DAILY MORNING NOTE | 14 July 2022

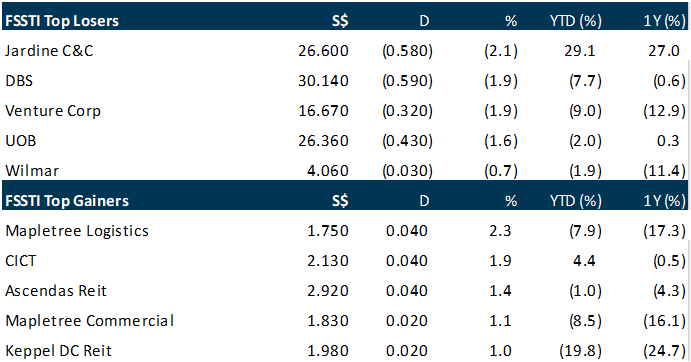

The Straits Times Index (STI) ended down 0.5 per cent or 17.08 points at 3,128.69 amid a mixed regional showing on Wednesday (July 13). Advancers beat decliners 231 to 224 in the broader Singapore market, with 1.09 billion securities worth S$1 billion changing hands during the session. In Japan, the benchmark Nikkei 225 index was up 0.5 per cent, rebounding from sharp falls the previous day. South Korea’s Kospi rose 0.47 per cent as the central bank raised interest rates within expectations. Hong Kong’s Hang Seng Index shed 0.2 per cent, the Kuala Lumpur Composite Index lost 1 per cent, while the Jakarta Composite Index fell 1.2 per cent.

Wall Street’s main indexes opened sharply lower on Wednesday (Jul 13) after hotter-than-expected inflation data fuelled bets that the US Federal Reserve will hike interest rates aggressively to tame surging prices. The Dow Jones Industrial Average fell 237.70 points, or 0.77 per cent, at the open to 30,743.63. The S&P 500 opened lower by 39.13 points, or 1.02 per cent, at 3,779.67, while the Nasdaq Composite dropped 208.18 points, or 1.85%, to 11,056.55 at the opening bell.

SG

Food solutions and gateway services provider SATS is divesting its 49 per cent interest in Brahim’s SATS Investment Holdings (BSIH) to Dewina Brahim’s Holdings for RM10 million or some S$3.2 million. BSIH holds a 70 per cent interest in Malaysian in-flight caterer Brahim’s SATS Food Services (BSFS), with the remaining 30 per cent interest held by Malaysian Airlines. Malaysia-based investment company Brahim’s Holdings, which delisted from the Bursa Malaysia in June 2022, owns the remaining 51 per cent stake in BSIH. In a bourse filing on Wednesday (Jul 13), SATS said the decision to sell its BSIH shares was made “following a comprehensive review of the current market position and challenging operating circumstances of BSFS, and the strategic value and financial significance of BSFS to the company”. As at Mar 31, sale shares of BSIH amounted to an attributable unaudited book value and net tangible asset value of about negative RM47.7 million. Based on SATS’ annual report for FY2021 to FY2022, the cost of investment for BSIH shares held by the group’s investing unit SATS Investments is S$49.1 million as at end-March. The sale transaction is slated for completion within 60 days from the date of SATS’ share purchase agreement, which was entered into with Dewina Brahim’s and Brahim’s Holdings on Jul 12. It is not expected to have a material impact on SATS’ net tangible assets nor consolidated earnings per share for the current financial year. Shares of SATS were trading S$0.02 or 0.5 per cent lower at S$4.01 as at 1.35 pm on Tuesday, after the announcement was made.

Mainboard-listed ComfortDelGro Corporation is acquiring Irish coach operator GoBus for 12 million euros (S$17 million), a move that will catapult it to be the third-largest inter-city coach operator in the country. Acquiring through its wholly-owned unit ComfortDelGro Irish Citylink, the Singapore transport behemoth will get a fleet of 31 buses and 3 inter-city coach routes, namely, the Galway-Dublin Express, the Cork-Dublin Express and the Galway-Ballina Express. These routes have been experiencing “strong” commuter demand in recent months, with the Cork-Dublin route already operating at pre-pandemic levels, ComfortDelGro said in its regulatory filing on Wednesday (Jul 13). The purchase price was arrived at on a “willing buyer willing seller” basis following arms’ length negotiations, taking into account factors including projected performance of Evobus and Coach based on relevant historical analysis, ComfortDelGro said. Evobus and Coach operates the GoBus coach service. ComfortDelGro Irish Citylink offers a range of services in Galway, Dublin, Cork, Limerick, Clifden, Loughrea, Athlone and Ballinasloe. Currently, the company operates a fleet of 33 buses and transports over 28,000 people a week across all routes, and is forecast to reach a ridership of more than 35,000 by end-2022. ComfortDelGro shares closed unchanged at S$1.42 on Wednesday, before the announcement was made.

Sinarmas Land is selling a wholly-owned subsidiary that owns a freehold commercial property in London for an estimated price of £247.5 million (S$414.2 million). The property company stated in its statement filed to the Singapore Exchange on Wednesday (Jul 13) that its wholly-owned subsidiary SML Victoria has entered into a sale and purchase agreement with LTH Property Holdings 3 for the divestment of Horseferry Property. Horseferry Property owns the freehold commercial property at 33 Horseferry Road in London. The £247.5 million price was determined on a willing buyer willing seller basis, taking into account factors including recent transaction prices of similar properties in the same location, Sinarmas Land stated. A cash deposit of 20 per cent of the sale price was received upon signing the agreement, with the balance payable on completion, which is expected to take place in early August. The proposed disposal provides an opportunity for Sinarmas Land to realise an “attractive” rate of return on its investment, the property company noted, without elaborating on the return rate. However, the company acquired the building in 2017 for £188.6 million, according to an earlier Business Times report. Sinarmas Land closed flat at S$0.195 on Wednesday, before this proposed divestment was announced.

A Keppel consortium comprising Singapore-listed Keppel Infrastructure Trust, Keppel Infrastructure Holdings and Keppel Asia Infrastructure Fund has been selected as the preferred bidder to acquire a major integrated waste management player in South Korea. Keppel Infrastructure Fund Management, the trustee-manager of Keppel Infrastructure Trust, said in a regulatory filing on Wednesday (Jul 13) that the group, as the preferred bidder, will enter into negotiations to finalise the sale-and-purchase agreement for the entire stake in Eco Management Korea Holdings. Eco Management Korea Holdings provides nation-wide waste management services in the North Asian nation. There is no certainty or assurance that the transaction will materialise or be concluded, Keppel Infrastructure Fund Management said, without elaborating on the acquisition price. Keppel Infrastructure Trust units at market close were trading 1.77 per cent higher at S$0.575 on Wednesday, before this announcement was made.

US

US inflation accelerated in June by more than forecast, underscoring relentless price pressures that will keep the Federal Reserve on track for another big interest-rate hike later this month. The consumer price index rose 9.1 per cent from a year earlier in a broad-based advance, the largest gain since the end of 1981, Labor Department data showed on Wednesday (Jul 13). The widely followed inflation gauge increased 1.3 per cent from a month earlier, the most since 2005, reflecting higher gasoline, shelter and food costs. Economists projected a 1.1 per cent rise from May and an 8.8 per cent year-over-year increase, based on the Bloomberg survey medians. This was the fourth-straight month that the headline annual figure topped estimates. The so-called core CPI, which strips out the more volatile food and energy components, advanced 0.7 per cent from the prior month and 5.9 per cent from a year ago, above forecasts. Treasury yields and the dollar jumped, while US stock futures fell following the report. The red-hot inflation figures reaffirm that price pressures are rampant and widespread throughout the economy and continue to sap purchasing power and confidence. That will keep Fed officials on an aggressive policy course to rein in demand, and adds pressure to President Joe Biden and congressional Democrats whose support has slumped ahead of midterm elections.

Oil prices rose modestly on Wednesday even after US oil inventories rose and after US inflation figures bolstered the case for another big Federal Reserve interest rate increase. Brent crude settled up 8 cents at US$99.57 a barrel, while US West Texas Intermediate crude gained 46 cents to US$96.30 a barrel. Global benchmark Brent is down sharply since hitting US$139 in March, which was close to the all-time high in 2008, as investors have been selling oil of late on worries that aggressive rate hikes to stem inflation will slow economic growth and hit oil demand. Prices fell by more than 7 per cent on Tuesday in volatile trade to settle below US$100 for the first time since April, and are in an oversold condition based on the relative strength indicator, a measure of market sentiment.

Netflix said on Wednesday (Jul 13) it has selected Microsoft as technology and sales partner for its planned ad-supported subscription offering, as the streaming giant looks to plug slowing subscriber growth by rolling out a cheaper plan. Shares of Netflix rose 2 per cent to US$178.06 on the news. Netflix said in April that it would introduce a new, lower-priced version of its service in a bid to attract more subscribers. The announcement came as the pioneering subscription service posted its first subscriber loss in more than a decade, and projected deeper losses to come. Chief operating officer Greg Peters said in a blog post that Netflix chose Microsoft because of its ability to innovate, as well as for its strong privacy protections. “It’s very early days and we have much to work through. But our long-term goal is clear. More choice for consumers and a premium, better-than-linear TV brand experience for advertisers,” Peters said. Microsoft is expected to power Netflix’s ad sales.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

Upcoming Webinars

Strategy & Stock Picks (US, HK & CN)

Date: 16 July 2022

Time: 1pm – 3.30pm

Register: https://bit.ly/3acvOQm

Guest Presentation by Keppel DC REIT

Date: 28 July 2022

Time: 2.30pm – 3.30pm

Register: https://bit.ly/3uLBo3f

Guest Presentation by Pan-United Corporation Limited

Date: 5 August 2022

Time: 11am – 12pm

Register: https://bit.ly/3OFbJ41

Guest Presentation by A-Sonic Group

Date: 11 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3PmoIrl

Guest Presentation by Meta Health Limited (META)

Date: 24 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3nYZXWx

Research Videos

Weekly Market Outlook: The Place Holdings, Uni-Asia Group Ltd, SG Banking Monthly, SG Weekly

Date: 4 July 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials