to subscribe for, purchase or sell any investment product. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise.

You should obtain advice from a financial adviser before making a commitment to invest in any investment product or service. In the event that you choose not to obtain advice from a financial adviser, you should assess and consider whether the investment product or service is suitable for you before proceeding to invest.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.