DAILY MORNING NOTE | 14 October 2022

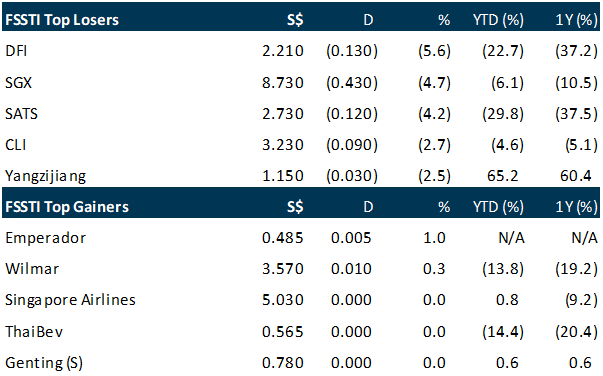

Singapore stocks extended a losing streak for the sixth day, ahead of US inflation data, with the benchmark Straits Times Index (STI) closing at a 19-month low. The STI fell 1.4 per cent or 42.74 points to close at 3,040.45 on Thursday (Oct 13), the lowest closing level since March 2021. Just two STI counters ended the day in the black. Emperador rose 1 per cent to close at S$0.485, finishing as the top index performer. Meanwhile, DFI Retail Group slid 5.6 per cent to US$2.21 to end as the biggest STI decliner. Across the broader market, losers outnumbered gainers 357 to 179 after 1.6 billion securities worth S$1.3 billion changed hands. Local tech manufacturers were among the biggest losers in the broader market, amid reports that Intel was planning to cut thousands of jobs. AEM Holdings shares fell 11.4 per cent, while UMS Holdings, Aztech Global and Frencken also slipped between 5 and 6.8 per cent.

Wall Street stocks finished a roller-coaster session solidly higher Thursday, reversing early losses and rallying after disappointing US inflation data. The Dow Jones Industrial Average ended at 30,038.72, up 2.8 per cent and nearly 1,400 points above its session low point. The broad-based S&P 500 jumped 2.6 per cent to 3,669.91, while the tech-rich Nasdaq Composite Index advanced 2.2 per cent to 10,649.15. The widely-anticipated consumer price index (CPI) report showed inflation rose 0.4 per cent in September from the prior month, twice the expected level and the latest indication that pricing pressures are becoming more entrenched. Stocks tumbled immediately after the report’s release. But equities soon reversed course, working their way back into positive territory by late morning and rising from there. Among individual companies, Delta Air Lines gained 4.0 per cent despite reporting lower-than-expected profits as it described travel demand as still robust, enabling strong pricing. Netflix jumped 5.3 per cent as it announced it will debut in November a subscription streaming option subsidised by ads. The new “Basic with Ads” subscriptions will be priced at US$6.99 in the United States – US$3 less than a no-ads basic option, Netflix chief operating officer Greg Peters said in a briefing.

SG

Flag carrier Singapore Airlines (SIA) said that it is currently in confidential discussions with Tata Group to explore a potential transaction relating to securities of Vistara and Air India, a subsidiary of Tata. “The discussions seek to deepen the existing partnership between SIA and Tata, and may include a potential integration of Vistara and Air India,” the company said in a bourse filing on Thursday (Oct 13). SIA currently holds a 49 per cent equity interest in Tata SIA Airlines which operates Vistara, an Indian full-service airline based in New Delhi. Tata holds the remaining 51 per cent stake. SIA said that discussions are ongoing and no definitive terms have been agreed upon yet. It added that even if a transaction were to materialise, it would be subject to relevant regulatory approvals, among other matters. It also said that the establishment of Vistara in 2013 gave SIA Group a stake in India’s growing aviation sector, with domestic and international travel flows expected to more than double over the next 10 years. SIA shares closed flat at S$5.03 on Thursday, before the announcement was made.

Stamford Land Corporation expects to record a net loss for the six months ended Sep 30, 2022. In a bourse filing on Thursday (Oct 13), the mainboard-listed company says the net loss is mainly attributed to foreign exchange losses and fair value loss on its investment property in London. The profit guidance is based on a preliminary assessment of unaudited consolidated management accounts of the group for the first half of its FY2023, which has not been reviewed by the audit and risk management committee of the company. Still, Stamford Land said that the group expects to record a gain on the previously-announced disposal of two properties in Sydney and Auckland in its unaudited consolidated management accounts in the six months ended Mar 31, 2023. Shares of Stamford Land closed flat at S$0.37 on Thursday, before the announcement was made.

Metech International has announced the termination of their joint venture with Jurong Barrels & Drums Industries (Jurong BD). In April 2021, the two sides entered into a joint venture agreement to establish a joint venture company, to be incorporated in Singapore. This company was supposed to explore the provision of environmental services globally, with an immediate focus on water treatment in China. Metech was supposed to have a 70% stake in the JV company, with Jurong BD holding the remaining 30%. The JV company would have an issued and paid-up share capital of $100,000. At the time of the JV agreement, Metech disclosed that Jurong BD specialises in the revitalisation and reconditioning of steel and plastic drums, and had started various investments in wastewater treatment projects in Singapore and China. Jurong BD’s controlling shareholders and management have had a long-standing business relationship with Metech’s principal shareholders and management, after having traded with each other in the metal recycling industry for many years. Metech says that as of Oct 13, the JV company has yet to be incorporated, as no definitive service agreement with any third party has been secured. As such, the termination agreement is not expected to have any material financial impact on the net tangible assets and earnings per share of Metech for its financial year ending June 30, 2023. None of Metech’s directors, controlling shareholders or substantial shareholders of has any interest in this termination, save for their shareholdings in Metech. Shares of Metech closed at 13 cents on Oct 13, down one cent or 7.14% lower than its previous close.

US

US consumer prices rose more than expected in September and underlying inflation pressures continued to build up, reinforcing expectations that the Federal Reserve will deliver a fourth 75-basis points interest rate hike next month. The consumer price index (CPI) rose 0.4 per cent last month after having gained 0.1 per cent in August, the Labor Department said on Thursday (Oct 13). Economists polled by Reuters had forecast the CPI climbing 0.2 per cent. In the 12 months through September, the CPI increased 8.2 per cent after having risen 8.3 per cent in August. The annual CPI peaked at 9.1 per cent in June, which was the biggest advance since November 1981. Despite the continued moderation as supply chains ease and oil prices retreat from the highs seen in the spring, inflation is running way above the Fed’s 2 per cent target. Stubbornly high inflation and a tight labour market have allowed the US central bank to maintain its aggressive monetary policy stance for a while. The government last week reported solid job growth in September, with the unemployment rate falling back to a pre-pandemic low of 3.5 per cent from 3.7 per cent in August. Excluding the volatile food and energy components, the CPI climbed 0.6 per cent in September after having risen 0.6 per centr in August. The so-called core CPI jumped 6.6 per cent in the 12 months through September. The core CPI rose 6.3 per cent year on year in August. Underlying inflation is being largely driven by higher costs for rental accommodation. Government data on Wednesday showed the weakest reading in producer core goods prices in nearly two-and-a-half years in September. The pass through from producer to consumer inflation could, however, probably take a while. Some of the inflation pressures are coming from the tight labour market. A second report from the Labor Department on Thursday showed the number of Americans filing new claims for unemployment benefits increased moderately last week. Initial claims for state unemployment benefits rose 9,000 to a seasonally adjusted 228,000 for the week ended Oct 8. Economists had forecast 225,000 applications for the latest week. The labour market remains tight. There were 1.7 job openings for every unemployed person on the last day of August, and layoffs also remain low.

Taiwan Semiconductor Manufacturing Co. cut its capital expenditure forecast by about 10% this year, despite reporting a record quarterly profit surge, responding to headwinds including slowing global chip demand and rising costs. The world’s largest contract chip maker on Thursday posted an 80% increase in net income for the July-to-September quarter, mainly due to strong sales of its cutting-edge chips used in smartphones and other devices. However, management flagged a likely decline in the whole semiconductor industry in 2023. “TSMC also is not immune,” Chief Executive C.C. Wei said during the earnings call on Thursday. TSMC lowered its capital expenditure forecast to $36 billion for 2022, compared with an earlier goal of at least $40 billion set three months ago. TSMC executives said the spending cut resulted from adjusting its plans to expand capacity because of factors including weaker global demand for semiconductors and rising costs caused by inflation. Signs of the semiconductor industry’s slowdown follow a period of soaring sales during the pandemic, which created extra demand for personal computers, gadgets and data servers. PC sales have slumped in recent months. Mr. Wei said some of the company’s capacity wouldn’t be as fully used in the October-to-December quarter, compared with the same periods in the previous three years. But he also cited the consistent demand from sectors such as autos and high-performance computing that processes data and calculations at high speeds, to support the company’s outlook for continuous growth in the next few years.

A souring market weighed on investing giant BlackRock Inc. in the third quarter, pushing profit down 16%. The world’s largest asset manager reported net income of $1.41 billion, down from $1.68 billion in the same period a year earlier. Earnings amounted to $9.25 a share. That exceeded the $7.06 expected by analysts polled by FactSet. Revenue dipped 15% to $4.31 billion, above analysts’ estimates of $4.2 billion. BlackRock is a top provider of exchange-traded funds and other low-cost alternatives that track market indexes, and demand for passive investing has helped fuel the firm’s growth. BlackRock is also a large provider of actively managed investments, which include businesses like stock-and bond-picking funds. Investors’ faith in the market declined, evidenced by slowing inflows of $17 billion, down from $75 billion a year ago. The firm’s assets under management were about $8 trillion, down from $8.5 trillion in the second quarter. That marks the third quarter-over-quarter decline in a row. BlackRock ended last year with $10.01 trillion in assets, the first time any money manager surpassed that milestone. BlackRock’s base management fees—fees not tied to performance that the firm receives for administering fund holdings—dipped 10% from a year ago to $3.53 billion. Performance fees from the firm’s actively managed funds fell 76% to $82 million. BlackRock said that partly reflected lower fees from a single hedge fund. Its technology remains the asset manager’s bright spot. Revenue from Aladdin, its proprietary software that helps investors manage their portfolios and assess risk, rose 6% to $338 million.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Analyst: Zane Aw

Recommendation: Technical BUY

Market buy: 217.24 Stop loss: 206.00 Take profit: 260.00

Tesla, Inc (NASDAQ: TSLA) A potential bounce to retest the previous support turned resistance zone.

Upcoming Webinars

Guest Presentation by RE&S Enterprises Pte Ltd [NEW]

Date: 21 October 2022

Time: 2pm – 3pm

Register: https://bit.ly/3REOBnY

Guest Presentation by Keppel REIT [NEW]

Date: 3 November 2022

Time: 12pm – 1pm

Register: https://bit.ly/3SOLOsr

Research Videos

Weekly Market Outlook: Technical Pulse, 4Q22 SG Strategy & Stock Picks

Date: 10 October 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials